Business.com aims to help business owners make informed decisions to support and grow their companies. We research and recommend products and services suitable for various business types, investing thousands of hours each year in this process.

As a business, we need to generate revenue to sustain our content. We have financial relationships with some companies we cover, earning commissions when readers purchase from our partners or share information about their needs. These relationships do not dictate our advice and recommendations. Our editorial team independently evaluates and recommends products and services based on their research and expertise. Learn more about our process and partners here.

The Hartford Review

Table of Contents

- The Hartford offers nine business insurance policy types, which is more than many household-name brands, including Progressive.

- The Hartford’s annual insurance premiums are competitively priced, and rates are easy to obtain.

- We’ve consistently been happy with The Hartford’s friendly, helpful and responsive customer support.

- For workers’ comp policies, you have to call the company for a quote and coverage details.

- The Hartford’s fees for paying your insurance premiums in installments incentivize lump-sum, upfront payments, which may not be feasible for policyholders with poor cash flow or low revenue.

- The Hartford’s EPLI policies may limit your coverage to one incident per policy term.

Every business needs insurance, and most need multiple policies to cover all the risks they face. The Hartford leverages its unparalleled expertise and experience to offer nine types of competitively priced business insurance policies, most of which you can purchase online. Below is our review of The Hartford, our top pick overall for business insurance.

The Hartford Editor's Rating:

9.7 / 10

- Rates

- 10/10

- Coverage limits

- 9.5/10

- Onboarding process

- 9.5/10

- Policy options

- 9.5/10

- Customer service

- 10/10

Why We Chose The Hartford as Best Overall

We chose The Hartford as the best business insurance company overall given its 200 years of experience in commercial insurance and the corresponding quality of its policies and customer service. Through its extensive knowledge and deep history, you get expert guidance in choosing the right policies for your exact needs. For many types of policies, however, you can go through the whole process online without talking to anyone, and we appreciate that convenience.

A standout point for The Hartford is that, in our customer-support experience, the company’s agents were genuinely interested in helping us secure the best possible coverage for our circumstances. That experience stood out from the poor customer-service reputation earned by other insurance companies we reviewed, such as Travelers. The Hartford also maintains a vast knowledge base that we found adequate for answering most of the questions we had about their insurance offerings.

Although its history is in traditional business insurance, The Hartford also offers modern products such as cyber liability insurance. Another present-day need it serves is speed; we’ve found that some claims take only five days to process. By comparison, Allstate — another legacy name — is known for a long claims process. The quotes we obtained when testing The Hartford were extremely competitive, especially compared with other companies, such as Progressive, which is known for high policy costs.

From cost to offerings to support, The Hartford checked more boxes than any other business insurer, which is why we selected it as our best overall pick.

Types of Insurance Policies

The Hartford offers nine types of business insurance policies. We were pleased to find that much choice; it’s the same number of policy types offered by Allstate and more than the six policy types offered by Progressive.

Below are the types of insurance The Hartford offers, with details on the company’s exact coverages and whether you may need each type of insurance.

General liability insurance

General liability insurance, also known as business liability insurance, covers your business in the event of third-party losses. Those may include defamation such as libel or slander, rental property damage, injuries customers experience on your property, or damage that occurs to a customer’s property due to your work. Your general liability policy will cover the costs of those losses and pair you with a legal representative who will protect your rights in court. It’s a policy that insurance experts often say every business owner should obtain.

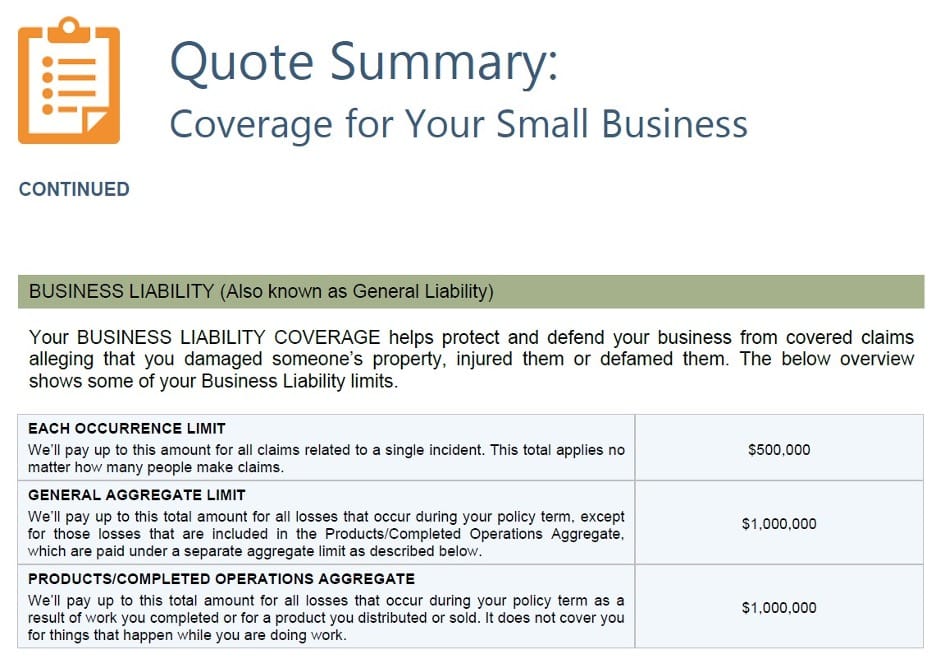

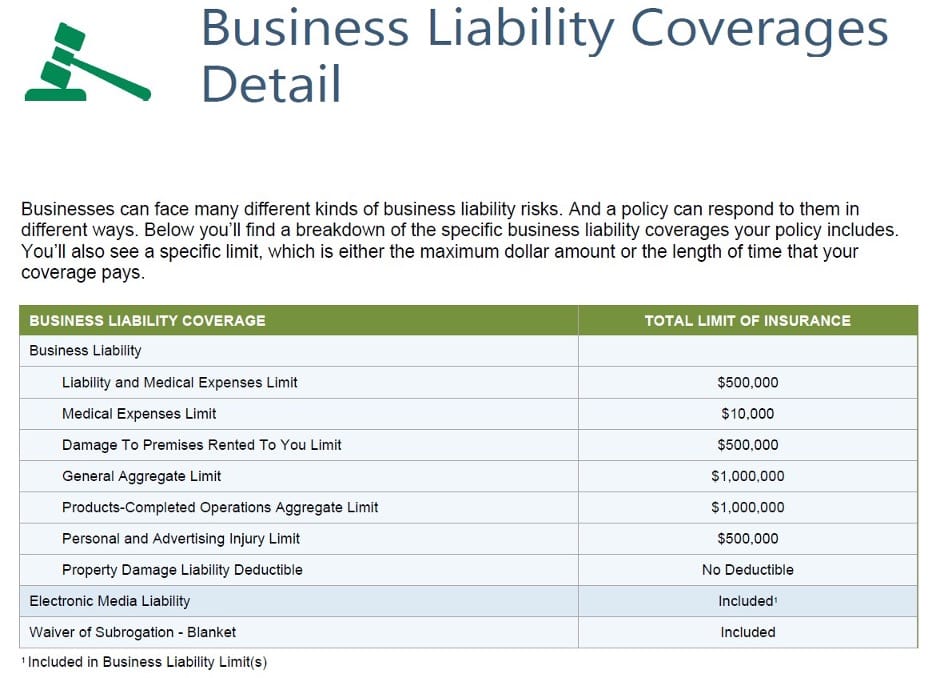

The quote we obtained for general liability insurance through The Hartford covered $500,000 for claims stemming from a single incident. It covered $1 million in all losses during the policy term (each year of the policy) and another $1 million for losses stemming from completed work or products sold or distributed. Other coverages included personal and advertising injuries ($500,000 limit), damage to rented premises ($500,000) and a category called “products-completed operations” ($1 million).

Commercial property insurance

Commercial property insurance protects your business in the event of losses to assets such as inventory, computers and furniture. Theft, vandalism and fire are typically covered, and a deductible (an amount you must pay out of pocket before the insurer starts covering costs) is typical with the policies. Like general liability insurance, it’s an important policy for all business owners to obtain.

The property coverage portion of our quote from The Hartford included a $1,000 deductible and paid for up to $2,500 in furniture, inventory, supplies and other business personal property in need of replacement. It did not, however, cover the costs of repairing or replacing business buildings and structures, including fixtures and equipment.

Among the property coverages included in our quote were building property of others, with a $10,000 limit; business income from off-premises operation, with a $25,000 limit; and business income from websites, with a $10,000 limit.

Certain coverages were included in our quote, which means our coverage limit was the amount we said it would cost to replace our property when we requested a quote. The coverages were, among others, backup of sewers and drains, equipment breakdown, and glass expenses.

Business owner’s insurance

Business owner’s insurance is a type of coverage that combines general liability insurance with commercial property coverage. The Hartford’s general liability and commercial property insurance coverages described in the previous sections were included in our quote as part of a business owner’s policy.

Insurers such as The Hartford offer business owner’s insurance since, by combining coverages, they can incur fewer operating costs. This, of course, has the added benefit of lowering premiums for business owners, which means you get two types of highly important coverage at a lower price than if you purchased them separately.

Workers’ compensation insurance

You’ve probably heard this type of insurance simply called “workers’ comp.” It covers losses for employees who are injured while performing work for your business. The losses include medical expenses, wages not earned while out sick and any rehabilitation services required to treat the injury. If your company has one or more employees, you are almost certainly required to obtain workers’ comp for your business.

Our quote from The Hartford didn’t include pricing for workers’ comp, but it encouraged us to call the company for more information. We didn’t understand why rates and coverage information weren’t immediately available as with business owner’s insurance. That was among our biggest disappointments with The Hartford. It was also confusing, because, if you apply for business insurance via Hiscox, they tell you that their workers’ comp insurance is underwritten by The Hartford. (All its other policies are underwritten in-house.)

Professional liability

With professional liability insurance, also known as errors and omissions insurance, you’re covered if mistakes in your professional work result in losses for third parties. Your insurer will pay you the amount of the financial loss and cover any legal defense costs stemming from the incident. If your business offers expertise in a certain area — law firms are a great example — it’s paramount to obtain this type of insurance.

Our quote from The Hartford included $100,000 in coverage per professional liability claim, including $25,000 for subpoena assistance claims. There was a separate $25,000 limit for costs arising when defending your business against disciplinary action from a regulatory agency, alongside a $500 deductible. We liked that our quote included a concise table of all the business liability coverages in our policy and the total limit per coverage.

Employment practices liability insurance

Employment practices liability insurance (EPLI) covers the costs and damages of lawsuits stemming from employee mistreatment claims. It typically covers discrimination, wrongful termination, retaliation, sexual harassment, breach of contracts and improperly managed employee benefits programs. Coverage usually still applies even if the lawsuit isn’t decided in your favor.

EPLI was included in our business owner’s policy quote from The Hartford at no additional cost. According to our quote, we would have up to $25,000 in coverage per EPLI claim. The same $25,000 limit would apply for all EPLI claims during the policy term, however, suggesting that the policy may cover only one incident.

Although it’s a potential source of frustration, it doubles as an incentive to run an ethical business, avoid power abuse, and ensure contractual compliance and robustly administered employee benefits. At the same time, even if you run your business as well as possible, EPLI lawsuits are increasing in prevalence, so this policy may provide some reassurance.

Commercial auto insurance

Commercial auto insurance covers any bills and expenses arising from your business’ vehicles being involved in accidents. It’s an absolute must if your company owns vehicles that your employees operate. The same is true if your employees use their own vehicles for work-related tasks — personal auto insurance rarely covers business vehicle usage — or if renting out your vehicles is among your company’s revenue streams.

Among The Hartford’s commercial auto insurance coverages are bodily injury liability, property damage liability, collisions and medical payments. The brand’s commercial auto policies don’t cover unrelated medical expenses, damages to items inside the vehicle and repairs to rental vehicles. If commercial auto insurance is the policy your business needs the most, you may prefer Progressive, our top pick for commercial auto policies.

Cyber liability and data breach insurance

Cyber liability insurance covers the losses and legal costs associated with cybercrime, malware, data privacy breaches and ransomware. Although you must typically purchase it separately from more commonplace policies, we were delighted to see that The Hartford included it in our quote for a premium of just $2 per month.

Not only is that premium as inexpensive as it gets, but The Hartford also included cyber insurance in our quote without us seeking out the insurance. We felt reassured by The Hartford’s looking out for not just our physical, financial and legal interests, but also our digital protection.

Admittedly, with the $2-per-month premium, the coverage limits for the cyber virus and malware coverage package in our quote were quite small. The plan we were quoted would cover up to $10,000 per policy year in digital ransom and extortion threats, and up to $25,000 per policy year for all other cyber claims.

We were happy to see, though, that if we wanted more extensive coverage on that front, The Hartford offers stand-alone cyber insurance plans. Within the plans, you can also obtain data breach insurance, which covers the costs of notifying the affected parties, bringing on a public relations firm and monitoring credit for data breach victims. Stand-alone plans may be necessary for organizations that use computer systems to handle customer data, businesses in sectors with concrete customer confidentiality standards and all large businesses.

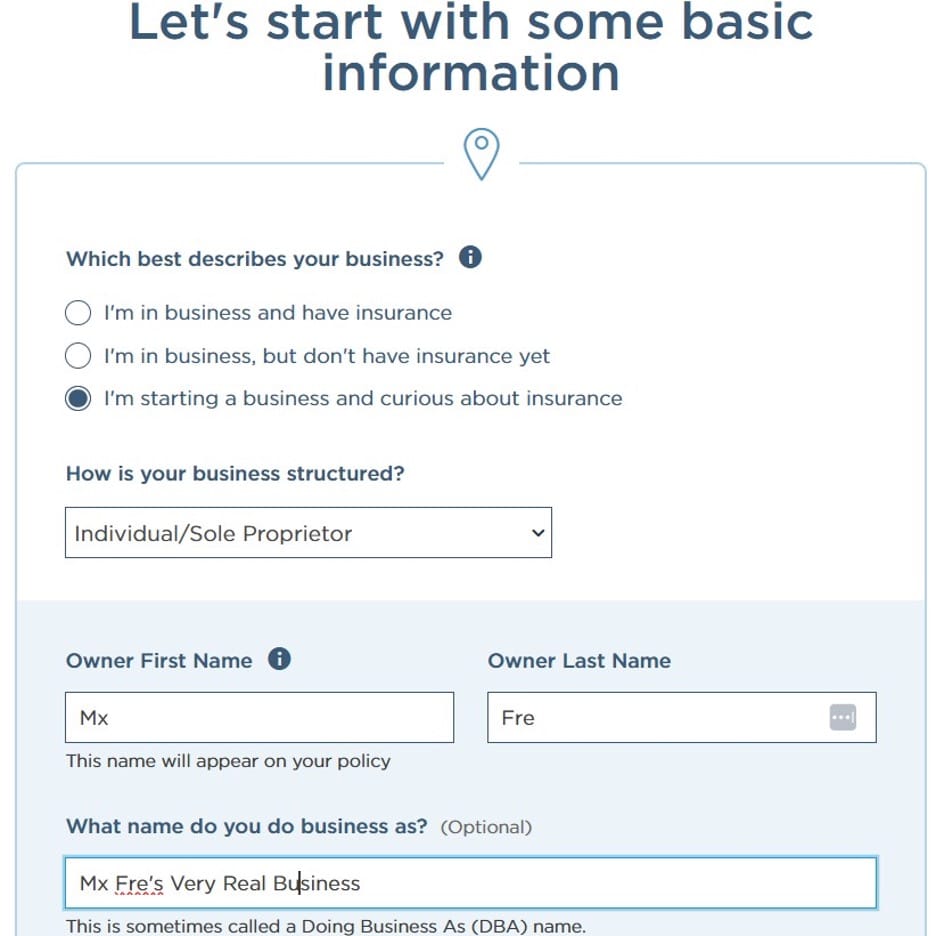

Onboarding

We like that The Hartford’s online quote engine is not only easy to use, but also easy to reach. It’s right there when you load The Hartford’s website, and it asks questions that cater to every potential business owner. We appreciated that aspiring and current business owners alike, with varying levels of existing coverage, are considered in the onboarding questionnaire.

It took us just a few minutes to reach a screen presenting the types of insurance policies we could take out with The Hartford. When we posed as a home-based digital marketing sole proprietorship with no employees, we were offered home-based business property, general liability, professional liability, workers’ compensation and commercial auto insurance. It was a superior experience to Allstate’s quote engine, which sometimes entirely declined to offer us commercial property insurance.

After choosing the coverages we wanted, we entered some extra information, such as how much it may cost to replace our business personal property. After that, we got our quote. The process took just 10 minutes, and we did it without digging into any business paperwork or records. Our quote arrived with a PDF policy summary detailing the included coverages and their premiums, deductibles and other limits. We loved that the information was presented so neatly and transparently that we had few questions about the coverage.

After you purchase a policy from The Hartford, you can create an account on the company’s website to access its online dashboard. The process is as easy as you would expect, but we had minor frustrations elsewhere in our onboarding experience. For starters, we would have to call The Hartford to officially purchase coverage; there was no online option. And we hit a surprising snag when we posed as a transportation LLC with two managers and 10 employees to use The Hartford’s online quote engine.

Although we initially had the option to pursue property, general liability, workers’ comp and commercial auto insurance alongside employee benefits, The Hartford’s quote engine told us it couldn’t help us. Instead, it redirected us to its partner Tivly, a national independent, licensed online small business insurance agency that offers same-day certificates. We were simultaneously happy that The Hartford didn’t leave us hanging and confused that The Hartford allowed us to request a quote for coverages that it then outsourced to another insurer.

Rates

In previous rounds of testing The Hartford, we found that its average monthly premiums for a business owner’s policy, general liability insurance, workers’ comp and professional liability insurance were, respectively, $141, $68, $86 and $62. The averages, though, don’t tell the whole story, since business insurance quotes are always customized to your company.

In our most recent round of testing, when we posed as a home-based digital marketing sole proprietorship with no employees, we were quoted $278 ($23.17 per month) for a business owner’s policy with one term year. That rate is significantly less expensive than the average rate. Likewise, our professional liability quote of $275 per year ($22.92 per month) is much less costly than The Hartford’s averages.

Those inexpensive figures reflect that factors including but not limited to your number of employees, whether you rent or own commercial property (or neither), and your industry may shape your rate. Moreover, rates are often quite unpredictable and can vary substantially from reported averages. For concrete pricing details, your best bet may be to pursue a quote from The Hartford. Doing so is quick and painless.

Notably, there was a small $1.66 surcharge in our quote from The Hartford. The fee is negligible, but we were disappointed to see additional fees incurred for installment payment plans. If we chose to pay our annual premium in two, four or 10 installments, we would pay $5 per payment if using autopay and $8 if not. Also disincentivizing installment payments is that we were offered a very small discount if we paid our premium in one upfront lump sum. We felt that The Hartford imposes needless obstacles to paying its premiums in installments.

Customer Support

In our experience, The Hartford’s customer-support agents are highly knowledgeable about the risks that insurance must protect against in any industry. They’re also eager to educate customers on all things business insurance so customers can make informed decisions. That, coupled with how friendly, thorough and easy to reach the support team is, ensured that The Hartford surpassed all our expectations for customer service. Best of all, we’ve never had to wait longer than 10 minutes to be connected with an agent.

The Hartford offers support on weekdays from 8 a.m. to 8 p.m. ET. Some other companies are available more often: Hiscox is reachable on weekends and weekdays, and Progressive offers 24/7 customer support. Nevertheless, the exceptional quality of The Hartford’s customer service made it completely acceptable that we could contact the company for support only during standard business hours.

Beyond real-life customer-service interactions, The Hartford continues its focus on educating customers via its online resources. The frequently answered questions on its business insurance landing page link to helpful blog posts. On its Small Biz Ahead website, it offers even more blog posts about topics beyond insurance, tying into the company’s emphasis on equipping its customers for success. The same is true of its business owner’s playbook, which is publicly accessible on its website. More than just an insurer, The Hartford is a trusted advisor.

Limitations

Our biggest frustration with The Hartford was that we needed to call the company to obtain our workers’ comp policy quote, which wasn’t the case with our business owner’s policy. We found that especially surprising given that other insurers, such as Hiscox, outsource their workers’ comp underwriting to The Hartford. We wish it were possible to obtain a complete quote outline.

We also disliked that The Hartford imposes fees if you pay your annual premium in installments instead of all at once. Although the annual premiums we were quoted were inexpensive, many businesses may pay thousands per year in business insurance. Those businesses shouldn’t be penalized for being unable to pay such a large amount of money upfront in one lump sum.

It also worried us that the EPLI policy included in our quote from The Hartford had the same coverage limit for each individual claim and all claims during the policy term. It seemed counterintuitive that, if we filed one claim of $25,000, we couldn’t file any more claims during the year. Although we firmly believe that The Hartford’s business owner’s policy is the best in show, we may consider other insurers for EPLI coverage.

Methodology

To evaluate The Hartford, we posed as two different businesses and used The Hartford’s online quote engine for each one. When scoring The Hartford, we considered our experience using the quote engine, the quote we received (including coverages and premiums) and how the quote was presented. We also contacted the brand’s customer-support team to evaluate whether real-life customers can easily get in touch with the company and get meaningful support. In comparing The Hartford with other business insurers, it emerged as our top pick overall.

FAQs

Bottom Line

We recommend The Hartford for…

- Business owners seeking a variety of policy types.

- Cost-effective business insurance.

- Highly accessible, education-oriented customer support.

We don’t recommend The Hartford for…

- Business owners seeking to buy insurance entirely online, without placing any phone calls.

- EPLI coverage.

- Business owners who need to make installment payments to afford their plan premiums.