Business Funding

Launching and growing a business takes capital, and there are a lot of places to find it. Determining which source of funding is right for your business can be a challenge. Fortunately we’ve made it easy to learn about your financing options and identify which ones will set your business up for long-term success.

Latest: Advice, Tips and Resources

Alternative lenders offer more flexible terms and faster approval and funding than traditional banks. Discover more about alternative loans.

Capital and operating grants are two different ways to fund your business. Here's what you need to know before applying for a business grant.

When your small business needs a funding source, you may consider a loan or try crowdfunding. Learn how to choose the right option for your business.

Your SBSS score matters when you're applying for a small business loan. Here's what you need to know.

Investor presentations require careful planning and organization. Learn what to consider before presenting an idea to investors and signs you're not ready.

Important information is tucked away in the fine print of a loan agreement. Learn what to look for and what you're agreeing to before you sign it.

Most entrepreneurs turn to small business loans when seeking startup cash, but there are other ways to raise working capital for a store. Learn more here.

Before you sell equity, make sure the capital is well worth it. Here's how to spot a good investment deal.

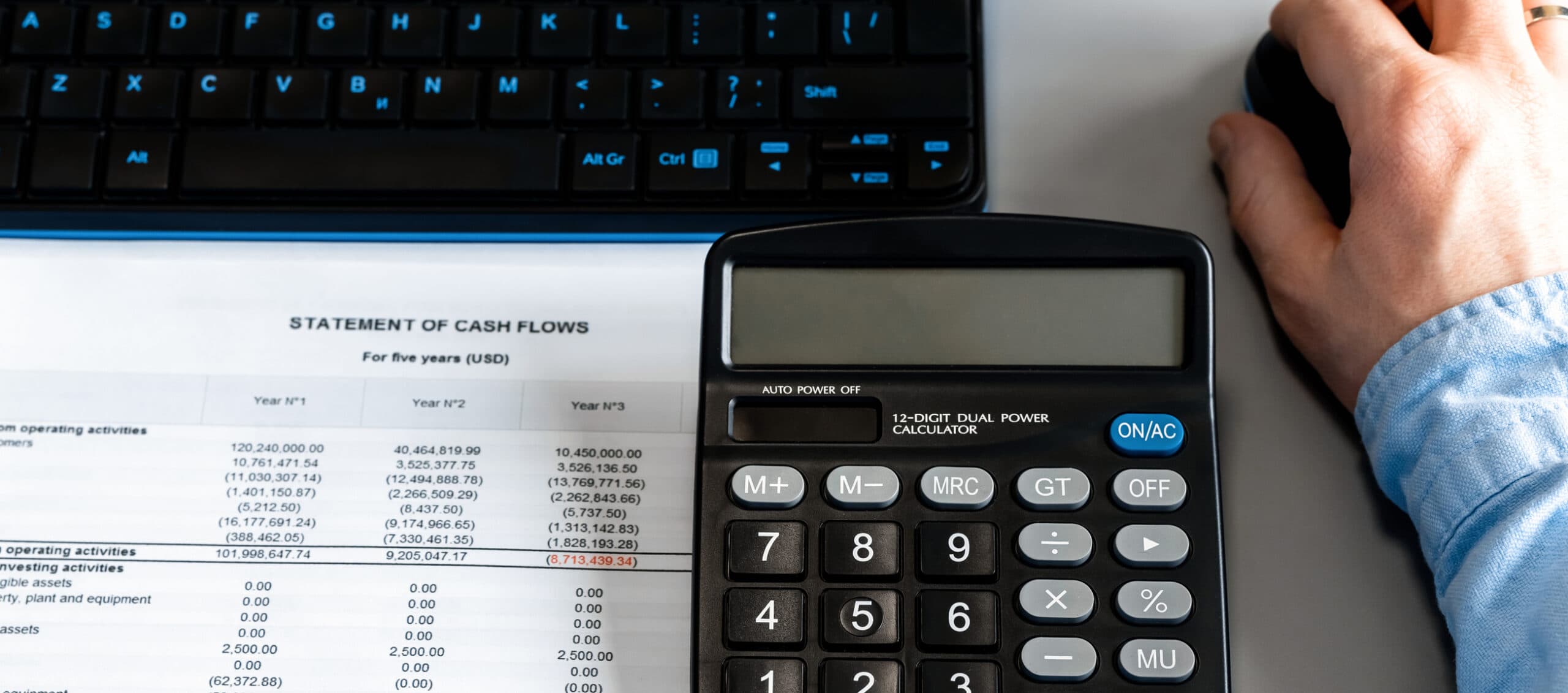

When considering accepting a business loan, it's important to develop a repayment plan. Learn about the calculation formula, amortization and more.

Learn whether a grant or loan is better for your business, the different types of each, how to choose between them and the best loan providers.

If your company is considered too risky by traditional lenders, a high-risk business loan might offer financing options.

Women-run businesses make up nearly half of all businesses, yet they're far behind in business funding. Learn about grants for women entrepreneurs to help close the gap.

Many small business loans require the business owner to sign a personal guarantee. Learn about the risks of personally guaranteeing a loan.

Merchant cash advances are risky, but they can be helpful if used correctly. Learn more about how they work and whether they’re the right option for your business.

The pandemic’s Paycheck Protection Program offered relief to businesses. Here is what you should know about the loan forgiveness process.

Need an investor to help grow your startup? Here's how to find an investor and what to look for.

Silicon Valley is home to some of the most powerful investors in the nation. Check out this list of some of the most well-known investors in the Valley.

Loan forgiveness can differ depending on whether you’re talking about PPP, EIDL or SBA 7(a) loans. Learn the differences between each of these types.

Learn what happens when you can't pay back your small business loan from the SBA.

To know which financing option is right for your business, it's important to understand the differences between angel investors and venture capitalists.

If you are considering debt or equity financing, it is important to know the pros and cons of each.

For the best chances of getting your business loan application approved, follow these steps: 1. Research lenders to discover the best ones for your business.

Merchant cash advances and working capital loans are financing tools for business owners who need fast cash. Learn how they differ and their pros and cons.

How to assess if supply chain finance is right for your business or if invoice factoring would work better for your company’s needs?

Healthy business debt is often necessary for growth. Learn how to distinguish good and bad business debt and determine a healthy debt amount to carry.

Business loans can be difficult to secure if you have bad credit. Here are financing options for businesses with poor credit history.

There's more to a loan than paying your monthly installment. Look for these hidden terms and fees a lender might include in a loan agreement.

Angel investors are accredited investors who use their money to help businesses they view as worthwhile. Learn how to find and work with them.

Defaulting on an SBA loan is serious; you can face bank levies, wage garnishment and foreclosure. But some cases allow forgiveness. Learn if you qualify.

Farm equipment is costly, and for many in the agriculture industry, it's imperative to find affordable financing. Read our guide on farm equipment loans.