You’ve heard the old saying, “Honesty is the best policy.” However, the rising dishonesty in the employment sector suggests this virtue has gone missing. Resume fraud started with slight exaggerations and small white lies in yesteryears. But job applicants today have gone beyond all prior limits with resume fraud thanks to the advent of high-tech scams.

Now, an enhancement or exaggeration in education credentials is considered a minor fraud. Some job hunters have gone as far as coming up with fake employment histories, job references, degrees and specialized licenses. As a small business owner, it’s critical to understand resume fraud so you can avoid being fooled when hiring employees. Keep reading to learn more about resume fraud, including how it impacts businesses and how to prevent it during the hiring process.

What is resume fraud?

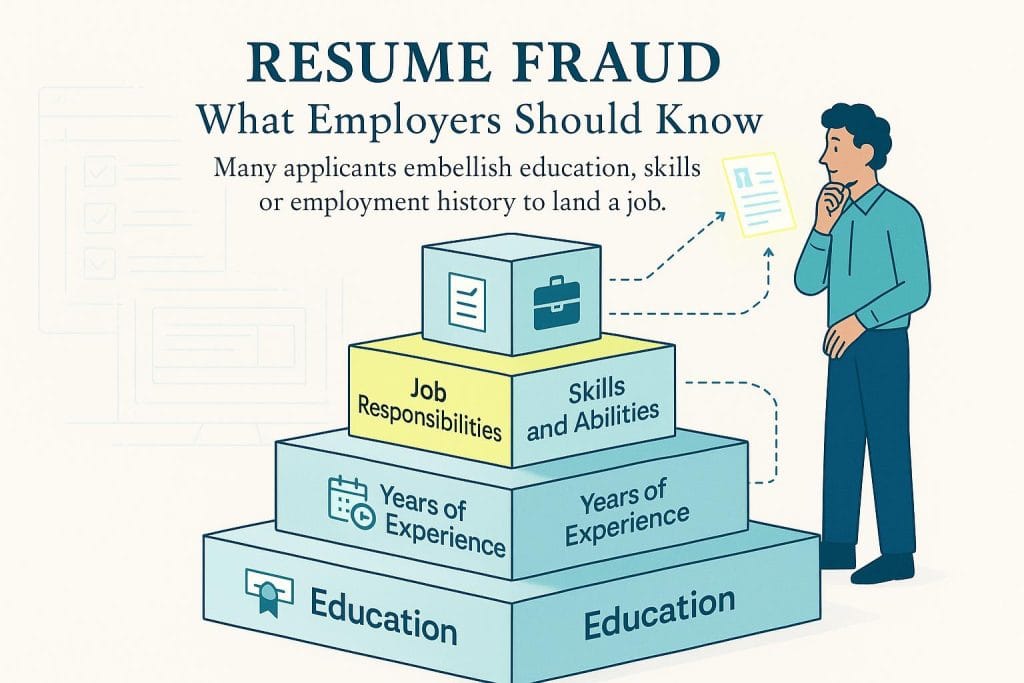

Resume fraud, also referred to as resume inflation, occurs when a job applicant includes false or misleading information on their resume. For example, someone might be misleading about how long they were at a job by solely stating years of employment months. They might falsify their previous responsibilities to make it seem they had more experience than they really did. According to Adam Corder, senior manager of talent acquisition at Alkami, resume fraud includes education and employment history lies, falsified job titles or responsibilities, skill exaggeration, achievements inflation and fake references.

Resume fraud is more common than you might think. In fact, a 2023 survey by ResumeLab found 70 percent of job applicants have either lied or would consider lying on their resume. In today’s job market, resume fraud isn’t just about lying though. “It’s strategic impersonation,” said Patrice Williams-Lindo, CEO of Career Nomad. “People are building entire careers with AI, stock language and just enough buzzwords to game the system.”

Some job seekers are even taking lying one step further by using technology scams to back up their false claims. Online services such as Fake Resume and CareerExcuse seem to be making the most of this trend. By offering “powerful underground guides” and showing job seekers how to “fill the gaps in your employment history,” these websites promise to help applicants add experience to their resume, rig their resume so it’s picked by top HR software programs that screen resumes, get fake references and so on. But that doesn’t mean it’s ethical to do. Plus, for the businesses that fall victim to resume fraud, there are real consequences.

Men are reportedly more likely to say they’ve lied on a resume than women.

How does resume fraud impact your business?

Applicants lying about their professional history and skill sets can have a significant impact on your business. It’s estimated that resume fraud costs employers $600 billion annually.

For companies that handle sensitive information, resume fraud can be even more detrimental. “In digital banking, we value integrity and transparency, especially when it comes to hiring,” Corder said. “These principles are essential to building trusted teams that manage sensitive data, drive innovation and uphold regulatory standards. Unfortunately, résumé fraud can sometimes undermine this process.”

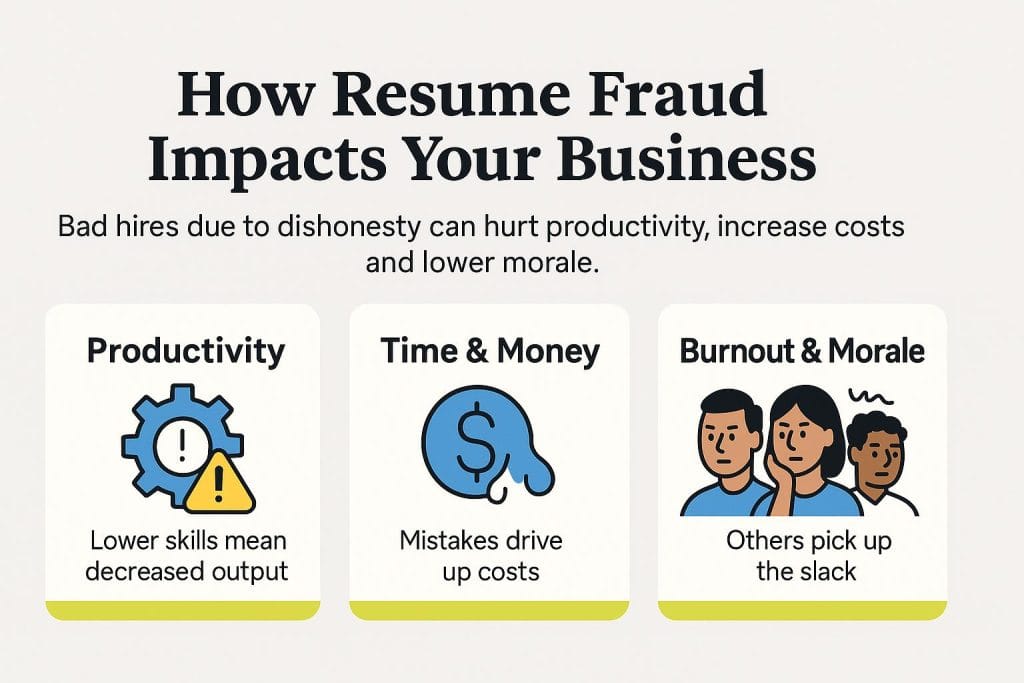

Here are some ways resume fraud can impact your business if you hire someone who has lied on their resume.

- Productivity and performance: New hires who don’t possess the specialized skills or experience they claim to have can cause a lot of problems for your organization, including reduced productivity and performance.

- Time and money: Without the proper knowledge required for the job, these new employees may make excessive mistakes, costing your business time and money when it comes to completing projects the right way.

- Burnout and morale: An unskilled worker can result in other employees needing to pick up the slack, train the new team member or correct mistakes — all of which can lead to employee burnout and low morale. According to Williams-Lindom, this comes with a high “emotional cost” for existing workers. “This is more than a bad hire,” she said. “It’s a culture killer.”

If an employee lied on their resume and isn’t qualified for the job you hired them to do, you have two options: You can train them or you can fire them. Both options cost you time and resources.

How can small businesses avoid resume fraud?

It’s undoubtedly a daunting task to check up on references and confirm the accuracy of every employee application and resume. But given the statistics, you shouldn’t take risks on this. The frequency of and high-tech complexities surrounding occupational fraud these days make it more important than ever to be confident in exactly who you’re hiring. [Read related article: Hiring Process Timeline Best Practices]

Consider these tips for avoiding resume fraud when screening applicants and to ensure your job candidates can back up the information on their resumes.

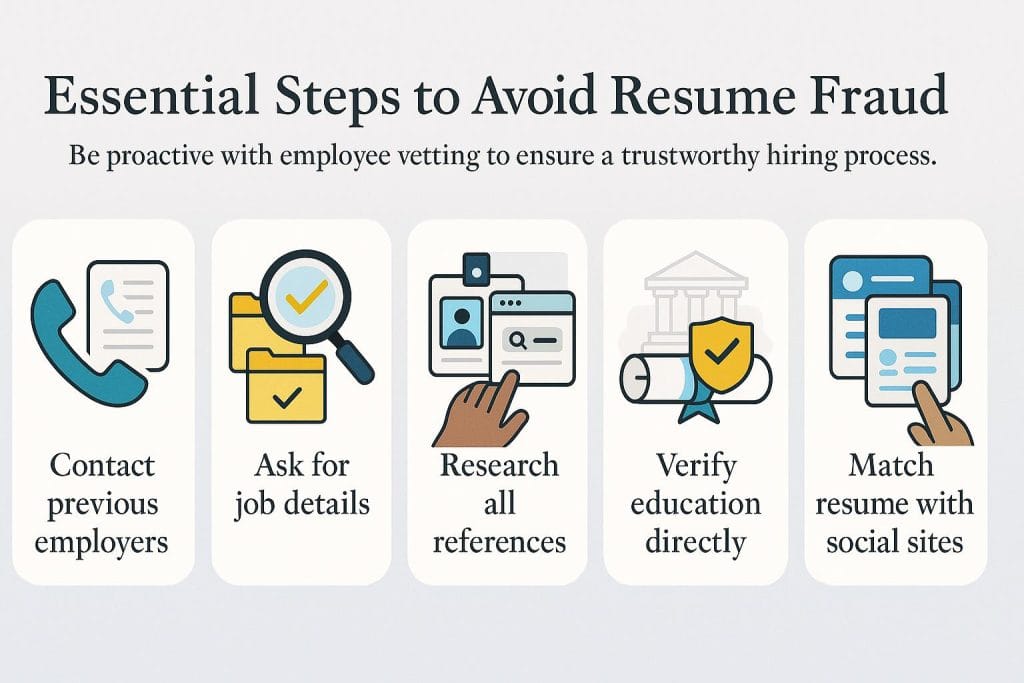

- Contact previous employers. Directly contact previous employers for job history verification. Don’t trust any “800” numbers, as they can be fake references. Always independently verify phone numbers. Ask about the employee’s time with the company, including duration of employment. Beyond fact-checking resume details, the employer may have insight into whether the new hire would be a cultural fit.

- Question the applicant about their previous employment in detail. When verifying employment history, ask the applicant about their previous responsibilities in detail. This can help you gauge if they know what they’re talking about and whether they actually held the job they’re claiming. It can also be helpful to ask about the months in which they began and ended working for a given employer. A date range of “2004-2005” may seem like two years of employment, when in truth, it could be just two months.

- Research their references. Look into the applicant’s references to ensure they are who they claim to be. In the digital era, nearly everyone has some form of online presence you can find. When you contact references, ask about the employee’s professional experience, personality traits and skills, including their assessment of the person’s strengths and weaknesses.

- Verify education with institutions directly. While verifying education and training, confirm certifications as well as attendance directly with the institution listed. In addition, check to make sure the institution is accredited and not just a degree mill. Also verify licenses with the state agencies that issued them.

- Check social media for consistency. Turn to social media platforms, like LinkedIn, to verify resume consistency. Does the applicant list the same colleges and companies? Are the dates and titles the same? It can be hard for people to keep their lies straight across the board.

Social media can tell you a lot about a candidate. However, be careful when checking it, as this can lead to potential

workplace discrimination if you make a hiring decision based on a protected class.

- Use skills testing. Conduct skills testing as part of the interview process. For example, if you’re seeking a candidate for a graphic design position, have them complete a sample graphic design project for you. This is a great way to see if someone can complete the tasks as well as they say they can. You should offer to compensate them for their work; think of it as an investment in improving your workforce.

- Conduct a formal background check. Conduct civil record and criminal background checks where appropriate. This is a must for positions of trust and safety-sensitive jobs, although many employers have grown accustomed to using background check services for all roles. When conducting a background check, be sure to partner with a highly rated background check company.

- Train your hiring team. It’s crucial to train your hiring manager(s) to identify signs of resume fraud. According to Williams-Lindom, “Most people can’t detect career catfishing because they’re looking for polish, not proof.”

- Don’t prioritize job titles. “The best candidate might not have the fanciest title — but they’ll have receipts and results,” said Williams-Lindom.

If you or your HR department don’t have the time or experience to thoroughly check all aspects of the applicant’s resume, you shouldn’t forgo the verification process entirely. Instead, enlist the assistance of an employment screening company. Employment screening companies have resume fact-checking experience and are up to date on all trends in resume fraud. You can outsource as much or as little of the applicant screening process to a third-party vendor as you want. Whatever you choose, be confident you have done your due diligence before hiring a candidate.

Take some time to know who you’re hiring. If you don’t do your homework, you can end up paying a hefty price.

Sammi Caramela and Marc Bourne contributed to the reporting and writing in this article.