Your business is responsible for the products you make, sell or distribute, as well as the completed services you provide. You can be held liable and accountable for any losses or damage if one of your products is faulty and injures or kills a third party or leads to property damage. To provide some financial protection in these circumstances, product liability insurance can help cover the legal costs of any claims filed against your business.

Current industry data shows that defective product incidents account for more than 40 percent of the value of all liability claims, making product liability insurance a critical protection for businesses of all sizes. Allianz Commercial analysis reveals this trend has persisted over the past five years, highlighting the ongoing financial risks businesses face.

This comprehensive guide will help you understand everything you need to know about product liability insurance, including who needs coverage, what it protects against, how much it costs and how to choose the right policy for your business.

>> Read Next: The Insurance Claims Process and How to File

What is product liability insurance?

Product liability insurance provides your business with coverage against expenses that arise when a person claims a product your business sold, made or distributed caused bodily injury, unlawful death or property damage.

This type of insurance policy can provide financial assistance to cover legal fees, judgments against you, settlements, compensatory damages, punitive damages and economic or business damages that result from a lawsuit. It will also cover the injured party’s medical costs that arose from the use of your product. [For a full list of the different types of business insurance you might need, check out our Business Insurance Guide.]

Product liability insurance vs. general liability insurance

Product liability insurance and general liability insurance are typically purchased together, but these policies are not the same. Product liability insurance provides coverage against damages related to the products you make, distribute or sell, as well as completed services.

General liability insurance, in contrast, provides coverage against a wide range of claims that arise when a third party is injured or property is accidentally damaged on your premises, such as a customer trips on the carpet in your store and drops their smartphone or breaks their ankle. Additionally, such policies cover damages an employee causes on third-party premises. General liability insurance also provides coverage against lawsuits over claims you copied a competitor’s logo or damaged their reputation.

Product liability insurance covers damages related to products while general liability insurance covers a wide range of claims related to incidents on your premises and other damages.

Who needs product liability insurance?

Businesses that make, sell or distribute products need product liability insurance. Companies and individuals involved in construction also require product liability insurance.

Here’s a closer look at some of the businesses and business professionals who should have product liability insurance.

Manufacturers

Product liability insurance protects manufacturers against claims that one or more of their products caused property damage or personal injury. The insurance provides coverage against lawsuits resulting from design defects, manufacturing defects and related issues.

Retailers, suppliers and distributors

Product liability insurance protects retailers, suppliers, distributors and other members of the distribution chain against lawsuits over damages caused by the products they sell. Retailers can be sued even if they’re not responsible for the products’ defects or issues related to their use. This kind of insurance can also provide coverage for lawsuits related to marketing defects, such as a lack of warnings about product use or misuse and improperly applied labels.

It’s important to note that retailers can be held liable even if they weren’t aware they sold a defective product. A person who is injured by a defective product or incurs financial losses due to the product’s use or misuse can sue anyone involved in the product’s supply chain. The injured person can also sue a retailer that didn’t provide sufficient warning or accurate instructions for using the product.

Tradespeople

Construction professionals, general contractors and installers require product liability insurance to protect them against lawsuits over personal injury or property damage that occurred after they completed their work. For example, a homeowner could sue a heating, ventilation and air conditioning professional who installed a furnace that later malfunctioned and led to a natural gas leak that injured or killed someone. In this case, the installer’s product liability insurance policy could cover their legal costs.

If you sold a defective product, you could be held liable even if you didn't know the product was defective.

What does product liability insurance cover?

Product liability insurance provides coverage if your product or completed service does one or more of the following:

- Damages another person’s property

- Causes bodily injury

- Makes another person ill

- Causes a person’s wrongful death through the use or misuse of the product, lack of safety warnings or improper instructions

Product liability insurance doesn’t cover services but does cover the results of services provided — for example, damages that resulted from a contractor’s work on a claimant’s property.

Below, learn more about what product liability insurance covers and what is excluded.

Defective products

Product liability insurance can provide coverage against lawsuits over damages caused by defective products. A defective product refers to an item not fit for its intended purpose. A defect may also make the product unsafe for use.

There are different types of defects:

- Design defects: A design defect makes the product risky to use even if it’s used properly. The person suing over liability must identify the product’s defect, show how the defect led to harm and demonstrate they were following instructions when using the product.

- Manufacturing defects: A manufacturing defect occurs when a manufacturer doesn’t follow a product’s design plans. This may include using incorrect parts, making mistakes during the assembly process or allowing the product to be contaminated by hazardous materials.

- Marketing defects: A marketing defect occurs when a company includes insufficient instructions and warnings or improper labels for a product that led to harm.

Wrongful death

In a lawsuit over a wrongful death, a claimant could sue for three types of damage:

- Economic damages: A family member of the deceased could sue for the loss of financial security. For example, a spouse or child can sue for the loss of the spouse’s or parent’s income.

- Noneconomic damages: A surviving spouse or child could sue for pain and suffering, emotional distress and missed future enjoyments due to the wrongful death of the spouse or parent.

- Punitive damages: A court can impose punitive damages, such as additional payments, if they believe the manufacturer or other party being sued was reckless in its actions or failure to act.

Exclusions

A product liability insurance policy typically includes reasons why the insurance provider may deny your claim, not provide coverage or choose not to renew your policy. These are known as exclusions.

Product liability insurance might include these common types of exclusions.

- Product recall exclusion: Most product liability insurance policies don’t cover costs related to inspecting, withdrawing, repairing, replacing or losing the use of a product if it’s recalled.

- Quality control exclusion: Insurance companies typically require manufacturers and distributors to maintain quality control standards for their products to ensure they’re safe for people who buy or use them. If a business fails to maintain quality control, the insurer is unlikely to provide coverage.

- Reporting exclusion: If you fail to report a new manufacturing method, product, material or ingredient, your product liability insurance will not cover claims related to that product.

- Efficacy exclusion: If your product doesn’t perform its main function, your product liability insurance will not cover any claims against it.

- Material exclusions: Many policies don’t cover certain ingredients or materials. If you manufacture or sell a product that contains one of those ingredients or materials, your product liability insurance will not cover claims against it.

Product liability insurance doesn't cover services but does cover the results of services.

How much does product liability insurance cost?

Product liability insurance is typically part of your general liability insurance premiums, so the cost will often be included in that amount. The price of the insurance depends on factors related to the risks associated with your profession and your policy limits. Manufacturers typically pay higher rates for product liability insurance because there are higher risks involved in their businesses.

Generally speaking, though, product liability insurance costs about 25 cents per $100 in sales revenue. For example, if your business sells $5 million worth of goods per year, your product liability insurance costs would be calculated like this: 0.25 x $5 million ÷ $100 = $12,500. [Learn how to save money on business insurance.]

Factors that affect cost

These additional factors may affect the cost of your product liability insurance:

- Industry risk level: High-risk industries like pharmaceuticals, medical devices and food products face higher premiums.

- Product type and complexity: More complex products with higher injury potential cost more to insure.

- Sales volume and distribution channels: Higher sales volumes and broader distribution increase exposure.

- Geographic coverage: Insurance providers price product liability insurance according to state insurance regulations and typical loss exposures in those states. International sales require additional coverage considerations as well.

- Claims history: Previous claims significantly impact premium costs.

- Coverage limits and deductibles: Higher limits increase premiums while higher deductibles decrease them.

To get a rough estimate of what your product liability insurance might cost, use this formula: 0.25 x (annual sales revenue) ÷ $100.

Coverage levels by business type

Each industry carries its own level of risk, which affects how much product liability coverage is needed.

For manufacturers:

- Minimum recommended coverage: $1 to $2 million per occurrence

- Preferred coverage: $5 to $10 million per occurrence, with umbrella coverage

- High-risk products (medical devices, pharmaceuticals): More than $25 million

For retailers and distributors:

- Minimum recommended coverage: $1 million per occurrence

- Preferred coverage: $2 to $5 million per occurrence

- E-commerce businesses: Additional cyber liability considerations

For small businesses and artisans:

- Minimum recommended coverage: $500,000 to $1 million per occurrence

- Considerations: Professional liability if offering custom or specialized products

How to choose product liability insurance

When choosing insurance coverage, select the limits for property damage and bodily injury separately:

- For property damage, choose the option that represents the maximum your insurance company will pay per accident to repair damages.

- For bodily injury, choose the maximum your insurance company will pay per person, as well as the maximum your insurance company will pay in total per accident.

These high limits will increase your costs but offer your business more protection.

Additional factors you should consider when choosing a product liability insurance policy include the following:

- Price: Choose a policy that meets your needs but fits within your budget. Shop around for the best price.

- Deductibles: The deductible you choose for the policy can affect your price. The higher the deductible (what you pay out of pocket before your insurance coverage kicks in), the lower the premium. However, make sure you can afford the deductible you choose.

- Carrier ratings: Insurance carriers are rated by third-party agencies such as AM Best. Look for a highly rated company, which means the insurer is solvent and capable of paying claims.

Your premiums are typically determined by the types of products you manufacture or sell, your expected sales volume and the role of your business. It’s essential to accurately assess your products (as well as your total expected sales) to ensure you pay for and receive the correct level of insurance coverage. Always review any existing business insurance policies to avoid overlapping or unnecessary coverage.

The

product liability insurance market has experienced significant changes, with premiums reaching $4.4 billion in 2023. This represents the ongoing demand for protection against product-related claims.

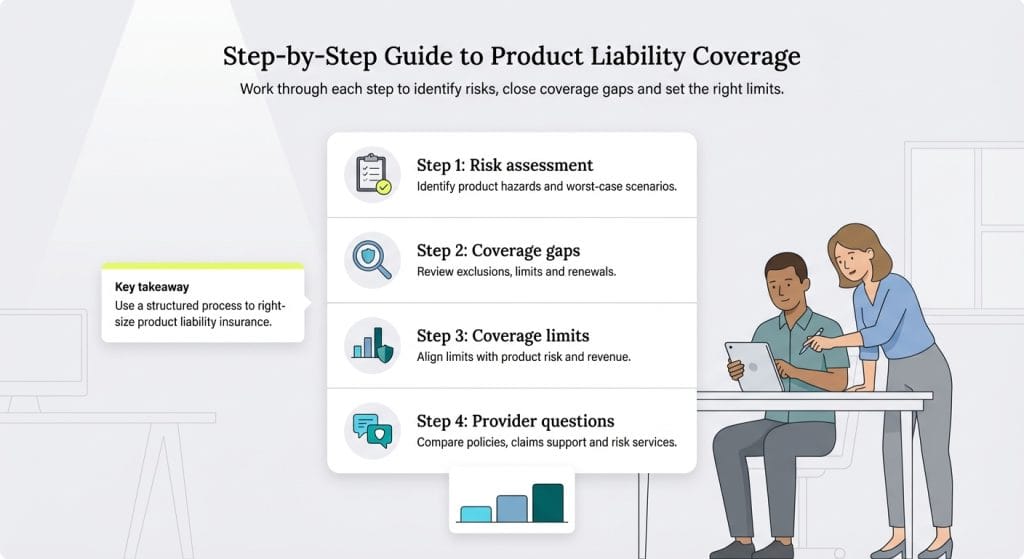

Step-by-step guidance for evaluating insurance needs

Choosing the right product liability insurance starts with understanding your specific risks and coverage gaps. Use this step-by-step framework to assess your needs, determine appropriate limits and make informed decisions when selecting a provider.

1. Conduct a comprehensive risk assessment.

Evaluate your products systematically by listing everything you manufacture, sell or distribute. For each product category, identify potential hazards and assess the severity of possible injuries or damages. Don’t forget to factor in your role in the supply chain, as your liability can vary depending on whether you’re the manufacturer, distributor or retailer.

Key questions to ask:

- What is the worst-case scenario if our product fails?

- Who are our end users and what are their risk profiles?

- Are there industry-specific regulations affecting our liability?

- Do we have international exposure requiring additional coverage?

2. Analyze your current coverage gaps.

Review your existing policies to ensure your coverage limits are adequate for potential claims. Check for exclusions that could leave you vulnerable, and consider any geographic limitations if you operate across state or national borders. It’s also important to take note of your policy’s renewal terms and the risk of non-renewal.

3. Determine appropriate coverage limits.

Use your product’s risk level and business model to guide how much liability coverage you need. The following benchmarks are widely used by insurers but should be tailored to your unique risk exposure and contractual obligations.

- Low-risk products: One to two times your annual revenue

- Medium-risk products: Two to five times your annual revenue

- High-risk products: Five to 10 times your annual revenue or specific industry standards

Your annual aggregate limit should typically be two to three times your per-occurrence limit to protect against multiple claims within the same policy year.

4. Ask strategic questions when evaluating providers.

Coverage questions:

- “What specific product categories does your policy cover?”

- “Are there any exclusions specific to our industry or product type?”

- “Does the policy cover worldwide product liability or just domestic?”

- “What is included in the defense coverage, and are there separate limits?”

- “How do you handle claims involving multiple parties in the supply chain?”

Claims handling questions:

- “What is your average time to resolve product liability claims?”

- “Do you provide legal counsel, or do we choose our own attorneys?”

- “What documentation do you require when filing a claim?”

- “How do you handle recall-related expenses?”

- “What support do you provide during litigation?”

Risk management questions:

- “What risk management resources do you provide to policyholders?”

- “Do you offer loss control services or safety consultations?”

- “Are there premium discounts for implementing specific safety measures?”

- “How do you help businesses stay compliant with evolving regulations?”

By working through these steps, you’ll gain a clearer picture of your product liability exposure and how to protect your business. Taking a proactive, informed approach helps ensure adequate coverage, strengthen your risk management practices, build credibility with partners and reduce the long-term cost of claims.