Financing is an essential step for any company and may include finding business investors or applying for a business loan. Entrepreneurs seeking loans might turn to a bank automatically, but another significant capital funding source exists for businesses: The federal government.

Several loan programs are available to startups and growing businesses and understanding which ones suit your needs is vital to unlocking additional capital for your venture. We’ll examine popular federal loan programs and explain how they work, how to qualify and how to apply for them.

Editor’s note: Looking for an alternative to a traditional bank loan? Fill out the below questionnaire to be connected with vendors that can help.

What government loans are available to entrepreneurs?

Government loan programs are available through the federal Small Business Administration (SBA) and the United States Department of Agriculture (USDA) for qualifying businesses that intend to use the funds for specific purposes, such as purchasing equipment, expanding operations or boosting working capital.

Government loans offered by the SBA

SBA loans are provided by banks and other lenders, including community development organizations and microlenders. However, the federal government guarantees a portion of the loan, lowering lender risk. The main benefit of these loans is they offer small businesses the opportunity to receive financing on more favorable terms than they would receive without the SBA guarantee.

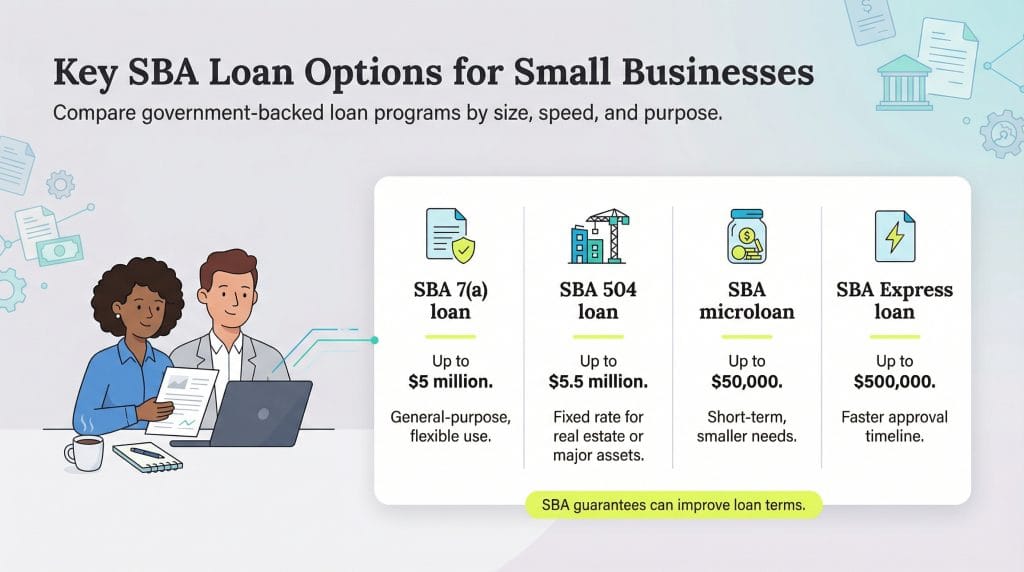

Here’s an overview of the most popular SBA loan programs:

1. SBA 7(a) loan guarantee program

The SBA 7(a) loan is one of the most popular and flexible federal loan programs. It’s generally used to help minimize startup costs or assist growing businesses and can be used for the following purposes:

- Buying land

- Covering construction costs

- Purchasing or expanding an existing business

- Refinancing existing business debt

- Purchasing machinery, furniture, supplies or materials.

The SBA will guarantee up to $5 million for this type of loan. If you’re looking for a loan of $350,000 or more through this program, the SBA will require your lender to ask for the maximum possible amount of collateral to offset the risk of default. Note that borrowers must meet specific criteria, such as size standards and creditworthiness.

2. SBA 504 loan program

The 504 loan program is designed for businesses that will directly benefit their communities by creating jobs or meeting essential local market needs. These loans feature a fixed rate and are structured for long-term financing, with a maximum value of $5.5 million.

Typically, when a 504 loan is funded, the lender will initially cover 50 percent of the borrower’s costs, the SBA will cover 40 percent and the borrower will be responsible for the remaining 10 percent of financing the project. The borrower must personally guarantee at least 20 percent of the loan.

3. SBA microloan program

The SBA’s microloan program is often used for short-term financial needs, such as bolstering inventory or furnishing office space. The maximum amount for this type of loan is $50,000.

4. SBA Express loan program

The SBA Express loan program provides expedited funding for business owners who need a fast business loan. Applications receive a response within 36 hours, though funding typically takes 30 to 60 days to complete.

Loans of up to $500,000 are available through SBA Express financing, with collateral potentially required for loans exceeding $25,000. These loans can serve as working capital (with five- to 10-year terms), lines of credit (seven-year terms) or commercial real estate financing (25-year terms).

5. SBA disaster assistance

The federal government’s disaster assistance loan program provides low-interest, long-term financing to businesses and property owners recovering from declared disasters. This program helps businesses restore their operations and properties to pre-disaster conditions after hurricanes, floods, wildfires and other natural disasters.

The SBA is also a source of

small business grants, along with other federal and private corporate grants.

How to qualify and apply for SBA loans

To be eligible for SBA loans, businesses or individuals must meet the following criteria:

- Location: The business must be located and operated in the U.S.

- Ownership: It must be controlled by a U.S. citizen or legal permanent resident of the U.S.

- Classification: It must be a for-profit business in an eligible industry that meets all SBA terms, conditions and eligibility requirements.

- Equity: It must have enough invested equity to operate soundly from a financial standpoint.

- Business type: It must qualify as a small business according to the SBA’s Size Standards, which can be found in the Electronic Code of Federal Regulations. Size requirements vary by industry and are based on either the number of employees or average annual receipts.

After determining the SBA loan you want and ensuring you qualify, applying is the next step. Borrowers work directly with SBA-approved lenders rather than applying to the SBA itself. Many borrowers initially apply for conventional small business loans. If they don’t qualify for standard financing, the lender can then request SBA backing. Alternatively, you can apply directly for an SBA loan through participating lenders.

Note that while the SBA guarantees these loans, they are administered by SBA-partnered lenders.

The

SBA's Lender Match tool on the agency's website can help you find potential lenders that can accommodate your needs.

Government loans offered by the USDA

The USDA is highly focused on rural areas and the agricultural industry, which is often capital-intensive. Its loan programs focus on economic development and job creation in rural communities, primarily targeting small businesses and farmers.

The USDA’s grants and financial assistance programs can be used for:

- Business modernization, development or repairs

- Commercial real estate purchase, development or improvement

- Purchase of machinery, equipment, supplies or inventory

- Working capital

- Debt financing (in cases where such funding would improve cash flow and save or create jobs)

- Acquisition of a business (again, if it would save or create jobs)

Consider the following USDA loan programs:

- Business and Industry (B&I) Loan Guarantees: Through the B&I program, the federal government acts as a guarantor of private loans for rural businesses, extending the private credit available to entrepreneurs in those regions.

- Intermediary Relending Program (IRP): The federal IRP provides low interest rates to intermediaries that lend to businesses locally to help stimulate local economies and kickstart job creation in rural communities.

- Rural Business Development Grants (RBDG): The USDA’s RBDG program provides technical assistance and training grants that help develop and expand small businesses in rural areas.

- Rural Business Investment Program (RBIP): The RBIP supports investment companies based in rural areas to help meet the financial needs of communities in those regions.

- Rural Economic Development Loan and Grant: This program provides funding for infrastructure projects in rural areas through local loans. Those loans are then passed on to local businesses in the community for projects that establish lasting jobs.

- Rural Microentrepreneur Assistance Program: Similar to the SBA’s microloans, the USDA provides loans up to $500,000 and grants to microenterprise development organizations that support rural businesses with fewer than 10 employees.

- Value-Added Producer Grants (VAPGs): The VAPG program extends grants up to $250,000 to agricultural producers to assist them in producing and marketing new agricultural products. New or disadvantaged producers receive priority in the program.

With some USDA loan programs, qualifying borrowers can finance 100 percent of a property’s purchase price, eliminating the need for a down payment.

How to qualify and apply for USDA loans

To qualify for USDA business and industry loans, businesses or individuals must:

- Be located in a rural area: USDA loans target areas with a population of 50,000 or less. To determine eligibility, use the USDA’s Rural Business Services Property Eligibility tool.

- Be a U.S. citizen or a permanent resident of the U.S.: This requirement applies to individual borrowers and businesses. For businesses, at least 51 percent must be owned by a U.S. citizen or permanent resident.

- Be an eligible borrower: The USDA considers an eligible borrower to be a for-profit business, nonprofit entity, federally recognized tribe, public body or individual.

- Have sufficient cash flow: You must have enough money coming in to repay your loan.

- Have a good credit history: Individuals typically need a credit score of at least 680, though requirements vary by lender. Businesses need a track record of on-time payments, low credit utilization and no recent derogatory marks like judgments, liens or bankruptcies.

- Have a tangible balance sheet equity position: This is the equity on a business’s balance sheet minus the value of any intangible assets (such as amortized loan costs, licenses, goodwill, customer lists, patents, copyrights, proprietary rights and trademarks). The accepted tangible balance sheet equity position is 10 percent for existing businesses, 20 percent for new companies and 25 percent to 40 percent for energy projects.

- Complete a feasibility study: This requirement is for new businesses or high-risk projects and must be conducted by an independent consultant.

- Pledge collateral: You must have property, equipment or other assets of monetary value that the lender can seize if you default on your loan.

- Sign personal and corporate guarantees: The business owner(s) must personally guarantee that the loan will be repaid.

Some lenders may require that borrowers meet additional criteria to qualify for USDA business and industry loans.

The USDA’s Rural Business Services Program Discovery Tool can help you learn more about the available loan and grant programs and program eligibility requirements. Consult your state’s Rural Development Office to start the loan application process.

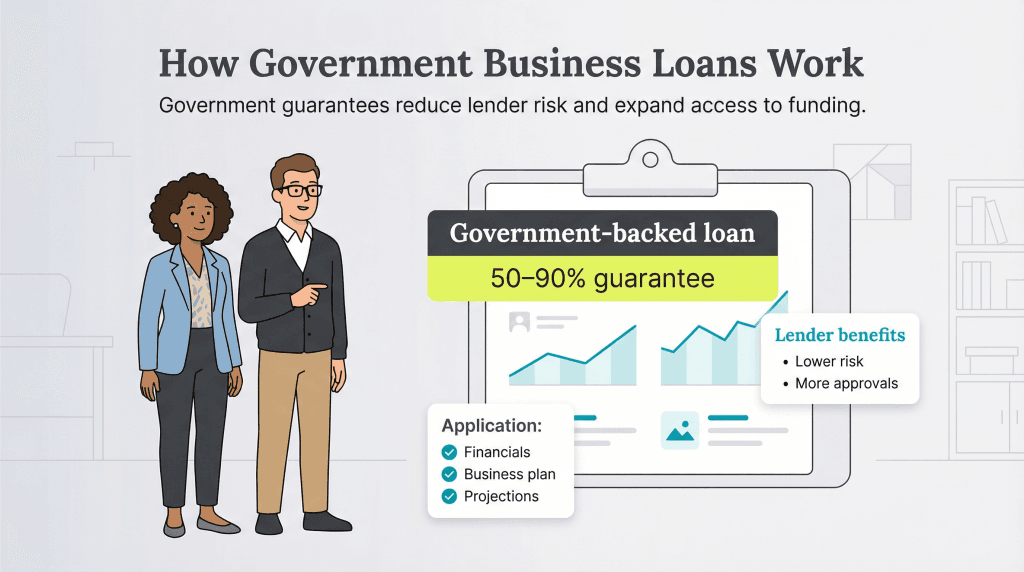

How do government loans work?

Federal loan programs typically don’t provide direct financing to businesses. Instead, the federal government guarantees a portion of the loan amount — often 50 to 90 percent — which reduces risk for conventional lenders and makes them more willing to approve loans for businesses that might otherwise struggle to secure financing.

“The SBA and the USDA provide guarantees to banks on a portion of the loan balance with a corresponding underwriting guideline that opens up the borrowing opportunity to a larger group of businesses,” explained Bernie Dandridge, a sales and operations specialist at Seaside Bank and Trust.

Businesses applying for federal loan programs must work with approved lenders and complete a comprehensive application process. This includes providing detailed financial records, business plans and projections to demonstrate your ability to repay the loan.

“[Entrepreneurs] should expect a careful financial review and be prepared with their financial documents, including a business plan,” Dandridge cautioned. “They should also understand that working capital and debt coverage are very important components in the evaluation.”

Why entrepreneurs should consider a government loan

Government loan programs help businesses that might face challenges securing traditional financing — whether due to lack of credit, an unproven business model or other factors — by providing federal backing that reduces lender risk. Consider the following benefits:

- Funding access: Government loans expand financing opportunities for entrepreneurs who might not qualify for conventional bank loans, particularly startups and businesses in underserved communities.

- Easier loan terms: Government loans often have lower fees and interest rates and longer repayment terms. In many cases, your initial down payment will also be smaller, making government loans more accessible than their private counterparts.

- Easier qualification terms: Although not every entrepreneur qualifies for government loans, these loans often have more flexible terms than bank or private loans. They’re often a type of business loan you can get with bad credit.

- Faster funding: SBA loans are often available within one month of applying. The turnaround time for most non-government entrepreneur loans is over two months.

What to consider before applying for government loans

Entrepreneurs entering government loan programs must consider the following:

- Informational accuracy: You must provide complete and accurate information throughout the application process. Misrepresenting financial data or business details can result in loan denial and potential legal consequences.

- Loan fees: Government loans include guarantee fees and other costs. For SBA loans, fees could be up to 3.75 percent of the guaranteed loan amount.

- Documentation: SBA and USDA loans are guaranteed by the government, so there are many documents to complete and guidelines to follow. Ensure you gather and closely examine all necessary paperwork.

- Geographic limitations: USDA loans have population-driven geographic limitations, which means you can’t access them in some regions. Depending on your location, SBA or other loans without geographic limitations may be necessary.

Government loans: Plan responsibly to avoid financial difficulty

Before accepting government-backed financing, carefully evaluate your business’s ability to meet loan obligations. Create detailed cash flow projections and consider various economic scenarios to ensure you can maintain payments even during slower business periods. If you can service your debt reliably, you should have little to worry about.

Mike Berner and Max Freedman contributed to the research and writing in this article. Source interviews were conducted for a previous version of this article.