Workers’ compensation insurance can help protect your business and employees when an employee is accidentally injured or falls ill on the job. Each state has its own workers’ compensation laws for both employers and employees, so it’s important to know how the regulations affect your business. Furthermore, nearly every state requires workers’ compensation insurance for companies with at least one employee, with the exception of Texas, where workers’ compensation isn’t required by law. We’re breaking down what you need to know.

>> Read Next: Workplace Accidents — How to Avoid Them and What to Do When They Happen

What is workers’ compensation?

Workers’ compensation is a type of business insurance that provides benefits to employees who become injured or ill while doing their jobs. The insurance covers the employee’s medical costs, a portion of their lost wages while they’re out of work and their rehabilitation costs so they can return to work or find a new job.

Workers’ compensation insurance also protects the employer by limiting its liability for legal claims in the event an employee sues the business over an illness or injury caused by work-related incidents.

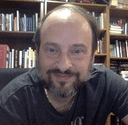

What does workers’ compensation cover?

Workers’ compensation covers the following expenses.

- Medical expenses: Workers’ compensation pays for medical treatment for work-related injuries or illnesses, including doctor visits, hospital stays, surgery, medication and rehabilitation services.

- Lost wages: Employees typically receive a percentage of their lost wages while they’re unable to work due to their injury or illness.

- Death benefits: If an employee dies from a work-related injury or illness, workers’ compensation provides death benefits to their surviving family members.

- Vocational rehabilitation: Workers’ compensation may cover retraining costs if an employee cannot return to their previous job due to their injury.

Some insurance policies don’t provide workers’ compensation coverage across multiple states or when employees travel to different states. Under these circumstances, you would need workers’ compensation insurance in each state where your employees work or travel.

What workers’ compensation doesn’t cover

Workers’ compensation is a no-fault system. When an employee receives workers’ compensation for their injury or illness, they give up the right to sue their employer. However, workers’ compensation will not cover your business if you purposefully harm an employee, such as committing assault, battery, fraud, defamation or emotional distress or protect your business if your employee sues you for the following acts:

- Intentional acts of violence or harassment

- Discrimination or wrongful termination

- Violations of employment laws

- Non-work-related injuries or illnesses

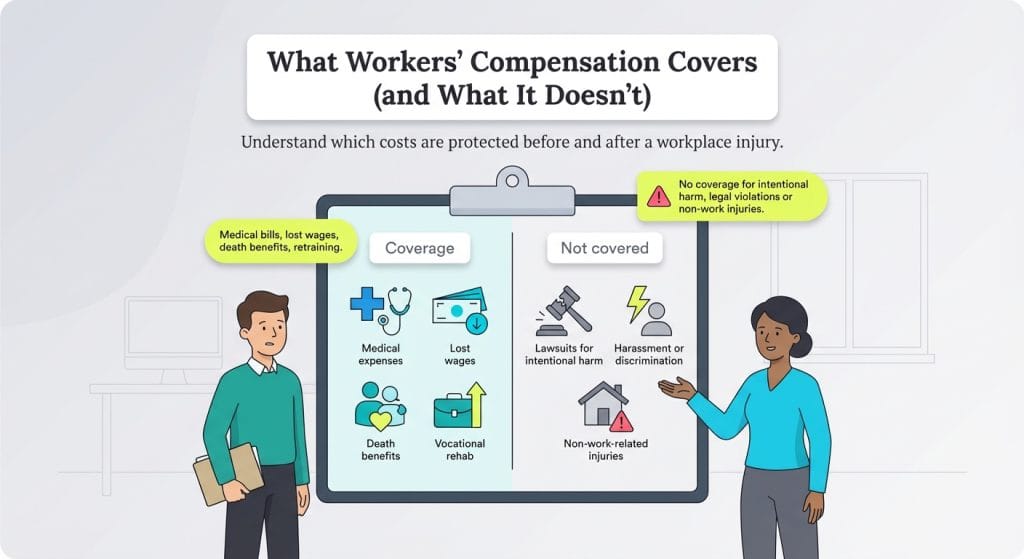

What injuries qualify for workers’ compensation?

Workers’ compensation covers medical costs or death benefits that result from employee injuries that occurred while the employee was doing their job or acting on your behalf. Examples include injuries or illnesses related to the following:

- Lifting or moving of boxes

- Operation of heavy equipment

- Repetitive motion

- Deliveries

- Falls or slips on a wet or icy floor

- Exposure to hazardous chemicals

- Burns from chemicals or hot materials

- Violent or terrorist acts

- Fires, floods and natural disasters

Different states exclude certain situations from workers’ compensation coverage. Here are some examples of employee actions that would not qualify for workers’ compensation:

- Employee injures themselves intentionally.

- Employee gets injured in a fight with another employee.

- Employee becomes injured due to drug or alcohol intoxication.

- Employee gets injured or dies on the commute to work but not in the course of doing their job.

- Employee experiences emotional injury without an accompanying physical injury.

Is there a cap on workers’ compensation?

As with any commercial liability insurance policy, workers’ compensation has a limit or cap on the amount a policy will pay out for a claim. However, workers’ compensation limits are structured differently than other types of insurance policies. These policies place limits on employer liability and employee benefits:

- Employer liability: If an employee claims employer negligence, the employee can sue for damages and workers’ compensation benefits. Workers’ compensation would cover the employer’s legal fees and pay any amount awarded by the court to the employee. The policy limits how much the insurance company will pay depending on the amount the employer chooses when purchasing the insurance.

- Employee benefits: Workers’ compensation would cover the employee’s lost wages, medical expenses and rehabilitation expenses or death benefits to their dependents. There is no limit on the employee’s medical bills, but the state can impose limits on how much is paid in lost wages.

State governments determine which types of employers must carry workers’ compensation insurance as well as the fines for not being covered, guidelines for reporting work-related injuries and medical care requirements. [Related article: How Much Workers’ Comp Insurance Do You Need?]

How much does workers’ compensation cost?

State laws determine the details involving workers’ compensation, including how much it costs. In all applicable states, employers pay for workers’ compensation insurance largely based on a percentage of their total payroll costs. On average, it works out to $1 per $100 of payroll. There are no employee payroll deductions for workers’ compensation insurance.

Below are some other factors besides payroll that affect the cost of workers’ compensation insurance:

- Amount of benefits provided by the insurance

- Types of injuries or illnesses covered by the insurance

- Types of benefits and employee care provided

- Claims history

- Risk level of different employees and industries

- Workers’ compensation class codes

Cost-saving strategies for workers’ compensation

Implementing strategic cost-reduction measures can significantly impact your workers’ compensation expenses while maintaining compliance and employee safety.

Develop comprehensive safety programs. Safety programs that can effectively prevent accidents and injuries will reduce the total number of workers’ compensation claims that are filed. Key safety program elements include:

- Regular safety training sessions for all employees

- Hazard identification and risk assessment procedures

- Personal protective equipment (PPE) requirements and training

- Emergency response protocols and drills

- Safety committee meetings and employee feedback systems

Implement return-to-work programs. Delayed injury reporting can significantly increase workers’ compensation claim costs, with research showing costs can increase substantially when reporting is delayed beyond two weeks. Establishing effective return-to-work (RTW) programs can dramatically reduce claim costs. Successful return-to-work programs should include:

- Light-duty job descriptions for various physical limitations

- Clear communication protocols with injured employees

- Regular check-ins with recovering workers

- Coordination with healthcare providers

- Modified work schedules when appropriate

Focus on early injury reporting. Immediate reporting and care can reduce harm, reduce total settlement amounts and let your team know that their safety is your top priority. Establish clear procedures for immediate injury reporting and response. Best practices for injury reporting include:

- Injury reporting forms readily available at all work sites

- 24-hour injury reporting hotlines

- Trained supervisors who can respond immediately to incidents

- Clear documentation procedures for all workplace incidents

- Direct communication channels with workers’ compensation carriers

Improve experience modification rates. Your experience modification rate (EMR) directly affects your premium costs. A strong safety program that reduces the frequency and severity of claims can reduce your EMR factor, which goes into the calculation for your annual workers’ comp insurance premiums. Strategies to improve EMR include:

- Aggressive claims management to minimize claim costs

- Fraud prevention and investigation procedures

- Regular review of claim reserves and settlements

- Proactive medical case management

- Data analysis to identify injury trends and prevention opportunities

Who needs workers’ compensation insurance?

Most businesses with one or more employees require some form of workers’ compensation insurance, except those in Texas, where workers’ compensation is optional. Whether your specific business and employees require this insurance will depend on the type of business and the status of your employees.

The following types of employees are likely to be exempt from a workers’ compensation insurance requirement.

- Family members who are employees

- Part-time employees

- Volunteers

- Government employees

- Commissioned employees

- Independent contractors

- Domestic workers in private homes

- Some types of real estate agents and insurance professionals

- Farm workers

- Maritime workers

- Railroad employees

Having a workers’ compensation policy in place can reduce the likelihood of an employee filing a lawsuit against their employer.

What are workers’ comp implementation deadlines?

Understanding workers’ compensation implementation timelines and deadlines is crucial for maintaining compliance and ensuring proper coverage. New businesses typically need one to three business days to secure workers’ compensation insurance after submitting a complete application. However, it’s important to plan ahead, as several factors can extend the timeline.

Coverage must be in place before your first employee begins work, and some insurers may require a workplace inspection before issuing a policy. High-risk businesses may face additional underwriting reviews, which can delay approval. Additionally, state-specific requirements may add processing time, making early preparation essential.

Key implementation deadlines

Employers must meet several critical deadlines when implementing workers’ compensation coverage.

Before hiring your first employee:

- Secure workers’ compensation insurance policy.

- Post required notices about coverage.

- Establish injury reporting procedures.

- Train supervisors on emergency response protocols.

Within the first month of operation:

- Complete any required state filings.

- Conduct initial workplace safety assessments.

- Implement basic safety training programs.

- Establish relationships with approved medical providers.

Ongoing compliance requirements:

- Annual policy renewals (typically 60 to 90 days before expiration)

- Quarterly payroll audits for premium adjustments

- Regular safety training updates

- Claims reporting within state-mandated timeframes

State-specific deadlines for injury reporting

State laws often impose shorter deadlines for reporting injuries to employers than for filing formal claims. For example, some states require injured workers to notify their employer immediately or within 24 to 48 hours, while others allow 30 to 90 days. In contrast, the deadline to file a formal workers’ compensation claim is usually one to three years from the date of injury, depending on the state.

Employers should be familiar with both sets of deadlines, as delays in reporting can lead to benefit denials or disputes. In cases involving occupational illnesses or repetitive stress injuries, the timeline may be based on when the symptoms were first recognized, rather than the actual date of exposure.

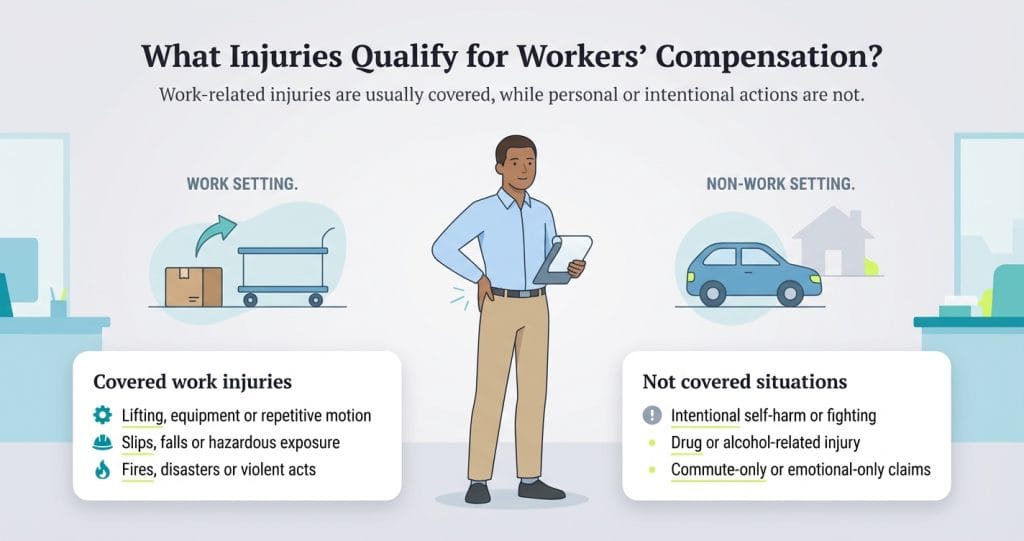

What are common workers’ compensation mistakes?

Avoiding common pitfalls can save businesses significant costs and compliance issues. These mistakes often result from lack of experience with workers’ compensation systems.

Premium and classification errors

Most employers are unfamiliar with the complicated calculations that make up their total workers compensation cost. Small oversights can lead to significant overpayments. Common premium mistakes include:

- Incorrect job classifications leading to overpayment of premiums

- Inaccurate payroll reporting during audits

- Failure to verify experience modification calculations

- Not applying for available credits or discounts

- Accepting audit results without review

To prevent this from happening, have an independent expert review all premium calculations annually and challenge any discrepancies.

Inadequate safety programs

A strong safety program is essential to reducing workplace injuries and lowering insurance costs. However, many employers make avoidable mistakes that weaken their safety efforts. Common safety program mistakes include:

- Treating safety as a compliance checkbox rather than a cultural priority

- Insufficient safety training for new employees

- Lack of regular safety meetings and updates

- Failure to conduct accident investigations

- Not involving employees in safety planning

Poor claims management

How you handle workers’ compensation claims directly affects your overall costs. Poor processes can result in longer recovery times and higher premiums. Common claims management mistakes include:

- Delayed injury reporting that increases claim costs

- Poor communication with injured employees

- Failure to offer modified duty work

- Inadequate medical case management

- Not investigating potential fraud

Focusing on price instead of protection

When purchasing workers’ compensation insurance, it’s important that you look at the whole picture, not just how much it costs. Choosing a policy based only on price can leave your business exposed.

Mistakes in insurance selection include:

- Choosing coverage based solely on price

- Not evaluating insurer claims handling capabilities

- Ignoring available risk management services

- Failing to understand policy terms and conditions

- Not considering long-term partnership potential

Insufficient documentation

Thorough documentation supports the legitimacy of claims and helps protect your business during disputes or audits. Poor documentation practices can lead to claim disputes and increased costs:

- Incomplete incident reports

- Missing witness statements

- Inadequate safety training records

- Poor communication documentation with injured workers

- Failure to document return-to-work efforts

How do I buy workers’ compensation insurance?

Businesses can purchase workers’ compensation insurance from state-funded programs or private insurance companies. Each state determines its workers’ compensation policy requirements. When you purchase a policy, you’ll need to provide the following information so the insurer can determine your coverage and costs.

- Total number of employees

- Number of employees requiring coverage

- Type of work each employee performs

- Total payroll

Each state has its own rules on what’s covered, how it evaluates different issues, how injured employees receive medical care and which benefits an employee can receive.

How do I file a workers’ compensation claim?

When an employee becomes injured or ill on the job, the first task is not to file a workers’ compensation claim — it’s to make sure the employee receives proper medical treatment. This may include calling an ambulance to take the injured or ill employee to the hospital.

Following that, the employer and employee have a limited amount of time — usually between 10 and 90 days — to submit the paperwork that’s required for the employee to receive workers’ compensation benefits. The process for filing varies from state to state. However, if the claim isn’t filed within the required time, coverage can be denied.

Employer responsibilities

When an employee is injured or falls ill due to work, the employer must do the following:

- Provide the employee with the required paperwork to report the workers’ compensation claim.

- Provide directions on how to file for workers’ compensation.

- File the insurance claim with the insurance company.

- Report the employee’s injuries or illness as required by state law.

The employer must also provide the employee with information on their rights and workers’ compensation benefits, as well as the procedure for returning to work.

Employee responsibilities

After the illness or injury occurs, the employee must take the following steps:

- Inform the employer in writing of the details relating to the injury or illness, such as date, time, type of injury or illness or how it occurred

- File the formal workers’ compensation paperwork for a claim. In some cases, the employer is responsible for filing the paperwork with their workers’ compensation insurance carrier. However, the employee’s healthcare practitioner must also submit a medical report.

Information to include in a claim

A workers’ compensation claim should include the following information:

- Company information, such as company name, account number and location and policy number)

- Injured employee’s personal information, such as name, date of birth, age, address, phone number and Social Security number

- Details of the work-related incident, such as date, type of injury or illness, cause of injury or illness, estimated number of workdays lost, expected return date and witnesses’ information

How long do workers’ compensation claims take?

The time required to complete a workers’ compensation claim depends on state requirements, the time needed to investigate the claim and other factors. Once the employer files the claim, the insurance provider must determine whether to approve or reject the claim.

If the insurance provider approves the claim, the company will provide the affected employee with payment details. The insurer can deny the claim if it doesn’t qualify for workers’ compensation benefits:

- If the insurance provider approves the claim, the employee can opt to accept the offer to pay their lost wages, medical bills and medicine and disability payments or negotiate a lump-sum settlement or structured settlement. [See how workers’ compensation settlements work.]

- If the insurance provider denies the claim, the employee can opt to appeal the decision or ask the insurer to review their decision.

Note that you may want to talk to a tax advisor about how a workers’ comp claim can affect taxes.

Kimberlee Leonard contributed to this article.