Preparing for the future, especially from a financial standpoint, is crucial for all businesses. Companies need to forecast their revenue and expenses to ensure they remain profitable.

Budget planning provides a snapshot of the expected business expenses for a given time. Having this information can help you forecast various costs, such as take-home pay, wages, bills and debt payments. It can also help you put aside emergency funds for unforeseen events. Here’s everything you need to know about budget planning for your business.

What is budget planning?

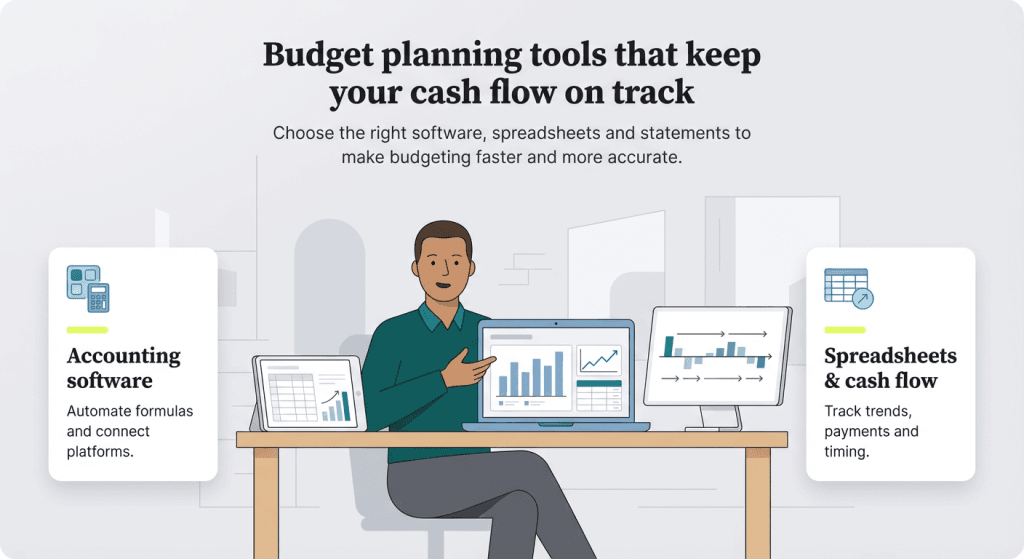

Budget planning is the process of creating a plan to spend your money. It allows you to predict whether you will have enough money to do the things you need or would like to do. Budgeting helps you save money for the long term or for when your business needs it most. If your accounting software doesn’t have budgeting features, use a budget calculator. This tool is meant to help you establish a budget, create a savings plan and pay down debt.

“Budget planning involves looking at external (economy, regulations and laws, etc.) and internal factors (staff, revenue, expenses, etc.) and then estimating needs, incorporating unexpected things, developing future goals, and looking at historical information and trends,” said JeFreda R. Brown, CEO of Goshen Business Group.

How do you plan a budget for a business?

Budgets indicate how much money is spent on different aspects of the business, like payroll, advertising, supplies and other necessities. To create a budget, analyze revenue and expenses for the entire calendar and fiscal year. Look at what you spent the previous year and project if you will spend the same, less or more moving forward.

Editor’s note: Looking for the right accounting software for your business? Fill out the below questionnaire to have our vendor partners contact you about your needs.

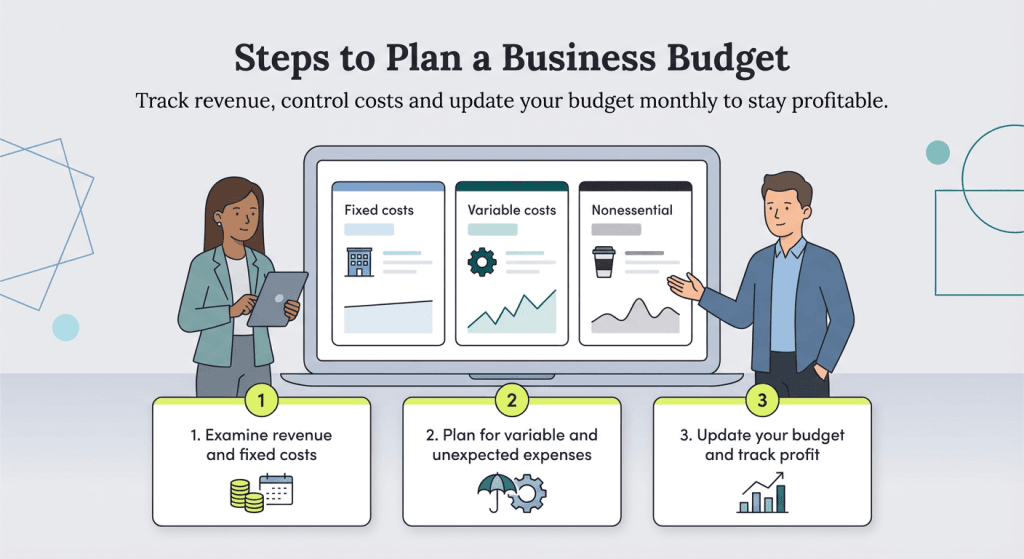

The goal of budget planning is to lay out all of the necessary components and brainstorm your goals, according to Shahid Hanif, founder of Shufti Pro. Hanif named some steps that the budgeting process should include:

- Examine your revenue. Look backward at your existing business and find all of your revenue sources.

- Subtract fixed costs. Subtract all of your fixed costs, like rent.

- Determine variable costs. Variable costs include the price of labor or raw materials.

- Set aside a contingency fund for unexpected costs. These expenses don’t arise only when it’s convenient.

- Create a profit and loss statement. Once you’ve collected the above information, put it together to create your profit and loss statement.

- Outline your forward-looking business budget. Whether you’re a new business owner or you’ve been doing this awhile, projecting what will happen to your business is educated guesswork.

“Generally, fixed costs are contractual,” said Axel DeAngelis, founder of NameBounce. “An example of a fixed cost is rent. Unless your business pays percentage rent based on sales, the rent is generally contractual, with fixed increases throughout the life of the lease.”

Business owners tend to have more control over variable expenses, which fluctuate based on sales. DeAngelis gave sales team commissions as an example: If your business sold 10,000 products, you would pay your sales team more in commissions than if you sold 100 products.

Nonnecessities are expenses such as travel, entertainment or office perks. This category usually does not include monthly business expenses.

As a part of your budgeting process, you should update your expenses monthly, which allows you to verify that your business is on target to maintain profitability.

Business budget templates

Business budgeting is complicated. A business budget template can save you a lot of time and frustration. There are many business budget templates available, but paying attention to some key features can help you narrow your search.

First, look for a budget template that is easy to use. If you don’t interact with your budget regularly, it won’t be effective. Online templates allow you to access your budget anywhere and make edits. If the process is inconvenient, you’ll be tempted to do the budget once and forget about it.

Customization is also important, as each business has its own nuances to consider. Look for a template that allows you to add items and change formulas if necessary. Below is Business.com’s budget template, which offers general guidance, planning tips and tax resources.

FREE TEMPLATE: Business.com Budget Template

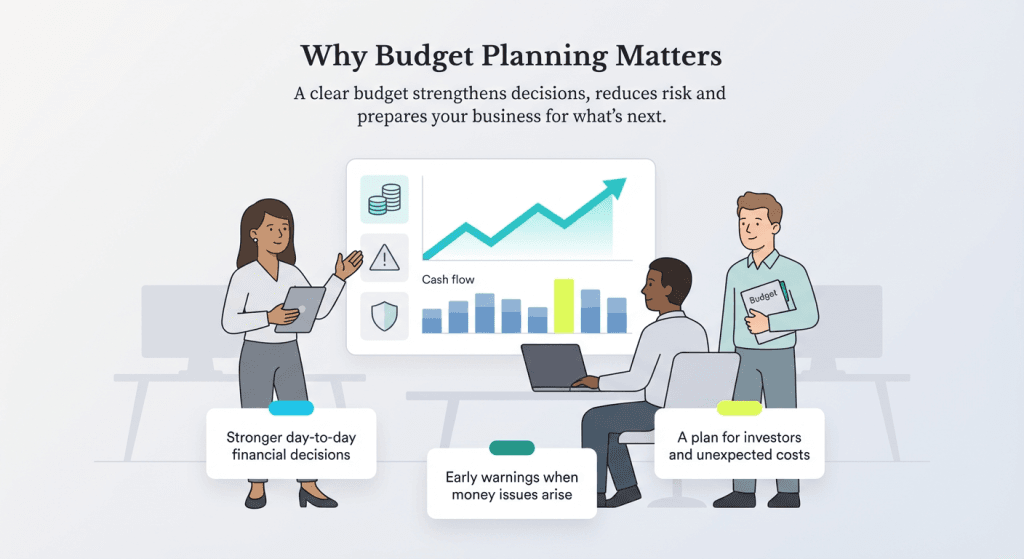

Why is budget planning important?

Budget planning is more than just a helpful tool; it’s essential to understanding and nurturing the financial health of your business.

“When you take the time to put the numbers to paper, you increase your chances of tracking them to ensure your business succeeds, helping you anticipate future needs, spending habits, profits and cash flow,” said Nick Kolbenschlag, CEO and co-founder of Crown Wealth Group.

These are some of the key benefits of budget planning for your business:

- Informs business decisions: By creating a workable budget, you can track cash on hand, expenses and the revenue you need to keep your company growing. Knowing these numbers can also assist in setting smart financial and overall business goals.

- Identifies potential problems early: A business budget can illuminate small deviations that could turn into larger problems when left unchecked. “Proper budgeting … allows you to identify problems before they become major issues, giving you the ability to course-correct in real time,” Kolbenschlag told business.com.

- Allows you to attract investors: If you’re seeking financing, any investor will want assurance that your business is viable and will remain profitable in the future. A strong budget that highlights your current and projected numbers can provide that confidence.

- Prepares you for emergencies: Even the most financially healthy businesses can suffer from unexpected events or market downturns. By knowing how much money you need to keep your business running, you’ll also know how much you can save for future expenses.

What are the risks of not budget planning for your business?

Budgeting incorrectly or not at all poses several business risks:

- Failing to secure investment capital or loans

- Having insufficient funds for large expenditures or emergencies

- Needing to renege on commitments to clients or vendors due to financial constraints

- Struggling to finance an expansion, or expanding in an unsustainable manner

Failure to do budget planning, or doing it incorrectly, can lead to negative outcomes for your business, including reneging on commitments and failing to secure loans or investment capital.

How is planning different from budgeting?

Business planning and business budgeting are closely related, but have different goals. According to Hanif, planning is usually the first step in setting up a small business and continues to be used in business workflow.

“Planning could be something simple, like building your daily agenda, or long-range enough to envision where you want to see your business in five or 10 years, whereas budgeting determines how existing financial resources are allocated,” Hanif explained. “Budgets are usually set by how previous money was spent and expected income.”

Creating a budget can be a difficult task, but once you do it, you’ll have a much better understanding of your business and how to plan for profitability. Updating your monthly budget makes annual planning easier and more accurate. When you know where your company stands financially, you can make better decisions to help your business achieve its goals.

Joshua Stowers contributed to the reporting and writing in this article. Source interviews were conducted for a previous version of this article.