MENU

Starting a Business

- Best Small Business Loans

- Best Business Internet Service

- Best Online Payroll Service

- Best Business Phone Systems

Our Top Picks

- OnPay Payroll Review

- ADP Payroll Review

- Ooma Office Review

- RingCentral Review

Our In-Depth Reviews

Finance

- Best Accounting Software

- Best Merchant Services Providers

- Best Credit Card Processors

- Best Mobile Credit Card Processors

Our Top Picks

- Clover Review

- Merchant One Review

- QuickBooks Online Review

- Xero Accounting Review

Our In-Depth Reviews

- Accounting

- Finances

- Financial Solutions

- Funding

Explore More

Human Resources

- Best Human Resources Outsourcing Services

- Best Time and Attendance Software

- Best PEO Services

- Best Business Employee Retirement Plans

Our Top Picks

- Bambee Review

- Rippling HR Software Review

- TriNet Review

- Gusto Payroll Review

Our In-Depth Reviews

- Employees

- HR Solutions

- Hiring

- Managing

Explore More

Marketing and Sales

- Best Text Message Marketing Services

- Best CRM Software

- Best Email Marketing Services

- Best Website Builders

Our Top Picks

- Textedly Review

- Salesforce Review

- EZ Texting Review

- Textline Review

Our In-Depth Reviews

Technology

- Best GPS Fleet Management Software

- Best POS Systems

- Best Employee Monitoring Software

- Best Document Management Software

Our Top Picks

- Verizon Connect Fleet GPS Review

- Zoom Review

- Samsara Review

- Zoho CRM Review

Our In-Depth Reviews

Business Basics

- 4 Simple Steps to Valuing Your Small Business

- How to Write a Business Growth Plan

- 12 Business Skills You Need to Master

- How to Start a One-Person Business

Our Top Picks

Insurance Deductions and Expenses for Small Businesses

Table of Contents

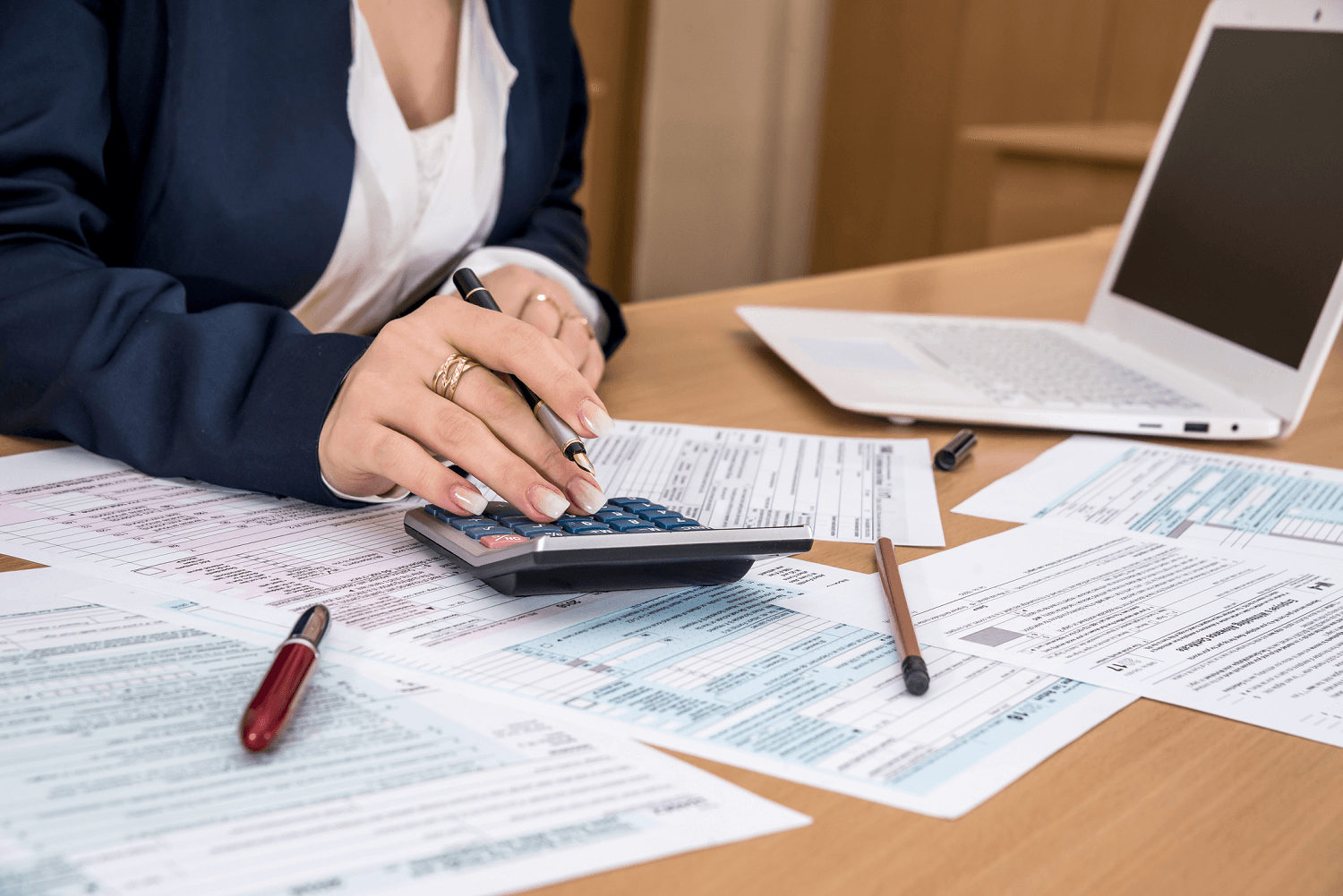

It always pays to know what tax deductions you can make as a small business owner. Most business owners know that they can generally deduct operational costs such as rent, employee benefits and salaries. But what about other types of business expenses such as business insurance?

If you are missing some deductions for the business insurance policies you carry, you may be paying too much in taxes and wasting money that you could either take home in profit or reinvest in your business. Here’s how to make sure you are taking all of the deductions you are entitled to for your business insurance expenses.

Is business insurance tax deductible?

Generally, yes, according to the IRS. If you operate a for-profit business, “you can generally deduct the ordinary and necessary cost of insurance as a business expense, if it is for your trade, business or profession.”

“The most common mistake I see is that small business owners forget to deduct their self-employed health insurance,” Gabriel Sandler, enrolled agent and financial advisor at Wolverine Tax and Financial, told business.com. “This can include out-of-pocket premiums covering their whole families, Medicare premiums and even long-term care insurance.”

Business owners don’t often forget to deduct general liability insurance, Sandler said, “but it is important to remember that if you maintain a home office and use the actual expense method, a portion of your homeowners insurance should be included on Form 8829. … I do [also] often see small businesses with employees forget to deduct their workers’ compensation insurance.”

Unfortunately, as Sandler noted, disability insurance for yourself or your employees is not generally deductible.

What can’t a business deduct?

According to the IRS regulations for 2022, businesses generally can’t deduct the following costs.

- Prepaid insurance expenses: You generally cannot deduct expenses in advance, even if you pay them in advance. This applies to prepaid insurance premiums.

- Disability insurance: Since this insurance covers the cost of your salary if you become sick or injured and unable to work, it is not deductible.

- Life insurance coverage: You can’t deduct the cost of life insurance coverage for you, an employee or any person with a financial interest in your business if you’re a direct or indirect beneficiary of the policy.

- Interest on loans with respect to life insurance policies: You generally cannot deduct interest on a debt incurred with respect to any life insurance, annuity or endowment contract that covers any individual, unless that individual is a key person in your business.

- Insurance you get to secure a loan: If a lender requires you to get a life insurance policy to be approved for a loan, the premiums for this policy are not deductible.

- Interest allocated to unborrowed policy cash value: Corporations and partnerships generally cannot deduct any interest expense allocable to unborrowed cash values of life insurance, annuity or endowment contracts. This rule applies to contracts issued after June 8, 1997, that cover someone other than an officer, director, employee or 20 percent owner.

- Self-insurance reserve funds: You can’t deduct amounts credited to a reserve set up for self-insurance. This applies even if you can’t get business insurance coverage for certain business risks. However, your actual losses may be deductible.

- Dividends from business insurance: If you receive dividends from business insurance and you have deducted the premiums in prior years, at least part of the dividends generally are income.

If your business experiences a loss that is not covered by insurance, 100 percent of the loss is likely tax deductible. If the loss is partially covered, the uncovered part of the loss is usually tax deductible.

How do you file and list your business insurance expenses?

How you list your insurance expenses on your business’ tax return depends on the structure of your company.

Type of business structure | Where to list business insurance expenses |

Sole proprietorships and single-member limited liability companies (LLCs) | Schedule C, line 15 under “Expenses” |

Partnerships and multimember LLCs | Form 1065 in the “Deductions” section Each partner should also list his or her share of all income, credits and deductions on Schedule K-1. |

Corporations | For C corporations: Form 1120 in the “Deductions” section For S corporations: Form 1120S in the “Deductions” section |

Follow the instructions for each form, deducting the amount of the insurance and other business expenses from income as outlined.

As always, check with your accountant if you have specific questions. Also note that IRS regulations are subject to change every year and this is just an overview. For more details, consult a tax professional or visit IRS.gov.

Jennifer Dublino contributed to this article. Source interviews were conducted for a previous version of this article.