Business.com aims to help business owners make informed decisions to support and grow their companies. We research and recommend products and services suitable for various business types, investing thousands of hours each year in this process.

As a business, we need to generate revenue to sustain our content. We have financial relationships with some companies we cover, earning commissions when readers purchase from our partners or share information about their needs. These relationships do not dictate our advice and recommendations. Our editorial team independently evaluates and recommends products and services based on their research and expertise. Learn more about our process and partners here.

Worldpay Review

Worldpay is a strong choice for retailers, businesses building customer loyalty programs and businesses dealing in multiple currencies.

Table of Contents

- Worldpay can be exceptionally cost-effective for new businesses.

- Its chargeback management system helps minimize expenses that often arise in retail settings.

- It combines credit card processing with retail-friendly tools like loyalty programs, gift cards, inventory tracking and employee management.

- Pricing details can be difficult to obtain and may vary significantly based on unclear factors.

- Unlike most processors, Worldpay does not have Better Business Bureau accreditation.

- Worldpay may decline applications from high-risk merchants.

Looking for more options?

Check out The Best Credit Card Processors of 2026: Pricing and Hardware business.com recommends.

Retail businesses conduct more transactions per day than most other companies. Along the way, things can go wrong, from chargebacks to inventory errors that cause frustrating stockouts. But a lot can go right too, like building loyalty through rewards programs and boosting sales with gift cards. Worldpay helps retailers manage these challenges while keeping costs low for new businesses, which is why we’ve named it our top credit card processor for retail.

WorldpayEditor's Rating:

9.1 / 10

- Pricing and fees

- 7/10

- Customer service

- 10/10

- Third-party integrations

- 9/10

- Payment options

- 10/10

- Added POS tools

- 9/10

Why We Chose Worldpay as the Best Credit Card Processor for Retail

Worldpay is our top credit card processor for retail because it empowers businesses to accept credit card payments and digital payment methods across currencies and channels while providing the tools to grow and stay organized.

With Worldpay, you can launch a loyalty program, track inventory, oversee employee schedules and manage sales tax — all in one platform. Other vendors cover some of these features. For example, as we note in our Square credit card processing review, Square offers robust inventory management tools. However, Worldpay stands out for offering them all.

We especially liked that Worldpay helps minimize credit card processing costs, which is crucial when you’re starting out or navigating a slow sales period. Its Fee Assist program lets you pass most processing fees on to customers, and its online transaction rates are highly competitive. Worldpay also provides hardware that may be entirely free, which can make a real difference, no matter your retail business’s stage.

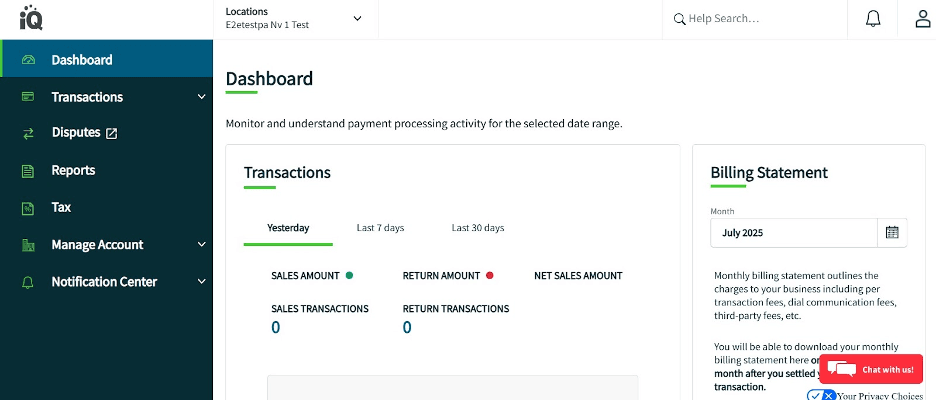

Ease of Use

We found iQ, Worldpay’s online customer dashboard, intuitive and straightforward to navigate. Even less tech-savvy business owners should be able to learn the system quickly without much difficulty.

When we logged in, we immediately saw an overview of transactions for the current day, the past week and the past month, along with a billing statement and dispute data on the homepage. Everything else was just a click away in the left-hand sidebar, which we found convenient and well-organized.

We were especially impressed by the level of detail available in the sidebar’s Transactions and Disputes sections, which provided granular data for deeper insights. The true standout, though, was iQ’s reporting tool, which let us generate reports on gift card transactions, potential fraud and more. Worldpay makes it easy for retailers to fully understand and manage their transactions.

Worldpay Features

While testing Worldpay, the following features stood out to us.

Inventory Tracking

With Worldpay 360, you get POS and inventory management tools alongside your credit card processing setup. The inventory suite lets you track stock levels across all locations and avoid stockouts. We were impressed by how much control these tools gave us over what was available to sell, helping ensure customers always had access to the products they wanted.

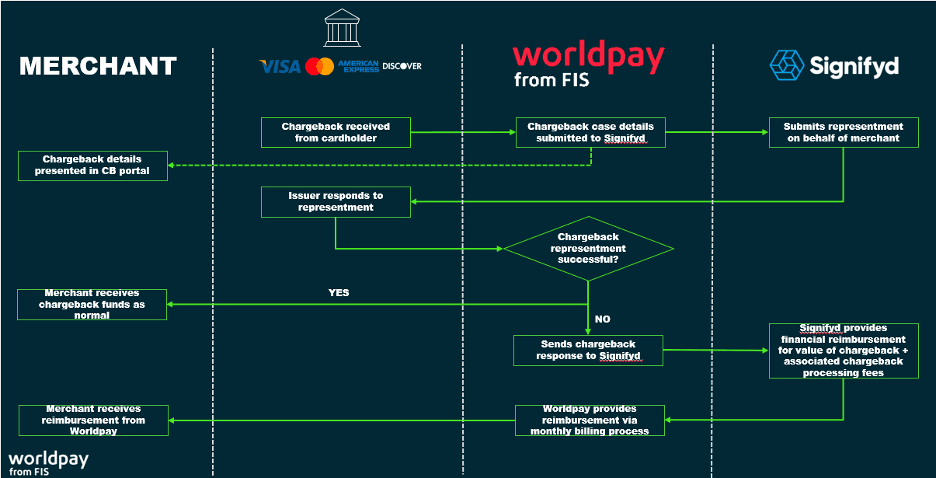

Fraud Prevention and Dispute Management

We were impressed by the breadth of Worldpay’s tools for preventing credit card fraud and handling disputes, including detailed reports for both needs. We like that Worldpay provides access to fraud specialists around the clock and offers a chargeback management system. With these tools, businesses can more easily avoid unnecessary costs that shouldn’t be part of daily operations.

Loyalty and Gift Card Programs

We were impressed by how easy Worldpay makes it to not only implement loyalty programs but also refine them over time. As more customers join your program, you gain actionable, data-driven insights through iQ’s reporting suite to improve your rewards structure.

Worldpay’s gift card solutions go even further, especially when it comes to customization. We liked how flexible the options were, from adjusting card design to setting values. We were also impressed with the data analytics and reporting tools that helped us measure the impact of gift cards on sales. In retail settings, highly customizable gift cards and loyalty programs can be significant revenue drivers.

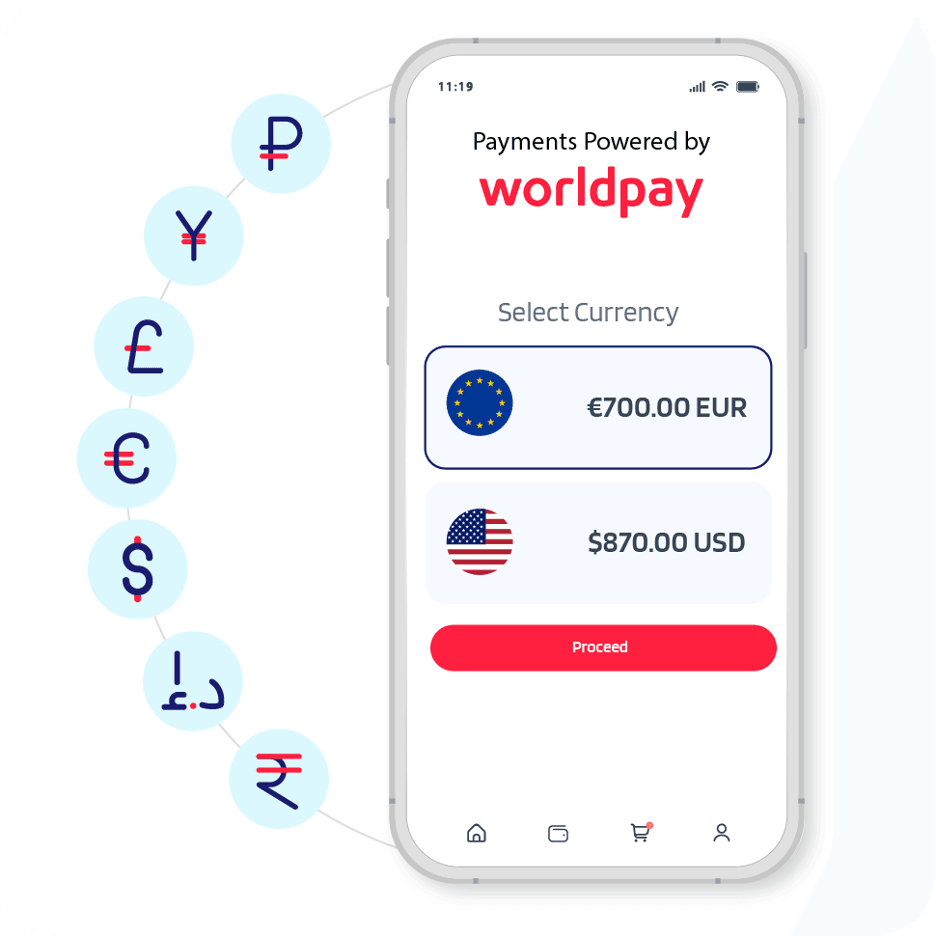

Multicurrency Pricing

As its name suggests, Worldpay emphasizes support for customers paying in their local currency. We liked the platform’s tools for marking up your international sales and securing foreign exchange rates ahead of transactions to protect your cash flow. If your retail operations occur across borders, Worldpay offers flexibility and security that we haven’t quite encountered with competitors.

Hardware

Worldpay provides access to several payment hardware options, including:

- Smart Terminal and Smart Terminal Flex

- Card readers

- Other countertop and mobile devices

A sales representative told us that Worldpay offers the Poynt C POS terminal at no additional cost, which functions as an all-in-one solution. However, we were less impressed with Worldpay’s overall hardware lineup compared with the broader range of devices available through Merchant One.

Payouts

Worldpay’s payouts arrive the next business day after you request them, which we found to be a strong safeguard against cash flow disruptions. These transfers are faster than those from competitors like Stripe, U.S. Bank, Helcim and, in some cases, Clover. (Read our Clover credit card processing review to learn more about its POS hardware and integrated payment solutions.)

You can also use Worldpay’s payout features to pay contractors, suppliers and other business partners. We found this feature to be a standout when comparing Worldpay to other credit card processors.

Worldpay also offers same-day payouts for customers who sign a contract amendment and pay an additional fee. For same-day payouts without extra charges, see our Chase Payment Solutions review or consider Paysafe.

Worldpay Pricing

Worldpay does not disclose its monthly fees online. We found this frustrating, especially when compared with competitors like Helcim that pride themselves on transparent pricing.

When we contacted Worldpay’s sales team, however, the representative we spoke with was fully transparent. We were told that as a Worldpay customer, we could receive the Poynt C POS terminal at no cost. This terminal accepts debit, credit and contactless payments.

Our representative also said Worldpay doesn’t charge early termination or common add-on fees, such as PCI fees. Despite the standard three-year contract term, we were told we could cancel at any time with no penalties since the contract is effectively month-to-month.

That said, many third-party sources cite an early termination fee of $295 to $495 for Worldpay. Others report a $99.95 monthly fee for PCI non-compliance and $15 to $25 per month for PCI compliance.

While we appreciated how easy it was to connect with Worldpay and get answers from a helpful representative, we still found the overall pricing picture confusing after our call.

Pricing and Transaction Fees

Here’s what you need to know about Worldpay’s pricing and transaction fees:

Interchange-Plus Pricing

Among our 12 picks for the best credit card processors, Worldpay is one of just four with an interchange-plus pricing model. (The others are Helcim, U.S. Bank and North Payments.) With interchange-plus pricing, you pay the card networks’ interchange fees plus Worldpay’s fixed markup. We like that Worldpay offers this model since most experts recommend it for small businesses.

Fee Assist Program

In our conversation with a Worldpay sales representative, we learned about the brand’s Fee Assist program. With Fee Assist, most of your processing fees are passed on to customers. The customer pays up to 3 percent in processing charges, while you pay only 0.50 percent. For a $50 transaction, this meant we would pay just $0.25.

Fee Assist does have significant limitations:

- It applies only to in-person payments.

- It does not apply to Visa and Mastercard, which prohibit the practice.

- It may be restricted to new businesses, though this was unclear.

More established businesses may find Stax a better fit. Read our Stax review to learn about its pricing model and features for higher-volume businesses.

Online Transaction Fees

We were also told that online payments incur processing fees of 0.30 percent plus 10 cents per transaction. This is competitive with Helcim’s fees of 0.40 percent plus 8 cents per transaction. That said, Helcim remains our top pick for businesses seeking transparency plus built-in tools like POS, invoicing and inventory management. Read our Helcim review to see how it compares in practice.

Implementation and Onboarding

We encountered no meaningful obstacles to onboarding with Worldpay. The platform is known to approve new customers within an hour, which is exceptionally fast. When we called the sales team to inquire about opening an account, we were connected to an agent within minutes. We were delighted by the quick human attention, and our representative even sent a follow-up email shortly after our call.

After approval, we quickly received an email to sign up for iQ, and completing our registration took only a few minutes. Overall, approval, implementation and onboarding were surprisingly straightforward and fast for a credit card processor — especially given that these vendors are known for being risk-averse. We had no complaints.

Customer Service

Here’s what you need to know about Worldpay’s customer support:

- 24/7 support: We were happy with Worldpay’s customer support, particularly its 24/7 phone availability (email support is also available, though not around the clock). This was a major reason we chose Worldpay as the best credit card processor for retail businesses, which often operate on weekends or after standard business hours. It’s important to choose a processor you can reach at those times, and Worldpay fits the bill. By comparison, not all processors offer 24/7 support — some, like Sekure, focus more on personalized service without round-the-clock availability.

- Online resources: You may be able to get help without making a call thanks to the FAQs on Worldpay’s support landing page. Similarly, the Knowledge Management Help Center allows you to search for topics such as fees, hardware and reports. We saw potential for this resource to answer quick questions, but we also found the help center limiting; its interface feels outdated, and it lacks a blog or other robust self-service materials.

- Online reviews: Although Worldpay is one of the rare credit card processors without Better Business Bureau accreditation, it scores well on independent customer review sites. On Trustpilot, Worldpay holds a 4.3 out of 5 rating, slightly better than North Payments’ 4.2 and far superior to Stripe’s 1.9. Most reviews highlight Worldpay’s patient and caring customer service.

Limitations

While Worldpay has many strengths, we identified a few drawbacks you should keep in mind:

- Lack of public pricing: Worldpay doesn’t list its fees online. Many competitors share this information for transparency, which is important since processing fees can quickly eat into revenue.

- Not for high-risk merchants: Worldpay does not work with businesses that require a high-risk credit card processor. For example, cannabis businesses are extremely unlikely to be approved.

- No BBB accreditation: Worldpay is one of the few processors without Better Business Bureau accreditation. However, this drawback is partly offset by its strong Trustpilot reviews and by our positive testing experience.

Methodology

To determine the best credit card processors for small businesses, we viewed product demos, tested platforms via free trials, read user reviews and contacted each vendor’s support team. We also evaluated how easy each vendor’s hardware and software is to use and whether the contract terms felt fair to merchants. Additionally, we compared rates and fees, paying special attention to whether a vendor would customize pricing options to meet a merchant’s needs.

To identify the best credit card processor for retailers, we focused on features tailored to retail operations, such as inventory tracking, employee management, loyalty and gift card programs and reporting tools. We also considered whether processors supported multiple payment methods, accepted transactions across currencies and channels, and offered hardware that fit the needs of in-store sales.

Worldpay FAQs

Bottom Line

We recommend Worldpay for…

- Retail businesses, especially new ones.

- Any business interested in running a loyalty program.

- Companies that serve customer bases across currencies.

We don’t recommend Worldpay for…

- Businesses in high-risk industries.

- Businesses that value pricing transparency from the start.

- Businesses that conduct most of their sales online rather than in person.

Looking for more options?

Check out The Best Credit Card Processors of 2026: Pricing and Hardware business.com recommends.