Whether you’re handling the books on your own or you’ve got a small accounting team, maintaining healthy financial processes can feel like a chore for small businesses. Entrepreneurs and their team members may spend considerable hours every week on mundane accounting tasks. That’s time that could’ve been spent pursuing new clients or improving operations.

This article is sponsored by Intuit.

Luckily, AI accounting agents are here to take some of that weight off your shoulders. Small businesses that use AI accounting agents are able to automate numerous bookkeeping tasks while providing helpful insights for better decision making. Read on to learn how AI accounting agents are making bookkeeping tasks a lot less painful for SMBs like yours.

What are AI accounting agents?

AI accounting agents are a type of automation software that can handle accounting tasks by making use of your business software and data to conduct a virtually autonomous workflow. Through machine learning, AI accounting agents are constantly improving workflow efficiency and quality.

As your AI accounting agent completes routine tasks, such as categorizing transactions or automating reconciliation and matching, it learns about your business’s accounting cycles. If anything out of the ordinary arises, your AI accounting agent acts as a helpful watchdog, alerting you right away of any anomalies.

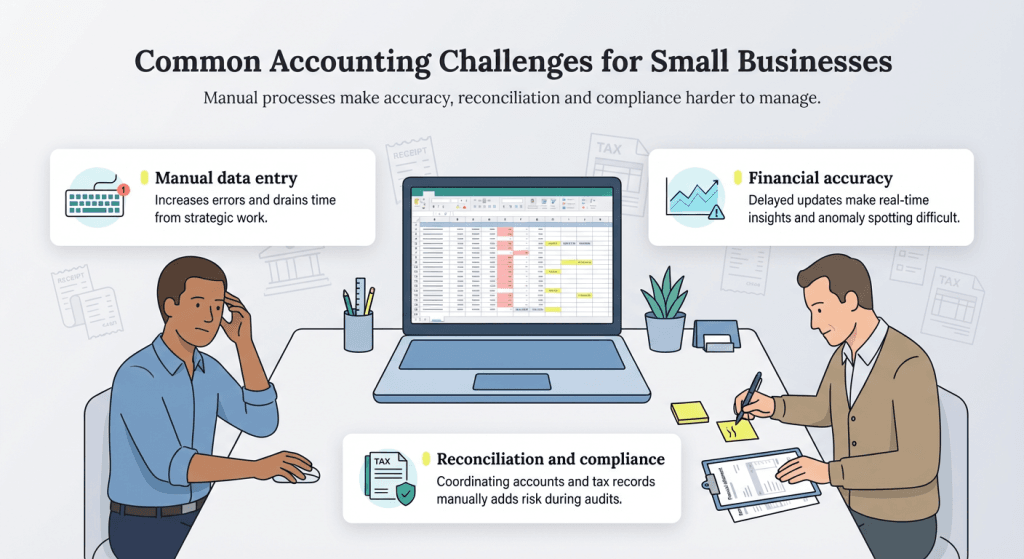

Common accounting challenges for small businesses

Every business has its own unique challenges, but these are some of the most common issues that AI accounting agents can resolve:

Manual data entry

Every second you spend on manual tasks takes valuable time away from big picture responsibilities. When you’re classifying each transaction one by one, maintaining consistent standards is a major challenge. If you’re bogged down with repetitive, tedious work, it’s much too easy to make small errors that cause big headaches.

A widely cited benchmark for acceptable error rates in manual data entry is one percent. This might sound small, but these mistakes can add up quite a bit. When you handle your accounting data manually, you could end up with skewed projections, inaccurate estimates and even compliance issues.

Financial accuracy

Even if you’ve got a perfectly accurate team that never makes a data-entry mistake, you still have to allot time for delays while your team completes all their data entry work. That means you won’t be able to get an accurate snapshot of your financial health in real time. This also makes it much harder to identify inconsistencies or unusual transactions while you’ve still got time to make corrections before they cause serious issues.

Reconciliation complexities

Accurate reconciliation is an enormous challenge for businesses handling everything manually, especially if your business is coordinating multiple accounts. Depending on when your team matches your bank accounts against the numbers in your books, there can be quite a lag in data accuracy for your financial reports. If there are any exceptions that require special care, such as accidental duplicate transactions, manual reconciliation takes even more time away from manual tasks.

Compliance and audit preparation

Ensuring tax compliance is one of the most common accounting challenges for small businesses. In the event of an audit, you’ll need evidence that your business is in compliance with tax regulations, which can be difficult to keep up with. Even if you hire a CPA who’s up to date on all new laws, you’re still responsible for providing and organizing extensive documentation of all financial transactions. In some cases, you may even need to present tax records and receipts from previous years.

What AI accounting agents can do

These are some of the top reasons AI accounting agents could be the answer for your small business.

Intelligent transaction categorization

AI accounting agents go above and beyond when it comes to classifying transactions. In addition to the time-saving wonder of automatic categorization, AI agents continuously learn the patterns of your financial processes. Accounting agents from platforms like Intuit QuickBooks are always on the lookout for red flags. The more transactions it reviews, the more your AI agent understands context, making it easier to identify an exception versus something suspicious.

It’s also important to remember that while your AI agent does most of the work, you’ll still oversee everything for quality control. If your AI agent miscategorizes anything when you’re starting out, you’ll have the chance to correct it. Think of your AI accounting agent as a helpful collaborator. The more you teach it about your business’s unique accounting needs, the better it becomes at categorizing properly.

Automated reconciliation

Integrate multiple bank feeds directly into your AI accounting agent platform for seamless reconciliation. The accounting agent will review what’s in your books with your bank statement in real time and immediately flag anything unusual. You won’t have to guess what the issue is, as the accounting agent will also provide an explanation and suggestions for resolution.

Anomaly detection and quality control

When you move from manual to AI agent-powered accounting, your approach evolves from reactive to proactive. AI accounting agents are always looking for trends in your processes. If any transactions defy your typical accounting practices, AI agents sound the alarm and offer helpful insights into the potential root cause.

Financial reporting automation

AI agents are continuously reviewing everything in real time, so your accounting reports will feature up-to-the-minute insights. You’ll also be able to easily review multiple accounting periods to compare trends, more precisely predict cash flow and set realistic KPIs that help you meet your business goals.

To set relevant financial KPIs, aim for

SMART business goals that are specific, measurable, attainable, relevant and time-based.

How AI accounting agents benefit small businesses

Implementing AI accounting agents saves your business time, money and energy. Here are just a few reasons why AI agents may be the answer to your small business accounting woes.

- Accuracy and consistency: AI agents significantly reduce the risk of human error with automated categorization and data entry. Since these agents follow strict rules-based processes, it’s much easier to ensure standardization across all of your accounting processes.

- Time and cost savings: Saying AI agents save you time isn’t just a well-informed assumption. Intuit found that AI agents can give your team as much as 12 hours back each month, meaning less obstacles to closing your books on time at the end of each month.

- Real-time financial visibility: When you use AI accounting agents, an accurate picture of your financial health is just a few clicks away — whenever you need it.

- Scalability: Saving time on smaller tasks means you’ve got more room to focus on growth. With AI agents, your team is equipped to accurately handle a higher volume of transactions. Additionally, AI agent reporting features offer valuable insights into growth opportunities that might be easy for busy small business owners to miss.

- Improved tax compliance: AI accounting agents help you keep all of your financial documents organized, so when tax season rolls around, you’re all prepared. In the event of an audit, you’ll have everything you need to prove your finances are sound.

Getting started with AI accounting agents

Trying to choose an AI accounting agent that fits your unique business needs? Start by taking a detailed look at your financial workflows and see which tasks you need the most help with. Do you need to categorize transactions for multiple accounts? Is robust reporting necessary for your business to make smart financial decisions? Answering these questions will help you identify the exact AI agent features you should prioritize.

The next step is balancing your needs with user experience and cost. Businesses with a tech-savvy team might opt to build an accounting agent from square one. But for small businesses already under a time crunch, accounting agents that take little training and offer a plug-and-play set up are the way to go. Popular accounting platforms like Intuit QuickBooks offer their own AI accounting agents for most subscription plans.

Remember, it’s important to keep a close eye on your new AI accounting agent in the beginning, so you can correct any errors while it’s still learning. The more input you give at the start, the more intelligent your accounting agent becomes over time. Before you know it, your AI accounting agent will be reconciling your accounts and categorizing transactions in mere minutes. And with detailed reporting, you’ll get tailored insights on how to help your business thrive.