Business.com aims to help business owners make informed decisions to support and grow their companies. We research and recommend products and services suitable for various business types, investing thousands of hours each year in this process.

As a business, we need to generate revenue to sustain our content. We have financial relationships with some companies we cover, earning commissions when readers purchase from our partners or share information about their needs. These relationships do not dictate our advice and recommendations. Our editorial team independently evaluates and recommends products and services based on their research and expertise. Learn more about our process and partners here.

Financing Your Retail Store

Opening a retail store can require significant funding. Learn about your options.

Table of Contents

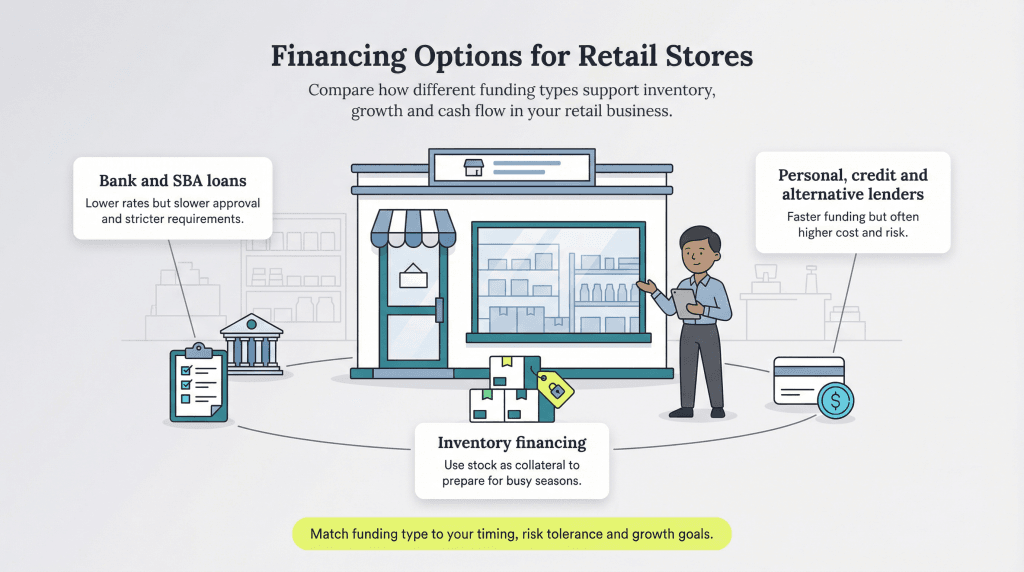

Opening a retail store is an exciting endeavor for many entrepreneurs. Getting your startup off the ground takes time and effort, and one of your top priorities is securing financing. Fortunately, various funding options are available to help you start and run your store, including traditional loans, SBA loans and alternative financing options.

We’ll outline the top financing options for retail stores, including the pros and cons of each, to help entrepreneurs prepare adequately and obtain the necessary funding for a strong start.

Financing options for retail stores

Your best financing options will depend on several factors, including how quickly you need funding, your credit score, how long you’ve been in business, and whether you can offer collateral. Below are several types of financing that can help you launch, stock or grow your retail store.

Retail inventory financing

Retail inventory financing, often referred to as vendor financing, lets you borrow money to stock your shelves, using that inventory as collateral for the loan.

“Retail inventory financing is either a short-term loan or a line of credit with the goal of helping a retail business purchase inventory,” explained Jeffrey Sachs, founder of SBG Funding. “The inventory that is being purchased is typically used as collateral for the loan.”

Sachs noted that businesses often use this type of financing during peak sales periods, such as holidays or the back-to-school season. “Naturally, this can help a business make sure they have enough stock during necessary periods, but if the inventory doesn’t sell, it can be difficult to repay the loan,” Sachs added.

Editor’s note: Looking for a loan for your business? Fill out the below questionnaire to have our vendor partners contact you about your needs.

Inventory loans and inventory lines of credit are both options:

- Inventory loan: This is a traditional term loan in which you receive a lump sum and pay it back with interest over an agreed-upon period. It’s better for a large purchase you make once a year or every few years.

- Inventory line of credit: If you’re not sure how much financing you need, an inventory line of credit may be a good choice. A line of credit allows you to borrow money as needed and repay only what you’ve used. Once you pay back what you owe, you can borrow up to the maximum approved amount again.

Robert Felder, CEO and founder of Bearbottom Clothing, noted that retail inventory financing may come with payment terms related to inventory delivery. “Terms can be net 7, net 30, net 90, etc.,” Felder explained. “That is a great way to finance inventory if you have a good relationship with your supplier, and it eliminates the need for working with a third party to finance inventory.”

Traditional business loans

Applying for a business loan from a bank can be a great option if you have strong credit, solid financials and time to go through the application process. Traditional loans can be harder to qualify for than other types of financing, but they often come with lower interest rates and longer repayment terms, making them a cost-effective choice in the long run.

The best business loan and financing options typically offer competitive rates, predictable monthly payments and clear terms, which can make managing your cash flow easier.

Term loans, in particular, are a smart option when you’re making a big investment.

“Something like a term loan is great if you’re making a large purchase, such as remodeling or buying equipment, whereas a credit line gives you flexibility to, say, cover an unexpected expense,” Sachs said. “If you need specific equipment, often the best option is equipment financing, which can be used to purchase things like a POS system or shelving.”

Traditional business loans are a good fit for retail owners planning major investments, like store renovations or large inventory purchases, and who want to lock in stable terms without relying on short-term or high-interest funding sources.

SBA loans

SBA loans are small business loans partially guaranteed by the U.S. Small Business Administration. That guarantee reduces the risk for lenders, which means borrowers can access better terms — like lower interest rates and longer repayment periods — than they might get with a conventional loan.

For retail entrepreneurs just starting out, SBA loans can be a great option, especially if you don’t yet qualify for a traditional business loan. While the application process is more involved and can take a bit longer, many lenders, such as banks and credit unions, are familiar with SBA lending and can guide you through it.

There are a few different types of SBA loans, but the most common for retail businesses are:

- SBA 7(a) loans: These versatile loans can be used for almost anything, from buying inventory to leasing a storefront or funding working capital.

- SBA CDC/504 loans: These loans are geared toward purchasing real estate or equipment. This money is specifically for property, so you can’t use the funds as working capital or to repay other debts. If you’re looking for a high-dollar loan, you may need to meet specific criteria to qualify. For example, if your business will create jobs, you could receive up to $65,000 per job created, up to $5 million.

- SBA microloans: These loans are ideal if you need $50,000 or less. The average SBA microloan is around $13,000, making it a great fit for home-based businesses or retail startups with minimal overhead. These loans often come from nonprofit lenders, and interest rates typically fall between 8 percent and 13 percent, depending on your credit and the lender.

You’ll need to meet certain qualifications, including a solid credit score and a strong business plan, but if you qualify, an SBA loan can be a low-cost, long-term funding option that supports your retail business from day one.

Personal loans

If you have good credit (a score of 650 or higher), you could qualify for a personal loan to help fund your retail startup. You’re not likely to borrow everything you need this way, since many personal loans are capped at $50,000. While most businesses need at least $30,000 to launch, some ventures, like franchises, may require significantly more. For example, if you want to open a McDonald’s location, you must have at least $500,000 in liquid assets.

Interest rates on personal loans vary widely and typically depend on your credit. The better your credit score, the lower your interest rate, which usually ranges between 5 percent and 20 percent.

However, there’s a caveat: using a personal loan means your business doesn’t build its own credit history, which could make it harder to qualify for larger financing later as your business grows.

Alternative lending

Alternative lending options can often provide faster, more flexible financing, especially for entrepreneurs with lower credit scores or newer retail businesses that haven’t had time to establish a track record. Traditional bank loans may be out of reach for these higher-risk borrowers.

Alternative loans may be a great way to get the money you need to launch your retail store — in some cases, up to $1 million. Another plus: many alternative lenders don’t require collateral. However, most of them lend only to business owners who are already operating and generate a minimum monthly revenue.

An unsecured small business loan from an alternative lender typically comes with short repayment terms, origination fees and high interest rates, though most rates are fixed.

Some types of alternative loans include:

- Invoice factoring: With invoice factoring, you sell your unpaid customer invoices to a lender in exchange for a cash advance.

- Merchant cash advances: With a merchant cash advance, you’ll receive a lump sum in exchange for a percentage of your future credit card sales.

- Online term loans: These are similar to traditional loans, but are offered by online lenders with faster approval and less strict qualifications.

- Business lines of credit: A line of credit is a flexible pool of funds you can draw from as needed and repay over time.

Crowdfunding

Crowdfunding is typically associated with creative entrepreneurial ventures, but it’s not unheard of to crowdfund a retail startup to raise the financing or working capital you need.

It’s crucial to do your research and present potential backers with realistic financial projections. If your numbers seem too high or overly optimistic, investors may be scared off — and that could keep you from reaching your goal. Some crowdfunding platforms even require you to hit your full goal to receive any funds.

Another key to successful crowdfunding is offering enticing rewards. For example, if you’re producing a $100 dress and need capital to get it made and shipped, you could create reward tiers. A $100 backer might receive the dress plus a free skirt or handbag you’ve also designed. Alternatively, you could offer a discount on future purchases or early access to new products.

Home equity loan

Homeowners have an advantage that others don’t: equity. This could be your ticket to borrowing a large sum of money to help launch your retail business. As long as you have at least 20 percent equity in your home and good credit, you may be able to borrow up to 80 percent of your home’s equity.

Interest rates are generally lower with these types of loans — usually between 6 percent and 9 percent — but there’s a major risk: you could lose your home if you default on the loan. It’s a high-stakes option, but it may make sense for some entrepreneurs, especially if you own more than one property or have significant equity built up.

Retirement account rollover

Consider this option only if you have at least $50,000 saved in a retirement account, such as a 401(k) plan or traditional IRA. (Roth IRAs aren’t eligible.) Through a process called a ROBS (Rollover for Business Startups), you can access up to 100 percent of your savings without paying early withdrawal penalties or taxes.

The biggest advantage is that you won’t have to take on debt, pay interest or worry about your credit. You’re using your own money to fund the business, just in a highly structured, tax-deferred way.

That said, this is a complex strategy with high stakes. If your business fails, you could lose your entire retirement nest egg. If things go well, you can eventually rebuild your retirement savings, but it’s important to work with a qualified provider to stay compliant with IRS rules.

Family and friends

You may have family members or friends willing to contribute to your retail venture. However, this strategy requires tact, delicacy and clear communication. The downside, of course, is that if things don’t go as planned and you can’t repay the money, you could permanently damage important relationships.

It’s best to create a legally binding agreement in these situations. Your family and friends must understand that they are investors, and if the business fails, their money may be gone for good.

You can also frame the contribution as a loan rather than an investment. A loan offers a more structured approach and helps manage expectations. There are even apps and platforms that let your lender set the interest rate and repayment terms. You make payments through the app, which then deposits the funds directly into their account.

Credit cards

Personal and business credit cards can help you manage expenses, but this approach comes with risks. Rewards credit cards may offer perks like cash back or travel points, which can add value — especially if you’re using the card for planned purchases. But high balances can quickly become hard to manage, and credit card debt can hurt your cash flow if not paid off quickly.

Many cards offer a 0 percent introductory APR for the first few months — sometimes up to a year — which can make short-term borrowing more affordable. However, once that promotional period ends, the interest rate usually jumps to 10 percent to 24 percent, some of the highest rates in the lending world.

The good news is that you only pay interest on what you actually spend, so this strategy could work if you’re confident you can pay your balance in full each month and avoid carrying debt.

Angel investors

This may be one of the most challenging ways to raise money for your business. Angel investors are relatively rare and tend to be highly selective about where they invest. They often focus on tech, science or other high-growth industries, so finding one aligned with a retail venture may take time and research.

An angel investor is usually a successful entrepreneur or executive who wants to help someone like them succeed. In exchange for funding, they may want a stake in your business and some say in how it’s run, so you’ll likely give up a degree of autonomy. This isn’t a loan — it’s more like they’re buying equity in your company and expecting a return on their investment if your business grows and succeeds.

If you’re pursuing this path, research investors within your industry, prepare a strong business plan and be ready to pitch your vision clearly and confidently.

Costs to consider when opening a retail store

Startup costs for a brick-and-mortar store in the U.S. can vary widely depending on factors like location, industry and store size. Sachs noted three core categories of startup expenses: startup costs, operating costs and hidden costs.

Sachs outlined these fixed and variable expenses as follows:

- Startup costs: lease deposits, security deposits, licenses and permits, furniture, initial marketing and advertising, and business insurance

- Operating costs: payroll, overhead costs, lease payments, utilities, ongoing marketing, equipment, inventory, IT, legal and accounting fees, market research, office supplies and regular repairs

- Hidden costs: shrinkage (losses from theft or damage), returns, training and software subscriptions

Felder emphasized the importance of managing fixed expenses — costs that remain whether sales are booming or slow.

“Ensuring you are able to cover fixed costs in good times and bad is essential to running a successful business,” Felder noted. “Cost of goods sold (COGS) is a major driver of cost as well as ensuring your business is profitable, so keeping a laser focus on having your pricing model based on your COGS is critical.”

Michael Chien, CEO and marketing director of 101 Pickleball, advised new retailers to plan conservatively when estimating working capital needs. “Many new retailers underestimate the need for working capital during slow seasons,” Chien said. “So always build a three- to six-month buffer into your financing strategy.”

Weigh your retail financing options

However you choose to fund your retail business, it’s essential to pick the method that works best for your situation. A loan may be a smart move if you have an excellent credit score or equity in your home, but if you’re starting from scratch, you might be better off launching a crowdfunding campaign or looking into alternative financing.

Chien pointed out that combining strategies can be a smart approach. “One of the best ways to finance a retail business is to start lean with a combination of self-funding and small business lines of credit,” Chien advised. “This helps maintain control and avoid early over-leverage.”

If you decide to take out a loan, look for low interest rates and flexible repayment terms. Understand the risks, especially if your business doesn’t succeed. Always have a backup plan in place if you’re putting your home or retirement savings on the line. While business bankruptcy can help resolve debt, it can also take years to rebuild your credit and become eligible for financing again.

Danielle Bauter contributed to this article.