Business.com aims to help business owners make informed decisions to support and grow their companies. We research and recommend products and services suitable for various business types, investing thousands of hours each year in this process.

As a business, we need to generate revenue to sustain our content. We have financial relationships with some companies we cover, earning commissions when readers purchase from our partners or share information about their needs. These relationships do not dictate our advice and recommendations. Our editorial team independently evaluates and recommends products and services based on their research and expertise. Learn more about our process and partners here.

Stock Options Profit Calculator

Estimate the potential value of your stock options before you exercise them.

Table of Contents

Stock options are often included in employee compensation packages, especially for C-suite executives and employees at early-stage companies. They’re a common form of equity as compensation that can offer significant financial upside if managed wisely. According to the National Center for Employee Ownership (NCEO), about 9 million U.S. employees hold shares or share rights, including stock options. These equity awards can be a meaningful wealth-building tool if you know how and when to use them.

Use our calculator to help determine whether you should exercise, hold or sell your stock options.

Key Terms

Years until option expiration

This is the time period you expect to hold your stock options. Once the expiration date arrives, the options either expire worthless or can be exercised and sold for a profit. Most employee stock options expire five to 10 years from the grant date.

Total number of options

This is the number of stock options awarded to you by your employer. The quantity typically reflects your role, tenure and the company’s overall equity compensation approach.

Current stock price

This refers to the current market value of a single share of the company’s stock. When the stock price is above the strike price of your options, you are “in the money,” meaning your options have value. You can track real-time stock prices through your brokerage platform or financial websites.

Strike or grant price

The strike price is the predetermined price at which you can purchase the company’s stock, as outlined in your stock option or stock purchase agreement. When the stock price rises above the strike price, the options are considered “in the money.” If the stock price remains below the strike price at expiration, the options have no value. For incentive stock options (ISOs), the strike price must be at least equal to the fair market value on the grant date, per IRS regulations.

Anticipated annual stock price return

This is the assumed annual growth rate of the company’s share price. Remember, this is a hypothetical projection and not guaranteed. Historically, the S&P 500 has delivered an average annual return of about 10 percent over the long term, though individual stock performance can vary significantly.

Annual dividends per share

Dividends are payments some companies make to their shareholders, usually on a quarterly basis, although some pay annually or on an ad-hoc schedule. Enter the total amount of dividends per share you expect to receive over the course of a year. As of 2025, the S&P 500’s dividend yield is around 1.3 percent — among the lowest levels seen in decades.

Opportunity cost

Enter the annual rate of return you could earn from an alternative investment. This represents where you would invest your money if you weren’t putting it into stock options. For example, the 10-year U.S. Treasury yield has been hovering around 4 to 4.5 percent in 2025, while high-yield savings accounts continue to offer roughly 4 to 5 percent annual percentage yield (APY).

Marginal tax bracket

Your marginal tax bracket is the highest tax rate that applies to your income. For tax year 2025, federal income tax brackets range from 10 percent to 37 percent, depending on your filing status and taxable income. Consult the current federal income tax brackets and rates to determine your exact percentage.

Long-term capital gains tax

The IRS treats profits from assets held for more than one year as long-term capital gains. For tax year 2025, you may owe 0 percent, 15 percent or 20 percent tax on those gains, depending on your income level. High-income earners may also face the 3.8 percent Net Investment Income Tax (NIIT). To estimate what you’ll owe, use this information to calculate capital gains tax based on your income bracket.

What are stock options?

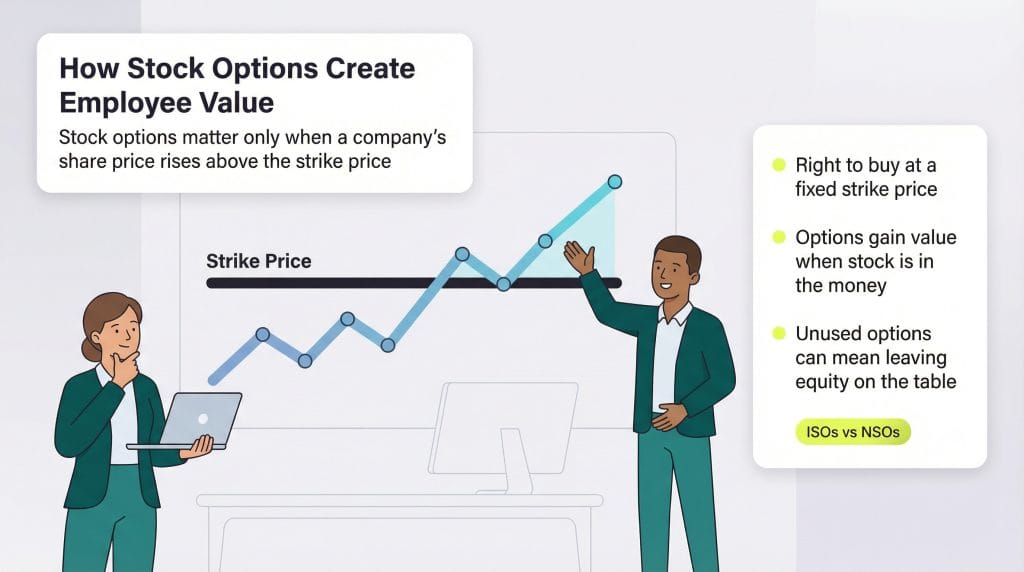

Stock options give employees the right — but not the obligation — to purchase company stock at a set price, known as the strike price. They’re a common form of equity compensation, especially in startups and fast-growing companies. Most employee stock options fall into one of two categories: incentive stock options (ISOs) or non-qualified stock options (NSOs), and each type is taxed differently.

Stock options only have value if the company’s share price rises above the strike price. When that happens, the options are considered “in the money,” and employees can buy shares at a discount. If the stock never exceeds the strike price before the options expire, they become worthless.

Many employees miss out on potential gains because they never exercise their options, even when they have value. Recent data from Carta shows that employees exercised just 32.2 percent of vested, in-the-money stock options in the second half of 2024, down from 54.2 percent three years prior, highlighting how often employees leave equity on the table.

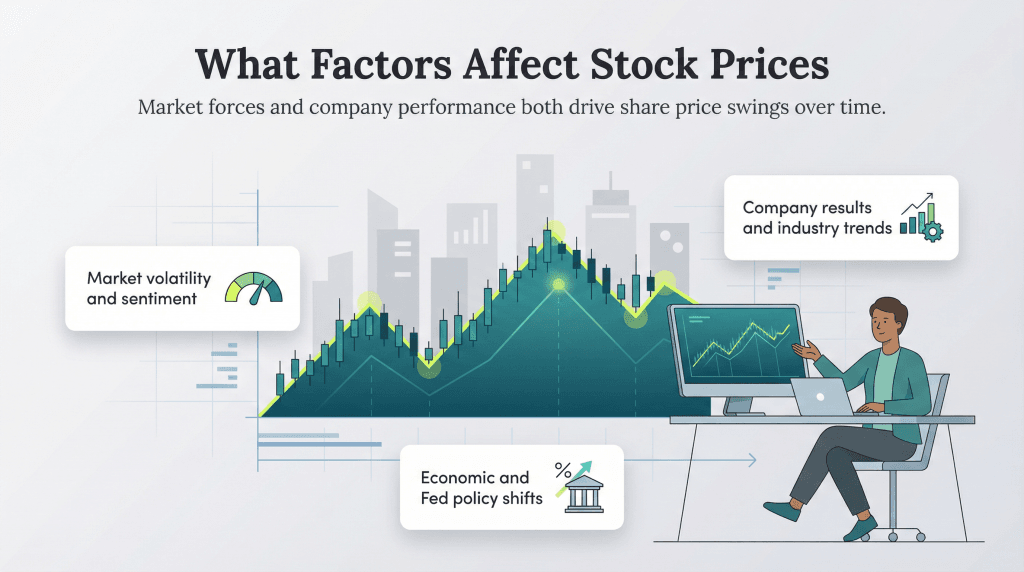

What factors affect stock prices?

Stock prices can move for many reasons, and short-term swings are often unpredictable. Here are some of the key factors that influence share prices:

- Market volatility: During uncertain periods, market volatility can cause daily price swings of 2 to 3 percent or more. The VIX index (often called the “fear index” because it tracks expected market volatility) is commonly used to gauge investor sentiment and market instability.

- Economic conditions: Inflation, unemployment, consumer spending and overall economic growth can all affect investor confidence and stock performance.

- Company-specific news: Leadership changes, management decisions, earnings reports and major product launches can move a stock up or down quickly.

- Interest rates and Federal Reserve policy: Rate hikes can slow growth and reduce investor optimism, while rate cuts often encourage spending and boost market sentiment.

- Industry trends: Sector-specific developments — such as new regulations, technology breakthroughs or competitive pressures — can influence stock performance.

Over the long term, stock prices generally reflect a company’s financial strength, profitable growth, and ability to create value for shareholders. Because stock performance contributes to overall business valuation, strong long-term results can benefit both employees and investors holding equity.

Businesses that grow revenue and profits steadily tend to see their stock price rise, while companies that struggle to generate returns often experience declining share prices.

When should you sell your stock options?

The best time to exercise and sell your stock options is when the company’s share price is above the strike price, so you can lock in a profit. However, timing isn’t always straightforward. Here are a few key factors to weigh when deciding when to exercise:

- Vesting schedule: You can’t exercise options until they vest. A common schedule is four years with a one-year cliff: 25 percent vests after the first year, with the rest vesting monthly or quarterly.

- Expiration date: Don’t wait too long. Most employees only have a limited window to exercise after leaving a company (often just 90 days), and unexercised options expire worthless at the end of the term.

- Taxes: ISOs and NSOs are taxed differently, and the timing of your exercise can affect whether gains are treated as ordinary income or long-term capital gains. A tax consultant can help you plan the most tax-efficient approach.

- Company performance outlook: Consider the company’s financial health and growth potential. If performance is strong or improving, waiting may increase your upside — but it also increases risk.

- Diversification: Holding too much of your net worth in a single company stock is risky. Many advisors suggest exercising and selling gradually over time to balance risk and potential reward.

Tracking vesting and expiration dates — and setting reminders — can help you avoid forfeiting valuable options.