Table of Contents

Running a small business often means wearing far too many hats. Between payroll taxes, benefits administration and ever-changing HR compliance rules, responsibilities can quickly pull owners away from the work that actually grows the business. To lighten that load, many companies turn to co-employment, outsourcing certain HR functions so they can focus more on strategy and day-to-day operations.

Still, sharing employer responsibilities with another company can give some leaders pause. Questions about control, liability and risk are natural, especially when employees are involved. The good news is that co-employment isn’t inherently riskier than hiring traditional full-time staff. Like any employment arrangement, it works best when you understand the legal framework, set clear expectations and actively manage the relationship.

What is co-employment?

Co-employment is a working arrangement in which your business shares certain employer responsibilities with another organization, such as a professional employer organization (PEO) or a staffing agency. In these relationships, both parties take on specific legal and administrative duties related to employees.

How that responsibility is divided depends on the type of co-employer you work with and the services you’re using. Different co-employment models are governed by different rules, so the structure — and the level of risk involved — can vary. Choosing the right partner ultimately comes down to what support you need and how much control you want to retain.

Staffing agencies

Staffing agencies remain an option for businesses that need flexibility in their workforce. Companies often rely on these co-employment partners to bring on temporary or contract talent for seasonal demand, short-term projects or employee leaves of absence.

According to the American Staffing Association, U.S. staffing companies hire roughly 12 to 13 million temporary and contract workers in a typical year. Temporary employees work across nearly every industry, though the distribution has shifted somewhat in recent years. The largest share of staffing placements is in industrial roles (36 percent), followed by office-clerical and administrative positions (24 percent) and professional and managerial roles (21 percent). Engineering, IT and scientific roles account for about 11 percent, while healthcare makes up roughly 8 percent of staffing employment.

PEOs

Small and midsize businesses without an internal HR department can benefit significantly from entering a co-employment relationship with a PEO. According to the National Association of Professional Employer Organizations, there are more than 500 PEOs operating in the United States, supporting approximately 4.5 million worksite employees and generating $414 billion in gross revenues. NAPEO data also shows that about 14 percent of employers with 20 to 499 employees now partner with a PEO.

By working with a PEO, businesses can outsource a wide range of HR responsibilities, including:

- Employee recruitment

- Administrative HR services

- Benefits administration

- Payroll processing

- Risk and compliance management

- Employee training and professional development

Mark Berry, a senior human resource specialist with Insperity, emphasized the distinction between what a PEO does — and does not — provide.

“When you enter a co-employment relationship with a PEO, the PEO becomes the professional employer of your workforce by providing HR services and employee benefits,” Berry explained. “It does not, however, supply the staff. The operating employer maintains control over business decisions, including day-to-day management, hiring and termination.”

Berry also noted that PEO arrangements vary, and the level of outsourcing depends on the specific services outlined in your agreement.

What are the benefits and risks of co-employment?

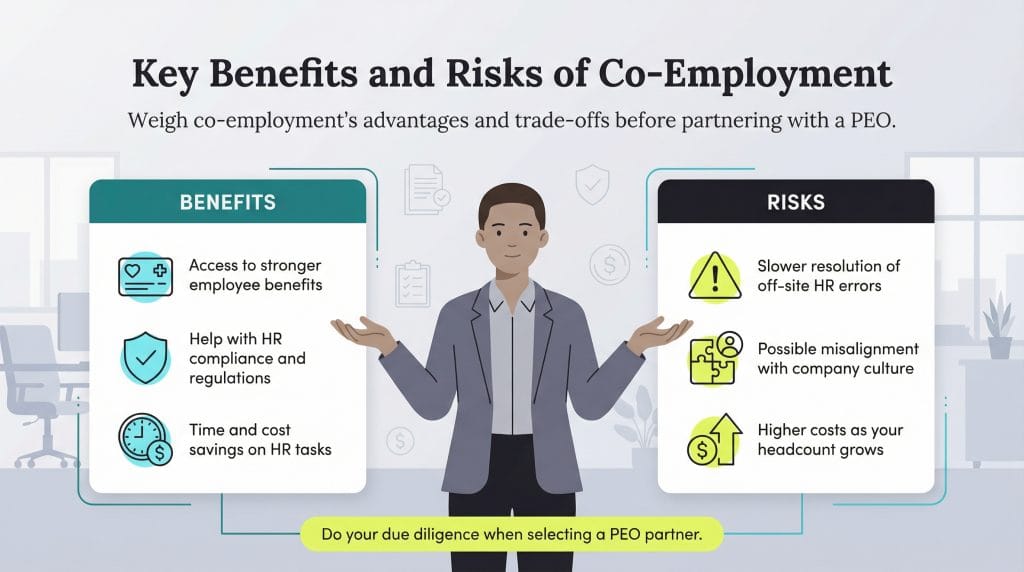

Successful business owners weigh every partnership carefully, and co-employment is no exception. While the model can offer meaningful operational advantages, it also comes with limitations that require careful consideration. Understanding both sides is key to deciding whether co-employment supports your growth strategy.

Here’s a look at the pros and cons of co-employment.

Benefits of co-employment

The benefits of co-employment vary based on the type of partner you choose and the services included in your agreement. Still, many businesses experience the following advantages.

Access to enterprise-class benefits

Co-employers can offer access to competitive employee benefits at more affordable rates. This allows smaller businesses, which may not otherwise be able to offer robust benefits, to compete with larger employers when attracting and retaining talent.

“PEOs can be well-positioned to negotiate favorable insurance rates and benefits,” noted Glynn Frechette, head of Paychex PEO. “This can help small businesses save on costs and compete more effectively for great talent.”

Assistance with HR compliance

Navigating labor laws remains a top challenge for business owners, particularly as remote work plans expand and state regulations change regularly. PEOs can help companies stay current with compliance requirements and reduce the likelihood of costly errors. According to NAPEO, businesses that use a PEO are 50 percent less likely to go out of business than those that do not, in part due to stronger regulatory support.

“A co-employment relationship helps mitigate risks and responsibilities associated with having employees, such as correctly reporting, collecting and depositing taxes, I-9 requirements, EEO reporting and claim resolution and management of certain employee-related claims,” Berry explained. “There are myriad other benefits that fall under reduced risk, such as informing employers of regulatory changes, providing guidance on keeping employees safe and helping employers communicate clearly with employees.”

HR support and expertise

Along with compliance assistance, co-employers can help businesses with general HR support and expertise. They can cover administrative tasks such as recruitment, job descriptions, employee handbooks, payroll and performance management. This delegation reduces administrative error rates and ensures processes are handled by certified professionals.

“Instead of spending time handling administrative tasks, business owners can focus on more strategic business functions that offer greater potential rates of return,” said Frechette.

Time and cost savings

The administrative burden on small businesses is measurable, and outsourcing HR functions can help reduce it. According to NAPEO research, the return on investment from using a PEO averages about 27 percent per year, reflecting savings from streamlined HR processes, reduced compliance risk and lower benefit and administrative costs. For many businesses, a co-employer can be an effective way to control expenses while operating more efficiently.

“PEOs can help organizations save time and money through recruiting support, performance management support and strategic HR planning, which helps map out the growth of an organization,” said Berry.

Risks of co-employment

Like any business arrangement, co-employment comes with potential risks, particularly when outsourcing HR responsibilities. Frechette advises employers to weigh the following considerations carefully before entering a PEO relationship:

- Error resolution: Because a PEO is not on site, resolving payroll, benefits or compliance errors may take longer than if those functions were handled internally.

- Culture and recruitment: If a PEO doesn’t fully understand your company culture, it may struggle to support recruiting efforts effectively or help identify candidates who are the right fit.

- Costs: Businesses experiencing rapid growth may see higher fees as headcount increases, especially if additional services are required to support employee onboarding and compliance.

In addition to these practical concerns, Berry pointed out that many perceived risks stem from misunderstandings about how PEO relationships work. PEOs do not take control of your business or replace internal leadership or HR decision-making. When chosen carefully, a PEO should support operations without disrupting workplace culture.

“As with any other third-party service, it is worthwhile for employers to do their due diligence when selecting a PEO to ensure that they have a full understanding of the depth of services offered by the PEO and their reputation and level of responsiveness,” Berry advised. “PEOs often offer current client testimonials to employers that are looking to utilize their services.”

How do you manage co-employment risks and maximize rewards?

Managing co-employment risk starts with being proactive. The right preparation helps limit liability, avoid surprises and get the most value from the relationship. Keep the following considerations in mind when evaluating a potential co-employer.

1. Research your co-employer thoroughly before signing on the dotted line.

Spend time discussing policies, procedures and service expectations before entering a co-employment arrangement. Make sure you understand how responsibilities are handled and confirm that processes align with local, state and federal employment laws. Pay particular attention to the following:

- How is liability managed? For example, when a staffing agency carries workers’ compensation insurance, injured workers in most states are limited to filing workers’ comp claims with the agency rather than the client company. If your state does not recognize the exclusive remedy rule (which generally limits employees to workers’ compensation claims instead of lawsuits), ask whether the provider can add your business as an alternate employer on its workers’ compensation policy.

- How is risk managed? Ask how the organization stays ahead of new regulations, protects sensitive employee data with a cybersecurity plan, and ensures its compensation and benefits remain competitive so you can attract the talent you need.

Additionally, review the provider’s screening and testing processes, and don’t hesitate to ask detailed questions to confirm the co-employer understands your workforce needs and business goals.

2. Know where your responsibilities begin and end.

A successful co-employment relationship depends on clearly understanding what each party is and isn’t responsible for. Business owners should make sure their co-employer has a plan for handling common employment scenarios, while also going into the conversation with a clear understanding of their own legal obligations.

Here are several areas worth discussing upfront:

- Immigration: Will your co-employer handle I-9 forms, which verify an employee’s identity and authorization to work in the United States? Will it respond to I-9 audits or address work eligibility issues if they arise?

- Discrimination and harassment: If a co-employer is unclear about its role in preventing or responding to discrimination or harassment claims, your business could be exposed to risk. In many arrangements, the co-employer helps receive complaints, conduct an initial review within its scope and coordinate next steps. From there, the parties should determine which organization is best positioned to carry out a full investigation.

- Upset or misaligned workers: When working with a temporary staffing agency, clarify whether it will counsel an unhappy worker and reassign them if the placement isn’t a good fit. In a PEO relationship, employee issues may be better handled by your internal management team, with guidance from the PEO.

- California overtime law: California is one of several states with strict wage-and-hour rules that can hold businesses responsible if a staffing agency fails to pay legally required overtime. Make sure payroll practices and oversight responsibilities are clearly defined.

- Family and Medical Leave Act (FMLA): In FMLA situations, a staffing or payroll partner may handle leave administration. However, the company where the employee works typically shares responsibility for helping the employee transition back to work when the leave ends.

Ultimately, the division of responsibilities between a business owner and a co-employer depends on the specific relationship and the terms of the service agreement.

3. Discuss benefits with your co-employer.

Employee benefits are a critical part of any co-employment arrangement, so it’s important to understand exactly what your co-employer offers. Here are a few points to consider:

- Health insurance: Start by confirming whether the provider supplies health insurance and, if so, what types of plans are available. Because of Affordable Care Act requirements, many staffing and payroll agencies offer health insurance options that include high-deductible plans paired with health savings accounts (HSAs). These plans allow agencies to meet coverage requirements while keeping costs manageable for client businesses.

- Higher-level benefits: If your business relies on highly skilled workers (such as IT, engineering or technical professionals), benefit expectations are often higher. In those cases, PEOs, staffing firms or payroll providers should be able to offer more comprehensive plans. These plans can cost two to three times more than high-deductible options but are often necessary in today’s competitive labor market. Many candidates also expect access to mental health support, telehealth services, dental coverage, short- and long-term disability insurance, and 401(k) retirement plans and other options.

- Customizability: Customization can vary by provider. Because of anti-discrimination rules, staffing agencies often limit their workforce to one or two benefit plans, which can make customization difficult. Some agencies offer benefit classes that allow for limited variation. PEOs, by contrast, typically provide greater flexibility to tailor benefits to different employee groups.

4. Seal the deal with a contract.

A clear contract sets expectations and helps both parties understand where responsibilities begin and end. Pay close attention to the following:

- Indemnification language: One of the most important elements is indemnification language, which outlines who is responsible if something goes wrong. In many cases, the co-employer should indemnify your business for claims tied directly to its responsibilities. Because indemnification rules vary by state, it’s important to ensure the language complies with local legal requirements wherever you employ workers.

- Duties and responsibilities: The agreement should clearly define each party’s duties, including obvious items such as background checks, drug screenings, wage payments, tax withholding and day-to-day supervision. Less obvious — but equally important — responsibilities should also be addressed. These may include employee training, the provision of safety equipment (especially in industrial, agricultural and healthcare environments) and the handling of any applicable sales taxes.

- Potential friction points: It’s also wise to address potential friction points before they arise. For example, clarify what happens if you decide to hire a co-employed worker directly. Discussing scenarios like this upfront can help prevent confusion, strained relationships or costly disputes later on.

- Insurance: Finally, request certificates of insurance from the co-employer. At a minimum, coverage should include general liability insurance, workers’ compensation, professional liability, hired and nonowned auto insurance, crime coverage and cyber insurance.

There’s always some risk involved when hiring employees. However, taking the time to structure a co-employment agreement carefully can help reduce those risks while giving your business the support it needs to manage people effectively.

How do you choose a co-employer?

If you’ve decided that a co-employment relationship makes sense for your business, these steps can help you narrow your options and choose the right partner.

- Decide what type of co-employer you need. As discussed earlier, the most common options are staffing agencies and PEOs, and they serve very different purposes. Think about whether you need temporary “boots on the ground” to fill short-term roles (a staffing agency) or a longer-term partner to manage HR infrastructure for your existing workforce (a PEO).

- Create a short list of potential providers. Once you know the type of co-employer you’re looking for, identify several vendors that appear to be a good fit based on your industry, size and workforce needs.

- Schedule demos or introductory calls. Use these conversations to dig into how each provider operates. Ask detailed questions about services, pricing and support models. For example, when speaking with a staffing agency, confirm what benefits are offered to workers. With PEOs, clarify whether services are bundled or available à la carte and get a clear breakdown of costs.

- Finalize the agreement carefully. After selecting a provider, focus on the contract. Pay close attention to indemnification language, which defines who is responsible if a claim arises. This section is critical to managing risk and should reflect both your business needs and applicable state laws.

Choosing a co-employer isn’t a decision to rush. While there are always risks associated with hiring employees, co-employment adds another layer: the relationship itself. Taking the time to evaluate providers carefully can help ensure the partnership supports your business rather than complicates it.

Skye Schooley contributed to this article.