If you think business checking accounts are the same as personal checking accounts, you’re in for a rude awakening. Business checking accounts are more nuanced than individual accounts and tend to come with more restrictions and higher fees.

Opening a bank account is essential for raising your business credit score. However, whereas a personal checking account is usually free to use, a business bank account is often subject to a range of fees. These banking costs can potentially add up to hundreds of dollars a year — if you don’t know how to avoid them. Here’s everything you need to know about business checking account fees to help you stay prepared.

Building a strong banking relationship through a business checking account can boost your chances of qualifying for the

best business loan and financing options. Lenders often favor applicants with established financial histories at their institution.

What are the types of business checking fees?

When choosing a business checking account, you must be mindful of monthly and discretionary fees. Banks often expect business owners to be more financially sophisticated than ordinary consumers, so it’s important to do your due diligence.

“It’s common for business checking accounts to have fees for services like wire transfers, large numbers of cash deposits, transactions or monthly service fees,” explained Michelle Wright, head of field sales for Capital One business banking.

The business checking fees you’re responsible for depend on the individual bank’s terms. As a starting point, though, watch out for these standard fees:

- Monthly service fee: This fee — typically $8 to $30 per month — covers the maintenance of your business checking account. It’s often waived if you meet a certain balance requirement or spend a minimum amount each month on the bank’s debit or credit card. Some online banks don’t charge a monthly fee at all.

- Transaction limits: Some banks charge a fee if you exceed a set number of monthly transactions. Transaction caps often hover around 200 per month, although some accounts allow as few as 100. While many no-fee business checking accounts don’t impose transaction limits, others apply penalties if you exceed a threshold or fail to maintain a minimum balance. Certain accounts also charge fees when cash deposits exceed a set dollar amount.

- Cash deposit fee: Banks limit how much cash you can deposit monthly. If you exceed the limit, you’ll pay a fee — usually calculated per $100 deposited above the threshold. If you run a cash-heavy business, this fee is worth weighing carefully when evaluating account options.

- Nonsufficient funds (NSF) fee: This fee applies when your account doesn’t have enough money to cover a transaction. The average NSF fee is around $35 per incident.

- Wire transfer fees: Banks charge $15 to $25, on average, to send funds to another bank via wire transfer. The exact amount varies by institution.

If you keep more than the Federal Deposit Insurance Corporation-insured limit in your business checking account, make sure you understand how to protect those excess funds.

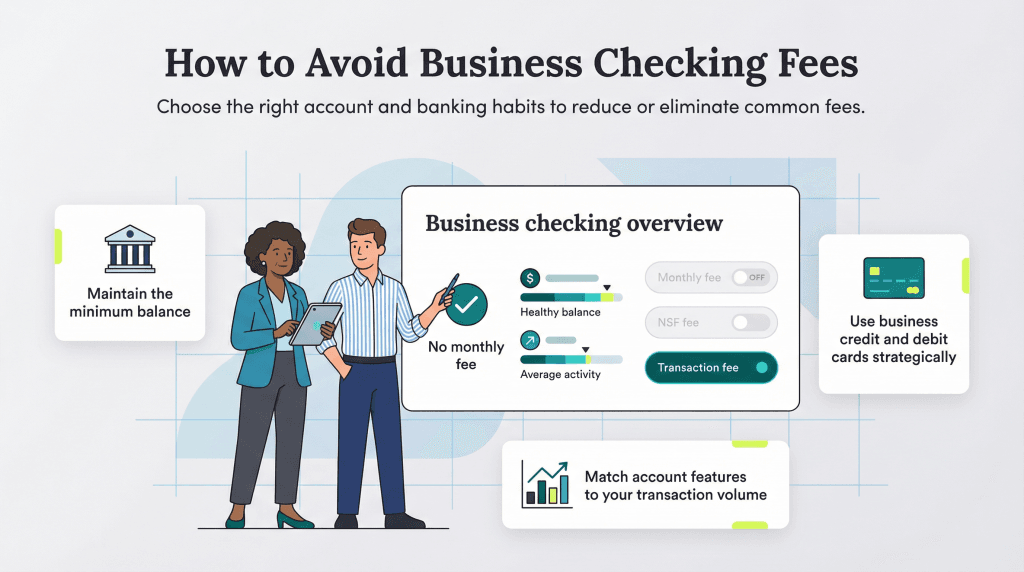

How do you avoid business checking fees?

The fees business owners face run the gamut, from monthly maintenance charges to NSF fees. However, not all business checking account fees are etched in stone — you can use a few strategies to avoid many of them.

“Many banks offer easy ways to avoid these fees,” Wright advised.

At traditional banks, meeting the minimum balance requirement typically waives the monthly service fee. Other banks may remove the fee if you regularly use the bank’s business credit or debit card. The same strategy applies to transaction fees: If you stay within your transaction limit, you won’t face extra charges. That logic also holds for online banks that set monthly transaction caps.

Your banking habits play a big role in how many fees you’ll incur. That’s why it’s important to choose an account that aligns with how money flows in and out of your business.

“As a small business owner, it’s important to have a sense of how much money you expect to move through your accounts on a regular basis,” Wright said. “That way, you’ll be able to choose an account that works best for you. If you’re not running a lot of transactions through your business checking account, it may make more sense to choose a basic account, which usually comes with a lower monthly service fee.”

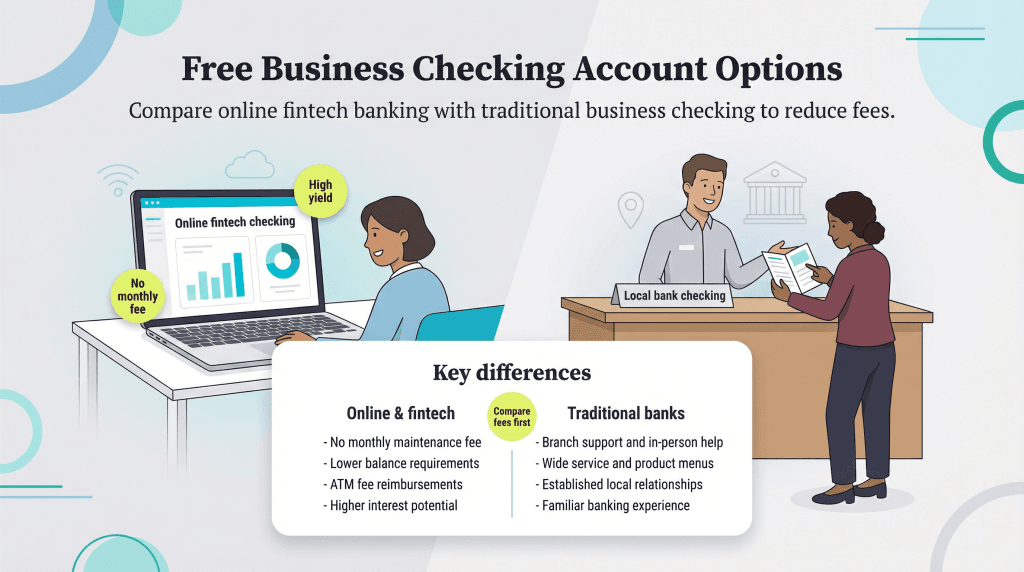

What are free business checking account options?

Popular ways to avoid business checking account fees include signing up with an online bank or using a financial technology (fintech) startup’s platform. In recent years, fintech startups have disrupted traditional banking by slashing fees, lowering requirements and leveling the playing field for small businesses. They may not have the deep pockets or broad service offerings of traditional banks, but they use automation and machine learning to reduce costs and improve customer service.

Online banks may not appeal to every business — after all, they lack local branches and face-to-face interaction — but they’re attracting thousands of business customers looking for cost-effective banking alternatives.

“Businesses shouldn’t pay to open a business checking account,” said Kathryn Petralia, co-founder of Keep Financial. “New online-only products eliminate much of the overhead traditional banking accounts require and therefore pass those savings on to customers by eliminating maintenance fees, minimum balance fees and similar costs. Find a product that supports your growth, not hinders it.”

With that in mind, here’s a list of some popular free business checking accounts and what they offer:

- Bluevine offers a business checking account with no monthly fees and unlimited transactions. Customers earn 1.5 percent interest on balances up to $250,000 — and up to 3.7 percent on an upgraded plan. Bluevine doesn’t require a minimum balance or limit the number of transactions.

- Novo offers a business checking account with no hidden fees or minimum balance requirements. It also reimburses up to $7 per month for third-party ATM fees.

- Axos Bank offers a Basic Business Checking account with no monthly maintenance fee, minimum balance fee or opening deposit requirement. Customers also have access to a surcharge-free ATM network.

- NBKC Bank charges no overdraft, NSF or returned item fees. There’s no minimum balance requirement and no per-item fees.

Both traditional and online banks offer different advantages, so it’s important to choose what best fits your needs. No matter which route you take, compare fee structures and account features carefully before selecting a business banking partner.

“Some people appreciate the in-person relationship with banks,” Petralia noted. “Other business checking accounts are optimized for efficiency online, reducing costs and increasing yields. Every business is different and preferences vary. But the banking options … are far different than they were even two or three years ago. I’d encourage all businesses to get to know their options.”