Business.com aims to help business owners make informed decisions to support and grow their companies. We research and recommend products and services suitable for various business types, investing thousands of hours each year in this process.

As a business, we need to generate revenue to sustain our content. We have financial relationships with some companies we cover, earning commissions when readers purchase from our partners or share information about their needs. These relationships do not dictate our advice and recommendations. Our editorial team independently evaluates and recommends products and services based on their research and expertise. Learn more about our process and partners here.

What’s the Difference Between a Grant and a Business Loan?

Learn which funding option is appropriate for your organization and its goals.

Table of Contents

From startup to expansion and everything in between, running a business is expensive. At some point, you’ll likely seek funding from an outside source. Two commonly considered options are business loans and business grants. Both funding sources can provide much-needed capital infusions, but they have critical differences and unique considerations. We’ll explain more about loans and grants for business use and share tips for choosing the right funding sources at the right time.

What is a business loan?

A business loan is a sum of money that a financing institution, such as a bank or credit union, temporarily provides to a small business with the expectation that it will be paid back over time with interest. Loan repayment periods typically range from five to 10 years. A business loan can be used for expenditures such as starting or expanding a company, paying employee wages, funding marketing efforts, purchasing new equipment or vehicles, or paying for office space.

> FREE TOOL: Loan Payment Calculator

Editor’s note: Looking for the right [category name] for your business? Fill out the below questionnaire to have our vendor partners contact you about your needs.

Types of business loans

There are many types of business loans, each with different terms and requirements. The best business loan and financing options for your company will depend on your goals, cash flow and overall financial situation. It’s worth taking the time to research what’s available so you can find the right fit for your needs.

Below is a sampling of typical small business loans.

Types of business loans

There are many types of business loans, each with different terms and requirements. The best business loan and financing options for your company will depend on your goals, cash flow and overall financial situation. It’s worth taking the time to research what’s available so you can find the right fit for your needs.

Below is a sampling of typical small business loans.

- Business line of credit: This financing option is an arrangement between a small business owner and a bank or financial institution in which the borrower has the flexibility to access a specified amount of money at any time. Like business credit cards, a line of credit allows the borrower to make minimum monthly payments and pay interest only on the amount they use.

- Equipment loans: These loans are provided specifically to fund the purchase or lease of business equipment, and they’re typically based on the value of the equipment being acquired. A farm equipment loan, for example, could help the borrower with tractor, trailer or irrigation equipment purchases. Similar loan options are also available for vehicles and real estate.

- Invoice financing and factoring: With invoice financing, a small business owner can borrow money against their outstanding accounts receivable. With invoice factoring, on the other hand, a small business sells its accounts receivable to a lender, who then collects on them.

- Merchant cash advance: A merchant cash advance is a type of funding provided to a small business based on the company’s anticipated credit card receivables for a specified term. The borrower then makes repayments based on a portion of their credit card sales. Merchant advances are a type of business loan for bad credit; they’re typically a good choice only for businesses with a high volume of credit card sales.

- SBA loans: An SBA loan is a highly competitive loan guaranteed by the U.S. Small Business Administration. The loan programs are popular among small business owners because of their low interest rates and long repayment periods, making SBA loans more affordable than other funding sources. SBA loans are available from banks and other lenders, but the application process is more involved because a portion of the loan is guaranteed by the government.

- Secured and unsecured loans: Secured business loans are backed by a business asset, such as a bank account balance, equipment, vehicle or real estate. Unsecured business loans don’t require the borrower to pledge collateral; they’re awarded based on the borrower’s creditworthiness.

- Short-term business loans: A short-term loan is a type of term loan typically repaid in less than a year, with either floating or fixed interest rates. The loans are often available to businesses that don’t qualify for a line of credit.

- Term loans: A term loan is a financing agreement in which a small business borrows a lump sum of money and repays it over a specified period with a fixed interest rate. Common business term loans include bridge term loans, multiyear term loans, SBA term loans, asset-based term loans and equipment term loans.

What is a business grant?

A business grant is a sum of free money awarded to a business by a private organization or a federal, state or local government agency. Unlike loans, grants don’t have to be repaid. Small businesses must meet specific criteria to qualify, however, and the funds must be used for the purposes outlined by the grantor.

“Business grants are not easily obtainable,” said Nick Chandi, co-founder and CEO of Smansha Analytics. “Your business needs to meet certain requirements.”

Chandi explained that grants are given for an authorized and specific purpose, typically to support a public good. “You may have to repay a grant if it’s not used for the purpose it’s awarded for,” Chandi said. “The federal government doesn’t provide grants for paying off debt, covering operational expenses and starting or expanding a business.”

Types of business grants

Top small business grants from government agencies and private organizations are highly competitive and awarded only to businesses that meet specific criteria. Below are some popular options.

Federal business grants

Federally funded grants are awarded to select small businesses that meet the eligibility requirements of each program. Chandi highlighted the following respected federal grant options:

- 3D Elevation grant

- Environmental Protection Agency (EPA) grants

- National Institute of Food and Agriculture (NIFA) grants

- National Institutes of Health (NIH) grants and funding

- National Institute of Standards and Technology (NIST) grants

- National Oceanic and Atmospheric Administration (NOAA) grants

- National Science Foundation (NSF) grants

- Value-Added Producer grants

State business grants

These grants are awarded by state governments, and they’re often slightly less competitive than federal grants. To find a state grant, check the following resources:

- The U.S. Economic Development Administration

- Small Business Development Centers (SBDCs)

- The State Business Incentives Database

Local business grants

Local business grants are still highly competitive, but your business may have a better chance of receiving one if you meet all the eligibility criteria. Chandi shared the following grant programs to consider:

- Ben Franklin Technology Partners

- The Chicago Small Business Improvement Fund

- The Cleveland Department of Economic Development

- The Miami Mom and Pop Small Business Grant

- The New Mexico True CoOp Program

- The New York City Fashion Manufacturing Initiative

- The Orlando Downtown Commercial and Residential Building Improvement Program

- The Delta Grants Program

Corporate business grants

Similar to government funding, corporate business grants from private companies provide aid to small businesses — typically through some form of competition. Some corporate grant options include:

- The FedEx Small Business Grant

- The Intuit National Association for the Self-Employed Grant

- Nav’s Small Business Grant

- Patagonia’s Corporate Grants Program

- The Visa Everywhere Initiative

Research business grants

Small businesses seeking funding for scientific research and development may qualify for grants awarded specifically for that purpose. Many of the opportunities are available through federal programs such as:

Specialty business grants

Government and corporate grants are available for specific populations. There are, for example, grants for women entrepreneurs and grants for minority-owned businesses. If you belong to an underrepresented or niche demographic, you may be eligible for a specialty business grant, such as:

What is the difference between a loan and a grant?

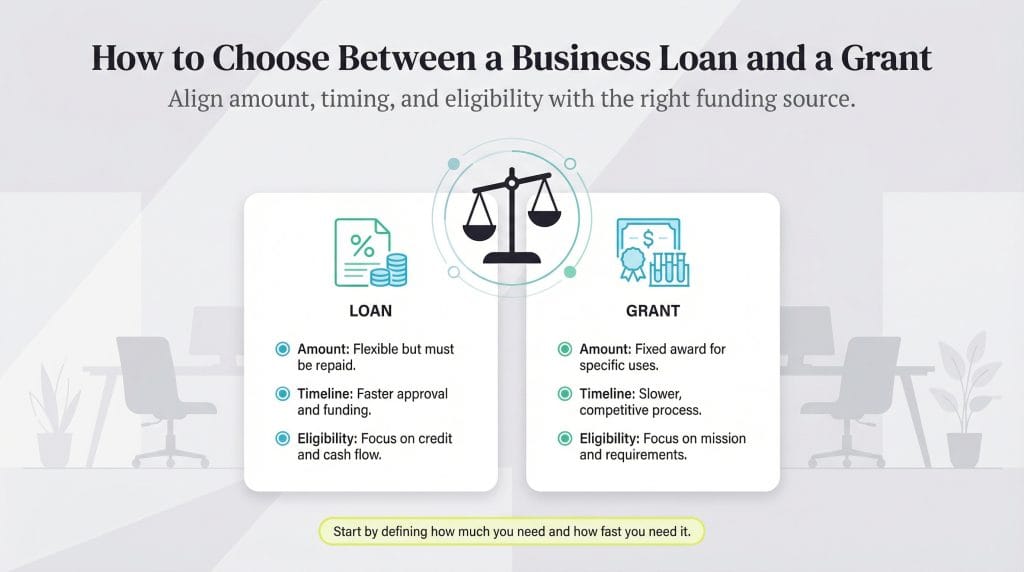

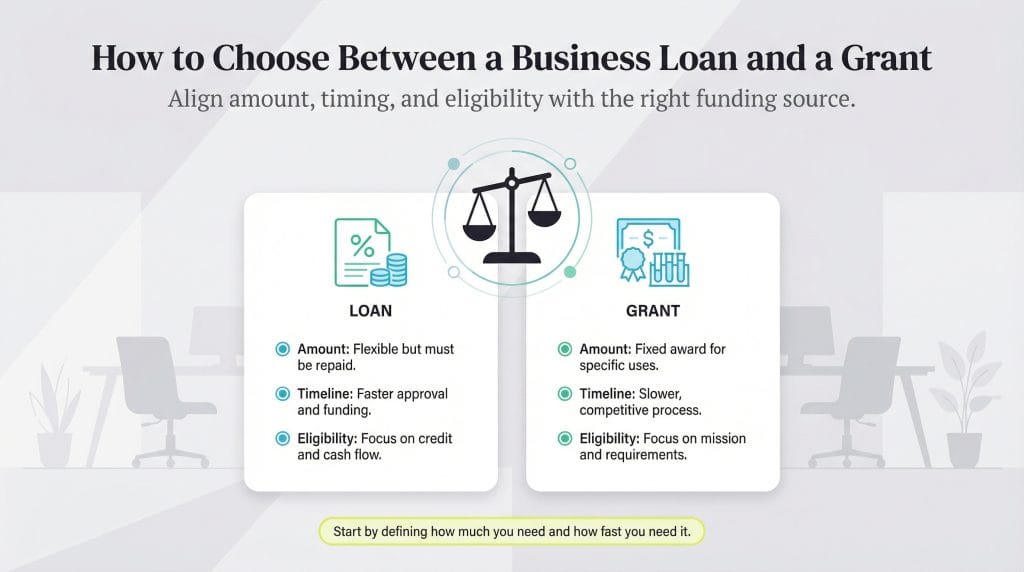

The biggest difference between a loan and a grant is that a loan must be repaid, while a grant does not. If you can’t repay funding, a grant may be the better option. That is the primary distinction, but there are other important differences to keep in mind.

Criteria

The criteria a lender or grantor uses to evaluate your business can vary widely. Some grants are available only to businesses in specific industries or locations, which can be a benefit or a limitation depending on your business. In contrast, lenders are more focused on your financial health and ability to repay the loan.

“Small businesses can qualify for grants based on their demographics or industry,” said Leslie H. Tayne, founder and managing director at Tayne Law Group. “For loans, lenders take your credit score and finances into consideration when making a lending decision. From checking the internet to requesting bank statements and business plans, small businesses may find that applying for a loan requires they provide much more information than a grant.”

Speed

Small businesses should also consider how quickly they need capital. Grants typically take much longer to process than loans. Applying for a business loan can take just a few days. If you need money fast, a loan may be the only practical option.

“Unlike with grants, small businesses can apply for loans and receive funding whenever they need financing,” Tayne said. “If a small business needs immediate funding with no restrictions, seeking out a loan is the better option.”

Source

Loans are offered by financial institutions and private lenders, while grants are provided by various governments and corporations. Depending on your professional connections, it may make sense to seek funding from one source or the other.

How do you choose between a loan and a grant?

You’ll need to set some parameters when deciding whether to pursue a business loan or a grant. Once you’ve clarified your goals and financial needs, you’ll have a better idea which option is best for your business.

1. Establish how much money you need.

Start by identifying what you’re seeking funding for and how much capital you need. Multiple funding options exist, but only a select few will fit your specific goals.

If you need only a small amount of funding, a microloan or short-term loan may be a good option. If you’re looking for a sizable amount to support research and development, a grant could be the better route.

“With grants, you can get a specific amount of money, whereas with loans, you can get as much funding as you need,” Chandi said. “Moreover, there are limited numbers of grants available, whereas you don’t have to compete with anyone to get a loan. Therefore, it’s always important to research and check the benefits and drawbacks associated with grants and loans to see what funding suits your needs the best.”

2. Decide on a funding timeline.

How quickly do you need the money, and how capable are you of repaying it within a specific time frame? Grants typically take longer to receive, so they’re better suited for small businesses that don’t need immediate funding. Loans are generally processed faster — some fast business loans may be funded in as little as a day — but you’ll need to think carefully about how long you’ll have to repay the money in full.

“When securing a business loan, personal credit history and score do matter,” Chandi said. “Also, there are no hard-and-fast rules to secure a business loan. Some lenders might provide you loans when you have more debts but a healthy cash flow too. Alternative lenders, such as online and nonbank lenders, are changing the face of small business lending and providing loans easier and faster than a bank — as little as 48 hours.”

3. Determine your eligibility.

Grants and loans each have specific eligibility requirements. Grants tend to focus on what you’re doing with the money, while lenders are more concerned with how you’ll repay it based on loan repayment terms. Those factors influence what types of funding you may qualify for.

“Make sure to read the fine print on any loans or grants before accepting them,” Tayne said. “Grants can sometimes have restrictions on what the funds can be used for, and loans can come with high interest rates and other fees you may not be aware of until it’s too late. Check your city or state’s local business associations and other resources for help regarding loans and grants.”

Ultimately, how much funding you need, how quickly you need it and whether you can repay it — along with the criteria you meet — should steer you toward the right option.

Julie Thompson contributed to this article. Source interviews were conducted for a previous version of this article.