Business.com aims to help business owners make informed decisions to support and grow their companies. We research and recommend products and services suitable for various business types, investing thousands of hours each year in this process.

As a business, we need to generate revenue to sustain our content. We have financial relationships with some companies we cover, earning commissions when readers purchase from our partners or share information about their needs. These relationships do not dictate our advice and recommendations. Our editorial team independently evaluates and recommends products and services based on their research and expertise. Learn more about our process and partners here.

How to Write an Executive Summary in a Business Plan

A compelling executive summary can help you win investor and lender interest and land more pitch opportunities.

Table of Contents

Whether you’re using your business plan to attract investors, support a business loan application or guide your internal strategy, providing a high-level snapshot of its contents up front is essential. This snapshot is called an executive summary.

Executive summaries can quickly tell angel investors and venture capitalists whether your venture aligns with their interests and if your financial projections meet their benchmarks. Similarly, they can give lenders a quick overview of your financials and how you plan to use the funds. We’ll explain how to write an executive summary and share an example you can learn from and customize to suit your needs.

How do I write an executive summary for a business plan?

While your executive summary is part of your business plan, it should be a standalone document. Its purpose is to get the reader excited about the business and eager to learn more and dive into the rest of the plan.

Follow these steps to write a clear, compelling executive summary:

1. Write it last.

Although the executive summary is the first thing investors or lenders will read, it should be the last thing you write. This ensures you’re working from the most up-to-date version of your business plan, which may change as strategies, team members and projections evolve.

The main body of a business plan is written in a neutral, fact-based tone. The executive summary, however, is more of a marketing document — its job is to make people want to keep reading. While you should maintain a professional tone, convey enthusiasm about your company’s unique opportunity and ability to succeed.

2. Customize it for your reader.

You may send your business plan to angel investors, venture capitalists, private equity firms and lenders. While the plan won’t change, it’s essential to tailor your executive summary for each specific audience and what they see as important:

- Angel investors often prioritize industries they’re passionate about.

- Venture capitalists and private equity investors tend to focus on financial performance and exit strategies.

- Lenders primarily care about your company’s stability and ability to repay the loan.

The executive summary should be edited for each audience to highlight how your company aligns with their specific priorities, goals, portfolio, interests and risk tolerance.

3. Make it easy to read.

Arie Brish, an author, investor and business professor, emphasized the importance of making your executive summary easy to read. “Investors are swamped with business plans on a weekly basis,” Brish explained. “They don’t have time to read them all. The purpose of the executive summary is to help the reader filter out the ones that are not relevant [to them].”

Even if you have a complex, technical product or service, anyone reading your executive summary should be able to immediately grasp the opportunity, what your company does and why it’s uniquely positioned to succeed. Avoid acronyms and technical jargon, and leave detailed specs and drawings for the main plan.

Using bullets can also make your information easier to scan, especially when listing key executives, products or markets. Your goal is to share just enough high-level information to make the reader want the full story.

4. Highlight your strengths.

Your business plan is where you go into detail about your unique selling proposition (USP) and your company’s strengths. In the executive summary, keep it brief and highlight only the most compelling points, including the following:

- Your team: Call out the experience and industry knowledge of your C-suite executives and leadership team. It’s even better if you can note that key executives are formally committed to staying with the company.

- Innovation: If your business sells a unique product or uses an innovative process, share this compelling information with investors or funders.

- Market demand: Share evidence of a growing or underserved market for your product, and back it up with market research, facts and figures.

- Company culture: Even if your products or services are comparable to competitors, a strong company culture can give you an advantage. Investors will understand that key employees will likely stay longer, you’ll have higher productivity, and your service will be stellar.

- Unmet needs: Your offering may solve customer pain points competitors can’t. This is a distinct competitor advantage. For example, before Uber, people without a car could only get a ride from a taxi or a friend — often not quickly or on demand. Uber identified that unmet need and built a company around it.

- Low competition: If you have few (or weak) competitors, this generally spells opportunity. However, this strength must be coupled with demand, or potential investors or funders might interpret this as an indication of there being no market for the product.

- Customer loyalty: Loyal, long-term customers demonstrate your market success. Showcase testimonials, loyalty program stats, brand ambassadors and positive customer reviews.

- Financial strengths: Have you discovered how to source or manufacture something at a fraction of its cost? Have you created a market for a high-priced good with an excellent profit margin? Play up your higher margins, lower costs or low price sensitivity.

5. Avoid salesy language.

Your executive summary should be clear and compelling enough to make readers want to learn more about your company. However, this isn’t the place for a hard sell. Don’t use hyperbolic phrases like “Get in now, while you can!” or “This is the deal of the century!” In fact, don’t use exclamation points at all. The executive summary is meant to pique interest, not close the deal.

6. Be honest.

Investors know that every business has potential challenges and weaknesses. If you paint too rosy a picture, they’ll likely be skeptical. Get ahead of any issues by being honest about your company’s potential pitfalls and how you plan to overcome them. They’ll likely appreciate your business transparency and foresight.

What should be included in a business plan’s executive summary?

Brish emphasized the importance of doing your homework before crafting an executive summary, particularly if it’s heading to busy investors. “Make sure you understand the scope of this investor’s interests,” Brish advised. “If your proposed business is not within these boundaries, don’t even bother.”

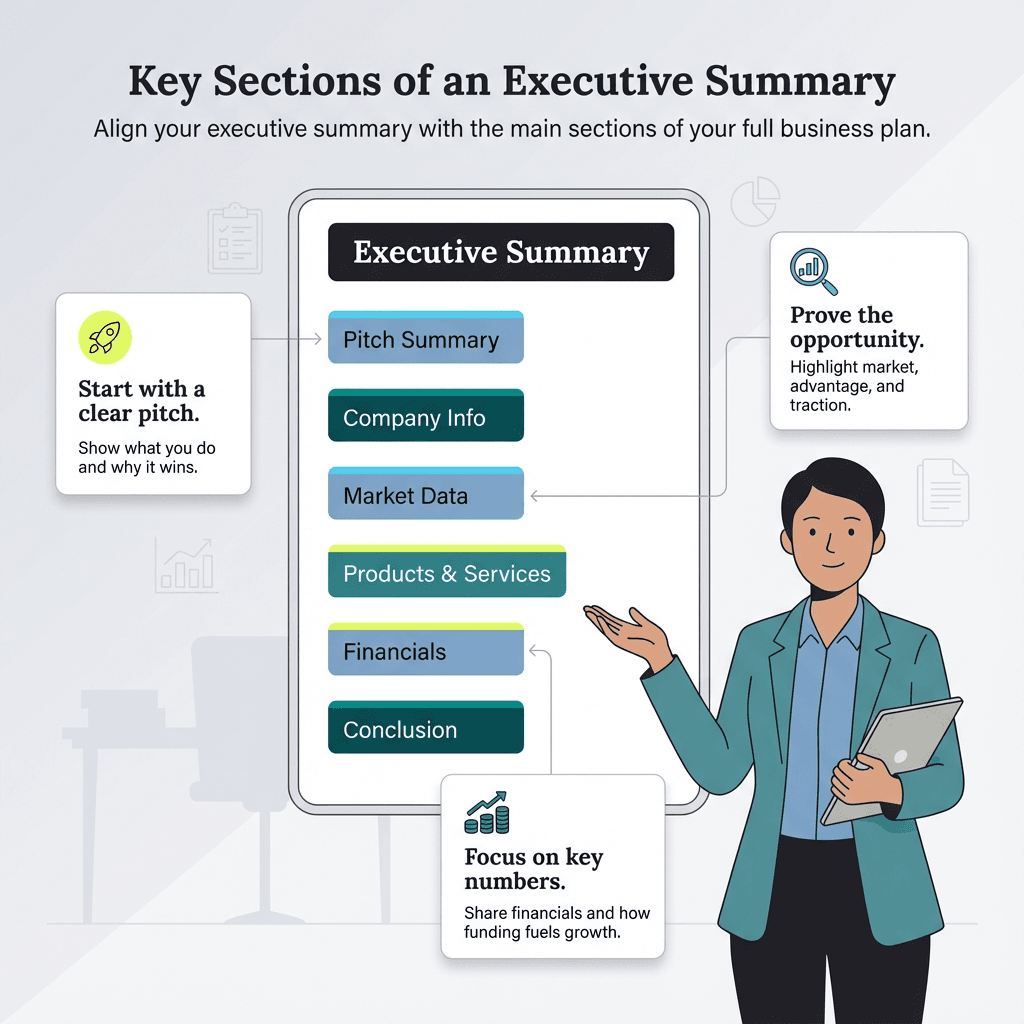

While you’ll tailor your document to specific investors and lenders, all executive summaries should generally include sections that align with the main sections of your full business plan, such as:

Pitch summary (Introduction)

Start your executive summary with a compelling sentence or two that tells the reader what your company does and why it will be wildly successful. You can get inspiration from your company’s elevator pitch, if you have one. An effective elevator pitch captures the imagination of a potential investor in the space of a couple of minutes (about the time of an average elevator ride).

Your pitch summary should include:

- The company name

- The product or service

- How the offering solves a pressing problem

- At least one number (target market number or value, sales growth percent, etc.)

Company information

Anyone in a position to give you money wants to know more about your business. This section includes:

- Mission statement: What business are you in, who do you serve, what is your main strength and which core value drives you? Keep your mission statement succinct.

- Company description: Detail the business’s purpose. Are you a manufacturer, wholesaler, retailer or service business? Briefly describe what it does, makes or sells.

- Company history: Include a brief company history with the founders’ names, when and where the company was formed, how many employees you have, and where you’re located. Add square footage of manufacturing space or the size of your vehicle fleet if it’s relevant.

- Your team: Who are your company’s executives and key employees? Say a little about each person’s outstanding skills, expertise, history or background.

- Additional notes: Briefly add anything noteworthy about your company that doesn’t fit elsewhere. This could include rapid growth, an innovative culture or strong customer satisfaction.

Market data

Summarize your market and drill down to the characteristics of your target market:

- Outline market demand, rivals and how you stand out from the competition.

- Share the total market size, your current market share and how much market share you reasonably think you can achieve with this investment or loan.

- Demonstrate market demand for your product with market research data.

- Show how your offering meets unmet or underserved needs in the market.

- Discuss industry trends to demonstrate additional potential for growth.

Products and service information

Here, you’ll delve into your offerings in more detail:

- Describe your best-selling product category and explain why it’s successful.

- Highlight up-and-coming products or services and include promising statistics (e.g., sales growth, customer ratings, sales revenue).

- Mention any new products, their key characteristics and their potential market size.

- Call out your offerings’ competitive advantages.

Financial summary

Your business plan will contain plenty of detailed financial information, from actual results to projections. In the executive summary, you’ll want to keep it short and focus only on the numbers that make the biggest impact, such as the following:

- Annual sales in dollars (and units, if that’s impressive)

- Net income

- Profit margin

- Breakeven date (if you’re a startup)

- The amount of funding you’re currently seeking

Conclusion

Here, you’ll summarize your company’s major advantages and restate the most compelling financial KPIs. In your final paragraph, explain how the capital you’re requesting will help the company grow. For example, you might share plans to open another location, develop new products or hire additional team members. Whenever possible, quantify how this investment is expected to boost revenue, profit and market share.

Example of an executive summary for a business plan

Here’s a business plan executive summary example (for a fictitious company) to give you an idea of how to model one for your organization.

ABC Company Executive Summary

ABC Company’s AI-enabled weeding device identifies common weeds in seconds and allows gardeners to zap them without bending.

Company

ABC Company is a family business founded in 1981 by Walter Nobbins in Madison, Wisconsin. The company originally sold high-quality gardening hand tools through a network of over 500 hardware stores and local nurseries in the region. Our executives and key employees are:

- Greg Nobbins, CEO: Grew the company from 50 to 200 employees and built two modern manufacturing plants.

- Tanya Nobbins, VP of Sales and Marketing: Expanded the company’s retail distribution to 710 Ace Hardware locations across the Midwest.

- David Friedman, CTO: Conceptualized and created our signature product, the WeedZap, and is under a five-year employment contract.

Market

- The U.S. home lawn and gardening market was worth $136.55 billion in 2024, with annual growth of 2.5% through 2029.

- Our target market is the 80 million-plus Americans over 55 who garden.

- Economic trends and new technology, along with trends like sustainability practices and organic gardening, have created new opportunities for growth.

- ABC Company’s traditional products hold a 12% market share with 58% brand awareness through our distribution network, including Ace Hardware stores in the region.

- There are no direct competitive products for WeedZap, which we have patented.

Products

ABC Company continues to sell high-quality, non-technical gardening tools. The WeedZap includes an AI-driven smart device that takes a photo of the plant and matches it with a database of over 3 million known plants. This is done through a long-handled device that eliminates the need for kneeling or bending.

The WeedZap product was adapted from our traditional propane-powered weeder, allowing us to produce it at a lower cost than if we had started from scratch.

Financial Summary

Our total sales revenue for 2024 from all products was $6,644,750. WeedZap sales have exceeded expectations at $987,654. With an infusion of $800,000 in capital, we plan to increase our social media outreach to sell our products nationwide. Within two years, we expect to generate sales revenue of $12 million with a profit margin of 23%.

Conclusion

With a proven track record in the gardening tools market, patented technology and a loyal customer base, ABC Company is well-positioned for nationwide expansion. The requested $800,000 in funding will allow us to accelerate marketing efforts and scale production, driving projected sales to $12 million within two years.

How long should an executive summary for a marketing plan be?

Brevity is an important feature of an executive summary. Ideally, it should be just one to two pages. “If it won’t fit on a page, it won’t fit in their head,” noted Jonathan King, founder and CEO of GSD (Get Strategy, Done).

There is plenty of room in the body of the business plan for explanations and details. In the executive summary, focus only on the most impressive areas of your plan — especially your financials. This will pique the reader’s interest, which is the goal. “[Well-written executive summaries] fit on one page, drive action, and everyone can explain them without reading a slide,” King added.