Business.com aims to help business owners make informed decisions to support and grow their companies. We research and recommend products and services suitable for various business types, investing thousands of hours each year in this process.

As a business, we need to generate revenue to sustain our content. We have financial relationships with some companies we cover, earning commissions when readers purchase from our partners or share information about their needs. These relationships do not dictate our advice and recommendations. Our editorial team independently evaluates and recommends products and services based on their research and expertise. Learn more about our process and partners here.

National Processing Review

Table of Contents

- National Processing features low interchange-plus pricing for high-volume businesses.

- The company locks in your rate and guarantees it for the duration of your term.

- The vendor is willing to work with a variety of businesses.

- National Processing's PCI noncompliance fees can be higher than with other competitors.

- The company doesn’t provide new businesses with free processing equipment.

National Processing is one of the best credit card processing companies because of its low transaction fees and rate-lock guarantee. There’s no monthly minimum processing requirement, which makes it a great pick for businesses on a budget. We also like that National Processing works with virtually every type of company, including new and high-risk businesses, which sets them apart from many rivals.

National ProcessingEditor's Rating:

8.8 / 10

- Pricing and fees

- 9.6/10

- Customer service

- 9.6/10

- Third-party integrations

- 8.5/10

- Payment options

- 8.5/10

- Added POS tools

- 7.7/10

Why We Chose National Processing for Low Transaction Rates

We were impressed with National Processing’s affordable credit card processing service thanks to:

- Transparent, low-cost transaction rates.

- A locked-in low-rate guarantee.

- A promise to match or beat competitor rates.

- Interchange-plus pricing, which can reduce monthly processing fees.

- Reasonable monthly fees that are lower than several rivals.

We like that merchants are not locked into a high monthly fee and can still benefit from the low processing rates, even when volume is slow. This keeps credit card processing affordable for all types of businesses. In comparison, other credit card processing vendors are better suited to specific types of companies or sales volumes. As an example, see our review of Payment Depot, which is one of the best processors for high-volume transactions but takes a cut of your revenue.

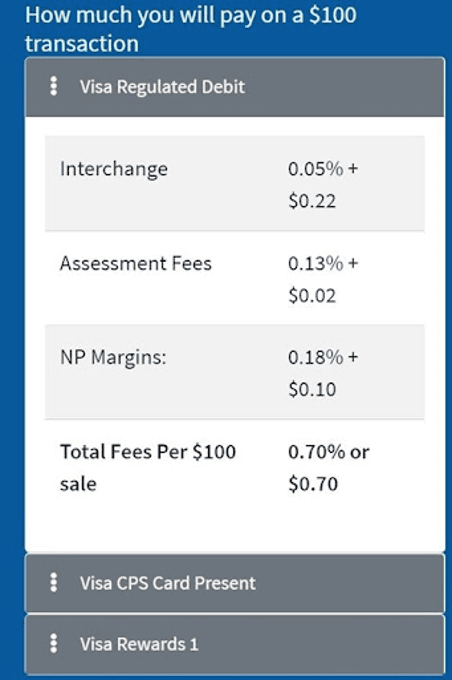

Thanks to National Processing’s transparent pricing, you know exactly how much a purchase will cost you to process. Source: National Processing

Ease of Use

National Processing makes it easy to accept credit card payments in store, online and over the phone. We appreciate that their own proprietary gateway is user-friendly and easy to navigate. It integrates with the company’s in-house POS system or a third-party terminal to accept payments, collect customer information and easily access sales data.

You also have free access to the vendor’s SwipeSimple virtual terminal. The easy-to-use platform lets you monitor inventory, save customer information and track purchase history. Rival Helcim also boasts a virtual terminal. See our full Helcim review to find out why it’s a great solution if you’re looking for an all-in-one POS and credit card processing system.

National Processing’s gateway connects to online shopping carts and can be used to manually run transactions. Source: National Processing

National Processing Features

National Processing offers a bevy of useful features and services that make it appealing beyond its low transaction rates and transparent pricing. Here is an overview of the company’s best tools.

Virtual Terminal

National Processing’s virtual terminal, SwipeSimple, allows you to accept credit card payments over the phone and take payments online by directing customers to enter their credit card information on a secure website.

Mobile Processing

National Processing partners with the SwipeSimple app to let you accept mobile payments on your phone. You can easily process payments with the mobile app and a credit card reader, like the Clover Go.

>> Learn about the Clover Go in our detailed review of Clover.

ACH Processing

You can provide direct deposits to employees, accept rent and other business payments, and create recurring transactions with National Processing’s ACH payment processing solutions. This is a unique service that other processors we reviewed don’t offer.

QuickBooks Integration

National Processing provides access to invoice and billing software that integrates with QuickBooks accounting software. This gives you deeper insight into your business’s operations and helps you manage your company’s finances.

>> Learn about the world’s leading accounting software provider in our comprehensive review of QuickBooks Online.

Merchant Account

National Processing provides merchant account services. Its invoicing and billing software lets you easily send recurring invoices and accept and make payments online. We like this added functionality, as it helps streamline the invoice process for business owners. There are also tools to reduce fraud and avoid chargebacks.

Hardware

National Processing offers several third-party POS devices, including Pax, Clover and SwipeSimple card readers. We especially like that National Processing offers the Clover Go, which allows you to accept payments with your mobile phone and see your entire transaction history in the mobile app.

National Processing offers a POS bundle that includes a cash drawer and other equipment. Source: National Processing

National Processing Pricing

We appreciate that National Processing’s website clearly lists its pricing, making it simple for small businesses to know in advance how much they’ll pay for different transactions. The company offers three plans and flat processing fees.

Merchant Service Plans

- Basic In-Person: $14.95 per month

- Basic Online: $14.95 per month

- Premium: $19+ per month (exact price based on features)

Processing Fees

- In-Person: 2.5% + $0.10 (Basic), 2.41% + $0.10 (Premium)

- Online: 2.9% + $0.30

- Manually Entered: 3.5% + $0.15

- Invoices: Custom

National Processing offers a custom solution for businesses processing over $30,000 per month. We also love that:

- There’s a calculator on the National Processing website to help you estimate your costs.

- National Processing guarantees transparent, locked-in rates.

- They promise to beat competitor rates and will give some businesses $500 if they can’t.

- There are no early termination fees, unlike many rivals.

- There are no PCI compliance fees for compliant businesses.

If your business fails to provide proof of compliance, you’ll be charged $99 a month. This is a bit on the high side compared to other credit card processors, some of whom do not charge any PCI-related fees.

National Processing promises no hidden fees in its pricing model. However, your business may be subject to the following:

- $0.05 per transaction for address verification service (AVS), an anti-fraud tool that verifies the customer’s billing address

- $2.50 per identification for voice authorization, an anti-fraud tool that’s triggered when a customer’s bank detects something suspicious about a transaction and wants to verify the customer is the cardholder

- $0.10 batch fee when you close out the day’s transactions

- $7.00 per sales draft retrieval for proof of a transaction

- $15 per chargeback, which is on the lower end compared to competitors

Implementation and Onboarding

National Processing is a full-service credit card processing company that provides a merchant account. When you apply, you’ll need to provide:

- Your employer identification number (EIN).

- Financial statements.

- Your business bank account information.

The approval process should take a couple of days. You can also schedule a same-day call with a sales representative if you want to be walked through any of the service details.

National Processing users will need to set up SwipeSimple to access the virtual terminal and other payment tools. SwipeSimple provides tutorials and walk-throughs for a seamless implementation process. Help is also available through National Processing’s customer support. Because National Processing’s hardware is provided by third parties, users will need to contact the individual vendors for help with the devices.

Customer Service

We were very impressed that National Processing earns stellar marks from customers in user reviews. The vendor’s customer service options include:

- A dedicated account representative you can call or email

- Phone support Monday to Friday from 10:30 a.m. to 7:30 p.m. ET

- 24/7 tech support and live chat

- An informative blog, help articles and an FAQ

Limitations

National Processing offers transparent, low rates, but there are a few drawbacks to consider.

- Rates aren’t published for businesses with a high volume of transactions; certain competitors might be a better choice.

- PCI noncompliance fees can be costly.

- Additional fees aren’t clearly outlined on their website.

Methodology

We researched and analyzed leading credit card processors to find the best services for small businesses. As part of these investigations, we used demos and free trials to get hands-on experience with each product and spoke with company representatives. We evaluated the usability of both hardware and software, considered the fairness of the contract terms, and weighed the credit card processing rates and fees merchants can expect. When determining the best credit card processing solution for businesses specifically seeking low transaction fees, we prioritized rate amounts, whether costs were transparent and if the vendor was willing to price-match competitors.

FAQs

Bottom Line

We recommend National Processing for …

- Merchants prioritizing low transaction rates and price matching.

- High-risk businesses that may have trouble finding a credit card processor willing to work with them.

We don’t recommend National Processing for …

- Business owners who are looking for a solution with free hardware.

- Merchants seeking an integrated POS hardware and credit card processing software solution with more advanced features.