Not all sales are created equal; some require specialized processing and approval. When the stakes are high and closing the sale is complex, deal desks can help. Deal desks help drive sales engagement and performance by providing a centralized department to handle deals that don’t fit into your organization’s traditional sales process.

Sales organizations have been using deal desks for several years, but this resource is gaining popularity thanks to its notable results: creating sales team efficiencies and offering creative solutions for customers. We’ll explore what a deal desk is and its benefits and disadvantages, and share how to maximize it to its full potential.

What is a deal desk?

A deal desk is a centralized team within a business that facilitates special, high-end deals. It often works with complex cases using a cross-functional group to find solutions slightly outside the box of the standard sales channels. Its goal is to increase sales by ensuring high-value deals quickly move through the sales funnel.

Deal desks play a crucial role for companies by providing a mechanism to support nonstandard deal requests. Deal desks significantly impact revenue generation and sales cycles because deal desk teams have specific workflows designed to close larger, complicated orders earlier. This is aided further by the use of technology like customer relationship management (CRM) systems that streamline manual and often unproductive business processes. This means teams have more time to spend on getting to know the customer and their needs.

Deal desks also noticeably impact sales-adjacent activities, such as pricing and contracts, that support the deal process. However, deal desks don’t handle all sales deals. Standard deals still go through the typical sales process, saving deal desk resources for high-value, nuanced situations.

Your deal desk is destined to fail if your company doesn't have a

positive sales culture. Leaders need to shape employee attitudes, not just processes.

What are deal desk responsibilities?

Deal desks are responsible for high-level business decision-making related to sales. They must have the information, power and authority to cut through approval red tape and make efficient pricing and contract negotiation decisions.

Specifically, deal desk responsibilities include:

- Creating and managing deals: Deal desks assist with complex deal creation, beginning with the proposal, and then manage complex deals through the entire deal process. “Complex” is defined as anything outside the guidelines provided to the sales organization for pricing and contract authority.

- Approving deals: Deal desks review and approve all deals that pass through the business.

- Outlining standard parameters: Deal desks provide and manage “standard deal” parameters and tools that the sales team can leverage.

- Handling internal issues: Deal desks serve as the point of contact for contract negotiations and internal deal issue resolution on behalf of the company.

- Finding solutions: Deal desks are empowered to find creative solutions to nonstandard deals that still align with your company’s brand.

- Making efficient deals: Deal desks reduce a deal’s cycle time from opportunity to execution.

- Collaborating with other departments: Deal desks actively engage with multiple cross-functional teams, gathering input to facilitate the deal process.

- Supporting the sales department: Deal desks allow the sales team to focus on selling so it can find and close more deals.

What are the pros and cons of deal desks?

Deal desks provide enormous benefits, but they’re not without their drawbacks. Here are some pros of establishing a deal desk:

- It saves time: Deal desks save time during complex transactions by cutting through red tape to make efficient decisions.

- It enhances deal accuracy: Since there’s more to lose on bigger deals, deal desks ensure that each sale is thoroughly reviewed, reducing risks related to pricing and compliance.

- It makes clients feel valued: A deal desk gives high-value targets preferential treatment, so they know the organization values their business.

- It eliminates bottlenecks: Deal desks eliminate the bottlenecks that can occur when traditional sales representatives are unsure how to proceed with more extensive contracts.

- It improves internal communications: Regular collaboration and communication between different teams on deals can lead to a more informed organization.

Here are some cons of establishing a deal desk in your organization:

- It takes away from other aspects of the company: A deal desk pulls company experts away from their day-to-day roles, so potentially some work isn’t being completed.

- It may snare lower-value deals: Without clearly defining the types of deals that desks are responsible for, they may attempt to take over smaller deals from the regular sales team, slowing the closing process.

- It confuses sales reps: Sales reps may be unsure about which deals they should handle and which should go to the deal desk.

- It can confuse clients: Since deal desks aren’t widely used, they may initially confuse customers.

- It requires a lot of resources: Deal desks can be expensive to set up, requiring CRMs and other business technology, as well as training for team members.

The

best CRM software can help you implement processes and workflows to streamline deal assignments and eliminate confusion, so you avoid some of the common deal desk pitfalls.

Types of companies that use deal desks and industry-specific variations

The types of companies in which deal desks are commonly used include:

- Software development businesses that create one-off solutions requiring custom software development and integration with client applications.

- Healthcare companies that navigate stringent regulatory requirements and involve medical professionals in procurement decisions.

- Professional services companies that manage substantial engagements with complex scope and service level definitions.

- Technology hardware providers that handle large-scale sales from system specification to implementation.

- Telecommunications companies that oversee complex pricing structures and custom contract terms for large voice and data contracts.

- Financial services companies that ensure complex financial products meet client needs and regulatory compliance.

- Energy companies that handle sales of energy solutions while ensuring regulatory compliance and managing long-term contracts.

Deal desk operations vary significantly across industries:

Software as a service (SaaS): Deal desks in this sector focus on subscription pricing optimization, multi-year contract negotiations and customer success transition planning. Key metrics include monthly recurring revenue (MRR) growth and customer lifetime value.

Manufacturing: These companies emphasize product configuration management, delivery timeline coordination with production schedules, and volume pricing strategies. Key metrics include order accuracy and delivery performance.

Professional services: Deal desks in these fields concentrate on statement of work development, resource allocation and project timeline management. Key metrics include project profitability and resource utilization rates.

Financial services: In these businesses, deal desks pay close attention to regulatory compliance validation, risk scoring and product-bundling optimization. Key metrics include regulatory compliance rate and risk-adjusted returns.

Signs your company may or may not benefit from a deal desk

Consider implementing a deal desk if your company experiences:

- Trouble managing complex deals: Deals requiring involvement from multiple departments

- Lots of big deals: Multiple large deals that overwhelm sales reps

- Poor risk management: Complex deals resulting in legal confrontations or operational problems

- Extended sales pipeline: Larger deals that take too long to close due to internal bottlenecks

While deal desks provide significant benefits, they’re not universally appropriate. This strategy may not be right for your business if:

- Your sales team is resistant to process changes.

- You have poor communication between your sales, finance and legal teams.

- Company CRM adoption is below 80 percent or you heavily rely on manual processes.

- You have a limited budget or personnel for dedicated deal desk functions.

When considering whether a deal desk is right for your business, pay attention to whether your company fits these criteria:

Company size and maturity thresholds

- Minimum revenue threshold: $10-15 million in annual recurring revenue

- Deal volume threshold: At least 15-20 deals per quarter requiring non-standard terms

- Deal value threshold: Deals exceeding $50,000 in individual value

Organizational maturity factors

- Standardized sales processes with basic CRM adoption

- Established pricing frameworks and discount approval levels

- Cross-functional coordination capabilities

- Change management capability and executive sponsorship

Which teams and staff members should be in a deal desk?

Your deal desk should consist of people from the following teams in your business:

- Senior leadership: Senior leaders like chief revenue officers and chief financial officers can provide valuable guidance to deal desk teams on sales in progress to ensure that they attract the support of the C-suite and, when applicable, shareholders and investors.

- Sales team: Your sales staff are experts in building and maintaining relationships with prospects and customers. They have the experience and insight to guide deals through various sales stages and are best placed to tailor products and services to meet each client’s needs.

- Finance and accounting team: During the sales process, your finance team should offer insights and feedback to the sales team and senior leadership on each deal’s financial viability and profitability. On larger deals where payment will be made in increments over an extended period of time, they can also account for revenue in the most tax-efficient way.

- Legal team: The complex agreements that deal desks negotiate often require careful legal drafting to ensure individual sales comply with regulatory requirements, protect intellectual property and manage liability risks. This can protect firms from future lawsuits and regulatory penalties.

- Information technology (IT) team: IT teams are a key part of most deal desks for two reasons. First, they ensure that the data and applications the deal desk team needs, like configure, price, quote (CPQ) software and CRM systems, are operational. Second, and particularly if the product being sold is technology-related, they provide technical support and implementation services to ensure that the integration of your product or service is seamless from the client’s point of view.

Involve your sales team in the deal desk’s creation to get staff buy-in and optimize how the desk can support all of your company’s sales representatives.

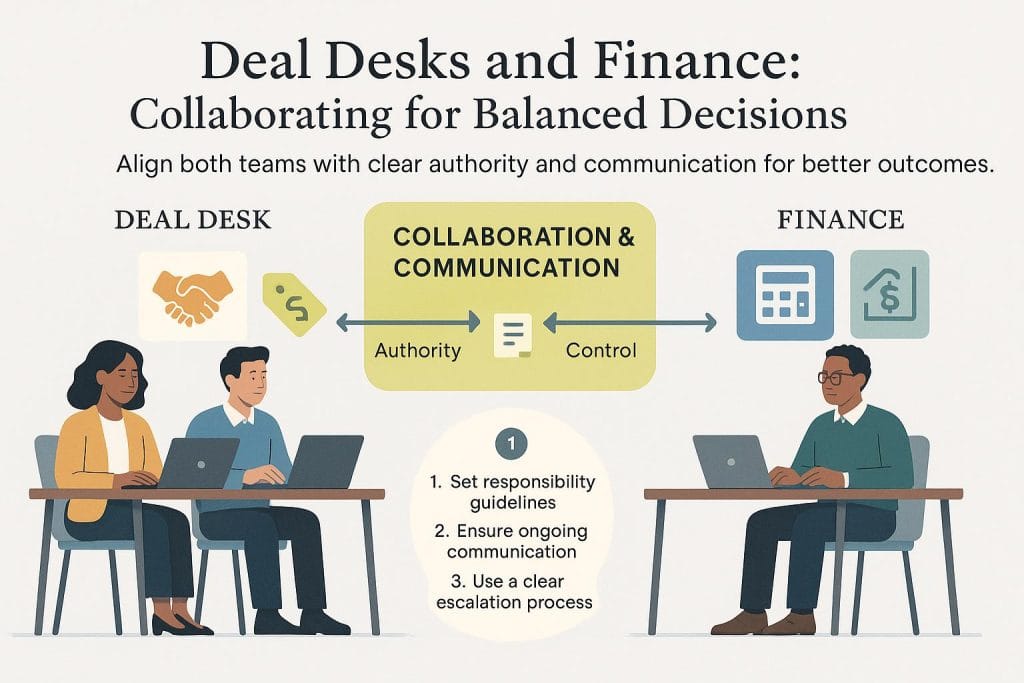

Sometimes, conflict exists between deal desks, which are motivated by wanting flexibility on pricing and contract terms, and finance teams, which want to manage cash flow and protect profit levels. This is when leadership is needed from senior and C-suite teams. Decisions on who has final say often come down to the skill levels and histories of deal desk and finance team members. For example, if you’re confident your deal desk team will make sales that respect your minimum profit requirements, you might give them authority to operate with greater flexibility when handling complex sales. If you’re not confident of that, you might want to give authority to your finance team on aspects like pricing decisions and payment terms.

Whichever team you give authority to, set clear guidelines for each team on their responsibilities. Set up a structure where both teams are compelled to communicate with each other on issues of importance. Also, establish a mechanism for resolving disagreements; this could involve both sides presenting to the C-suite for a final decision.

How to implement a deal desk

Successfully implementing a deal desk requires a structured approach with clearly defined timelines, team structures and success metrics. Based on industry best practices, here’s a comprehensive implementation framework to use in your business:

Phase 1: Foundation and planning (months 1-2)

- Define deal desk mission and objectives.

- Identify stakeholder teams and assign dedicated resources.

- Establish deal complexity thresholds (typically deals over $50K or requiring non-standard terms).

- Create initial process documentation.

- Set up governance structure and approval workflows.

Phase 2: Process design and technology setup (months 2-4)

- Map current deal flow and identify bottlenecks.

- Design new deal routing and approval processes.

- Implement or configure CPQ and CRM integrations.

- Create deal scoring and prioritization criteria.

- Develop initial templates and standardized documentation.

Phase 3: Pilot implementation (months 4-6)

- Launch pilot with select deal types or sales teams.

- Monitor key performance indicators closely.

- Gather feedback from sales reps and stakeholders.

- Refine processes based on pilot learnings.

- Develop training materials and documentation.

Phase 4: Full deployment and optimization (months 6-12)

- Roll out to entire sales organization.

- Implement comprehensive training programs.

- Establish regular review and optimization cycles.

- Build reporting dashboards and analytics.

- Create feedback mechanisms for ongoing improvement.

How to maximize your deal desk

Follow these guidelines to ensure your deal desk operates at its full potential:

- Empower your deal desk. Ensure your deal desk has the authority to set its own sales cadence and make decisions on nonstandard pricing and contract terms using clear guidelines.

- Leverage the deal desk to manage the deal cycle. When you put your deal desk in charge of the deal cycle, you allow traditional sales reps to focus on customer-facing activities and develop new business opportunities.

- Specify deal desk regions. Regional coverage eliminates the need for sales to operate outside the process, and you won’t risk losing an opportunity.

- Ensure the right people are on your deal desk. You’ll want a combination of critical thinking, creativity and attention to detail in your deal desk team. Members must also have credibility, excellent communication and relationship-building skills.

- Size and staff the deal desk appropriately. A deal desk’s size and staffing depend on the roles and functions you expect to fulfill. There is no right or wrong model as long as it meets your company’s needs.

- Set boundaries. The best deal desk results stem from clear rules. Articulate boundaries and provide policy documentation.

- Prioritize accountability. Successful deal desks are accountable for their responsibilities and hold others to established standards.

- Gather feedback regularly. Hold regular formal and informal feedback sessions to discuss trends and changing conditions so the sales organization can react in real time.

- Utilize technology. Integrate CRM and CPQ tools into deal team workflows to streamline the management of leads.

Overall, a properly run deal desk can significantly help your business build and improve customer relationships, drive sales reps’ productivity and execute deals that benefit both the customer and your company.

Kimberlee Leonard and Michelle Seger contributed to this article.