Applying for a business loan doesn’t always work with borrower requirements. Business credit cards offer various features that make it easier to manage finances and steady your cash flow. However, there’s enormous potential for financial trouble if you’re not careful — below, we’ll share best practices for using these financial tools.

Editor’s note: Looking for the right financing solution for your business? Fill out the below questionnaire to have our vendor partners contact you about your needs.

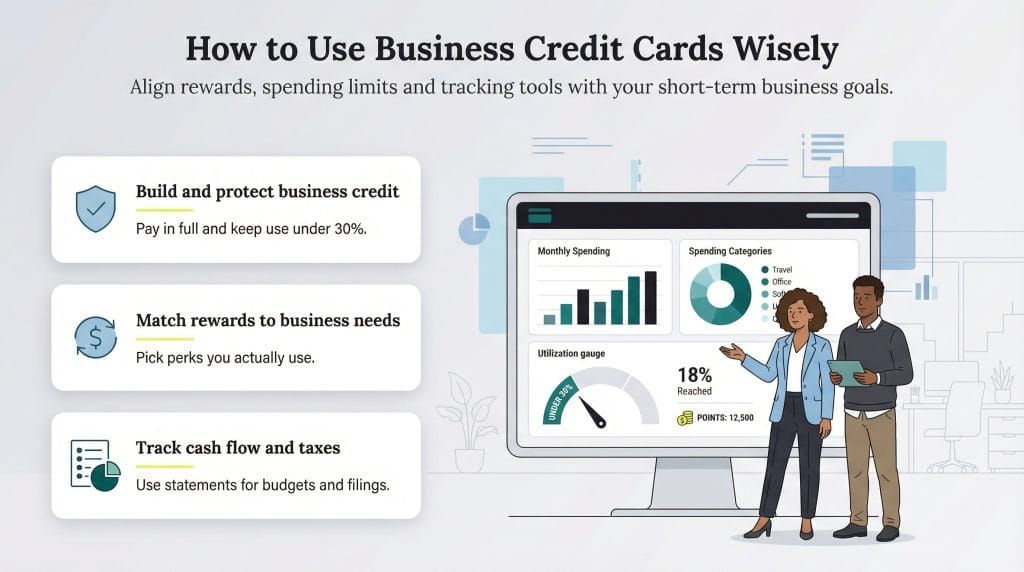

How to use business credit cards wisely

Optimal business credit card usage is about achieving short-term goals. Understand that business credit cards are a tool for:

- Building business credit

- Establishing a good business credit score

- Managing cash flow while awaiting payments

- Financing major purchases (within the introductory period)

“First, select the credit card that best fits your business needs, both for overall terms and benefits (cash back, rewards, etc.),” said Ned Murchison, director of small business lending at First Bank. “Next, make sure to pay off credit card balances in full each month, and, finally, aim to keep card utilization rate below 30 percent of [the] limit.”

Business credit cards should not be seen as a way to cover excessive or unnecessary expenses, mask underlying financial problems or operate beyond your means.

Applying for a business credit card can be a great way to support your business’s cash flow, but it’s critical to use a credit card responsibly and avoid taking on unnecessary debt.

Choose a business credit card with beneficial rewards

Membership rewards are typically one of the first things that may attract you to a business credit card. Rewards may include:

- Cashback spending incentives

- Hotel and airline discounts or freebies

- Partnerships that extend discounts from specific merchants

- Shipping and advertising discounts

- Unique, business-specific bonus categories

- Purchase and fraud protection

- Price protection (save your receipts and get the difference in price if it drops after you buy a product)

- Elite status for additional upgrades and discounts

“Most premium rewards cards offer their highest value when you transfer your points to their airline partners and spend them on business or first-class flights,” said Jack Prenter, CEO and personal finance expert at Dollarwise. “That can produce an incredible return per dollar spent — but only if your business actually requires travel. If you never need flights, a flight-centric rewards card is basically wasted potential.”

In other words, choose a credit card with features that can help your business reach its short-term goals.

Handle employee credit card usage carefully

Many business owners extend business credit card privileges to some employees. Consider the following tips to ensure responsible spending:

- Set individual spending limits for employees: Based on their roles and requirements, assign specific spending limits to card-holding employees. Your goal is to prevent unauthorized purchases, credit card fraud and going over budget.

- Use employee credit cards for expense tracking and reporting: Employee credit streamlines employee expense reimbursement. Instead of sifting through receipts and lengthy expense reports, use your card provider’s reporting tools to track real-time spending.

- Earn rewards on employee spending: When employees use company-issued cards, their transactions contribute to your business’s rewards program such as cashback, travel perks or discounts. These offset costs or are reinvested into your business.

- Establish clear usage policies: Create and communicate clear guidelines, receipt submissions and transaction explanations for appropriate card use. Specify what expenses are allowed (e.g., travel, client meals, office supplies) and which are prohibited.

- Monitor usage regularly: Review employee card transactions to detect misuse or unusual spending patterns.

Many business credit cards automatically integrate with the

best accounting software, making it easier to categorize and analyze individual employee expenses.

Utilize credit card statements for taxes and financial tracking

Business credit card statements are incredibly helpful for day-to-day financial tracking and annual tax preparation.

Use routine statements to do the following:

- Track and categorize expenses: Business credit cards generate detailed monthly statements, breaking down spending by categories, such as travel, office supplies or advertising.

- Review financial performance weekly: Regularly review and analyze your financial statements to track your revenue, reallocate resources and reduce business expenses. Look for trends, such as periods of higher revenue, to inform budgeting and forecasting decisions.

Use end-of-the-year statements to do the following:

- Generate annual expense summaries: Many business credit cards generate comprehensive annual statements with categorized expenses. These summaries simplify tax preparation from an organized breakdown of deductible expenses.

- Ensure all eligible fees are deducted: Some business credit card fees are tax-deductible, including annual membership fees or transaction charges. Include eligible fees in your tax filing to maximize your deductions.

Keep clear and accurate records of all transactions. This documentation is essential for tax purposes and in case of a

tax audit.

Avoid paying interest

Don’t carry a balance from month to month. Credit card interest charges accumulate quickly and become financially burdensome.

If you anticipate carrying a balance on a large purchase, consider one of the best business loan options instead. Loans often come with lower, fixed interest rates.

If carrying a balance is unavoidable, actively monitor your cash flow and make additional payments when possible to pay down debt faster.

Watch for introductory offers

Credit card offers often come with strings attached, so it’s essential to read the fine print carefully. Using earned rewards like miles or points usually requires you to meet a spending threshold in a certain time frame. Some offers require only a small amount of spending, like $3,000, while others demand $20,000 or more.

A promotion can also end abruptly, leaving you blindsided. Say your business floats thousands of dollars on a card. You’ll face a substantial bill when the introductory offer ends, costing you more than the initial offer.

Avoid commingling personal and business expenses

It’s tempting to make personal purchases on your business credit card or business purchases on your personal credit card. However, this makes it difficult to track your expenses and profits for tax season and negatively affects your credit score if you miss a payment.

Hop cautiously — or not at all

Credit card hopping is when you move from one card to another to take advantage of perks or rewards, such as cashback or zero-interest-rate periods. Many cards feature introductory offers, and opening a new account allows you to benefit from them.

However, you’ll need to take note of annual fees, transfer fees and any conditions tied to the rewards. Opening new lines of credit also lowers your credit score, so getting new cards too often is unwise. If you plan to apply for a large loan soon, avoid credit card hopping.

If you're unsure about choosing a

business credit or debit card, focus on your goals. A credit card is ideal for building credit and accessing extra funds, while a debit card is better for cash-based spending.

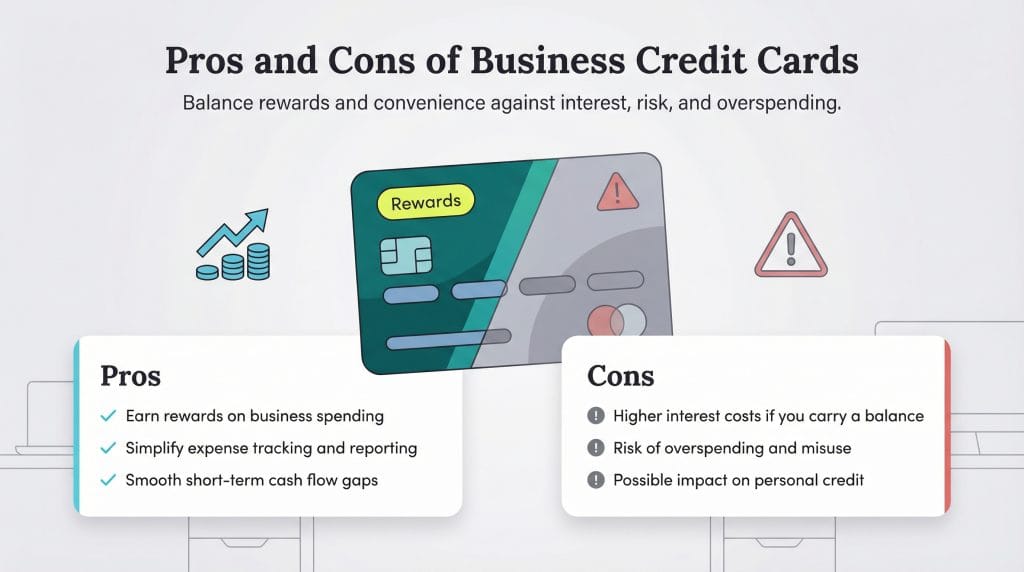

Pros and cons of business credit cards

Weigh the pros and cons of business credit cards before applying:

Pros of business credit cards

Many credit cards offer rewards that pay you back for your spending, a perk you won’t receive with other payment methods.

“If you pay by bank transfer or check, you get nothing in return,” Prenter explained. “However, by putting those same expenses on a credit card — assuming you can pay off the balance before interest kicks in — you’re effectively earning money on purchases you already have to make. It’s like adding extra profit directly to your bottom line, provided you manage debt responsibly.”

Additional upsides to business credit cards include:

- Easier expense management: Business credit cards simplify separating business and personal expenses.

- Faster access to funding: Obtaining a business credit card is quicker and easier than applying for a business loan.

- Cash flow management: Credit cards help smooth cash flow, especially when awaiting client payments.

- Exclusive perks: Business credit cards offer benefits that personal cards don’t.

Cons of business credit cards

Despite their benefits, there are downsides to using business credit cards:

- Higher interest rates: Business credit cards have higher interest rates than personal cards.

- Risk of misuse: Employee abuse can occur if credit card permissions are extended without clear policies.

- Impact on personal credit: Personal credit may be affected by business credit card usage.

- Overspending: Credit cards can encourage overspending if not managed carefully.

These drawbacks can be mitigated with careful credit card usage and a responsible repayment plan.