Business.com aims to help business owners make informed decisions to support and grow their companies. We research and recommend products and services suitable for various business types, investing thousands of hours each year in this process.

As a business, we need to generate revenue to sustain our content. We have financial relationships with some companies we cover, earning commissions when readers purchase from our partners or share information about their needs. These relationships do not dictate our advice and recommendations. Our editorial team independently evaluates and recommends products and services based on their research and expertise. Learn more about our process and partners here.

What Is a High-Risk Business Loan and What Industries Can It Help?

A high-risk business loan is a financing alternative for businesses deemed too risky for conventional loans.

Table of Contents

Startups, companies with poor credit, and businesses in nontraditional industries are often left with few places to turn for financing help. While perhaps not ideal, they may be able to secure a high-risk business loan — potentially incurring higher interest rates, stricter repayment guidelines and short-term agreements. We’ll explain more about high-risk business loans, discuss businesses that may be considered high risk and share expert advice for organizations that find themselves in this precarious position.

Editor’s note: Need a loan for your business? Fill out the below questionnaire to have our vendor partners contact you with free information.

What is a high-risk business loan?

A high-risk business loan is a last-resort financing option for businesses considered too risky by traditional lending standards.

When you apply for a business loan, the lender will analyze your creditworthiness based on the five C’s of credit:

- Character

- Capacity

- Capital

- Collateral

- Conditions

Businesses that fall short in any of these areas are categorized as high risk and will likely find it challenging to obtain a traditional business loan. Instead, they must seek alternative financing.

What constitutes a high-risk business loan?

Neal Salisian, a business attorney and managing partner at Salisian Lee LLP, outlined specific conditions that often constitute a high-risk loan.

“High-risk business loans are ones with high interest rates, large payments or frequent payment requirements,” Salisian explained. “They are short-term, have interest rate hikes at default and are collateralized with important assets or are personally guaranteed.”

In short, high-risk business loans often include one or more of the following factors:

- Short repayment terms

- High interest rates

- Large or frequent payment requirements

- Default interest rate increases

- Personal guarantees

- Use of valuable assets as collateral

Common types of high-risk business loans

Although the conditions for financing a high-risk business are often similar, several types of loans fall under the alternative lending umbrella. Each comes with its own set of advantages, disadvantages and stipulations.

Here are several high-risk business loans you should know about.

Merchant cash advance (MCA)

An MCA is not a traditional loan — it’s a cash advance a lender provides based on your business’s past and current sales. You repay the lender by giving up a percentage of your future revenue, typically from credit card receivables, until the advance and fees are paid in full.

To qualify, a small business owner typically needs a personal credit score of 500 or higher, and the business must have been in operation for at least five months and generate annual revenue of $75,000 or more. However, qualifications vary by lender, so it’s important to verify the minimum requirements with each MCA provider.

Invoice factoring and invoice financing

If your business has outstanding unpaid invoices, you may be able to use them to access working capital. While these two funding options sound similar, there’s a key difference: Invoice factoring involves selling your invoices to a third party while invoice financing uses your invoices as collateral for a loan or line of credit:

- Invoice factoring: With invoice factoring, a factoring company purchases your outstanding customer invoices and advances you a portion of their value upfront. Typically, the company collects payment directly from your customers. Because of this, your clients’ business credit scores are usually examined instead of yours to ensure they have a strong history of paying their bills.

- Invoice financing: With invoice financing, you retain control of your accounts receivable. The lender advances funds based on the value of your outstanding invoices, and you repay the loan after your customers pay you. Since you’re responsible for collections, your own credit profile and business performance may carry more weight during the approval process.

Short-term loan

Short-term loans are the most traditional type of high-risk loan, typically with a maturity of 18 months or less, according to Zachary Weiner, vice president of finance at Paka Apparel.

“The shorter time frame provides money lenders with an assurance of lesser default risk than conventional loans,” Weiner explained.

You may be able to get a short-term loan from a bank, credit union or alternative lender, such as Fora Financial. (Our Fora Financial review explains more about this lender and its specific requirements.) Typically, business owners need a personal credit score between 560 and 600. Your business must be in operation for at least six months and have a minimum of $50,000 in annual sales revenue — although at least $100,000 in revenue is more commonly accepted.

Personal loan

As long as you follow the set terms, a personal loan can be a good option for a startup with no credit history and limited annual revenue. In this case, the business owner — not the business — takes out the loan personally and is responsible for repayment. You’ll need a strong personal credit score to qualify, and you can apply through a bank, credit union or online lender.

Credit card

Applying for a business credit card may be a way to secure financing. However, if you have a lower credit score and limited sales revenue and are approved, you may pay higher interest rates than you would with other lending options. Still, there are instances where using a credit card can be a more affordable option, as some offer cash-back features or an introductory 0 percent annual percentage rate. Remember that credit cards can help cover short-term expenses, but carrying a balance over time can become costly.

Subprime business loans and equipment financing

Subprime loans are generally intended for borrowers with a poor credit score or limited borrowing history. Borrowers who don’t qualify for prime-rate loans will likely need to look elsewhere for financing. Subprime business loans, including equipment financing, can be an option, though the term “subprime” is a bit misleading. These loans often come with higher-than-average interest rates, not lower ones, which is the main risk of taking them out.

Hard money loan

When you take out a hard money loan, the loan amount is based on the value of the collateral you provide, often real estate. Typically, the loan is issued for a percentage of the collateral’s appraised value. As such, the asset’s value matters more to hard money lenders than your credit score or borrowing history. The risk is that if you can’t repay the loan quickly, the high interest rates can make it prohibitively expensive.

Asset-based loan

An asset-based loan is any loan secured by collateral. Hard money loans are a type of asset-based loan, as are most secured loans. This category can include Small Business Administration loans, term loans and lines of credit. Equipment, inventory and invoice financing can also fall under this definition. Whichever asset-based loan you choose, the risk is clear: Failing to repay may result in the seizure of your assets.

Which businesses are considered high risk?

The following types of businesses are typically considered high risk by lenders:

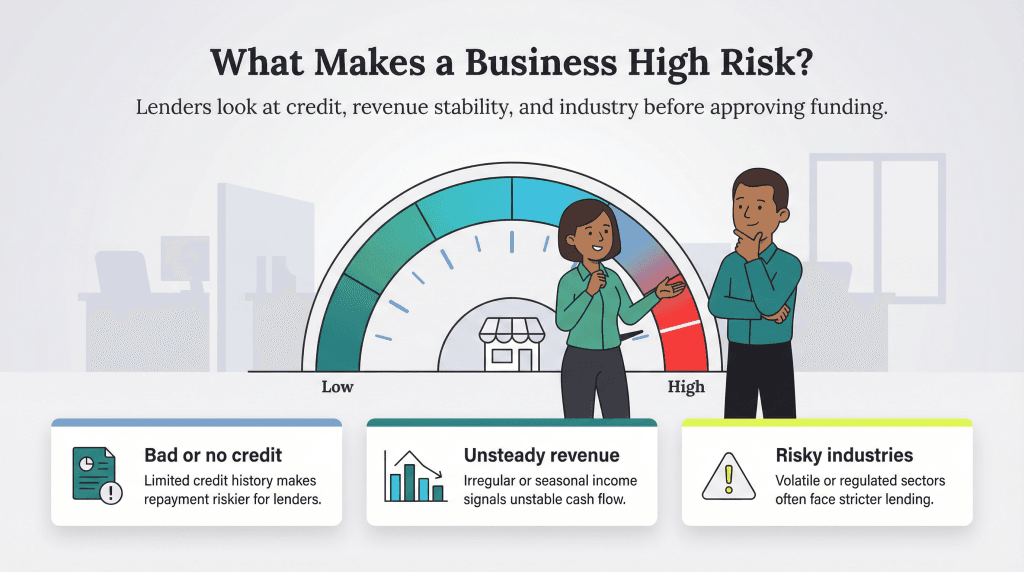

- Businesses with bad credit: Companies with a poor credit history are considered high risk. Both the business’s credit history and the business owner’s personal credit score can impact this analysis. If you have a poor track record for repaying credit, it’s unlikely a traditional lender will invest in you.

- Businesses with no credit: Businesses with no credit history are considered high-risk investments because lenders have no frame of reference to assess the likelihood they’ll be repaid.

- Startups: Typically, startups have very little revenue and unstable business metrics for lenders to evaluate. While being a new business can place you in the high-risk category, there are still ways to secure funding. To prove your value to a lender, present a well-thought-out business plan that demonstrates your projected revenue clearly.

- Businesses with unsteady revenue streams: Revenue stability also impacts how risky your company appears to a lender. Salisian noted that two primary types of businesses often considered high risk are those with cyclical or irregular income streams and those with little to no control over repayment capacity, such as businesses whose funding depends on third parties or external factors.

- Businesses in volatile or risky industries: Your industry can impact how lenders perceive your business’s risk level significantly. While this varies case by case, economic uncertainty and its potential effect on your ability to repay can make traditional lenders wary. Conventional lenders often view “sin” industries, such as adult entertainment, tobacco, marijuana and gambling, as high risk, according to Rob Misheloff, president of Smarter Finance USA.

What constitutes a high-risk commercial lender?

High-risk commercial lenders provide money to businesses that can’t secure funding through traditional lending options. By assuming greater risk, they expect a higher return.

Here are some of the key characteristics that define a high-risk commercial lender:

- They serve nonprime borrowers: “High-risk commercial lenders specialize in ‘nonprime’ transactions,” Misheloff explained. “They are typically smaller private institutions.” These lenders often work with businesses that don’t meet traditional lending criteria due to poor credit, limited operating history or industry volatility.

- They impose aggressive repayment terms: High-risk lenders often require hefty or frequent payments and charge high interest rates, placing a heavy burden on borrowers, especially those with limited cash flow.

- They rely on collateral to minimize risk: Many high-risk lenders secure their loans with business assets, such as property, equipment or inventory, to protect against default.

- They use a borrowing base for risk management: According to Jared Weitz, CEO and founder of United Capital Source, some high-risk lenders manage risk by tying credit lines directly to asset levels. “One way that lenders work with conditions like this is through establishing a borrowing base, where the line of credit is provided based on the level of accounts receivable and inventory,” Weitz said.

- They build loss reserves: Weitz also noted that high-risk lenders must build reserves to protect themselves against unexpected losses. Some businesses may be too risky even for nonprime lenders and having a financial cushion helps mitigate that exposure.

What are the benefits of high-risk loans?

While potentially risky, as the name implies, high-risk loans bring benefits to both borrowers and lenders.

Borrower benefits

While they come with potential downsides, high-risk loans can offer important advantages — especially for businesses that can’t secure capital through traditional means.

Here are key benefits for borrowers, along with some expert insights:

- Access to capital when no other options are available: Acquiring a high-risk loan may be the only option left for some entrepreneurs and business owners. These loans provide access to working capital that might otherwise be out of reach.

- Opportunity to act quickly and capitalize on growth: “When a business can make enough profit to justify the high cost of funds and cannot access capital any other way, high-risk loans make good business sense,” Misheloff said. “Without access to those funds, the business may lose an opportunity.”

- Potential for strong return on investment (ROI) with strategic use: “Be smart to optimize the usage of this financing and build a solid return on investment that will offset any higher interest rates or fees based upon your risk assessment standing,” Weitz said.

- A tool to stabilize a struggling business — if used wisely: “High-risk loans can be a good tool to get a business back from the brink if used properly,” Salisian explained. “But they shouldn’t be considered a long-term financing solution because of the risk and because of what they can signal to the industry — consumers, investors and potential partners — about your business’s health.”

Lender benefits

Lending to high-risk borrowers may seem too risky to be worth the reward. However, when done strategically, high-risk lending can be profitable for lenders.

Potential benefits for lenders include the following:

- Higher ROIs: High-risk lenders typically charge higher interest rates and require large or frequent payments. When borrowers repay as agreed, these lenders can often earn significantly more than traditional lenders.

- Selective borrower vetting: Even though they lend to higher-risk applicants, these lenders don’t approve everyone. They evaluate each borrower to determine who has the strongest likelihood of repayment.

- Loss mitigation strategies: High-risk lenders protect themselves through built-in safeguards, such as strict repayment terms, collateral requirements and internal guidelines for writing off or remitting losses when necessary.

What are alternatives to high-risk business loans?

Because of their cost and risk, the experts we interviewed recommend using high-risk loans only as a last resort. Fortunately, there are several alternative funding options, depending on why you’ve been categorized as high risk.

“Alternatives for high-risk loans include peer-to-peer [P2P] lending, angel investors, external lenders and getting a co-signer for the loan,” Weitz said. “All [are] enticing options that should be vetted during the financing process.”

Here’s a closer look at why these alternatives can be a better choice:

- Angel investors: Angel investors fund your business in exchange for equity, not repayment. If your business fails, you typically don’t owe them money — a rare level of flexibility in small business funding.

- P2P lending: P2P loans are often more affordable than traditional lending options and they come from individuals, not institutions. Individuals are typically more sympathetic than banks, private lenders and the government if you encounter repayment issues.

- Co-signers: A trusted co-signer with strong credit can help you qualify for better financing terms.

Misheloff added that small business owners can investigate other alternatives, such as supplier (trade) financing, borrowing from friends and family and seeking a personal loan. He said that personal loans are often cheaper than business loans.

How you finance your business is a critical decision that can shape your long-term success. Analyze every option carefully and, once you secure funding, manage your cash flow wisely to reduce future borrowing needs.

Simone Johnson and Sean Peek contributed to this article. Source interviews were conducted for a previous version of this article.