Business.com aims to help business owners make informed decisions to support and grow their companies. We research and recommend products and services suitable for various business types, investing thousands of hours each year in this process.

As a business, we need to generate revenue to sustain our content. We have financial relationships with some companies we cover, earning commissions when readers purchase from our partners or share information about their needs. These relationships do not dictate our advice and recommendations. Our editorial team independently evaluates and recommends products and services based on their research and expertise. Learn more about our process and partners here.

Fundbox is a technology-enabled lender that specializes in business lines of credit. The company offers lines of credit for up to $150,000, repayment terms of three to six months, and next-day funding. We were impressed that Fundbox also includes several cutting-edge technological innovations in its services that help business owners repay their loans while maximizing their cash flow. For these reasons, Fundbox is the best lender for those looking for a lending platform with useful technology features.

8.7 / 10

Fundbox is one of the more technologically advanced lenders we discovered in our investigation of leading financiers for small businesses. Its flagship business line of credit is similar to competing services from the best business loan and financing providers, but the company really stands out with its specialized tech features. We love how Fundbox’s digital platform allows borrowers to integrate the service with their accounting software and retain flexibility around how they repay their loans. Fundbox is also one of the few lenders we came across with a dedicated mobile app. If you’re looking for a modern-day lending platform with digital tools, Fundbox is the answer.

According to Allied Market Research, the global small business lending market is expected to grow at a compound annual growth rate (CAGR) of 13 percent until 2032, reaching a $7.2 trillion market size. This growth is driven primarily by digital lending solutions offered by non-bank lenders like Fundbox. Data from Precedence Research highlights the rise of digital lending platforms in particular, which indicates the increasing value consumers are finding in such products compared to traditional lending operations.

Fundbox primarily offers business lines of credit and emphasizes its technology platform. The company is also piloting short-term loans for select customers. Below are the financing options and features that caught our attention when evaluating Fundbox.

A line of credit allows you to draw on funding when you need it and only pay interest on the amount you’ve borrowed. This credit facility is often used to finance immediate short-term obligations and expenses like payroll, inventory and maintenance.

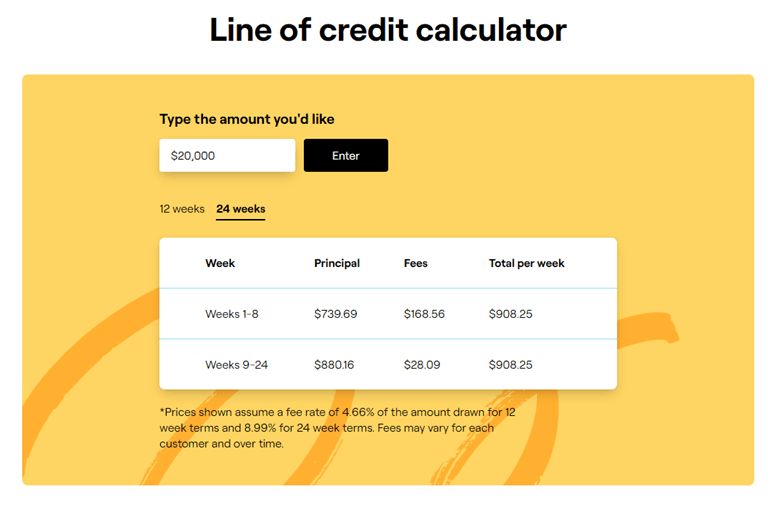

Fundbox’s line of credit is available for up to $150,000 for 12 to 24 weeks. The starting interest rate of 4.66% on the 12-week product is very competitive with similar offerings we reviewed. To qualify, you need at least $100,000 in annual sales, three months in business, a credit score of 600 and at least three months of transaction history in a business checking account. Fundbox says these are “ideal” requirements and may show some flexibility if you’re strong in other areas.

Fundbox’s new small business term loans are designed to be repaid over 6 to 12 months. Currently, the company is still testing this product, and no application is available. Borrowers who apply for Fundbox’s line of credit will be automatically notified if they qualify for the term loan and will be given a choice between the two products. Our comparison of term loans and lines of credit can help you determine which financing option is right for your business before you make any decisions.

Fundbox maintains one of the most technologically advanced platforms among the alternative lenders we evaluated, with several unique features available online for its line of credit customers. We particularly liked the cash flow insights tool, which helps ensure you can make your payments. Fundbox also offers a paid subscription product called Fundbox Plus that allows borrowers to extend their repayment terms, obtain discounts on new draws and more.

Fundbox’s technological appeal extends to its mobile app — a rarity in this sector — and its other digital tools. During our testing, we found Fundbox’s line of credit calculator (pictured earlier in this review) useful for determining costs based on different loan amounts and repayment terms. The 2024 Small Business Credit Survey from the Federal Reserve found that the “most common reasons for seeking financing were meeting operating expenses (56%) and pursuing an expansion or new opportunity (46%).” With the help of Fundbox’s calculator, you can better determine how much funding you need and can afford for those use cases.

Fundbox’s Flex Pay is a free service for its line of credit borrowers. It acts as a middleman between your business bank account and vendors or suppliers. For example, rather than directly debiting your business bank account for payroll, Fundbox temporarily covers the tab until you repay them, ensuring you always have the funds to make payroll. Similarly, you can use Flex Pay to cover other expenses like inventory. We believe business owners will find this extra financial assistance valuable during slow seasons.

Fundbox integrates with several top accounting software solutions, including QuickBooks, FreshBooks and Zoho. This integration is designed to automatically record your Fundbox transactions using the double-entry bookkeeping system, ensuring your accounts always stay balanced and eliminating the need to manually enter this data. This is another example of how Fundbox uses technology to aid its customers.

For business lines of credit, Fundbox requires applicants to meet a certain threshold for annual sales, time in business and personal credit score. As mentioned above, the minimums are $100,000 in annual revenue, three months in business with a business checking account, and a 600 credit score, though the lender recommends six months in business for better approval odds.

Fundbox operates under current federal lending regulations, including compliance with the Consumer Financial Protection Bureau’s (CFPB) regulatory framework. The CFPB has established new small business lending data collection requirements under Section 1071 of the Dodd-Frank Act, with compliance dates extending through 2026 for different tiers of lenders. These regulations aim to increase transparency in small business lending and promote fair lending practices.

Collateral

Fundbox offers unsecured loans, so you aren’t required to put up collateral. However, in some cases, the company may ask you to sign a personal guarantee to take out one of their loans, and they also reserve the right to require a personal guarantee in the future. This is on par with competing lenders.

Special Documentation

Fundbox doesn’t require any special documentation, and applicants can be approved as soon as the same day they apply. However, as previously mentioned, you need a business checking account to be considered. For another lender that doesn’t have special documentation requirements, see our review of Balboa Capital, a loan company we found especially noteworthy for its ease of approval.

Fundbox makes applying for a loan simple if you meet the minimum qualifications. You can fill out a form online via Fundbox’s website or mobile app, and you can rest easy knowing that applying will not impact your credit score. As previously mentioned, the company requires little documentation, save for business bank account information, further speeding the application process along. We love that applicants can receive a same-day decision, even within minutes. If approved, funds can arrive in your business checking account as soon as the next business day.

This rapid approval and funding process is particularly valuable in today’s lending environment. According to the Federal Reserve Bank of Kansas City, more than 30 percent of survey respondents “reported a change in small business loan demand in fourth quarter 2024,” with about 4 percent indicating stronger loan demand — marking the first net increase since 2022.

Fundbox has a robust customer support operation. We appreciate that its representatives can be reached by phone Monday through Friday, from 8 a.m. to 8 p.m. ET, which is a much longer window than other alternative lenders we looked at. You can also reach out for assistance via an online form or email.

Additionally, the company’s online help center contains an extensive FAQ section and a host of articles and blog posts to guide you through the process of obtaining funding and using its services. We also found that many Fundbox customers praised the company’s customer service on independent user review sites like Trustpilot.

Fundbox has an A+ rating with the Better Business Bureau (BBB) and has been BBB-accredited for years. This accreditation demonstrates the company’s commitment to maintaining quality business practices and high customer service standards. The company also maintains strong customer satisfaction ratings across independent review platforms.

The most obvious drawback of Fundbox is that it focuses mainly on one funding solution instead of a variety of loan types. While Fundbox has nearly perfected its line of credit offering and technology platform, business owners will need to look elsewhere if they’re seeking long-term loans, equipment financing and other common forms of small business funding. For a more comprehensive selection of financial solutions to choose from, read our SBG Funding review.

Prospective borrowers should also be aware that Fundbox’s line of credit is limited in size and repayment terms. Business owners seeking larger lines of credit or longer terms should look at our review of Rapid Finance.

Lastly, Fundbox’s minimum requirements for applicants have become stricter in recent years, which may prevent startups and small business owners with lower credit scores from being approved. This reflects broader industry trends, as credit standards have tightened for 13 consecutive quarters, according to the Federal Reserve Bank of Kansas City’s small business lending survey. Nearly 90 percent of respondents cited a less favorable economic outlook as a reason for tightening standards. If you’re concerned about approval, check out our free guide to the best business loans for businesses with bad credit.

In determining the best business financing options for small business owners, we analyzed each loan provider’s:

Our evaluation considered current regulatory compliance standards, including adherence to CFPB guidelines and fair lending practices. We also examined third-party validation sources, including BBB ratings and customer review platforms, to comprehensively assess each lender’s reliability and trustworthiness.

To identify the top provider for business owners specifically interested in a financing solution with technology features, we sought lenders with modern platforms and unique tools that enhance the financing experience for the duration of the term.

We recommend Fundbox for …

We don’t recommend Fundbox for …