When you enter a business partnership, it’s easy to get swept up in the possibilities of your new venture and not think about what happens if things don’t work out. Even well-run partnerships can reach a natural end if goals shift, interests fade or the business simply stops performing.

That’s why it’s important to have a signed partnership agreement in place and to understand how dissolution works before you ever need it. Knowing the right steps can help you end the partnership cleanly, protect your relationships and avoid potential business lawsuits if one or more partners loses interest, conflicts can’t be resolved or the company needs to close.

- Discuss the terms and issues.

- Draft a dissolution agreement.

- Double-check the terms.

- Check your state's business laws.

- File a statement of dissolution with your state.

- Notify all of your customers, clients and suppliers directly.

- Divide the remaining assets.

The process of dissolving your partnership

Although dissolving your partnership isn’t as simple as ceasing operations and closing up shop, it doesn’t have to be overly complicated, either. Start by reviewing your partnership agreement to see whether it includes a dissolution clause; many agreements outline the procedures you must follow, which makes things much more straightforward and smooth.

If your agreement doesn’t include a predetermined dissolution procedure, follow these general steps to dissolve a partnership:

- Discuss the terms and issues. Sit down with your partners and talk through the terms of the dissolution. If you can’t agree on certain issues, ask an impartial third party or legal support services to mediate.

- Draft a dissolution agreement. Vote on your decisions and draft a dissolution agreement that outlines the agreed-upon termination terms. Document how each partner voted, such as noting whether each partner approved the final distribution of assets or supported closing outstanding accounts.

- Double-check the terms. Before signing, make sure everything you’ve agreed to under the partnership has been completed and no obligations remain outstanding, such as final payroll, outstanding invoices or any deliverables you promised clients.

- Handle any remaining administrative tasks. You’ll need to deal with any lingering admin issues, such as the following:

- Terminate permits, business licenses and other registrations.

- Notify creditors and all applicable tax agencies about your dissolution.

- File your final tax return, and cancel your tax accounts and Employer Identification Number (EIN) with the IRS.

- Review contracts, leases and vendor agreements. Some may end automatically, while others may continue and require action.

- Close your business bank accounts.

- Take steps to limit any future liability your partners could bind you to.

- Check your state’s business laws. Your state’s laws govern the dissolution process. Your secretary of state’s website should outline any required forms, termination fees and timelines.

- File a statement of dissolution with your state. Once you and your partners agree on the terms of dissolving your company and all wind-down tasks are complete, you must file a statement of dissolution with your state. This is a formal government filing — not a private contract — and it notifies the public and state agencies that your partnership or LLC is ending. Requirements vary by state, and in some cases, you may need to clear any outstanding tax obligations before the filing is approved (if you’re behind on your taxes). Once submitted, this process can take up to 90 days, depending on the state. The IRS also provides a checklist of final steps for closing a business, which is a helpful tool to make sure no federal requirements are overlooked.

- Notify customers, clients and suppliers. Your state may require a public notice, but you should also contact the people directly involved with your business.

- Divide the remaining assets. After all business debts and obligations have been settled, divide any remaining business assets among the partners.

It’s important to note that when a partnership ends, the individuals involved may no longer be partners in a legal sense, but the partnership continues until all debts are settled, the business is legally terminated, and the remaining assets are distributed.

Consult an experienced

business lawyer to understand state-specific rules and other legal obligations that may apply to your dissolution.

Types of dissolution agreements

There are a few types of agreements that govern how your business partnership or LLC can be dissolved without creating additional acrimony among the partners. Here’s an overview:

Agree to dissolve

If one partner has lost interest but the other hasn’t (or vice versa), the partners can mutually agree to dissolve the business. In some cases, one partner may buy out the other’s ownership share instead of closing the company altogether.

Buy-sell agreements

A buy-sell agreement clearly spells out who can and cannot buy into the business if you or your partners sell your shares, declare personal bankruptcy or experience a major life event such as death, divorce or disability. With this type of agreement in place, the remaining partners are protected against unwanted individuals buying into the business or former spouses claiming an interest in the company.

Partnership dissolution agreement (the standard voluntary option)

If you and your partner mutually decide to end the business, a partnership dissolution agreement can help you agree on the terms of the breakup. This agreement outlines each partner’s responsibilities, sets timelines for winding down the business and clarifies who handles what during the process. Entering into a dissolution agreement does not immediately end the partnership; you still need to settle debts, legally terminate the business and distribute any remaining assets.

There are several types of dissolution agreements that can help you end your business amicably. Review each option and choose the agreement that best fits your partnership's situation.

The effects of ending a partnership

Ending a partnership has several consequences, many of which involve taxes. But the impact isn’t only financial: Dissolving a business can take a toll on you, your partners and the people connected to the company. Here’s what you need to know:

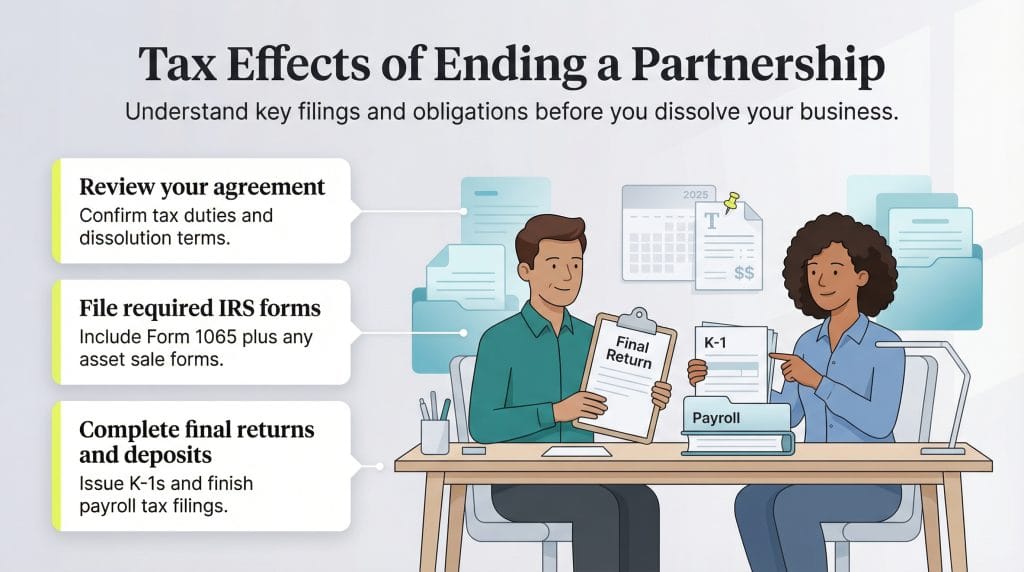

Tax effects of ending a partnership

A partnership isn’t a tax-paying entity. Instead, profits and losses pass directly to the partners, who aren’t considered employees of the business. Because of that structure, dissolving a partnership comes with multiple tax implications. Here are a few of the key considerations:

- Legal obligations in your agreement: Start by reviewing your partnership agreement to identify any tax-related provisions or dissolution requirements. Many agreements include guidance on allocating final profits and losses, handling outstanding liabilities or managing buyouts. A tax consultant can help you interpret and follow these provisions correctly.

- Tax forms for your partnership: When you dissolve a partnership, you’ll need to file a final Form 1065 for the year in which the dissolution occurs. Depending on how the dissolution occurs, you may also need to file:

- Form 4797, for reporting the sale or exchange of business property

- Form 8594, if the business is sold and the partners must allocate the purchase price among the assets

- Final tax filings for partners and any employees: Dissolving the partnership triggers several final filings, including your last partnership tax return and Schedule K-1 forms showing each partner’s share of income, deductions and credits. If your partnership had employees, you must also complete your final federal employment tax deposits and filings. Failure to remit withheld payroll taxes, such as Social Security and Medicare, can lead to serious penalties, including the trust fund recovery penalty.

Strategic tax planning throughout the year can help minimize liabilities, keep you compliant with changing tax laws and prevent costly mistakes when it's time to dissolve your business.

Additional effects of ending a partnership

Ending a business partnership isn’t just a legal or financial process; it can affect your relationships, your team and the overall stability of your business. Here are a few areas to keep in mind as you navigate the transition.

Partner relationships

Ending a partnership can be tough on your relationship with your soon-to-be former partner, especially if you’ve built a friendship along the way. Even when everyone agrees it’s time to move on, it can feel personal.

To navigate the process as smoothly and painlessly as possible, start by reviewing your partnership or operating agreement so you both understand the exit plan, asset division and remaining obligations. From there, keep the lines of communication open and focus on clear expectations, which can help prevent misunderstandings and keep the relationship intact as you wind things down.

Business structure

Depending on how the partnership ends, your business structure may need to change. If you’re closing the business entirely, you’ll need to follow your state’s rules for winding down a partnership or LLC. But if one partner is leaving and the remaining partner plans to continue operating, the business may need to shift to a different structure — for example, converting to a sole proprietorship or single-member LLC.

Either scenario comes with administrative work, such as updating registrations, adjusting your legal classification or taking on new compliance steps, all of which can add cost and complexity. These changes may also affect your employees, from shifting responsibilities to new reporting lines. Keep your team informed and give them space to ask questions as things evolve.

Brand reputation

Customers and clients tend to notice when a business’s leadership changes, and it’s natural for them to have questions about what the transition means for them. The simplest way to keep their trust is to be upfront about the changes and give them a clear sense of what to expect. When people understand what’s happening and why, they’re much more likely to stay confident in your business. And if disagreements arise, choosing mediation over litigation can help protect your brand reputation and avoid unnecessary conflict.

You don't always have to dissolve a partnership when it's time to move on. In some cases, the partners may be able to sell the entire business instead.

Selling the business can preserve the company's operations, protect your employees' jobs and allow both partners to exit cleanly.

Can a dissolved partnership be sued?

Yes. Even after a partnership dissolves, you and your partner(s) can still be sued under certain circumstances.

If your general partnership entered into contracts with customers, vendors or other businesses, you and your partners may remain personally liable for those obligations. Unless the contract specifically releases you from liability if the partnership ends, the partnership — or each individual partner — can be sued for breach even after dissolution.

This is because dissolution doesn’t erase past obligations. The partnership continues for the limited purpose of winding up its affairs, and claims related to actions taken before dissolution can still be brought against the former partners.

Julianna Lopez contributed to this article.