Comprehensive employee benefits plans can improve your business, demonstrating to existing staff that you value them and enticing prospective workers to join your team. Creating a suite of employee benefits can be a huge undertaking, so having a benefits administrator and using human resources (HR) software to handle employee benefits management is vital. Below is a guide to benefits administration, including how it fits into a company’s HR department.

What is employee benefits administration?

Employee benefits administration is an organization’s way of managing its employee benefits program. For most companies, benefits administration is the HR department’s responsibility. Larger corporations may even have HR employees exclusively dedicated to benefits administration and management. These benefits may include health, dental and disability insurance as well as retirement accounts, paid time off (PTO) and sick leave.

Employee benefits administrators are responsible for discussing benefit options with the organization’s employees, overseeing open enrollment periods, ensuring benefits are accessible and troubleshooting any problems employees have with their benefits. [Related article: Human Resources Management Glossary: Key Terms HR Pros Should Know]

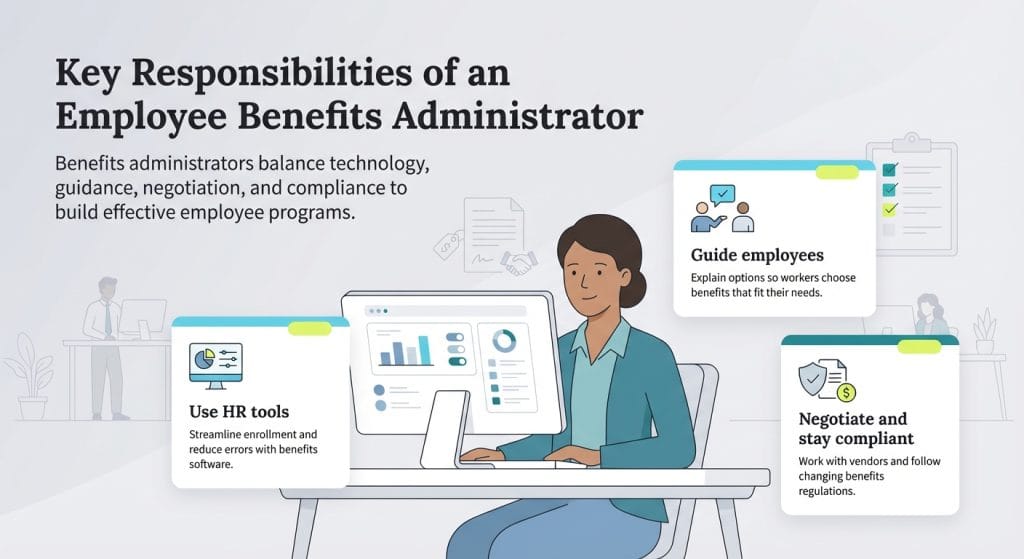

What is the role of an employee benefits administrator?

An employee benefits administrator has multiple responsibilities in executing and overseeing an organization’s benefits program. Here is a high-level overview of their core tasks.

Use HR software and employee benefits management tools to administer benefits

Manually overseeing an entire corporate network of benefits can be complex for one HR person — or even one department. That’s why most larger companies — and even many smaller organizations — use the best HR software and employee benefits management tools to keep some or all of their benefits plans organized.

“There are an array of HR platforms on the market that make the process of enrolling in benefits easy for an employee,” said Jared Brown, CEO at Hubstaff. “These same platforms also streamline the process for benefits managers to get reporting and analytic details on the enrollment levels and what plans are being selected.”

These solutions provide benefits administrators with access to online dashboards, templates, enrollment portals and more. Many of these programs even allow you to automate workflows. By digitizing virtually all aspects of benefits management, administrators can be more efficient with their time and are less likely to make mistakes.

Train and counsel employees

Benefits opportunities can be complicated and overwhelming for employees. They may have trouble understanding what their benefits are and how to use them properly. “Most people won’t ask about benefits they don’t fully understand,” said Brittany L. Truszkowski, chief operating officer at Grand Canyon Law Group.

It’s the benefits administrator’s job to train employees on how to enroll, explain their benefit choices and discuss how to use them. Companies are doing their employees a disservice if each individual is left to choose their own benefits package without guidance or if staffers are assigned a package that isn’t customized. Administrators need to make sure team members comprehend their benefits and only pay for what they believe they’ll use.

“Talk about benefits year-round — not just during open enrollment,” Truszkowski said. “We use manager check-ins and team huddles to reinforce what’s available. It helps people remember what they have access to when they need it most.”

Negotiate with vendors

A competitive benefits package can motivate employees to join or stay with a company. Benefits administrators are responsible for getting the best possible premiums for their organization and their employees. Administrators listen to pitches from benefits providers and then negotiate the rates the company and its staff members pay. Cheaper rates can lead to lower costs for employees. From there, the benefits administrator and a representative from the organization’s leadership team make a contract with the vendor and work with them to provide employees with a new benefits package each year.

Monitor, analyze and review benefit and enrollment usage

A benefits package isn’t set in stone. Administrators should audit which benefits are being used and which are not and adjust offerings accordingly. They should also seek feedback from employees about additional benefits they would like to see. Younger employees may want benefits like student loan repayment or comprehensive mental health coverage while older employees may focus on retirement savings options. Administrators should evaluate employees’ needs and adapt their benefits programs as necessary.

“Ask your team what actually matters,” Truszkowski said. “You can’t build a people-first benefits program without asking the people. We conduct an annual anonymous benefits survey to understand what’s working, what’s not and what’s missing. That’s how we knew to prioritize mental health services and gym stipends over flashy perks like catered lunches.”

One benefit that's growing in importance for employees of all ages is

employee assistance program access. These programs offer employees confidential help with various issues, including stress management, domestic violence and alcoholism.

Ensure compliance with government regulations

Your company’s employee benefits must comply with federal regulations, including the Affordable Care Act, Health Insurance Portability and Accountability Act, Family and Medical Leave Act and Consolidated Omnibus Budget Reconciliation Act. Each of these acts has its own requirements that benefits administrators must comply with and verify their company is regularly following.

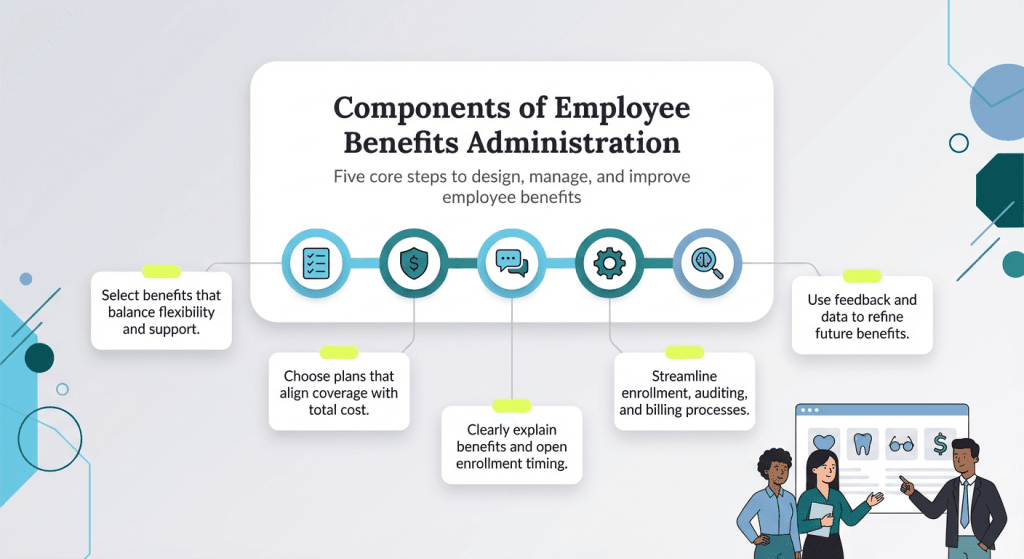

What are the components of employee benefits administration?

There are five key components to administering employee benefits.

1. Pick the benefits your company wants to offer.

It’s up to the employee benefits administrator and the company’s leadership to determine which benefits to provide. Employees value benefits that provide them and their families flexibility and support. Today, the most popular benefits packages are a combination of traditional and voluntary benefits. Voluntary benefits are offered by employers but are mostly paid for by the employee. Most companies provide health care, dental and vision insurance, but some of the more popular additional options are student loan assistance and financial wellness planning.

It's critical to

create a benefits package that appeals to employees. The best plans include robust benefit offerings for a low cost. While facilitating great benefits is valuable, that value loses its effect if employees have to pay high out-of-pocket costs to access them.

2. Find benefits plans that balance cost with coverage.

Benefits administrators should look for plans that balance cost and coverage. On average, employers cover 70 percent of the cost of medical, dental and vision insurance plans, according to Arcoro. Bundled payment plans can save on costs as they combine pre- and post-procedural care into one negotiated price, resulting in cost savings for the organization.

3. Communicate to employees what the benefits package includes and when open enrollment is.

Benefits administrators should explain to employees what benefits are being offered and how to use them. It is also essential for administrators to tell employees when their open enrollment period is so they don’t miss their opportunity to sign up for benefits. This period usually differs for new hires vs. existing employees.

“Benefits managers should have a communication campaign mapped out to alert employees on open enrollment timing, what benefits are offered and any changes that have been rolled out since the previous enrollment period,” Brown said. “I highly suggest benefits managers schedule Q&A sessions for the team to attend to get clarification on any uncertainties.”

4. Manage benefits efficiently.

Once benefits administrators negotiate rates with vendors and set up the benefits program for employees, they should ensure the benefits are being used efficiently. This includes providing team members assistance during enrollment, auditing premium deductions and reconciling bills.

An individual employee’s benefits package is idiosyncratic, making it time-consuming to manage one person’s terms, let alone an entire staff. This is why companies use HR software and benefits management tools to relieve some of the burden from administrators and HR departments.

5. Analyze and ask for feedback.

Benefits administrators should check in with employees regularly to see how their benefits are serving them. They should make sure the benefits are easy to use and that they provide the coverage promised. Between these conversations and internal analytics from HR software and employee benefits management tools, administrators can identify patterns and glean insights on how to improve plans for the following year.

Best practices for employee benefits management

Managing employee benefits effectively is essential not only for compliance and workers’ compensation, but also for attracting and retaining top talent.

1. Ask your team for input on the plan to choose.

One of the most important first steps in crafting a strong benefits strategy is getting input directly from your employees. Understanding what your workforce values can help you provide benefits that are relevant and meaningful. “This can be done at scale by leveraging employee surveys,” Brown said. “The inputs collected will help [benefits] managers craft packages that are tailored to the various needs and desires of the team.”

By starting with feedback, HR teams can avoid guesswork and ensure company benefits actually align with real needs rather than assumptions. Once the plan is in place, it’s important to track how employees are engaging with it. “Monitoring and reviewing enrollment in benefits is the best indicator of employee satisfaction,” Andy Lange, SVP of people operations at Take Command said. “When people are using their benefits, it means they’re getting the support they need to stay happy and healthy.”

2. Decide if you want group insurance or individual employee insurance.

Employers must choose between traditional group insurance and more modern approaches like Health Reimbursement Arrangements (HRAs), particularly Individual Coverage HRAs (ICHRAs). “Businesses that opt for an HRA do not need to negotiate insurance premiums, eliminating one of the most stressful parts of benefits administration,” Lange said. “Employees shop for and purchase insurance premiums on the individual market with an allowance provided by their employer. They own the policy and can choose to stay on the same plan — even after changing employers — or switch each enrollment period if their needs change.”

While HRAs offer flexibility for both employers and employees, group insurance is another route. “Businesses should gather quotes from several providers to strengthen their bargaining power,” Lange advised. “Employers can also leverage workforce size and employee demographics to negotiate lower rates. However, keep in mind that group insurance rates are unpredictable and companies often see double-digit renewal rates, especially in response to high usage or low participation.”

3. Offer continuous resources and support.

Signing up for benefits isn’t a one-time event when employees are onboarded to the company. To truly empower any workforce, education and support should be ongoing from employer to employee. “Health insurance is highly personal and impacts employees’ everyday lives, so they need to be well informed,” Lange said.

To ensure lasting impact, companies should develop a year-round communication plan that includes reminders, Q&A sessions and access to tools that explain benefit changes or upcoming deadlines. Regular touchpoints, whether via email campaigns, benefits portals or in-person info sessions, help reinforce what’s available and encourage employees to ask questions.

4. Keep it simple.

Accessibility is key when it comes to benefits. By narrowing down the choices to clear, user-friendly options, businesses can improve participation and reduce confusion during open enrollment. “Benefits shouldn’t feel like a maze,” Truszkowski said. “Too many options can overwhelm employees. We’ve found success with a few well-structured plans that are straightforward and easy to use.”

5. Regularly review benefits strategy and change as needed.

As your business changes, so should your benefits strategy. Start by evaluating your workforce — their ages, needs and how your business is growing. If your business isn’t going to expand any time soon, that’s another important consideration.

For small business owners, outsourcing can be a smart move. When internal resources are limited, relying on external expertise can streamline the process and reduce compliance risks. Brokers, consultants or third-party administrators can also provide insight into benefit trends and legal obligations — ensuring your offerings remain competitive and compliant.

If your company is on the rise and expanding your workforce, prioritize insurance that’ll suit your larger employee count. “For companies with thousands of employees, traditional group insurance remains the leading choice — large organizations can negotiate better premium rates with carriers,” Lange said. “But even within group insurance, there are choices to be made. PPOs, for example, offer employees with greater health needs a wide choice of providers but typically come with higher premiums.”

Amanda Hoffman and Skye Schooley contributed to the reporting and writing in this article.