Business.com aims to help business owners make informed decisions to support and grow their companies. We research and recommend products and services suitable for various business types, investing thousands of hours each year in this process.

As a business, we need to generate revenue to sustain our content. We have financial relationships with some companies we cover, earning commissions when readers purchase from our partners or share information about their needs. These relationships do not dictate our advice and recommendations. Our editorial team independently evaluates and recommends products and services based on their research and expertise. Learn more about our process and partners here.

How to Get PPP Loan Forgiveness

The Paycheck Protection Program offered relief to businesses during the pandemic. Here’s what you need to know about PPP now.

Table of Contents

The Paycheck Protection Program (PPP) provided much-needed relief to businesses of all sizes in 2020 and 2021. First-draw PPP loans were available for up to $10 million, and second-draw loans for up to $2 million. Best of all, they were 100 percent forgivable for qualifying borrowers.

The program officially ended on May 31, 2021. Of the approximately 11.5 million loans issued, about 10.5 million have been fully or partially forgiven as of 2025. Although most borrowers have completed the forgiveness process, some businesses may still be eligible to apply if their loan hasn’t yet matured. Here’s what you need to know about PPP loan forgiveness and how the application process works.

- Contact your lender directly

- Verify you qualify for forgiveness

- Complete the appropriate SBA Form 3508

- Submit your application

What is PPP loan forgiveness?

Loan forgiveness was a key feature of the PPP — a loan initiative created to help small businesses survive the COVID-19 pandemic. Congress empowered the Small Business Administration (SBA) to issue hundreds of billions of dollars in low-interest loans. According to the SBA, nearly $800 billion was distributed to 8.5 million small businesses.

PPP loans were forgivable as long as the borrower used the funds for qualified expenses, such as keeping staff on payroll. Certain operating costs and other pandemic-related business expenses were also eligible.

Borrowers were allowed to apply for forgiveness as soon as they used the loan proceeds. Most eligible borrowers have already applied for PPP loan forgiveness, but, as of 2025, businesses can still apply as long as their loan hasn’t reached its maturity date. Loan terms typically allow forgiveness applications up to two or five years after disbursement. If a borrower doesn’t apply within 10 months after the covered period ends, however, they must begin making payments.

“You have up until the loan matures if you are requesting forgiveness, but there is no incentive to wait,” said Alan Haut, the U.S. Small Business Administration’s district director for North Dakota. “You’ll have to start making payments if you apply after the deferment period.”

How do you apply for PPP loan forgiveness?

As of 2025, most eligible borrowers have already applied for PPP loan forgiveness. If your business hasn’t yet submitted a forgiveness application, however, you may still be eligible — as long as your loan hasn’t reached its maturity date.

Depending on how much you borrowed, applying for PPP loan forgiveness can take just a few minutes or require more documentation. Either way, below are the steps to follow.

Step 1: Contact your lender.

The first step in applying for PPP loan forgiveness is to contact your lender directly. Lenders are responsible for facilitating the forgiveness process, and many offer streamlined online application portals.

To make the process easier, the SBA launched the PPP Direct Forgiveness Portal, which allows borrowers to submit forgiveness applications directly — but there’s a catch. Your lender must be enrolled in the SBA portal, and not all lenders have opted in.

The SBA provides a list of participating lenders, so you can check if yours is included.

“You have to contact your lender and make sure they opted in,” Haut said. “Many lenders have an online process of their own that is quick and easy. Starting with the lender is the best option.”

If your lender is part of the Direct Forgiveness Portal and doesn’t offer its own online platform, you can use the SBA tool to apply.

Step 2: Determine if you are eligible for loan forgiveness.

To qualify for PPP loan forgiveness, you must meet specific criteria. The size of your loan will determine how much documentation you need to provide, but the eligibility requirements are the same for all borrowers.

- At least 60 percent of the loan was used to cover payroll liabilities and expenses.

- The remainder was spent on eligible nonpayroll costs, such as mortgage interest or rent, utilities, operating costs, pandemic-related property damage, business supplies, and personal protective equipment (PPE).

- You maintained employee headcount and compensation levels in line with prepandemic benchmarks.

If you can check all those boxes, you’re likely eligible for full loan forgiveness and can move on to the next step.

Step 3: Determine which application is right for you.

To receive forgiveness for your PPP loan, you’ll need to complete an SBA Form 3508. There are three versions of the form, and the one you use depends on the size of your loan and your employee headcount.

All versions require basic business information, including your business name and address, tax ID number, and contact information. You’ll also need to indicate whether the loan was a first-draw or second-draw PPP loan and input the loan amount and terms.

The primary difference between the forms is the number of calculations and supporting documents required.

SBA Form 3508EZ

Use Form 3508EZ if your business meets one of the following criteria:

- You are self-employed with no employees

- You did not reduce employee salaries by more than 25 percent and met employee retention requirements

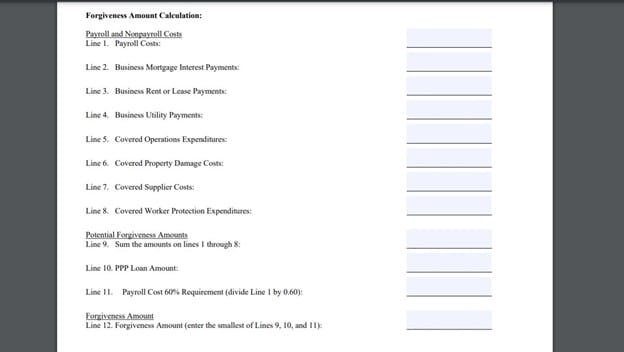

The three-page application includes a calculation form, signature form and an optional demographic information form. You’ll be required to document how the PPP loan was spent and calculate your forgiveness amount.

SBA Form 3508EZ requires you to calculate your PPP expenses. Source: U.S. Small Business Administration

SBA Form 3508S

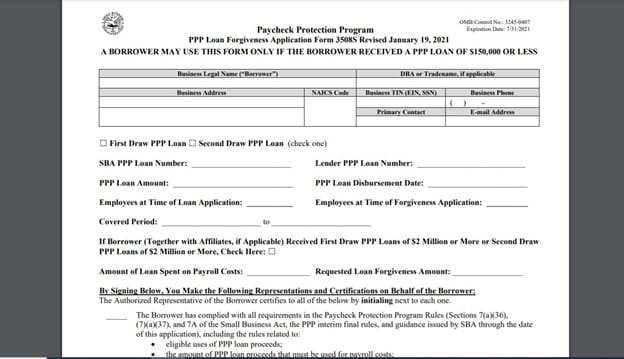

Form 3508S is the simplest PPP loan forgiveness application. It’s available only to borrowers whose loans were $150,000 or less. The two-page form requires minimal calculations and, in many cases, no supporting documentation. If you’re applying to forgive a first-draw PPP loan, documentation is not required. For second-draw loans, however, you must provide evidence that your business experienced a revenue reduction of at least 25 percent.

Form 3508S requires no documentation. The loan amount can’t exceed $150,000. Source: U.S. Small Business Administration

SBA Form 3508

Form 3508 is the most detailed and complex of the three forgiveness applications. It’s intended for small business borrowers who don’t qualify to use Form 3508EZ or Form 3508S.

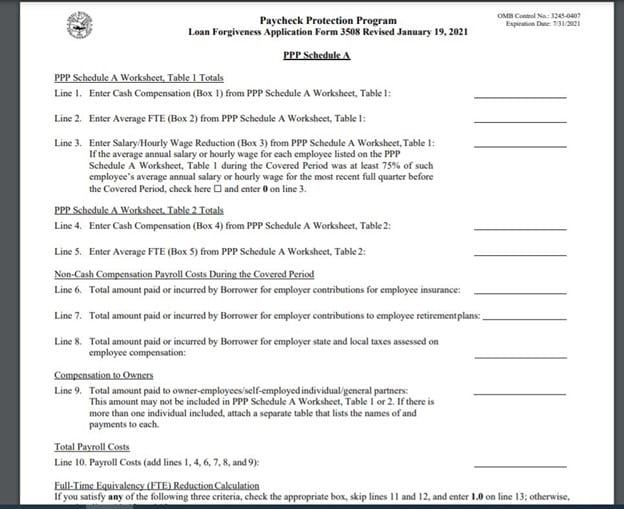

The full application is five pages long and requires extensive calculations and supporting documentation. It includes:

- A calculation form

- A signature/authorization page

- Schedule A

- Schedule A Worksheet

- An optional demographic information form

The Schedule A page of Form 3508 requires extensive information. This is just a snapshot of the information required. Source: U.S. Small Business Administration

Step 4: Don’t wait too long to apply.

If you used your PPP loan funds for approved purposes, you’re likely eligible for forgiveness — but if you wait too long to apply, you could be required to start making loan payments.

As of 2025, the 10-month deferment period has passed for most borrowers. If your loan was issued late in the program and you haven’t yet applied, however, you may still be within your forgiveness window. Borrowers can apply for forgiveness any time before their loan matures — typically two years for loans issued before June 5, 2020, and five years for loans issued on or after that date.

“Small business owners need to know they only have 10 months to procrastinate,” said Brock Blake, CEO of online loan marketplace Lendio. “Once it’s 10 months from when you got the loan, it is the day of reckoning. You have to start making payments after that.”

PPP loan forgiveness FAQs

- You spent the funds during the eight- to 24-week covered period.

- Employee headcount and compensation levels were maintained.

- At least 60 percent of the funds were spent on payroll costs.