As a business professional, you’re responsible for the advice and services you provide to clients. Customers who believe they’ve been financially harmed by your advice can bring a legal claim against you and your company. Under these circumstances, errors and omissions (E&O) insurance can help protect you against legal claims of inadequate work or negligence. In this guide, find out what errors and omissions insurance covers and costs.

>> Read Next: Do You Need Product Liability Insurance?

What is E&O insurance?

E&O insurance — a form of professional liability insurance — provides you, your business and your employees with coverage against lawsuits from clients claiming inadequate work or negligent action resulting from your professional services. Your business’s insurance policy will pay your legal fees, court costs and any settlements up to the amount specified in your policy.

General liability insurance vs. E&O insurance

Note the difference between general liability insurance and E&O insurance: General liability insurance provides coverage against claims that can arise when a third party is injured or property is accidentally damaged on your premises, such as a customer tripping on the carpet in your store and hurting their arm. It also covers damages that an employee causes on the premises of a third party. However, general liability insurance doesn’t protect against claims related to professional or business practices — those would be covered by either E&O insurance or professional liability insurance.

Who needs an errors and omissions insurance policy?

Any business or professional that provides advice or professional services needs errors and omissions insurance. Some states and licensing boards require certain types of companies to have E&O insurance coverage. For example, the Financial Industry Regulatory Authority requires professionals like insurance brokers, insurance dealers, registered investment advisors and financial planners to have this type of insurance.

Other companies and business professionals who provide advice or a service, such as writers, real estate agents, accountants and advertising firms, would also benefit from having E&O insurance as it would protect them against claims from clients who suffered financial harm due to the advice or services received.

For example, a client could sue a financial advisor after their investment loses money, even though the advisor explained the risks and they were within the client’s established guidelines. E&O insurance would cover the financial advisor’s legal fees, which can be high, even if a court finds in favor of the advisor.

Business.com provides a FREE guide that breaks down and compares the

top business insurance providers, making it easier for you to find the right insurer for your needs.

Other areas where E&O insurance is common, if not required, are healthcare and technology businesses.

Healthcare professionals

Healthcare professionals (namely physicians) require medical malpractice insurance, which is a type of E&O insurance. This insurance protects against claims from patients who assert they were harmed by the healthcare professional’s negligence or due to treatment decisions that were intentionally harmful. It also provides coverage against claims that arise from a patient’s death.

Technology businesses

Traditional liability policies don’t always cover pure financial losses resulting from technology failure. Clients can sue technology providers for losses associated with the products or services that the businesses provided. E&O insurance covers the legal costs in situations like these:

- A software developer creates an application that fails to perform as promised

- An IT consultant provides advice that results in system failures

- A cybersecurity firm’s recommendations prove inadequate during a breach

E&O insurance differs from cyber liability insurance, which protects your business from cyberattacks and data that is accidentally lost or leaked.

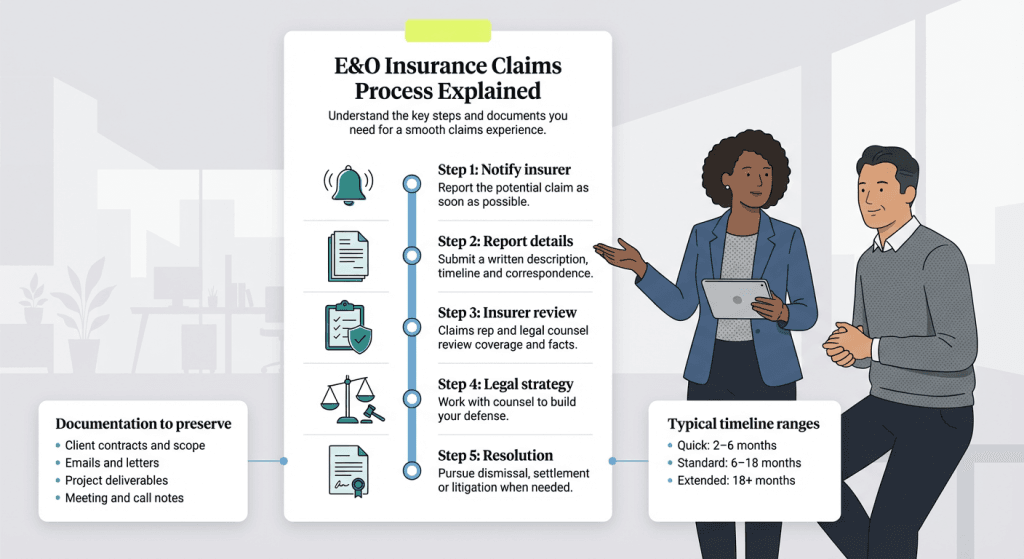

What does errors and omissions insurance cover?

Errors and omissions insurance covers clients’ claims of wrongdoing made during the policy period. The insurance provides coverage for the following types of claims:

- Negligence

- Errors in services provided

- Omissions

- Misrepresentation

- Violation of good faith and fair dealing

- Inaccurate advice

- Work mistakes and oversights

- Undelivered services or unfinished work

- Missed deadlines

Policies are usually arranged on a claims-made basis, wherein insurance coverage applies only to claims made during the policy period. A typical E&O insurance policy protects the insured against financial loss that arises from a claim made during the policy period for a covered error, omission or inaccurate advice that occurs in the conduct of the insured’s professional business.

Below is more information on what E&O insurance covers — and what it doesn’t.

What’s covered

Expenses

Liability claims can be very expensive and force you to close your business if you can’t afford the costs. E&O insurance helps you pay for the following expenses:

- Attorney fees

- Court costs

- Administrative costs

- Settlements and judgments

Temporary staff and independent contractors

E&O insurance covers your business’s permanent employees and, in some cases, temporary staff and independent contractors. This is important because some businesses rely on temporary employees during busy periods. Others use independent contractors to take on projects as needed. Insurance coverage is necessary for these workers, as they, too, can be negligent or make mistakes and, in turn, cause clients to sue your company.

Omissions

Omissions involve the failure to perform a task or the failure to provide information, resulting in the client’s loss of money. Here are some examples of omissions:

- An accountant fails to file tax returns by the deadline, resulting in penalties for the client

- A financial advisor neglects to recommend appropriate insurance coverage

- A real estate agent forgets to disclose known property defects

Professional negligence

When a client hires you for your specialized skills or experience, you must meet a higher duty or standard of care than a person without these skills and knowledge. You could be held liable for professional negligence if a client experiences physical or financial harm because you didn’t abide by this higher standard.

Here are some examples of professional negligence:

- An architect designs a building that doesn’t meet safety codes

- A lawyer misses a critical filing deadline in a legal case

- A consultant provides inaccurate market analysis, leading to poor business decisions

Misrepresentation

Misrepresentation is when a business professional makes a false statement of a material fact that affects the client’s decision when agreeing to a contract. If the client discovers the misrepresentation, the contract can be declared void, and the client can seek damages. For example, a business consultant could be charged with misrepresenting themselves to a client if they stated they have experience in an industry when, in reality, they do not.

There are three types of misrepresentation:

- Innocent misrepresentation: False statement made without knowledge of its falsity

- Negligent misrepresentation: False statement made without reasonable care to verify its accuracy

- Fraudulent misrepresentation: Intentional false statement made with knowledge of its falsity

What’s not covered

E&O insurance doesn’t cover the following:

- Bodily injury or property damage to third parties

- Employee injuries (workers’ compensation covers these)

- Employment practices violations

- Intentional wrongdoing

- Criminal acts

- Property damage

- Cyber liability and data breaches (unless specifically included in your policy)

- Claims arising from work performed before the policy inception

Even if you have E&O insurance, claims made in some jurisdictions might not be covered. We recommend checking coverage limits with your prospective insurance provider before signing the agreement.

When coverage applies

E&O insurance should apply under the following circumstances:

- The claim is made during the policy period.

- The incident occurred on or after the policy’s retroactive date.

- The claim involves covered professional services.

- The claim doesn’t fall under policy exclusions.

Most insurance policies don’t cover claims arising from work done before the policy was implemented.

How much does E&O insurance cost?

The cost of E&O insurance varies significantly based on your industry, business size and risk factors. According to data from Insureon, small businesses pay an average of $61 per month, or approximately $735 annually, for E&O coverage. However, premiums can range from as low as $30 to more than $300 per month.

Premium ranges by industry and business size

Industry-specific premium ranges

- Low-risk professions (photographers, writers, graphic designers): $30-$50 per month

- Medium-risk professions (consultants, accountants, real estate agents): $50-$100 per month

- High-risk professions (architects, engineers, medical professionals): $100-$300+ per month

Business size considerations

- Sole proprietors and freelancers: Premiums for $250,000-$500,000 in coverage typically start at $30-$60 monthly.

- Small to mid-sized companies (2-20 employees): $1-2 million in coverage can cost $100-$300 monthly.

- Larger businesses: Premium calculations are often based on revenue, with costs scaling accordingly.

Key factors affecting premiums

Several critical factors influence your E&O insurance costs, including the following:

Revenue and business size: Your gross commission income or annual revenue serves as a primary rating factor. Higher revenue typically correlates with increased risk and, therefore, higher premiums.

Claims history: A clean claims record can help secure lower rates, while previous E&O claims may increase your premiums significantly.

Coverage limits: Higher policy limits result in higher premiums. Most businesses choose $1 million per occurrence and $1 million aggregate as a starting point.

Deductible amount: Selecting a higher deductible (typically ranging from $1,000 to $10,000) can reduce your premium costs.

Industry risk level: Professions with higher litigation risk face steeper premiums due to an increased likelihood of claims.

Geographic location: Some states have higher claim frequencies or legal costs, affecting regional premium rates.

Tips for reducing E&O insurance costs

When getting quotes for E&O insurance specifically, show insurers what you’ve done to maintain your professionalism, expertise and knowledge. During the buying process for any type of policy, follow these best practices to save money on insurance costs:

- Shop around: Compare quotes from multiple insurers.

- Bundle policies: Combine E&O with other business insurance.

- Pay annually: Annual payments often cost less than monthly.

- Maintain continuous coverage: Avoid gaps that can increase future rates.

- Implement risk management: Good practices can lead to discounts.

- Choose appropriate deductibles: Balance affordability with premium savings.

It's worth investigating trade organizations' options for E&O insurance. Through this affiliation, members can often get a reduced cost.

E&O policy coverage limits and deductibles

Coverage limits and structure

When comparing E&O policies, understanding the different coverage structures is essential.

Per-occurrence limits: This represents the maximum amount the insurer will pay for a single claim. Common limits include:

- $250,000 per occurrence (entry-level coverage)

- $500,000 per occurrence (small business standard)

- $1 million per occurrence (medium-risk businesses)

- $2 million+ per occurrence (high-risk or large businesses)

Aggregate limits: This is the total amount the insurer will pay for all claims during the policy period. It typically matches or doubles the per-occurrence limit. Insureon reports that 63 percent of its customers go with $1 million per occurrence and $1 million aggregate.

Deductible options and considerations

E&O policies typically offer several deductible options.

Standard deductibles:

- $1,000-$2,500: Most common for small businesses

- $5,000-$10,000: Can significantly reduce premiums

- $25,000+: For larger businesses seeking extensive premium savings

Deductible types:

- Loss and expense deductibles: Applied only when there’s a loss payment or settlement

- First dollar defense deductibles: Applied regardless of fault

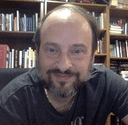

How does the E&O insurance claims process work?

Filing an E&O claim requires prompt action and careful documentation.

Step-by-step claims filing process

Step 1: Immediate notification (0-24 hours)

Contact your insurance provider immediately upon learning of a potential claim. Most policies require notification “as soon as practicable,” and delays can jeopardize coverage.

Step 2: Initial claim reporting (1-3 days)

Submit written notice that includes:

- Detailed description of the alleged error or omission

- Timeline of events leading to the claim

- All relevant correspondence with the client

- Documentation of services provided

- Estimated potential damages

Step 3: Insurer review and assignment (3-7 days)

Your insurer will:

- Review the claim for coverage eligibility.

- Assign a claims representative.

- Recommend or appoint legal counsel specializing in E&O defense.

- Begin initial investigation.

Step 4: Legal strategy development (1-2 weeks)

You’ll work with appointed counsel to:

- Analyze the merits of the claim.

- Develop a defense strategy.

- Gather additional documentation.

- Interview relevant witnesses.

Step 5: Resolution process (varies)

Depending on the claim’s complexity, you may pursue:

- Motion to dismiss: If the claim lacks legal standing (2-4 months)

- Settlement negotiations: Often preferred for cost control (3-6 months)

- Trial preparation and litigation: If settlement fails (6-18+ months)

Required documentation

Maintaining proper documentation is crucial for successful claim defense.

Essential documents to preserve

- Client contracts and service agreements

- All email and written correspondence

- Project deliverables and work products

- Meeting notes and phone call records

- Change orders and scope modifications

- Internal communications about the project

- Industry standards and compliance documentation

Documentation best practices

- Keep detailed records of all client interactions.

- Document project changes in writing.

- Maintain backup copies of all work products.

- Record rationale for professional recommendations.

- Store documents for extended periods (recommended 7+ years).

Typical timeline expectations

Understanding claim resolution timelines helps with business planning.

Quick resolutions (2-6 months) are common with:

- Clear documentation supporting your position.

- Weak or frivolous claims.

- Successful motions to dismiss.

Standard resolutions (6-18 months) typically involve:

- Settlement negotiations.

- Discovery and depositions.

- Mediation proceedings.

Extended litigation (18+ months) occurs when there are:

- Complex professional liability issues.

- Multiple parties involved.

- Trial proceedings and potential appeals.

E&O insurance state requirements and industry-specific regulatory mandates

State requirements

State insurance commissions provide valuable guidance on local E&O requirements. Below are some examples.

Nebraska Real Estate Commission requirements: According to the Nebraska Real Estate Commission, all active licensees must carry uninterrupted errors and omissions insurance with minimum coverage of $100,000 per occurrence and $300,000 annual aggregate. The state maintains approved insurance carriers and requires proof of coverage for license issuance and renewal.

Iowa real estate licensing requirements: Iowa’s Department of Inspections, Appeals & Licensing mandates that all active real estate licensees maintain continuous E&O coverage. Proof must be provided with new applications, license reactivations after 20+ days of inactivity and during random audits.

Rhode Island insurance producer requirements: Per Rhode Island state law, insurance producers must carry E&O coverage with minimum limits of $250,000 per occurrence and $500,000 aggregate as a condition of licensing.

Industry-specific regulatory mandates

Different professions face varying E&O insurance requirements.

Real estate professionals: States requiring E&O insurance in the real estate industry include Nebraska, iowa, North Dakota, New Mexico, Rhode Island and others. Requirements typically include:

- Minimum coverage amounts

- Approved insurance carrier standards

- Continuous coverage maintenance

- Proof of coverage for licensing

Tax preparers: Some states require professional tax preparers to carry E&O insurance, particularly those who prepare returns for compensation. The IRS also encourages voluntary errors and omissions coverage for enrolled agents and other tax professionals.

Legal professionals: Most states don’t require malpractice insurance for attorneys, though some (like Ohio and Pennsylvania) require either coverage or client notification of the absence of coverage.

Accessing regulatory resources

Business owners can find state-specific requirements through:

- State insurance commission websites (.gov domains)

- Professional licensing board publications

- National Association of Insurance Commissioners (NAIC) resources

- Industry association guidance

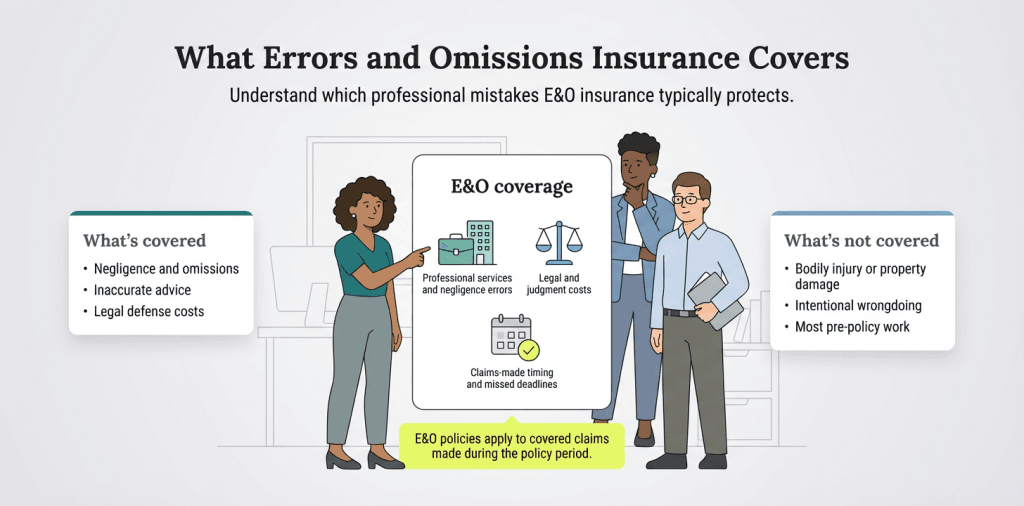

How to get the right errors and omissions policy for your business

To get the right errors and omissions policy for your business, you should start by assessing your E&O insurance needs and then asking specific questions of multiple insurers and comparing your options.

Assessing your E&O insurance needs

Use this structured approach to evaluate your coverage requirements.

Risk assessment questionnaire

- What professional services do you provide to clients?

- What is your annual revenue from professional services?

- What is the average value of client contracts?

- How many clients do you serve annually?

- What is the potential financial impact if your advice proves incorrect?

- Does your profession require E&O insurance for licensing?

- Do client contracts mandate specific coverage levels?

Industry-specific considerations

- Technology professionals: Consider cyber liability integration.

- Financial advisors: Evaluate investment-related risks.

- Healthcare providers: Assess malpractice exposure levels.

- Real estate professionals: Review transaction volume and value.

- Consultants: Consider scope and impact of recommendations.

Questions to ask insurance providers

When evaluating E&O insurance options, ask prospective insurers these critical questions.

Coverage scope

- What specific professional activities are covered under this policy?

- Are there any profession-specific exclusions I should know about?

- Does the policy include coverage for employees and independent contractors?

- Is work performed internationally covered?

Claims handling

- How quickly do you typically respond to claim notifications?

- Can I choose my own legal counsel, or do you appoint attorneys?

- What is your average claim resolution timeline?

- Do you provide risk management resources to help prevent claims?

Policy mechanics

- What is the retroactive date for coverage?

- Is there an extended reporting period if I cancel the policy?

- How will policy limits be affected if I change coverage mid-term?

- What documentation do you require for underwriting?

Cost considerations

- What discounts are available (multi-policy, claims-free, industry)?

- How do claims affect future premium pricing?

- Are there payment plan options available?

- What happens to my rates at renewal?

Coverage assessment criteria

Compare potential insurance providers and policies using these key criteria.

Insurer’s financial strength

- A.M. Best ratings of A- or higher

- Robust financial stability and claims-paying ability

- No regulatory actions against the company

Insurer’s policy features

- Claims-made vs. occurrence coverage structure

- Defense cost coverage (within or outside policy limits)

- Prior acts coverage availability

- Extended reporting period options

Insurer’s service quality:

- Positive claims-handling reputation and customer reviews

- Risk management and loss prevention resources

- Online policy management capabilities

- Fast customer service accessibility and responsiveness

Insurer’s industry expertise

- Experience serving your specific profession

- Understanding of industry-specific risks

- Specialized policy forms for your field

- Professional association partnerships

Protecting your business with errors and omissions insurance

Errors and omissions insurance can protect your business from the immense costs associated with lawsuits. A comprehensive evaluation framework, understanding of costs and coverage options, and knowledge of the claims process will help you make an informed decision about safeguarding your professional work. Whether mandated by regulation or chosen as a prudent business practice, E&O insurance provides essential financial protection in today’s litigious business environment.

Kimberlee Leonard contributed to this article.