Business.com aims to help business owners make informed decisions to support and grow their companies. We research and recommend products and services suitable for various business types, investing thousands of hours each year in this process.

As a business, we need to generate revenue to sustain our content. We have financial relationships with some companies we cover, earning commissions when readers purchase from our partners or share information about their needs. These relationships do not dictate our advice and recommendations. Our editorial team independently evaluates and recommends products and services based on their research and expertise. Learn more about our process and partners here.

Lightspeed vs. Square: POS Comparison

This comparison guide shows how the Lightspeed and Square POS systems stack up across a variety of categories, including plans, pricing, payment processing and hardware.

Table of Contents

No matter what type of small business you run, you need a way to charge customers and process payments that saves you time and money. A smart way to do just that is by using one of the best POS systems on the market. These software and hardware packages offer a complete solution for all stages of the purchase experience, from engaging customers to ringing up their sales both in person and online.

We compared leading vendors Lightspeed and Square, two of our top choices for a comprehensive POS and payment processing package, to see how their features and pricing stack up. With this detailed information, you can decide which full-service point-of-sale system is right for your business.

Lightspeed vs. Square Highlights

Criteria | Lightspeed | Square |

|---|---|---|

Plans and pricing |

|

|

Payment processing | Lightspeed Payments is a full payment processing service. You can also use an external payment gateway. The chargeback fee is $15. | Square is an all-in-one payment processor. Customers can pay in installments. There are no chargeback fees. |

E-Commerce | You get a website builder and social media advertising tools for free. Paid plans include social media selling. Not all plans include unlimited products. | Free plans include a website builder, social media selling and marketing tools. Paid features include a custom domain and customer profiles. All plans include unlimited products. |

Hardware | Lightspeed is designed to run on your iPad or desktop computer. You can get card readers and accessories, but pricing isn’t publicly listed. | Square provides a free card swipe reader. Affordable card readers and POS terminals are available on Square’s website. |

Additional features | Lightspeed boasts excellent inventory management tools. Marketing and customer loyalty features are also included. | Square also provides inventory management features. Additional products, like payroll, marketing and customer loyalty tools, cost extra. |

Who is Lightspeed For?

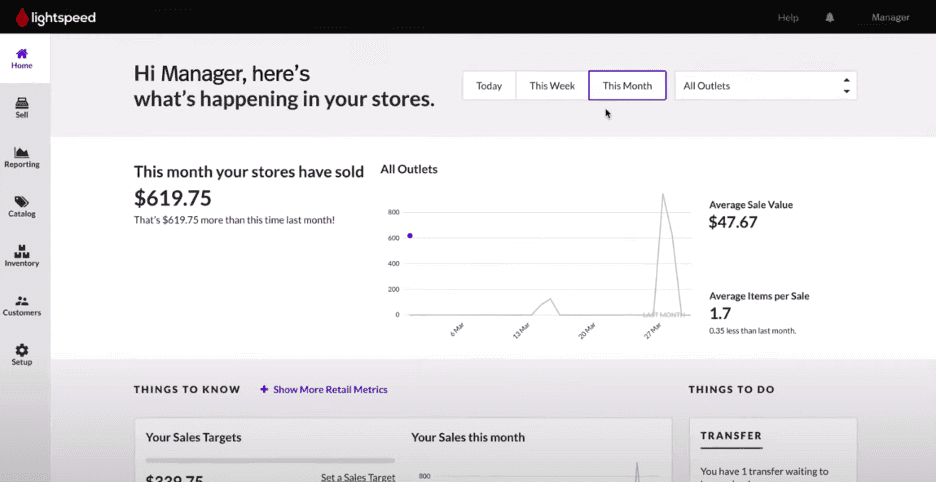

Lightspeed is a POS system vendor with products tailor-made for retail, restaurants and the golf industry. It also lets you process payments, either as a full-service solution with Lightspeed Payments or through a third-party payment gateway. While its plans are stacked with powerful features, the price point isn’t cheap, making Lightspeed an appropriate choice for established small to medium businesses with a stable sales volume.

One of the features that makes Lightspeed shine is its robust POS inventory management system. Thanks to its useful tools and multichannel tracking, Lightspeed is great for businesses with high inventory turnover, particularly those that sell online and in person. We especially love that Lightspeed’s e-commerce features, like a website builder and social media tools, can help you affordably build an online presence. Check out our comprehensive Lightspeed review for more details.

Who is Square For?

Square is one of the best credit card processing companies and POS system providers for startups and small businesses thanks to its free entry-level POS service, reasonable processing fees and affordable paid plans. Like Lightspeed, it offers products with features designed specifically for restaurants and retail stores. Square is also an excellent choice for service businesses that need tools to help manage appointments.

We love how easy it is to set up and use Square, especially for businesses just getting started that can’t afford to spend a lot of time or resources navigating a complex platform. Being easy to use, however, doesn’t mean Square offers a basic solution, as even its free packages have a ton of features, like a website builder and social media selling tools.

The paid POS plans are all economical, and there are many additional products, like payroll and marketing, that you can add on as needed. Overall, Square is a flexible solution that can help you get off the ground and stick with you as your business grows.

Lightspeed vs. Square Comparison

Plans and Pricing

Lightspeed

Lightspeed offers a variety of POS services, with specific plans for the retail, restaurant and golf industries. There are also additional e-commerce plans for taking your business online, and we love that the basic e-commerce package is free. But if you have a large sales volume over $250,000 per year, Lightspeed can create a tailor-made package for you with custom rates. [Learn more about e-commerce and selling online.]

Lightspeed’s retail POS pricing is based on where you do business, how many locations you operate from and how many registers you need. All prices in the chart below reflect a U.S. business paying annually for one location and one register.

Retail Plan | Monthly Cost | In-Store Processing Rate | Features |

|---|---|---|---|

Basic | $89 | 2.6% + $0.10 | Retail POS, one register, inventory management, basic e-commerce plan, onboarding, 24/7 chat support |

Core | $149 | 2.6% + $0.10 | All Basic features, plus advanced e-commerce tools, loyalty program, advanced reporting, integrations, mobile device scanner |

Plus | $239 | 2.6% + $0.10 | All Core features, plus custom reporting, API access, workflows, custom roles, 24/7 phone support |

Here’s how the restaurant POS plans break down.

Restaurant Plan | Monthly Cost | In-Store Processing Rate | Features |

|---|---|---|---|

Starter | $69 | 2.6% + $0.10 | Customizable POS, menu & floorplan management, insights, takeout & delivery, CRM & loyalty; some Essential features available as add-ons |

Essential | $189 | 2.6% + $0.10 | All Starter features, plus online ordering, contactless ordering, tableside payments, multilocation management, advanced inventory management |

Premium | $399 | Custom rates | All Essential features, plus multiple revenue centers, raw API access |

Enterprise | Custom pricing | Custom rates | Custom features with access to dedicated support team and customer service manager |

We love that Lightspeed lets you integrate an online store into your POS solution. You can access essential e-commerce features for free and some advanced features might come with your retail POS plans. We recommend speaking to Lightspeed to find out the best way to get all the features you need. The chart below shows how the Lightspeed eCom plans work when paying annually.

E-Commerce Plan | Monthly Cost | Card Processing Rate | Features |

|---|---|---|---|

Free | $0 | Negotiable; standard card-not-present transaction rate is 2.9% + $0.30 | Online store website builder, social media advertising, five products, multiple site selling, GDPR compliance, tax invoices, platform integrations, email support |

Venture | $14.08 | Negotiable; standard card-not-present transaction rate is 2.9% + $0.30 | All Free features, plus online Facebook and Instagram stores, mobile point-of-sale, store management app, 100 products, loyalty features, tax calculations, inventory tracking, SEO tools, live chat support |

Business | $29.08 | Negotiable; standard card-not-present transaction rate is 2.9% + $0.30 | All Venture features, plus Amazon and eBay selling, automated email marketing, 2,500 products, advanced selling tools, phone support |

Unlimited | $82.50 | Negotiable; standard card-not-present transaction rate is 2.9% + $0.30 | All Venture features, plus unlimited products, POS integrations, priority support |

Square

Square also offers a variety of plans to match different business needs. Similar to Lightspeed, Square has packages specifically designed for restaurants and retail stores, but they also sell a POS product for appointment-based service businesses. Square Online is an additional option for businesses solely focused on online sales and is similar to Lightspeed’s eCom offering.

We love that Square offers a free version of its POS software to businesses in all industries, so you can engage and check out customers and only pay processing fees. You can also easily combine any Square product with the vendor’s other services, like invoicing, payroll and marketing. Take a closer look at Square’s different plans in the charts below.

Retail Plan | Monthly Cost & Card Processing Rate | Features |

|---|---|---|

Free |

| Inventory and catalog management, e-commerce website, social media selling, invoices, gift cards, virtual terminal, product sales reports, customer profiles, time tracking, scheduling for up to five employees |

Plus |

| All Free features, plus advanced inventory and catalog management, online customer accounts, advanced reports, time tracking, scheduling for all staff |

Premium |

| All Plus features, along with professional website tools, one-on-one onboarding |

Restaurant Plan | Monthly Cost & Card Processing Rate | Features |

|---|---|---|

Free |

| Menu, table & cash management, auto gratuity, inventory, kitchen display system (additional charge per device), offline payments, reports, free tier of Square Online Ordering, Square Shifts for up to 5 employees, weekday support from 6 a.m. to 6 p.m PT |

Plus |

| All Free features, plus order-ready texts, seat & course management, advanced reports, Square Shifts Plus, 24/7 support |

Premium |

| All Plus features and custom pricing for additional Square services |

Appointments Plan | Monthly Cost & Card Processing Rate | Features |

|---|---|---|

Free |

| Unlimited calendars, mobile app, custom schedules, Square assistant, online booking, booking integrations, offline payments, basic reporting, marketing tools, client management features |

Plus |

| All Free features, plus multilocation management, advanced scheduling, Google calendar sync, Bookings API, advanced reporting |

Premium |

| All Plus features, along with resource management, staff management, custom contact fields |

E-Commerce Plan | Monthly Cost & Card Processing Rate | Features |

|---|---|---|

Free |

| Website builder, sync with Square POS, social media selling, delivery options, age verification, fraud controls, marketing tools |

Plus |

| All Free features, plus website themes, custom domains, advanced site customizations, PayPal payments, analytics |

Premium |

| All Plus features, along with lower processing rate and premium support |

Both Lightspeed and Square offer a number of POS solutions geared toward specific industries, and the standard processing fees for both in-person and online transactions are the same with both providers. But Square edges out Lightspeed when it comes to plans and pricing because it offers a free version of its POS software, so companies on a limited budget can save money by only paying processing fees.

However, ultimately, the right choice depends on the features you need for your small business. Lightspeed still has affordable plan options, and the costs might be worth it to access the vendor's potent point-of-sale tools. You may even be able to negotiate lower processing fees with Lightspeed, so it's worth inquiring.

Payment Processing

Lightspeed

Lightspeed provides a complete payment processing service for accepting payments in person and online. Your customers can pay with all major credit cards and digital wallets like Apple Pay and Google Pay. However, the Lightspeed Payments service is only available in the U.S. and doesn’t include options for customers who want to pay later.

The credit card processing fees are affordable, but we like that you can negotiate better rates for e-commerce sales no matter which plan you choose. There are no hidden fees or extra costs except for $15 chargeback fees. We appreciate that you can integrate over 100 other payment gateways if you don’t want to use Lightspeed Payments, so you can find the solution that best fits your payment needs. External payment gateways might let you process payments in more countries or currencies, but it could raise your overall cost.

Square

Square also provides a complete solution for accepting payments, but unlike Lightspeed, you must use the vendor as your payment gateway. That means U.S. businesses can only accept payments in U.S. dollars. Square does accept all major credit cards, including international cards, but your customers will most likely be charged currency conversion fees. Customers can also pay with digital wallets, including Samsung Pay.

We like that there are no chargeback fees, which can save your business money if you have frequent disputed transactions. We also appreciate that Square offers customers the possibility to pay later in installments, which is a great way to incentivize purchases, especially of big-ticket items.

E-Commerce

Lightspeed

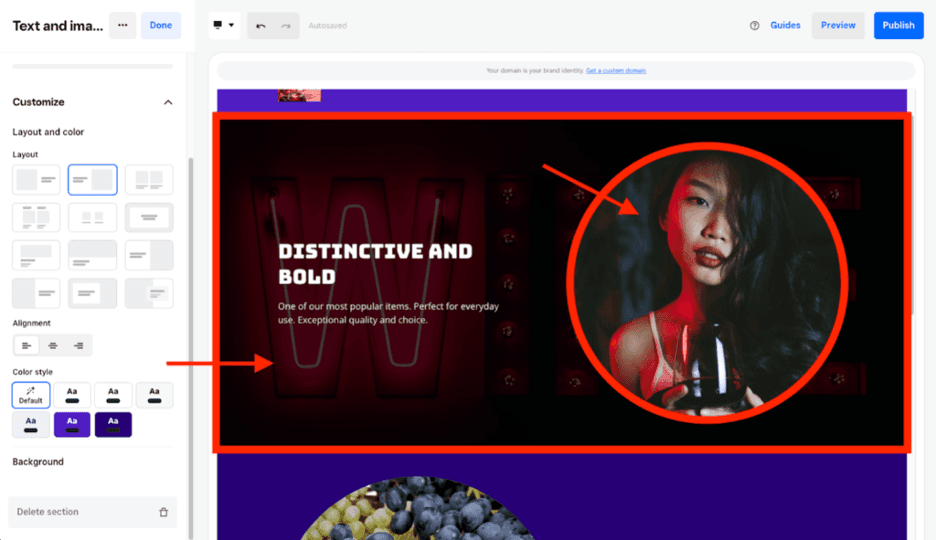

Lightspeed’s e-commerce solution can help your business start selling online, and we love that most features are included in the free plan. You’ll get access to the vendor’s free website builder, or you can integrate an online store into your existing website on any platform, like WordPress or Tumblr. You’ll also get tools for advertising across social media and can even enable one-tap checkout for Apple Pay users.

The only downside is that the free plan is limited to five featured products. Paid plans start at 100 products and there is a more expensive unlimited option. You’ll also be able to sell on Facebook, Instagram, eBay and Amazon. Plus, you get automatic tax calculations, SEO tools and other selling and customer support features. We especially appreciate that the paid packages include Lightspeed’s stellar inventory management features.

Square

Like Lightspeed, Square also lets you set up an online shop for free. The vendor provides a free website builder, but paid plans include even more web design features to take your online store to the next level. That said, we appreciate that Square includes more features than Lightspeed in its free plan, including unlimited products, marketing tools and the ability to sell on social media.

Square also offers businesses more in its paid plans than Lightspeed does. Beyond taking advantage of website customization, you can connect to a custom domain, and Square will even provide one for a year. You can create customer accounts for easy checkout and accept more payment methods, like PayPal, or process recurring payments. You also get useful analytics to help make the most of your online store’s performance.

Hardware

Lightspeed

No matter what kind of business you operate, the Lightspeed POS program is designed to run on iPads or desktop computers. You can download the POS software onto your own device and be up and running in no time.

Lightspeed also offers barcode scanners, iPad stands, cash drawers, printers, card readers and handheld terminals. There are even hardware bundles. But we were disappointed that Lightspeed doesn’t list pricing on its website.

Square

Square offers a number of POS hardware devices and also gives you the option of accepting payments through your mobile device. We particularly like that Square will send you a free card swipe reader when you sign up for a plan. Beyond that, here’s what equipment you can get with Square.

- 1st generation contactless card reader: $49

- 2nd generation contactless card reader: $59

- Square Stand (iPad POS for chip and contactless payments): $149

- Square Terminal (includes a built-in printer) $299

- Square Register (includes customer-facing display) $799

- POS Kits (includes register and printer) $579 – $1,959

Additional Features

Lightspeed

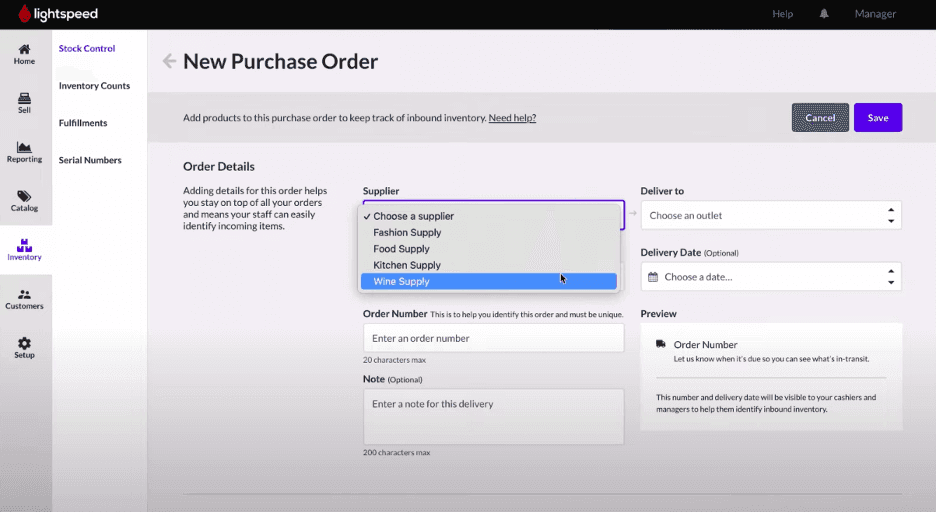

Lightspeed offers many valuable features depending on which POS package you choose. We found the inventory management tools to be especially useful. You can use them to easily keep track of stock, connect with suppliers and reorder right from the platform. We also really love that you can track inventory across multiple locations and channels, including your physical and online shops.

The platform further includes solid marketing tools to connect with consumers and build customer loyalty. You can create customer profiles and use pre-built email templates. You’ll also get useful reports and insights that you can leverage to segment your customers to provide better service.

Beyond that, there are also API capabilities to build custom workflows and integrations. Lightspeed can even help finance your business with a merchant cash advance program.

Square

Square also offers several additional features, like inventory management. You can keep track of stock across multiple locations and even transfer bulk from one store to another. It’s easy to manage orders right from the platform, too. Reporting insights help you manage your stock better to maximize profits.

Unlike Lightspeed, Square’s marketing services have to be added to your package as an additional paid product. Square offers email marketing, text message marketing and a customer loyalty program. You can also add a payroll service, but all these extras will raise your monthly price. Square also has financing options, including business loans and checking and savings accounts.

Lightspeed vs. Square Summary

Choose Lightspeed if:

- You’re looking for extensive features in your POS system and don’t mind paying more for them.

- You want the flexibility to choose your own payment gateway.

- You need advanced tools for managing your inventory.

Choose Square if:

- You want an affordable POS system that can scale with your business.

- You need robust tools for building an online presence.

- You’re looking for affordable POS hardware, including full-fledged POS terminals.

FAQs