Most businesses offer their customers the option to pay on credit — often called “trade credit” — to provide added flexibility and convenience. When a customer purchases a product or service on credit, that pending payment is recorded in your accounts receivable.

We’ll explain what accounts receivable means, how it works, and what goes into tracking and processing customer payments efficiently and accurately.

Editor’s note: Looking for the right accounting software for your business? Fill out the below questionnaire to have our vendor partners contact you about your needs.

What is accounts receivable?

“Accounts receivable” (AR) is an accounting term that refers to the total amount of money customers owe your business for goods or services they’ve received but haven’t yet paid for. That includes invoiced amounts, as well as any credits or discounts that have yet to be applied.

Accounts receivable reports show how much revenue your business has generated through invoicing — and how much of that revenue is still outstanding. AR is considered an asset on your balance sheet because it represents money your business expects to receive.

Let’s say, for example, that James buys a $1,200 washing machine, but he doesn’t have the cash at the time of the sale. The business may offer him 45 days to pay. During that time, the $1,200 is listed under accounts receivable on the seller’s general ledger. Once James pays, the business marks the invoice as settled.

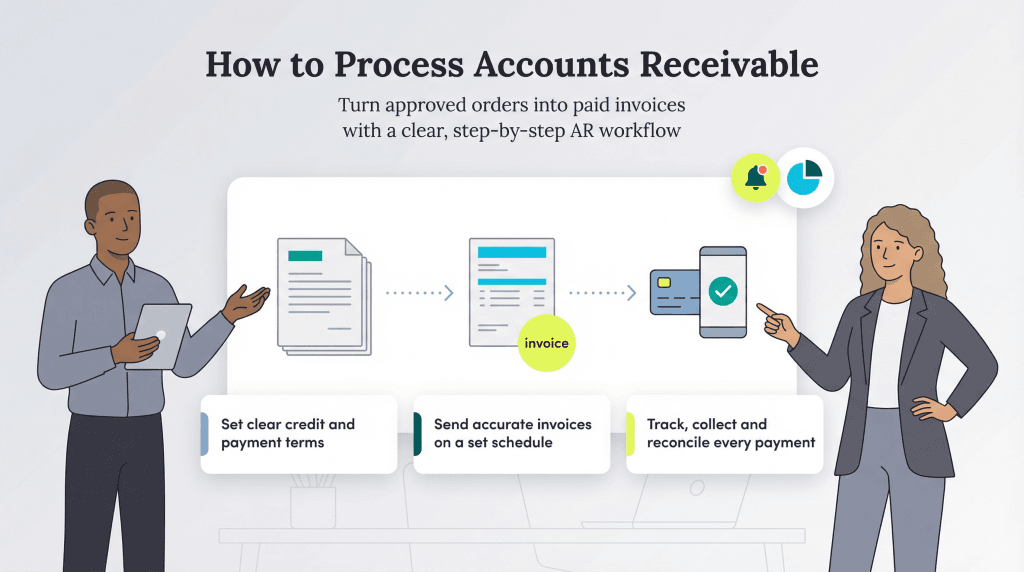

How to process accounts receivable

Accounts receivable processing is relatively straightforward. Here’s how it works.

- Agree to the purchase and issue a sales contract

- Establish your credit terms

- Create an invoice

- Track your accounts receivable

- Handle invoice disputes

- Collect payments

- Reconcile payments

1. The customer places an order.

Once a customer decides to place an order with your business, they’ll submit a purchase order. If you agree to the purchase order, you’ll issue a sales contract outlining the following details:

- The products or services the customer is purchasing

- The total quantity purchased and the amount due

- The expected delivery date

- The sale’s terms and conditions

Always assess a customer’s creditworthiness, including their

business credit score, before finalizing and sending a sales contract.

2. Outline the credit terms.

Extending credit to your customers can be risky, even for a seasoned business owner. To increase your chances of collecting your accounts receivable on time, clearly outline your credit terms at the outset. That way, you’ll be able to evaluate each customer’s credit eligibility before doing business with them. You’ll also set your customers’ expectations from the start.

Here are some of the credit terms you’ll need to clearly explain:

- The amount of credit you’re willing to extend to each customer

- Your payment terms (for example, Net 30 or Net 60 — the number of days before payment is due)

- Whether your business offers early repayment discounts

- Penalties for late payments (e.g., charging interest or late fees)

- Any other criteria for extending customer credit

Once you’ve established these parameters, consider each customer’s payment history, cash flow and overall value to your business. You may also want to evaluate the terms your competitors offer to stay competitive.

3. Invoice your customers.

You’ll create an invoice and bill your clients either at the end of the month or once the project is complete. Your invoicing system can make or break your accounts receivable process, since invoices are the primary way you communicate payment details to customers.

Every invoice should include the following information:

- The goods or services sold

- The costs of the goods or services

- The name of the customer

- The payment due date

Invoicing is a key

accounting software feature to prioritize when choosing a financial solution. Look for a platform that offers easy invoicing and automatic payment reminders.

4. Keep track of outstanding payments.

Business owners don’t want to lose money, but it can be easy to overlook outstanding accounts receivable payments. Not paying close attention to AR, however, can cause a cash flow shortfall when expected revenue doesn’t appear.

Accurate financial tracking is an essential part of the accounts receivable process. Experts advise creating a dedicated AR ledger to monitor unpaid invoices and the total amount you’re owed from customers. This helps you easily identify overdue accounts and take action before payment issues get out of hand.

A great way to manage outstanding payments is to use accounting software such as QuickBooks Online or Xero. (Read our detailed QuickBooks Online review and review of Xero to learn more.) These tools track invoices automatically and send payment reminders and real-time updates to your customers. You can also generate an accounts receivable aging report to monitor overdue balances.

The

best accounting software can do more than manage overdue invoices — it also tracks business transactions, stores customer and vendor data, and generates helpful reports during tax season.

5. Address any disputes.

Invoice disputes are among the most frustrating parts of doing business, but they’re a reality every business owner faces at some point. It’s essential, however, to handle disputes professionally to maintain strong client relationships.

If a client raises a dispute about their invoice, start by asking questions and investigating the situation to determine what happened. Most invoice disputes are caused by accounting mistakes or human error, and they can be resolved quickly with clear communication. If mistakes were made on both sides, work with your client to find a mutually beneficial solution and move forward.

Offering customers better visibility into their accounts can also help reduce disputes before they start. Paul Hunter, CEO and chairman of Bill360, recommends using self-service portals in which customers can easily view their invoices and payment history.

“Invoice-level instant messaging between the business and their customer allows both parties to send, receive and store important information, images and more, reducing disputes and questions that can cause delays,” Hunter said.

6. Collect the payment.

Most businesses offer payment terms between 30 and 60 days, depending on the customer’s relationship with the company. Make sure you have a process in place for collecting payments and encouraging on-time payment. The longer an invoice sits unpaid, the less likely you are to recover the full amount.

To make it easier for customers to pay on time, it’s important to offer flexible payment options. “Giving customers multiple, digital ways to pay — like credit cards, ACH transfers, customer-controlled digital wallets, single pay options on multiple invoices and auto pay — makes it easier for customers to pay promptly and reduces payments by check,” Hunter said. “Checks are the bane of good cash flow for sellers. The more convenient the payment process is, the faster businesses get paid.”

To support faster payments, many companies also offer alternative methods such as PayPal (you can even create and send invoices through PayPal directly). You can speed up collections even more by including a secure payment link on your invoices, letting customers pay online with just a few clicks.

7. Reconcile the payment.

Once the customer has paid their invoice, reconcile the payment in your accounting system. An efficient reconciliation process keeps your books accurate, prepares you for potential tax audits and helps you avoid costly financial mistakes down the road.

Using accounting software is the easiest way to stay on top of this step, since it gives you a simple, automated way to track and match incoming customer payments to outstanding invoices.

Offering early payment discounts can be a smart way to encourage customers to pay invoices quickly. You can mention the discount terms directly on the invoice or outline them in your business contract.

Why is it important to track accounts receivable?

Staying on top of your business’s accounts receivable is essential for the following reasons:

- Improved cash flow: Without steady cash flow, you wouldn’t be able to cover overhead costs, payroll or other essential business expenses. Accounts receivable is the crucial link that turns your sales into real cash. If you fail to track outstanding invoices, you could run into cash flow problems down the road.

- Better cash management: Generating sales is critical, but a lack of cash on hand can quickly hurt your company’s ability to manage daily operations. Ideally, your accounts receivable should convert into cash faster than your accounts payable come due. Tracking AR helps you efficiently collect money owed to your company and maintain strong working capital.

- Fewer uncollectible debts: Any time you offer credit, there’s a risk the customer won’t pay. If too many customers default, it cuts into your company’s profits. The longer an invoice remains unpaid, the less likely you are to recover the full amount. Once a receivable is deemed uncollectible, it’s written off against your gross profit. Tracking accounts receivable helps you spot overdue customers early and reduce the risk of future bad debts.

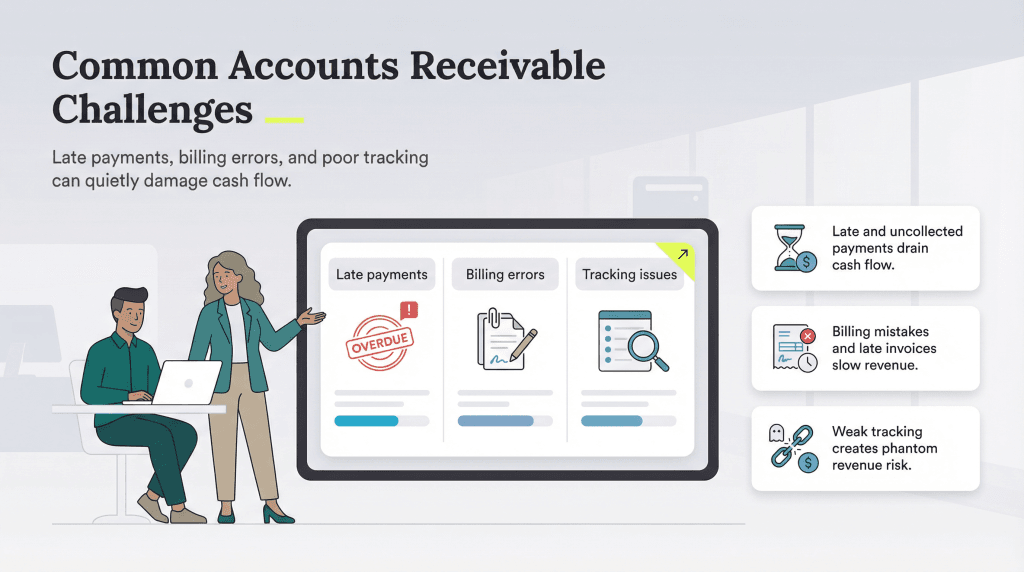

Common accounts receivable challenges

Here are some of the biggest challenges of managing accounts receivable in a business:

- Dealing with late payments: Frequent late payments from one or more customers can wreak havoc on your cash flow. It’s important to have a process in place to quickly spot and follow up on overdue invoices.

- Encountering bad debt: Occasionally, a business may be unable to collect a customer payment entirely — this is known as bad debt.

- Committing billing mistakes: Businesses that rely on manual invoicing often struggle with billing errors, such as incorrect amounts or duplicate invoices. The right invoicing software can help prevent and correct those mistakes.

- Sending invoices late: If your business frequently sends invoices late, it can delay customer payments and lead to cash flow issues. Timely invoicing is critical to getting paid faster.

- Tracking receivables: If your company sends a high volume of invoices each month, you may struggle to organize and monitor outstanding payments. Without a strong tracking system, your business could end up leaving money on the table because your accounting and finance team simply doesn’t have time to chase overdue accounts.

Many businesses struggle with something called phantom revenue — when a company recognizes revenue on its books before actually receiving the cash. It often causes businesses to appear more profitable than they truly are.

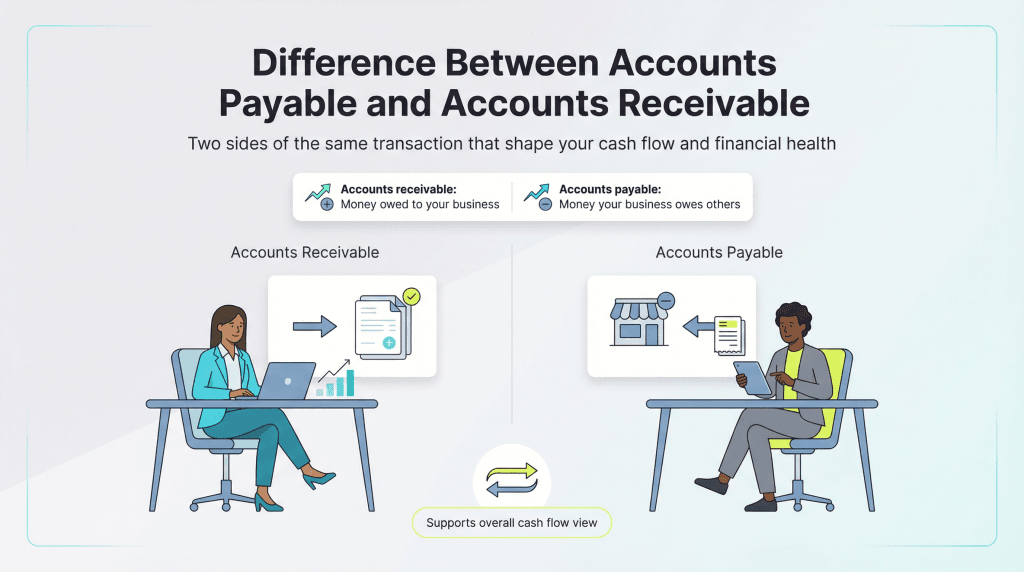

What’s the difference between accounts payable and accounts receivable?

Accounts payable and accounts receivable are different, though related, processes.

- Accounts receivable: Accounts receivable are the payments owed to a company for the sale of goods or services. AR is typically listed on a company’s balance sheet as a business asset and recorded whenever a business offers trade credit to its customers.

- Accounts payable: In contrast, accounts payable represent the amount of money or credit a business owes to its vendors and suppliers. Accounts payable are usually tied to general expenses, recurring bills and operating costs. Whereas accounts receivable are recorded as assets, accounts payable are considered liabilities.

Here’s an example: Say your company purchases linen material from a vendor. The seller will send you an invoice. Your business owes the money to the vendor, so you’ll track the bill under your accounts payable section. The vendor, however, will record the transaction in its accounts receivable column.

Accounts receivable and accounts payable are two sides of the same

financial accounting coin, and both play major roles in your business’s cash flow. Together they help you evaluate the financial health of your business at any point in time.

Look for creative ways to manage accounts receivable

Offering trade credit is an excellent way to build customer loyalty and increase profits. Customers who can’t make an upfront payment may be willing to use credit, making it one of the best ways to expand your customer base and boost your bottom line.

Offering trade credit, however, also means you’ll need to stay on top of your accounts receivable process. Driving more sales is only helpful if you can collect the money you’re owed.

Establishing clear credit terms, staying vigilant about overdue invoices and quickly reconciling payments are essential to building a strong AR process. Integrating accounting software into your accounts receivable management can also go a long way in improving your business’s financial health.