Whether you’re an employer running payroll or a W-2 employee trying to understand where your paycheck is going, it’s important to know which federal, state and benefits-related deductions come out of each pay period. Understanding these deductions ahead of time can help you plan your personal or business finances more effectively and build a budget that accounts for any tax obligations you may owe.

You can use our payroll deductions calculator to estimate accurate take-home pay for you or your employees. With this tool, you’ll get a clear snapshot of your financial picture and make sure your payroll deductions line up with current regulations and expectations.

Key terms when using the payroll deductions calculator

When using the payroll deductions calculator, it’s helpful to understand the following terms. These definitions explain how each input affects your estimated take-home pay.

Year-to-date earnings

This is the total amount you’ve earned from the start of the calendar year up to your most recent paycheck. YTD earnings help determine whether you’re approaching annual tax or benefit limits.

Filing status

This is the tax category you choose when you file your return, such as single, married filing jointly or head of household. Your filing status directly affects how much federal tax is withheld from each paycheck.

Pay period

This refers to how often you’re paid, such as weekly, biweekly or monthly. Your pay period determines how your annual salary is divided across individual paychecks.

Credit for children under the age of 17

This is a federal tax credit available for each qualifying child under 17. For 2025, the credit is worth up to $2,200 per child and can reduce your federal tax withholding.

Credit for other dependents

This is a tax credit for dependents who don’t qualify for the child tax credit; it’s worth up to $500 per eligible dependent.

Two jobs or spouse works

This indicates whether you work multiple jobs or if your spouse is also employed. These situations can increase your combined income and result in higher federal withholding.

Other income (not from jobs)

This includes earnings outside your primary employment, such as freelance income, interest, dividends, rental income or investment gains. Additional income may increase your tax liability.

Other deductions

These are non-tax deductions taken from your paycheck, such as union dues, disability insurance premiums or certain health benefits.

Gross pay

This is your total income before any deductions or taxes are taken out. Gross pay includes wages, salaries, employee bonuses and overtime.

401(k)/403(b) plan withholding

This is the amount you contribute to employer-sponsored retirement plans before taxes. Based on the most recently published IRS limits (for the 2025 tax year), employees under age 50 can contribute up to $23,500, while those age 50 and older can contribute an additional $7,500 in catch-up contributions (or up to $11,250 if ages 60-63 and their plan permits). The IRS updates these limits annually for inflation, so future contribution ceilings may rise once new figures are released.

Employee-paid health insurance

This is the portion of your health insurance premiums that you pay through payroll. Premiums may reduce your taxable income if they’re deducted pre-tax.

State and local taxes

These are taxes withheld by your state or local government. Nine states — Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming — don’t tax wage income, while other states have rates ranging from 2.5 percent to 13.3 percent. This matters if you work in one state and live in another or employ workers across multiple states.

Other pre-tax deductions

These are deductions taken before tax calculations, such as contributions to health savings accounts (HSAs), flexible spending accounts (FSAs) or commuter benefit programs. Pre-tax deductions lower your taxable income.

Post-tax deductions

These are deductions taken after your taxes are calculated, such as Roth retirement contributions, charitable giving programs or certain insurance premiums.

Post-tax reimbursements

These are expense reimbursements added to your paycheck after taxes, such as mileage or travel reimbursements.

Keeping accurate

payroll records, including year-to-date earnings, pre-tax deductions and tax withholdings, can reduce the risk of

payroll discrepancies later on, especially if you need to correct a withholding error or review past pay periods.

Social Security tax

This is the federal payroll tax that funds Social Security. Employees and employers each pay 6.2 percent on wages up to the annual Social Security wage base. According to the most recently published limit (for the 2025 tax year), that cap is $176,100. The Social Security Administration updates this wage base every year, so future limits will increase once new figures are released.

Medicare tax

This federal payroll tax funds Medicare. Employees and employers each pay 1.45 percent on all wages. High earners pay an additional 0.9 percent on wages above $200,000 for single filers or $250,000 for married couples filing jointly.

Federal tax withholding calculations

This is the amount of federal income tax withheld from your paycheck based on your filing status, income, dependents and other adjustments.

What are payroll deductions?

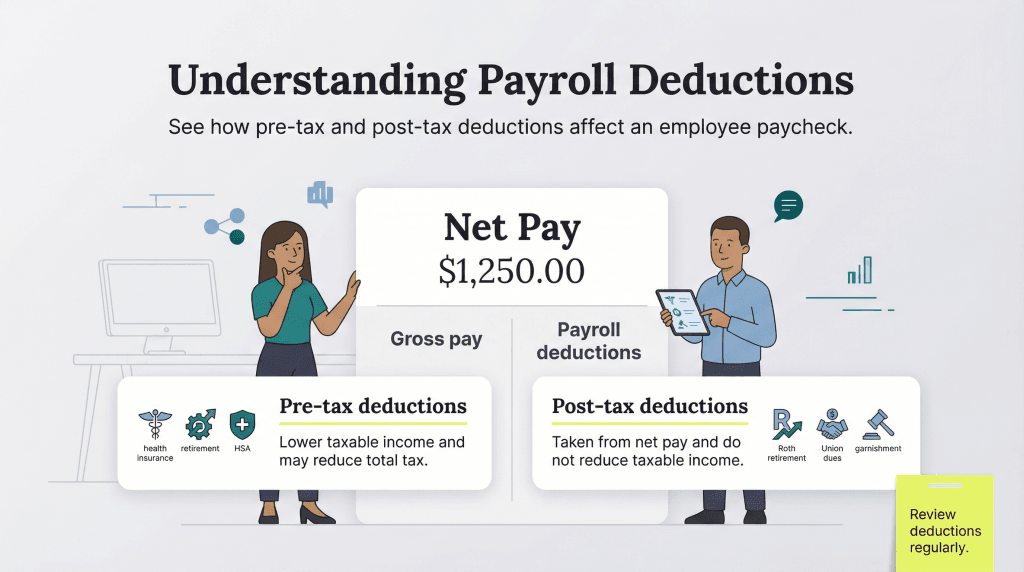

Payroll deductions are the amounts taken out of an employee’s gross pay before they receive their final take-home paycheck. These deductions cover taxes, employee benefits and other required withholdings that help determine an employee’s net pay.

Typical payroll deductions include federal and state income taxes, Social Security and Medicare taxes (FICA), retirement plan contributions, health insurance premiums and other employee-selected benefits. Employers also account for current IRS tax brackets and standard deductions when calculating how much to withhold from each paycheck.

Pre-tax vs. post-tax deductions

- Pre-tax deductions: Pre-tax deductions are taken out of your paycheck before taxes are calculated. Because they aren’t included in taxable wages, pre-tax deductions lower your taxable income and can reduce your overall tax bill. Common pre-tax deductions include health and life insurance premiums, FSAs, HSAs and retirement plan contributions such as a 401(k) plan.

- Post-tax deductions: Post-tax deductions, on the other hand, come out of your paycheck after taxes have been calculated and withheld. Since they reduce net pay rather than gross pay, these deductions don’t lower your taxable income. Examples include Roth retirement contributions, union dues and certain insurance premiums. Some post-tax deductions are optional, while others — such as wage garnishments — are mandatory.

Employers should review their deductions regularly as part of a routine

payroll audit, especially if they operate in multiple states or offer a wide range of employee benefits. This helps catch errors early, ensures compliance and makes it easier to

file payroll taxes accurately each quarter.

What is the difference between gross payroll and net payroll?

Gross payroll is the total amount an employee earns before any deductions are taken out — essentially their full employee compensation for the pay period. Net payroll, often called take-home pay, is the amount the employee actually receives in their paycheck after all taxes, benefits and other withholdings have been subtracted from gross pay.

Calculating gross payroll vs. net payroll

The way you calculate gross payroll depends on whether the employee is salaried or hourly:

- For salaried employees: Gross payroll is the annual salary divided by the number of pay periods in the year. Common schedules include weekly (52 pay periods), biweekly (26), semi-monthly (24) or monthly (12).

- For hourly employees: Gross payroll is the hourly rate multiplied by the number of hours worked in the pay period. Be sure to include overtime when applicable, as the Fair Labor Standards Act (FLSA) generally requires employers to pay time-and-a-half for hours worked beyond 40 in a week.

Once you have the gross payroll amount, you can calculate net payroll by following these steps:

- Subtract pre-tax deductions such as 401(k) contributions, health insurance premiums, FSAs or HSAs.

- Calculate and withhold taxes, including federal income tax, Social Security, Medicare and any state or local taxes.

- Deduct post-tax items such as Roth retirement contributions, union dues or mandatory wage garnishments.

Clear gross-to-net calculations play a major role in accurate

payroll reporting. Even small mistakes can create

payroll liabilities that affect year-end filings, employee tax forms and long-term financial accuracy.

How does payroll software help manage payroll deductions?

Modern payroll software simplifies the complicated process of managing payroll deductions by automating calculations and staying up to date with changing tax rules. These systems automatically apply the correct federal, state and local tax rates, manage retirement plan contributions based on employee elections and calculate benefit deductions accurately each pay period.

Payroll platforms stay current with the most recently published tax tables and IRS updates — including changes to tax brackets, standard deductions and contribution limits — which helps employers remain compliant without having to track each update manually. This automation reduces errors, saves time and produces clear digital pay stubs that show every deduction in detail.

Many of the best online payroll software tools also integrate with time-tracking systems and benefits administration platforms, creating a seamless workflow that minimizes manual data entry and supports accurate, on-time payroll processing.