Table of Contents

Most entrepreneurs assume their business loans are issued in good faith. However, unfortunately, that’s not always the case. Loan agreements often contain complicated fine print that’s easy to overlook, and unclear terms can land you in unnecessary — and sometimes overwhelming — debt. That’s why it’s critical to understand your business loan agreement thoroughly and ask questions before signing on the dotted line.

Whether you’re preparing to apply for a business loan or reviewing an approved agreement, we’ll break down what to look for in the fine print and explain the key terms and components you should expect.

Editor’s note: Looking for a small business loan? Fill out the questionnaire below to have our vendor partners contact you about your needs.

What should you look for in the fine print of your loan agreement?

Once you’ve reviewed the main terms of your loan agreement, don’t stop there. The fine print may include details that could trip you up later. Taking the time to understand those specifics can help you sidestep potential issues and make smarter comparisons as you weigh the best business loans and financing options for your organization’s funding needs.

1. Is the interest rate fixed or variable?

Understanding whether your loan has a fixed or variable interest rate is essential to calculating loan payment amounts and overall costs.

- Fixed interest rate: A fixed interest rate remains the same throughout the life of the loan, regardless of market fluctuations. This can be a smart choice if you lock in a low rate, as it protects you from rising interest rates over time.

- Variable interest rate: A variable rate changes with the market. For example, you may pay the Wall Street Journal prime rate plus 2.5 percent. While variable rates sometimes start lower than fixed rates, they introduce more risk — especially on long-term loans — since your payment amount can increase.

Watch for interest-only loan structures.

Some business loans come with an interest-only period, meaning you’ll only pay interest for a set time without reducing the principal. After this period ends, the loan may:

- Convert to a standard amortizing loan

- Require a balloon payment

- Need refinancing

Interest-only loans can reduce your upfront payments, which may feel like a lifeline at first for cash-strapped small businesses. However, these types of loans can be very risky. If you don’t clearly understand how they’re structured, you may mistakenly believe you’re paying down your debt when, in actuality, you’re not.

Some predatory lenders exploit this confusion. For example, The New York Times reported that misleading interest-only structures and other deceptive financial practices were used to exploit New York taxi drivers, leaving them with devastating large debts they thought they had been repaying.

2. What are the APR and APY, and how do they affect your loan?

The APR (annual percentage rate) combines the loan’s interest rate and fees, averaged over the loan term. It gives you a single figure to evaluate and compare financing options and helps make it easier to understand the true cost of borrowing.

However, APRs don’t account for compounding interest. For a more accurate read on total cost, borrowers should also consider the APY (annual percentage yield), also known as the effective annual rate. Unlike the APR, which multiplies the interest rate by the number of times it’s applied, such as quarterly or monthly, the APY includes compound interest or interest paid on previous interest.

Because the APY tends to be higher and harder to conceptualize, lenders usually highlight the APR instead.

Look out for factor rates.

If you’re considering a short-term loan or merchant cash advance (MCA), the lender may quote a factor rate instead of an APR. These two figures aren’t interchangeable.

- APR: APR is based on your remaining loan balance. As you repay the principal, you owe less interest.

- Factor rate: Factor rates apply to the entire loan amount, regardless of how quickly you pay it back. This means you’ll pay more interest overall than you would with an APR of the same percentage.

That’s something Glenn Read, president of Allegra Print Marketing Mail, learned the hard way when his small business needed quick capital to operate and run payroll.

“I was forced to take out merchant cash advances and high-interest line-of-credit loans just to meet payroll and keep the lights on,” Read recalled. “One of the first MCAs I took out, the amount I was given was $40,000, and the payback was $56,000 for a one-year term.”

That’s a 40 percent factor rate and a clear example of how misunderstanding loan terms can be costly. “It’s important to understand the language of the nonbank lenders,” Read cautioned.

3. Whose credit rating is important?

Loan approval and terms are often based on a combination of your personal and business credit scores. If your business hasn’t yet established strong credit, lenders may rely more heavily on your personal credit history, especially when dealing with small businesses or startups. They’ll typically check the credit history of all founders and any equity-holding partners with at least a 20 percent stake in the business.

Look out for unjustified risk-based pricing.

Lenders use risk-based pricing to adjust loan terms based on creditworthiness. Subprime borrowers (those with poor credit) may receive loans for bad credit that come with higher interest rates or additional fees as a result.

However, some predatory lenders take this practice a step further by inflating interest rates under false pretenses, claiming your credit is worse than it actually is. This tactic, known as unjustified risk-based pricing, can trap and confuse borrowers who aren’t familiar with their own credit profile.

Knowing your personal and business credit scores gives you the power to spot unfair terms, push back and get a fair deal.

4. Do you have to put up collateral?

In an unsecured business loan, the borrower doesn’t need to provide collateral. But if you’re applying for a secured loan, you’ll need to offer an asset, such as property, equipment or inventory, the lender can seize if you default on the loan. For example, in a mortgage, the property itself serves as collateral.

Unsecured loans are standard in the consumer space (e.g., credit cards or student loans), but they’re much harder to get in the business world. Most small business loans require some type of guarantee, especially for companies without extensive credit histories. Only well-established businesses are likely to qualify for unsecured financing.

Look out for personal guarantees.

Because many startups and small companies haven’t built sufficient credit or don’t have valuable business assets, lenders often require the owner to personally guarantee the loan. This means you’ll be on the hook for repayment with your personal assets if the business can’t pay.

Some banks aren’t always transparent about the liability involved in a personal guarantee, so read the fine print carefully. Make sure you understand which of your personal finances — such as your home, savings or other assets — may be at risk if your business can’t repay the loan.

5. What is the payment and amortization schedule?

Interest rates and APR aside, business loans can differ widely in how and when you’re expected to repay them. This includes the number of payment periods per year, as well as potential grace periods, late fees and prepayment penalties.

One detail that’s often buried in the fine print (or omitted entirely) is the amortization schedule, which shows how each loan payment is split between interest and principal. Early in the loan term, most of your payment goes toward interest. As the loan matures, more of each payment is applied to the principal — the original amount you borrowed.

An amortization schedule is different from a basic payment schedule, which tells you how much you owe each period, but doesn’t always show the full breakdown. An amortization schedule gives a clearer picture of how your loan balance declines over time.

Understanding this breakdown can help you monitor your debt and calculate how much interest you could save by paying off the loan early. Plugging your loan terms into an online amortization calculator is a smart move.

Look out for prepayment penalties.

Paying off a loan early might seem like a win, but some lenders charge prepayment penalties, essentially penalizing you to recoup lost interest. These fees are more common in mortgages but are still worth checking for in business loan agreements. If you’re planning to pay your loan off ahead of schedule, be sure to read the fine print and understand the terms.

6. What is the lender’s definition of default on payments?

Some borrowers carefully read most of the fine print but only skim the section about defaulting. After all, no one plans to miss a payment. Still, overlooking a lender’s definition of “default” can be an expensive mistake, especially if the terms are unusually strict.

That’s why Jared Weitz, founder and CEO of United Capital Source Inc., urges borrowers to do their homework.

“One piece of language and content to look out for is the time period allowed to make amends after receiving a default notice,” Weitz advised. “If you read this prior to signing and default on your loan, you will already know what to do and how quickly it must be done.”

In some cases, borrowers can even go into technical default without missing a payment, for example, by failing to provide tax returns or taking on new debt without approval.

Look out for confessions of judgment.

A confession of judgment (COJ), also known as a cognovit note, is a written agreement signed by the borrower that forfeits their rights to dispute any actions taken by the lender upon default. If a borrower defaults, the lender can present the COJ in court and obtain a judgment without the borrower ever being notified, let alone given the opportunity to defend themselves.

“These days, it seems the No. 1 predatory lending scheme that SMBs are prone to is the use and misuse of confessions of judgment,” Weitz cautioned.

According to Weitz, some predatory lenders exploit COJs by triggering default and moving swiftly to seize assets, often before the borrower has a chance to resolve the issue. “These predatory lenders go into the financing agreement with the intention of default so that they can seize the business and personal assets of the business owner,” Weitz explained.

Luckily, COJs are not a necessary evil. “There are many lenders out there that will work with you without the use of a COJ, so when shopping around, make sure you mention that you will not agree to any terms that involve a COJ,” Weitz recommended.

7. How does the lender make money?

One of the smartest things a small business owner can do before signing a loan agreement is to understand how the lender profits. A fair lender earns the bulk of their income from interest rates that are reasonably tied to your credit history and the risk involved.

Look out for lenders raking in profit from penalties or seized collateral.

If a lender stands to earn more from late fees, penalties or repossessed assets than from interest, they have a built-in incentive to push borrowers toward default. This kind of reverse-engineered lending structure is a hallmark of predatory loan schemes, which is why you should never sign a contract that rewards the lender when you fail to pay.

You won’t get to review your lender’s income statement, but warning signs include unusually low interest rates, excessive fees and no grace period. Before committing, check the lender’s rating with the Better Business Bureau and see what other borrowers have reported.

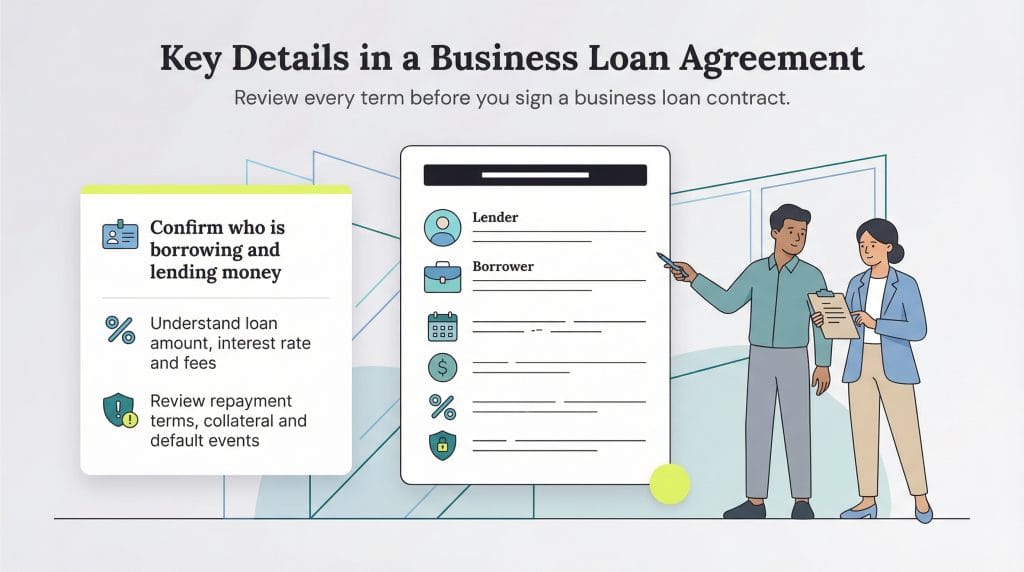

What is a business loan agreement?

A business loan agreement, also called a commercial loan agreement, is a contract between a lender and a borrower that outlines the terms of a specific business loan.

“The agreement specifies the promises of both parties: the promise of the lender to give money and the promise by the borrower to repay that money,” explained Paul Sundin, CPA and CEO at Emparion.

Business loan agreements typically apply to loans used to start or expand a business, purchase property or equipment, or buy inventory.

How does a business loan agreement work?

Once a loan application is approved, the lender drafts a loan agreement and sends it to the borrower for review and signature, typically via email.

The agreement becomes legally binding as soon as both parties sign. At that point, the lender is obligated to provide the loan under the terms specified, including the amount, rate and repayment timeline. In turn, the borrower is required to repay the loan as agreed and meet any additional conditions outlined in the contract.

What information should a business loan agreement include?

If you’re a small business owner who’s been approved for a business loan, the hard part may be over. However, don’t let your excitement override your caution. Before signing, review the contract carefully and make sure it includes the following key details:

- The lender’s name

- Borrower information (e.g., the business name and the names of any representatives signing on its behalf)

- Important dates, such as when the agreement is executed and when the loan must be fully repaid

- Loan amount — the total sum the lender is providing

- Down payment amount, if applicable

- Interest rate

- Fees, including closing costs, administrative charges or origination fees

- Repayment terms, including the payment schedule (e.g., monthly on a specific date), payment method and any prepayment penalties

- Collateral information, such as equipment, vehicles, inventory or real estate pledged to secure the loan

- Additional lender requirements, such as a guarantor or a blanket lien

- Events of default — what happens if you fail to meet the terms, such as seizure of collateral, acceleration of the loan balance or legal action

Business loan agreement terms to know

Below is a glossary of loan terms you’ll likely encounter as you review the terms of your business loan agreement.

- ACH: Short for “automated clearing house,” this type of loan payment is automatically withdrawn regularly from your business bank account on a regular schedule.

- Amortization: This refers to the process of spreading loan payments over time. With an amortized loan, your regular payments remain the same, but the split between interest and principal shifts over the life of the loan.

- APR: APR refers to the total yearly cost of your loan, including interest and fees, expressed as a percentage. APR gives you a more accurate cost comparison than just the interest rate alone.

- Balloon payment: A balloon payment is a large, lump-sum payment due at the end of some loan terms. Earlier payments typically cover only interest or a small portion of the principal.

- Blanket lien: This is a claim that allows a lender to seize any or all business assets if you default, not just specific collateral listed in the agreement.

- Cosigner: A cosigner is someone the lender can pursue loan repayment from if you default.

- Curtailment: This is a payment made outside the regular schedule that reduces the loan balance. A partial curtailment lowers the principal, while a full curtailment pays off the loan entirely.

- Default: Defaulting means failing to meet the repayment terms of your loan. This can trigger penalties, legal action or the seizure of collateral or cosigner assets.

- Deferred payment loan: This type of loan allows you to delay repayment for a set period after funds are disbursed.

- Factor rate: This rate is common with short-term loans and MCAs; it’s multiplied by the loan amount to determine your total repayment. You shouldn’t confuse this with the APR, which is calculated differently and accounts for time and fees.

- Loan underwriting: This is the lender’s process of reviewing your application, credit, financials and risk level to determine loan eligibility and terms.

- Loan-to-value (LTV) ratio: This ratio is used in equipment or real estate financing to show how much of a purchase is covered by the loan compared to the asset’s total value.

- Principal: Your principal is the amount of your loan before any fees or interest.

- Refinancing: Refinancing a loan is when you pay off an existing loan by replacing it with a new one, often to secure better terms or a lower interest rate.

- Servicing: Servicing refers to the ongoing management of your loan, including disbursement, payment collection, recordkeeping and applying penalties if needed.

Julie Thompson and Max Freedman contributed to this article. Source interviews were conducted for a previous version of this article.