Business.com aims to help business owners make informed decisions to support and grow their companies. We research and recommend products and services suitable for various business types, investing thousands of hours each year in this process.

As a business, we need to generate revenue to sustain our content. We have financial relationships with some companies we cover, earning commissions when readers purchase from our partners or share information about their needs. These relationships do not dictate our advice and recommendations. Our editorial team independently evaluates and recommends products and services based on their research and expertise. Learn more about our process and partners here.

Top 5 Accounting and Finance Certifications to Get Ahead

The right accounting and finance certifications signal to employers and customers that you're committed to the field and ongoing learning.

Table of Contents

Nearly every public and private business entity — across all levels of government, small and large businesses and major accounting firms (such as KPMG, EY, Deloitte and PwC) — employs finance professionals. These individuals help organizations manage their finances.

To improve their accounting skills, knowledge, credibility and job prospects, many financial and accounting professionals seek additional certifications, earning specializations in various accounting niches. We’ll explore five of the most popular accounting and finance certifications and how they can benefit finance professionals.

What are accounting and finance certifications?

Accounting and finance certifications are official credentials that demonstrate an individual’s specialized knowledge in a specific area of accounting or finance. They show potential employers and clients that the certificate holder has completed additional training and passed a standardized exam, showcasing both expertise and a commitment to professional development.

Certification coursework and exams are developed and administered by professional industry associations or government entities. Only individuals who pass the certification exams are qualified to include the corresponding designation in their name or résumé, which can help them earn higher pay than they might without the certification.

Several types of accounting and finance certifications exist, including the following:

- CPA: The Certified Public Accountant (CPA) certification is one of the most well-known and respected certifications. CPAs specialize in auditing, compliance, taxes, forensic accounting, fraud examinations and more.

- CMA: Another popular certification is the Certified Management Accountant (CMA), which focuses on financial analysis and strategic management.

Other lesser-known certifications include Certified Bank Auditor (CBA), Certified Fraud Examiner (CFE), Certified Information Systems Auditor (CISA), Certified Internal Auditor (CIA) and Enrolled Agent (EA). However, the CPA remains the most sought-after designation, as many accountants’ careers can plateau early without one.

Top 5 accounting and finance certifications

We’ll take an in-depth look at five of the most popular and valuable accounting and finance certifications, along with some additional credentials you may be interested in pursuing.

1. Certified Government Financial Manager

Those interested in government accounting, financial reporting, auditing and budget planning at the local, state or federal level should consider the Certified Government Financial Manager (CGFM) certification offered by the Association of Government Accountants (AGA).

According to Payscale, those who have obtained their CGFM certification typically earn an annual salary of about $90,000. For comparison, the average salary of a budget analyst is about $69,000.

To obtain a CGFM certification, candidates must hold a bachelor’s degree and have at least two years of professional experience in government financial management. They must also pass three CGFM exams:

- Governmental Environment (GE)

- Governmental Accounting, Financial Reporting and Budgeting (GAFRB)

- Governmental Financial Management and Control (GFMC)

Each exam costs $150. Candidates must also pay an application fee of $90 for AGA members, $36 for student members and $120 for nonmembers. AGA also offers two live preparation courses in Alexandria, Virginia, for $950 and $725, as well as three virtual courses for $325, $725 and $525, respectively.

2. CMA

The Institute of Management Accountants (IMA) is the membership organization behind the CMA certification, which is aimed at management accountants and financial professionals.

Regarding what differentiates a CMA from other accounting-related professionals, the IMA explains that CMAs understand the “why” behind numbers, not just the “what.” That means a CMA’s role may involve analyzing and reporting on monthly financials, forecasts, and the annual budget, as well as providing strategic planning input.

Arvind Rongala, CEO of Invensis Learning, summarized it this way: “The CMA bridges finance and business strategy, equipping professionals to drive internal financial decision-making.”

A CMA certification can be lucrative. IMA’s Global Salary Survey reports that the median total compensation for CMAs is 58 percent higher than that of those without the designation. The study found that the overall median base salary in 2021 was $110,000, with an overall median total compensation of $124,000.

Globally, the average salary for CMAs in 2023 was about $14,853 higher than the average salary of non-CMA holders. IMA’s 2023 Global Salary Survey shows that 62 percent of CMAs credit their salary increases to their CMA certification.

To achieve the CMA designation, you must have the following:

- Current IMA membership

- A bachelor’s degree or an approved accounting certification

- Two years of relevant work experience

- A passing score on the two-part CMA exam

The first part of the CMA exam covers financial reporting, planning, performance management and analytics. The second part focuses on financial strategy and decision-making.

The IMA charges $295 for a Professional membership, an enrollment fee of $300 (for professional members) and $495 for each of the two exam parts. (A discount is available to students and academic members, and a limited number of scholarships are available each year.) If you wish to enroll in a review course, the cost will be between $1,000 and $2,000.

3. CPA

The CPA is considered the crème de la crème of accounting certifications. CPAs can work for public- or private-sector organizations or as consultants. CPAs can handle various tasks, such as maintaining financial records, corporate finance, budget oversight, tax preparation and financial planning.

Some CPAs earn additional certifications and take on more specialized roles, such as auditing internal financial records, using forensic accounting techniques to detect financial crimes or acting as fraud examiners.

Each state, along with several U.S. jurisdictions, certifies and licenses CPAs through its board of accountancy, so you’ll need to research your state’s specific requirements. A typical minimum is a bachelor’s degree with coursework in general and cost accounting, among other relevant fields. AccountingEdu.org and the Association of International Certified Public Accountants (AICPA) CPA Exam page are good starting points for determining the requirements you’ll need to meet.

The Bureau of Labor Statistics (BLS) reports that the average CPA salary is around $81,680, though CPAs who also hold a CMA certification earn an average of $151,017.

4. Chartered Financial Analyst (CFA)

The CFA Institute offers the Chartered Financial Analyst (CFA) certification, which is geared toward investment and portfolio managers, corporate finance advisors and analysts.

To be eligible for the CFA Level I exam, candidates must:

- Have a valid international passport

- Hold a bachelor’s degree (or be in the final year of a four-year program), or have 4,000 hours of professional work experience and/or higher education completed over at least three consecutive years

To become a CFA charterholder, candidates must also:

- Pass all three CFA exams (Levels I, II and III)

- Complete 4,000 hours of qualified professional work experience in investment decision-making, accrued over a minimum of 36 months

- Submit professional references and become a regular member of the CFA Institute (annual membership costs $299)

Each CFA exam focuses on specific competencies:

- Level I emphasizes knowledge and comprehension of investment tools

- Level II focuses on asset valuation and analysis

- Level III covers portfolio management and wealth planning

The CFA Institute charges a one-time program enrollment fee of $350 and a standard registration fee of $1,290 for each exam. Early registrants may receive a discount.

According to the Bureau of Labor Statistics, the median salary for financial managers was $161,700 in 2024.

5. Enrolled Agent (EA)

Tax professionals may be interested in earning the Enrolled Agent (EA) credential. Created by the IRS, this designation identifies individuals qualified to represent U.S. taxpayers in personal and business tax matters, such as collections and appeals. EAs typically have extensive experience preparing a wide range of federal and state tax returns. The EA is the highest credential issued by the IRS.

Financial consultant Ethan Richardson highlighted the IRS’s role in authorizing this credential and explained what’s involved in obtaining it. “Candidates must pass a three-part exam covering individual and business tax returns, tax planning and representation,” Richardson explained. “Taxation experts are qualified to advise, prepare and represent taxpayers.”

To become an EA, you must either:

- Have at least five years of IRS experience interpreting the tax code, or

- Pass all three parts of the Special Enrollment Exam (SEE)

Additional requirements include:

- Obtaining a Preparer Tax Identification Number (PTIN)

- Passing a background check

- Complying with IRS ethical standards

To maintain EA status, credential holders must complete 72 hours of continuing education every three years.

Each part of the SEE costs $267, and candidates must pay a $140 application fee after passing the full exam.

The National Association of Enrolled Agents (NAEA) provides additional information and training resources for individuals seeking to become an EA.

According to ZipRecruiter, the average annual salary for EAs is approximately $72,500, though pay varies by location and experience.

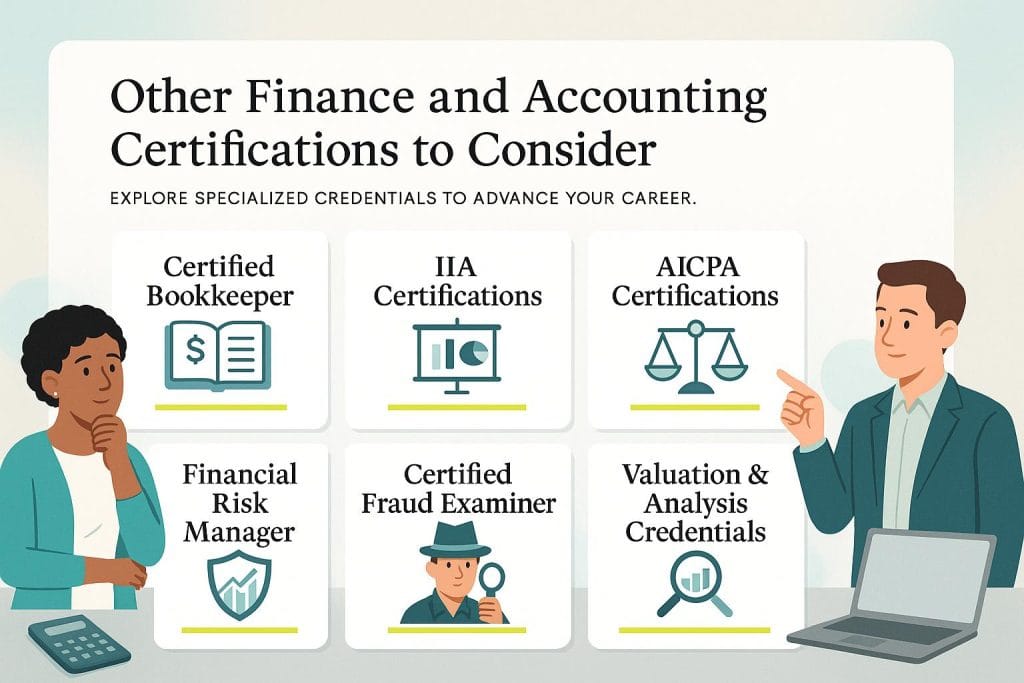

Other finance and accounting certifications to consider

The certifications listed above are the most common, but other accounting and finance certifications are also available, including the following.

- Certified bookkeeper: Offered by the American Institute of Professional Bookkeepers, this certification can help professionals qualify for more advanced bookkeeping positions.

- Institute of Internal Auditors (IIA) certifications: The IIA is well known for its Certified Internal Auditor (CIA) credential. It also offers certifications such as Certified Financial Services Auditor (CFSA) and Certified Government Auditing Professional (CGAP), among others.

- AICPA certifications: In addition to providing CPA exam resources, the AICPA offers several specialty certifications, including Certified in Financial Forensics (CFF), Certified in Entity and Intangible Valuations (CEIV), Certified in the Valuation of Financial Instruments (CVFI), and the Chartered Global Management Accountant (CGMA) designation.

These are some additional high-level or niche certifications worth noting:

- Financial Risk Manager (FRM)

- Certified Fraud Examiner (CFE)

- Certified Valuation Analyst (CVA)

- Master Analyst in Financial Forensics (MAFF)

- Chartered Alternative Investment Analyst (CAIA) charterholder

What are the benefits of being certified?

Certifications demonstrate that an individual has pursued and earned specialized knowledge in accounting and finance, which can help clients hire the right accountant for their specific needs. Current and pertinent financial certifications can also help professionals do the following:

- Enhance their reputations

- Support continued professional development

- Demonstrate a high level of commitment to the field

- Validate skills and knowledge

- Communicate credibility

- Increase opportunities for career advancement and higher earnings

- Differentiate candidates in a competitive job market

Certifications also benefit the public, the financial industry and employers. For businesses, certifications can help:

- Standardize practices

- Enhance collaboration among organizations within the same discipline

- Provide a framework for self-regulation

- Increase employee competence

- Identify quality service providers

- Establish an ethical code of conduct

- Build customer confidence in employees

- Inform employment decisions

Rongala noted that accounting and finance certifications offer more than just technical benefits. “They build a mindset for governance, ethics, and analytical rigor that organizations desperately need,” Rongala explained. “Many assume a certification alone is the end goal, but real value comes from how it’s applied across evolving financial challenges. The right credential, aligned with career goals, has the potential to accelerate leadership paths and unlock cross-border opportunities in an increasingly global finance ecosystem.”

Financial certification FAQs

- CPA: Most CPAs have earned a bachelor's degree, and many pursue a Master of Business Administration or a master's degree in accountancy. The CPA exam varies by state but typically includes four sections administered over multiple days.

- CFA: The CFA designation requires a bachelor's degree (or equivalent experience) and 4,000 hours of qualified work experience. It also involves passing three exam levels, not two. Typically, it takes four or more years to complete the CFA program, with candidates logging over 300 study hours per exam level.

- CGFM and CMA: Both the CGFM and CMA designations require a bachelor's degree or an approved accounting credential, along with a minimum of two years of professional experience. Each certification involves passing a set of exams — three for CGFM and two for CMA.

- EA: The EA designation requires either five years of relevant IRS experience or a passing score on the three-part SEE.

Jennifer Dublino contributed to this article.