Business.com aims to help business owners make informed decisions to support and grow their companies. We research and recommend products and services suitable for various business types, investing thousands of hours each year in this process.

As a business, we need to generate revenue to sustain our content. We have financial relationships with some companies we cover, earning commissions when readers purchase from our partners or share information about their needs. These relationships do not dictate our advice and recommendations. Our editorial team independently evaluates and recommends products and services based on their research and expertise. Learn more about our process and partners here.

Traditional vs. Roth IRAs: What SMB Owners Must Know

Traditional IRAs are taxed when you liquidate them in retirement, while Roth IRAs are not. Learn how to choose the right option for your needs.

Table of Contents

Traditional IRAs are taxed when you liquidate them in retirement, while Roth IRAs are not. Learn how to choose the right option for your needs.

Unlike traditional employees with company-sponsored retirement plans, small business owners bear sole responsibility for funding their golden years. An individual retirement account (IRA) is a popular option. An IRA is a tax-advantaged savings account designed to help you save for retirement. It allows you to invest your money and grow your capital gains tax-deferred or tax-free — depending on the type of IRA you choose, traditional or Roth. This article will explore the differences between these two popular investment vehicles so you can decide which one is best for you.

Editor’s note: Looking for the right [category name] for your business? Fill out the below questionnaire to have our vendor partners contact you about your needs.

What are the differences between traditional and Roth IRAs?

Understanding the nuances of traditional and Roth IRAs is crucial for building a robust retirement nest egg and choosing the right option for your needs and goals.

“The differences between a traditional and Roth IRA are regarding the tax benefits, age and income requirements and withdrawal,” explained Alissa Todd, a financial advisor at The Wealth Consulting Group. These differences are not necessarily pros or cons, Todd noted. “What could be a pro for one investor may be a con for another, so it really depends on each person’s financial situation and goal.”

More specifically, the traditional vs. Roth IRA choice comes down to three questions:

- Do you want to pay taxes on your retirement account now or later? Traditional IRAs offer upfront tax deductions, while Roth IRAs provide tax-free withdrawals in retirement.

- Do you have a high modified adjusted gross income (MAGI)? If so, you may only qualify for traditional IRAs.

- Do you need flexibility for early withdrawals? Roth IRAs allow penalty-free access to contributions at any time, while traditional IRAs impose penalties for withdrawals before age 59½ .

Traditional vs. Roth IRAs at a glance

Here’s a quick reference guide to traditional vs. Roth IRAs for 2025:

Traditional IRA | Roth IRA | |

|---|---|---|

Annual contribution limits | $7,000 ($8,000 if you’re 50 or older) | $7,000 ($8,000 if you’re 50 or older) |

Income requirements (MAGI) | None | Less than $150,000 if filing individually; $236,000 if married and filing jointly |

Age limits for contributions | None | None, as long as MAGI is within guidelines |

Tax benefits | Contributions may be fully or partially deductible, depending on income and filing status. | Contributions are made with after-tax income, so there are no full deductions. However, you may qualify for a saver’s credit of up to 50 percent of your contribution, depending on your income and filing status. |

Withdrawals and distributions | Distributions are taxable starting at age 59½; before then, they incur a 10 percent penalty. Required minimum distributions begin at age 73. | You can withdraw anytime with no tax penalties and no minimum distribution. |

What are the contribution limits of Roth and traditional IRAs?

Both Roth and traditional IRAs have identical annual contribution limits that the IRS adjusts periodically for inflation. For 2025, you can contribute up to $7,000 to all your IRAs combined ($8,000 if you’re 50 or older). These contribution limits apply whether you have one IRA or multiple accounts — the total contributions across all accounts cannot exceed these thresholds.

What are the income requirements for Roth and traditional IRAs?

Roth and traditional IRAs have different income requirements:

- Roth IRA income requirements: Eligibility is based on your modified adjusted gross income. For 2025, single tax filers with MAGIs below $150,000 can make full contributions to Roth IRA plans, with partial contributions allowed up to $165,000. Married couples filing jointly can contribute fully with MAGIs below $236,000, with reduced contributions up to $246,000.

- Traditional IRA income requirements: Contributions are not limited by your income, and you may be able to open a traditional IRA for a spouse who does not work. However, in either case, the IRA contribution amount you can deduct from your taxes may be limited by your income.

What are the age limits for Roth and traditional IRAs?

Age limit rules are similar for Roth and traditional IRAs:

- Roth IRA age limits: You can contribute to a Roth IRA at any age as long as you meet the MAGI requirements.

- Traditional IRA age limits: You can contribute at any age with earned income. The SECURE Act of 2019 eliminated the previous age 70½ contribution cutoff, allowing business owners to continue building retirement savings regardless of age.

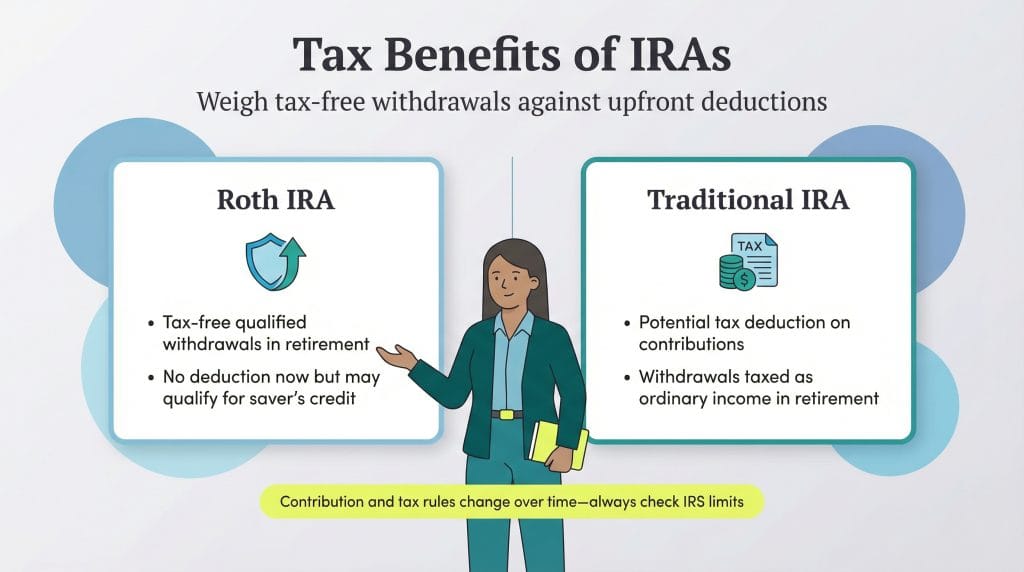

What are the tax benefits of Roth and traditional IRAs?

There are significant differences between the tax benefits and structures of Roth and traditional IRAs.

Roth IRA tax benefits

Contributions to a Roth IRA are made with post-tax income. “However, when you withdraw money from a Roth IRA, it comes out tax-free as long as you meet the guidelines,” Todd explained.

The Roth IRA tax structure means you can’t directly deduct any Roth IRA contributions on your taxes. However, you may qualify for the retirement savings contributions credit, also known as the saver’s credit. You qualify if you meet the following requirements:

- You are at least 18 years old.

- You are not claimed as a dependent on another taxpayer’s return.

- You are not a full-time student for five or more months during the tax year.

The saver’s credit provides a tax credit worth 10 percent, 20 percent or 50 percent of your retirement contributions, depending on your income level. For 2025, the saver’s credit has the following rates:

- Maximum credit: $1,000 for single filers and $2,000 for joint filers.

- 50 percent of eligible contributions: For taxpayers with an AGI of $23,750 or below (single) or $47,500 or below (married filing jointly).

- 20 percent of contributions: For taxpayers with an AGI above the 50 percent threshold but below $25,500 (single) or $51,000 (married filing jointly).

- 10 percent of contributions: For taxpayers with an AGI above the 20 percent threshold but below $39,500 (single) or $79,000 (married filing jointly).

To qualify for the saver’s credit, you must contribute to a qualifying retirement account such as a traditional or Roth IRA, 401(k) or similar plan and meet the income eligibility requirements.

If your adjusted gross income exceeds these thresholds, you cannot claim the saver’s credit. You have until the tax filing deadline (typically April 15) to make IRA contributions for the previous tax year.

Traditional IRA tax benefits

Because contributions to traditional IRAs are made pretax, you can partially or completely deduct contributions from your taxes. However, you will have to pay taxes in retirement. “When you withdraw money from a traditional IRA, all distributions are taxed as ordinary income,” Todd noted.

To determine your traditional IRA deduction eligibility for 2025, consult these IRS guidelines:

- Single with no employer-sponsored retirement plan: If you’re a single taxpayer, head of household or a qualifying widow(er) and are not covered by a retirement account at work, IRA contributions are completely deductible, regardless of income.

- Single with an employer-sponsored retirement plan: If you’re a single taxpayer or head of household and are covered by a retirement plan at work:

- IRA contributions are completely deductible if your MAGI is less than $79,000.

- IRA contributions are partially deductible if you make more than $79,000 but less than $89,000.

- There’s no deduction if your MAGI exceeds $89,000.

- Married filing jointly with no employer-sponsored plan: IRA contributions are completely deductible for married couples filing jointly or separately, regardless of income, when neither spouse is covered by a retirement plan at work.

- Married filing jointly with an employer-sponsored plan: If you’re a married taxpayer filing jointly (or a qualifying widow or widower) and you’re covered by a retirement plan at work:

- IRA contributions are completely deductible if your MAGI is $126,000 or less.

- IRA contributions are partially deductible if you make between $126,000 and $146,000.

- If your income exceeds $146,000, no deduction is possible.

- Married filing jointly when your spouse is covered: If you’re a married taxpayer filing jointly and your spouse is covered by a retirement plan at work:

- IRA contributions are completely deductible only if the MAGI is $236,000 or less.

- IRA contributions are partially deductible if you make more than $236,000 but less than $246,000.

- If the MAGI is over $246,000, there is no deduction.

- Married filing separately with coverage: If you’re a married person filing separately and either partner is covered by a retirement plan at work, you can claim a partial deduction if your MAGI is below $10,000. Otherwise, no deduction is possible.

The saver’s credit also applies to traditional IRAs.

What are the withdrawal and distribution rules for Roth and traditional IRAs?

Understanding withdrawal rules is essential for retirement planning and avoiding unexpected penalties:

- Roth IRA withdrawals and distributions: You can withdraw your contributions (not earnings) from a Roth IRA at any time without taxes or penalties. To withdraw earnings tax-free, you must be at least 59½ and have held the account for at least five years. Roth IRAs have no required minimum distributions during the owner’s lifetime, allowing tax-free growth to continue indefinitely.

- Traditional IRA: Withdrawals before age 59½ incur a 10 percent early withdrawal penalty plus income taxes, though certain exceptions apply. Starting at age 73, you must begin taking required minimum distributions based on IRS life expectancy tables.

What’s the right IRA for a small business owner?

Choosing the correct IRA for your retirement savings depends on several factors.

“The benefit of a Roth IRA is that … withdrawals are not taxable; withdrawals don’t impact Social Security [or] Medicare taxes,” said Ilene Davis, certified financial planner and author of “Wealthy By Choice: Choosing Your Way to a Wealthier Future.” “However, there is no guarantee that withdrawals will not be taxed in the future … My general rule is that if a client is in the 22 percent or more tax bracket and can qualify for a traditional IRA, they should take the tax breaks now.”

If neither the traditional nor Roth IRA seems like the best option for you, speak to a financial advisor about other retirement plan options available to business owners, including a Savings Incentive Match PLan for Employees (SIMPLE) IRA, Simplified Employee Pension (SEP) IRA, solo 401(k) or 7702 plan. These plans often allow you to contribute more than you would in a traditional or Roth IRA, though there are more eligibility requirements.

No matter what type of plan you choose, Davis says the best thing any small or midsize business owner can do to plan for retirement is to start saving as soon as possible. “Find the type of plan that best suits your financial situation and needs and start,” Davis advised. “Don’t stop with tax-deductible or tax-advantaged plans if you can afford to invest more and still enjoy life. Often, the difference between an OK retirement and a great one is the wealth accumulated beyond retirement plans.”

How does an IRA differ from a 401(k)?

Both IRAs and 401(k)s are retirement savings accounts, but there are some key differences. A 401(k) retirement plan is an employer-sponsored plan, while an individual establishes an IRA without an employer’s involvement.

In some cases, employers will match employee contributions to their 401(k) as an employee benefit. Having a 401(k) plan at work impacts how much of a taxpayer’s IRA contributions are deductible.

IRAs are available to people regardless of employment status and can be set up by business owners, self-employed individuals and those without a traditional job. Distributions in retirement are tax-free for Roth IRAs but taxable for 401(k)s and traditional IRAs.

Both IRAs and 401(k)s invest primarily in mutual funds or stocks. Their value fluctuates based on market performance and asset allocation, making diversification and regular rebalancing essential for long-term growth.

Mike Berner and Jennifer Dublino contributed to the reporting and writing in this article. Source interviews were conducted for a previous version of this article.