Creating a budget for your business may seem daunting. However, it’s a crucial first step in any successful business financial plan. While a business budget can take multiple forms, it should outline how much money you have coming in and what you must spend to continue operating. It should also show how much money you must earn to stay profitable and pay your expenses. Read ahead for a complete guide to drafting a business budget using business.com’s free budget template.

What is a business budget template?

A business budget template is a customizable worksheet business owners can use as a budget planning guide. Budget planning templates can be a huge help for business owners who don’t have time to create a business budget from scratch. They’re handy tools that give you a place to record all your numbers in an organized way, helping you set up an easy-to-read budget you can update quickly.

Budgets can be complicated, so consider downloading a template if this is your first time creating a business budget. Even if you choose to create your own, referring to templates or sample budgets can help you stay on the right track.

Different types of businesses may need different budget templates. For example, service-based businesses may want a budget template emphasizing

overhead costs, while large companies may need a labor budget template.

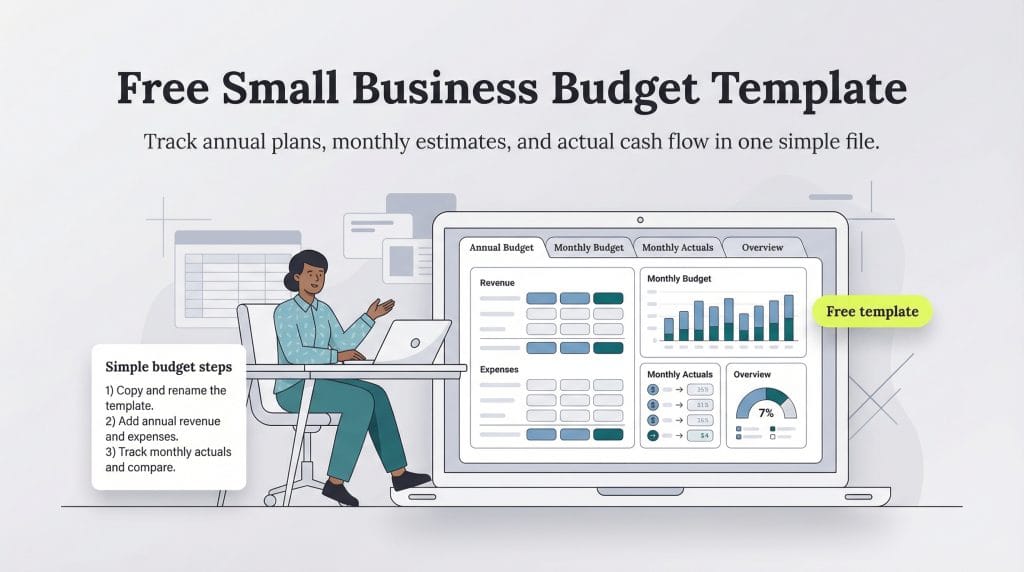

Free small business budget template

If you’re unsure where to begin, download business.com’s free budget template. This template will help you track your expenses, estimate your monthly income, and record your earnings and spending.

Our budget template has five tabs. To use it, take the following steps:

- Make a copy of or download the template.

- On the first tab, Instructions, replace the Your business’s name text with your actual business name. Once you do that, your business name will automatically fill in on the other pages.

Here’s a breakdown of how to use the other four tabs.

Annual Budget

The Annual Budget tab examines how much money your business brings in each year. Use this tab to input your company’s yearly revenue and expenses. Be as specific and detailed as possible because this information is used throughout the budget template.

Monthly Budget

The Monthly Budget tab shows your monthly expenses. Since you already filled out the Annual Budget information, this data has been prorated; you now have monthly estimates for each of your yearly totals.

By default, each month’s budget is weighted equally. However, you can change this by updating the percentages in row 5. Your percentages must add up to 100.

Monthly Actuals

The Monthly Actuals tab is for financial tracking. You’ll use this tab to track your actual expenses and revenue as they come in each month, allowing you to see how much money your business is making.

Overview

The Overview tab shows how your actual numbers compare to your budget. It gives an overview of your annual and monthly budgets. This information helps you see where your business is doing well and identify areas for improvement. To see your finances for a particular month, select that month from the drop-down list in row 4.

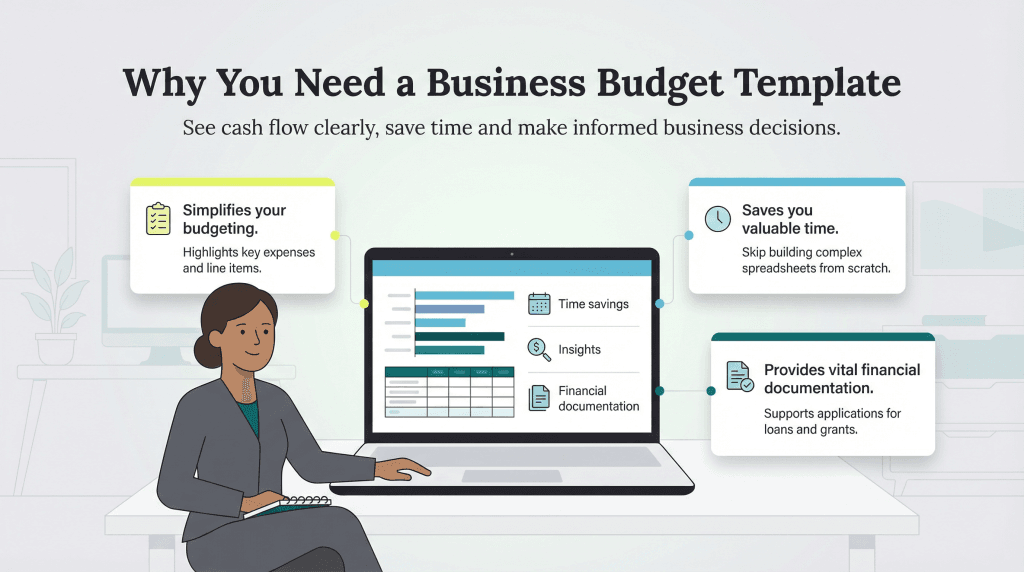

Why do you need a business budget template?

A business budget template is vital for keeping your expenses and financial goals updated. A good template makes it easy to see how much money you have available; what you need to pay for; and how much money you have left after covering your necessary fixed and variable expenses.

Here are a few reasons why business budget templates can be essential tools for business owners.

- Simplifying business budgeting: Carol Lee Mitchell, managing director of business banking growth strategies at Bank of America, emphasized that templates simplify the potentially challenging budgeting process for business owners. “Using a template can help ensure business owners identify any key line items that may factor into their budgeting,” Mitchell explained. “However, every business is different, and business owners should consider which expenses may be unique to them to avoid excluding costs from the budget based on the template used.”

- Time savings: Andrew Lokenauth, founder of BeFluentInFinance.com, noted that templates help business owners save valuable time. “Templates eliminate the need to create spreadsheets from scratch, which can save you hours of work,” Lokenauth said. “I’ve seen new business owners spend days trying to build something that could’ve taken 30 minutes with a template!”

- Valuable insights: Your business budget template will show you if you can grow your business, give yourself or your employees raises, or purchase inventory and business assets. If you don’t have sufficient money coming in, it will reveal which bills you don’t have the funds to pay, helping you avoid bankruptcy.

- Financial documentation: If you apply for a business loan or grant, the application may ask for financial accounting documentation, such as a monthly or annual budget. This information will give the lender an idea of your business’s financial standing and how you manage your money.

If your budget shows it's time to

cut business expenses, consider looking for lower-cost vendors, streamlining your marketing or eliminating unnecessary perks.

How do you create a startup business budget?

If your business is new or in the planning stages, creating a budget is tricky. This is the case even with a template because you don’t have actual numbers to plug in. Still, it’s something you need for your business plan and loan applications.

Here are five steps to help you create a startup budget to get your business off on the right foot.

1. Set your budget goal.

Your budget goal is the total amount you’re willing to spend on your business. Setting this number helps establish clear parameters for your budget from the beginning and keeps your spending in check.

To set your goal, consider the amount of money you currently have or can realistically obtain. How much money makes sense for you to spend? Keep in mind that loans must be repaid — often with interest — and you shouldn’t deplete your personal savings.

Mitchell noted that goals will vary by business. But, the SMART goals framework can provide a tried-and-true method for determining any operation’s budget goals.

“[SMART goals], or specific, measurable, achievable, relevant and time-based [goals], are best for achieving steady progress,” Mitchell explained. “Think about which goals you would like to attain long term (e.g., breaking even within the first year), and set short-term goals to maintain your momentum over time.”

2. Categorize your expenses.

For this step, brainstorm all potential expenses on a budget worksheet. Begin with your startup costs, which are one-time expenses related to starting your business.

Startup costs could include a building (if you’re buying, not renting), computers or photography equipment. Be specific and write down the exact costs of every item you must purchase and any associated costs. For example, to build a website, you may pay for a designer, web hosting company, plugins, business domain name, security software or stock photos.

Next, categorize each item as essential, nonessential or later:

- Essential items: Essential items are purchases crucial to starting your business, such as a business license.

- Nonessential items: Nonessential items will make your life easier but are not crucial to your business’s operation. For example, professionally designed logos or websites are likely nonessential elements. What you deem “nonessential” can be subjective, but try to look at your business as a whole and use your best judgment.

- Later items: Later items can be put off for at least six months and are not required for your business’s immediate functions. Examples include a fresh coat of paint for your building or a state-of-the-art VoIP phone system.

Add up your essential and nonessential items to get your estimated startup costs.

3. Estimate your losses and forecast your revenue.

Your losses refer to the period during which you’re covering expenses without yet turning a profit. A new business needs time to build a customer base, and your budget must reflect these losses.

Here’s how to estimate your startup losses and forecast your revenue:

- Create an opening budget. Start by calculating your estimated monthly overhead costs, including subcontractors, payroll, software subscriptions, website fees, rent and advertising expenses. This step helps establish your operating budget — the amount you’ll need to keep the business running each month.

- Estimate how long you’ll operate without generating revenue. Next, estimate how many months you will go without revenue. New businesses often go several months before turning a profit, so your budget should reflect that period of loss. Start by determining your break-even number, then estimate how many months it might take to reach that point.

- Forecast your revenue. It’s hard to predict income in the early days, so make an educated guess based on your business model, pricing and expected customer growth. Lokenauth recommended underestimating when creating your first forecast. “Whatever revenue you think you’ll generate, cut it by 25 to 30 percent for your initial budget,” Lokenauth advised. “It’s better to be pleasantly surprised than desperately scrambling.”

- Plan for unexpected financial risks. In addition to estimating early losses, Mitchell emphasized the importance of preparing for potential disruptions to your cash flow. “Startups should identify potential risks — such as material price increases, lost or damaged product, or lower sales — then estimate the likelihood of occurrence and the potential impact on cash flow,” Mitchell explained. “From there, business owners should pay careful attention over time and adjust their plans accordingly.”

4. Build in a safety net.

Given the unpredictable nature of starting a business, it’s easy to exceed your estimated budget. Building some financial padding into your budget can help you cover unexpected costs. Think of this money like a vehicle’s airbags — it’s only for emergencies.

To create your safety net, add 10 percent to each expense in your startup budget and 15 percent to your monthly operating costs.

“Like personal savings recommendations, businesses are advised to save 10 percent of their annual revenue or enough funds for three months of business expenses in case of emergencies,” Mitchell noted. “In their initial stages, it can be challenging for startups to develop profit margins large enough to enable this emergency cushion, but business owners can work this up by adjusting their budget periodically to increase savings over time.”

Lokenauth warned that even promising startups can fail without a strong financial buffer:

“Aim to have 6 to 9 months of basic operating expenses in reserve,” Lokenauth advised. “This might seem excessive, but I’ve watched too many promising businesses fail because they ran out of runway just before breakthrough.”

5. Refine your budget.

Now that you have some rough numbers to work with, it’s time to tighten them up to make your budget more actionable. Here’s how to refine your budget:

- Review nonessentials: Start by going through your nonessential startup items. Is there anything you can cut out or move to the “later” category? Can you reduce the cost of any items by buying something secondhand or trading labor?

- Examine overhead costs: Review your overhead expenses and determine if any are unnecessary or can be reduced.

- Reevaluate essential costs: If you can’t get your budget to balance, you can also reevaluate your essential costs. Go through them with a trusted advisor or colleague to determine if they are all truly essential to starting your business.

Mitchell noted that how often you refine your budget may depend on the type of budget you’re using.

“As there are multiple types of budgets to choose from, business owners may prefer different frequencies to review and refine their budgets,” Mitchell explained. “For example, operating budgets, which show projected revenue and expenses within a particular period, may need to be updated monthly or quarterly, while a capital budget, which helps determine the impact of a large investment on cash flow, may not need as much refinement.”

Mitchell added that this level of ongoing analysis applies to all businesses — not just startups.

“Business owners should consider the age and stability of their business and their goals for the future when determining a cadence for budget analysis,” Mitchell recommended. “Although startups need close monitoring to ensure revenue growth, it can still be beneficial for seasoned businesses to examine their budgets multiple times throughout the year.”

Natalie Hamingson contributed to this article.