It’s hard to grow your business when you’re not paid on a reliable schedule. Inconsistent payments cause short-term headaches and make long-term forecasting nearly impossible. But AI payment agents are changing all of that. This innovative technology makes it possible for your accounting team to easily collect payments while managing the most tedious aspects of invoice management. Read ahead to learn how AI payment agents are transforming financial workflows, helping businesses make better predictions and taking the reins on collections.

This article is sponsored by Intuit.

What are AI payment agents?

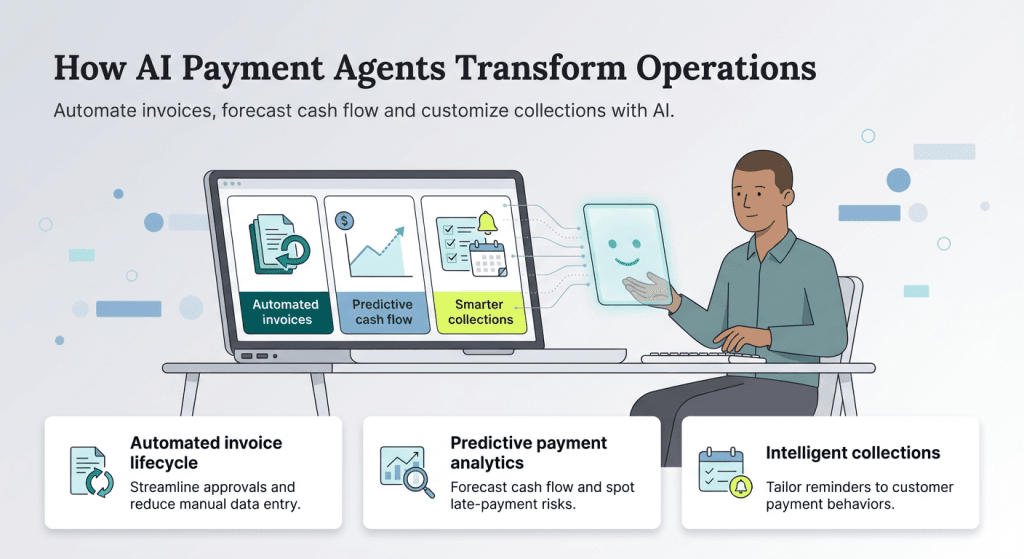

AI payment agents are automated software programs with the power to assist your business in managing various aspects of financial health and cash flow management. These AI agents facilitate simple tasks such as invoice collections while learning how to manage complex workflows to resolve businesses’ biggest financial pain points. AI payments agents enable predictive payment analytics, automated invoice lifecycle management, intelligent collections and payment reminders, and real-time cash flow optimization features.

Late payments can cost small businesses as much as

$40,000 per year, according to a survey of small businesses conducted by Gateway Commercial Finance.

Traditional payment challenges for small businesses

These are some of the top issues AI payment agents will help your business resolve.

Invoice management bottlenecks

Manual invoice management presents numerous opportunities for human error and inefficiency. It’s easy for overwhelmed accounting teams to make costly errors. If an invoice is created with incorrect information, that means your company isn’t getting paid until a corrected one is sent, delaying the time it takes to collect what you’re owed.

Moreover, manually sending invoices and handling the debt collections process is time- and resource-intensive. Even if your team’s work is flawless, automating these processes can free them up to spend time on other tasks.

Financial visibility issues

If your team is still tracking payments manually, you may not see the full financial picture in real time. This lack of real-time data makes it difficult to make long-term financial predictions, creating an environment where your accounting team is operating on a more reactive than proactive basis; that’s never the right environment to foster business growth.

Customer relations strain

It’s impossible to divorce customer satisfaction and payment processes. If a customer has a negative experience trying to pay for your services, that experience can impact how they view your overall brand. Even if your team does everything right, conversations about outstanding invoices are rarely a pleasant experience for either parties involved. Plus, if you’ve got a small team juggling the burdens of a growing business, it can be hard to keep a consistent communication schedule, delaying payments and causing confusion.

Real-world benefits for small businesses

AI payment agents remove numerous barriers for smaller teams, keeping everything running smoothly and clearing the way for your business to thrive. When you implement AI payment agents into your accounting practices, you can expect:

- Faster payment collection: Businesses with a virtual team of AI agents on their side get paid an average of five days sooner than organizations that don’t use payment agents.

- Increased operational efficiency: Payment agents reduce the amount of manual work for your accounting team, from invoice creation to collections.

- Better customer relationships: With advanced automation and segmentation, payment agents allow customers to experience consistent communication that doesn’t sacrifice a personal touch.

- Enhanced working capital management: Predictability is key to accurate forecasting and payment agents help you plan accordingly based on real time cash flow data.

- Time savings: AI agents can save small businesses as much as 12 hours per month.

- Risk management support: See obstacles long before they cross your path with predictable analytics and continuous monitoring that identifies potential issues.

Getting started with AI payment agents

When deciding which AI payment agent solution is best for your team, start by taking stock of your biggest priorities and what you hope to accomplish. Do you need the most support with collections follow-up or invoice generation? How much training will your team require? Does the agent you’re considering integrate with your current systems?

Often the key is to balance ease-of-use with scope of features. There are highly customizable options, including the choice to build your own agent if you’re prepared for extensive coding.

For most teams, though, it’s best to choose an AI payment agent with minimal setup and strong customer support. You may even get access to payment agents with systems you’re already using.

Certain Intuit Quickbooks subscription plans now feature payment agents and getting started is simply a matter of customizing your settings to get the exact features you want. For instance, your payment agent will automatically suggest an invoice send schedule. You can review and tailor as needed while your agent is still getting attuned to your typical payment cadence. If you need guidance, you can always turn to QuickBooks’ team of trusted experts who will help you get the most out of your payment agents.