Business.com aims to help business owners make informed decisions to support and grow their companies. We research and recommend products and services suitable for various business types, investing thousands of hours each year in this process.

As a business, we need to generate revenue to sustain our content. We have financial relationships with some companies we cover, earning commissions when readers purchase from our partners or share information about their needs. These relationships do not dictate our advice and recommendations. Our editorial team independently evaluates and recommends products and services based on their research and expertise. Learn more about our process and partners here.

What Is Commercial Property Insurance? A Complete Guide to Insurance on Commercial Building

Commercial property insurance covers the building and items that you own or lease against threats such as fire, explosions, theft and vandalism.

Table of Contents

Regardless of the size of your business, if you own any type of commercial property you should consider commercial property insurance. That’s because if you suffer a loss, commercial property insurance pays for the repair or replacement of your goods and property. This includes the structure where you conduct business, as well as furniture, computers, inventory and supplies.

Commercial property insurance coverage is broad, so we’ll help you understand the specifics on getting insurance for commercial buildings, including what you may pay for insurance on commercial property.

What is commercial property insurance?

Commercial property insurance pays to repair or replace your building and any items owned by your business on business property if they are damaged or lost in a covered claim. This type of business insurance is often paired with business liability insurance.

What does commercial property insurance cover?

As with all insurance policies, there are certain events, called perils, that a commercial property insurance policy protects against. While the covered losses may change depending on your provider, these are some of the most common perils that a commercial property insurance policy covers:

- Fire

- Explosion

- Burst pipes

- Windstorm

- Theft

- Vandalism

Commercial property insurance provides coverage for both real estate and physical objects. “Things like your building, equipment, inventory and income loss if you have to shut down for repairs,” explained Daniel Garzella, the CEO of Avalon Risk Management. “It also helps cover extra costs while you get back up and running.”

Essentially, anything that you physically use for your business is considered business property and is covered by your policy. You don’t have to itemize your business property to get coverage, although completing an inventory will ensure that you have enough coverage for everything, including office chairs, paper and other supplies. Commercial property insurance covers:

- Real estate

- Office furniture

- Office electronics

- Equipment

- Supplies and materials

- Inventory

- Signs and fixtures

What does commercial property insurance not cover?

Just like all insurance, not everything is covered. Some common exclusions include damage and loss resulting from a hurricane, earthquake or flood. Coverage for these natural disasters often requires a companion policy to the commercial property policy. Read through your policy to identify any exclusions of coverage.

Commercial property policies fall into two categories: named perils or all-risk. All-risk typically has broader coverage because rather than covering losses described in the policy, it names the exclusions. So, it is important to remember that “‘all-risk’ doesn’t cover everything — check the fine print for exclusions,” advised Garzella.

Also note that a commercial property policy will not protect you from general liability claims. General liability claims include third-party claims when you are responsible for injury or property damage to others. It protects businesses from claims related to bodily injury, property damage and advertising injury. For example, if you break something that belongs to a client, you’ll need to make a general liability claim.

Sometimes, it is important to invest in other types of insurance policies, too. Commercial auto insurance protects against a crash of a company car, for instance. Business interruption insurance, meanwhile, pays for lost revenues if your business is shut down due to a covered claim. “Business interruption coverage may require an add-on to your standard commercial property insurance,” Garzella noted.

Why should you get insurance on commercial property?

Every business owner with business property should consider getting a commercial property insurance policy. Without commercial property insurance, you would pay for loss recovery by dipping into the company coffers, taking out a loan or closing shop. With a commercial property insurance policy, you exchange a monthly or annual premium for the peace of mind that your business assets are protected.

In the long run, insurance can save you thousands of dollars. To put these savings into context, take a look at the average costs of some common claims:

- Burglary and theft: $8,000

- Water and freezing damage: $17,000

- Wind and hail damage: $26,000

- Fire: $35,000

Most small business owners don’t have that kind of money sitting around, so it’s important to get a good commercial property insurance policy.

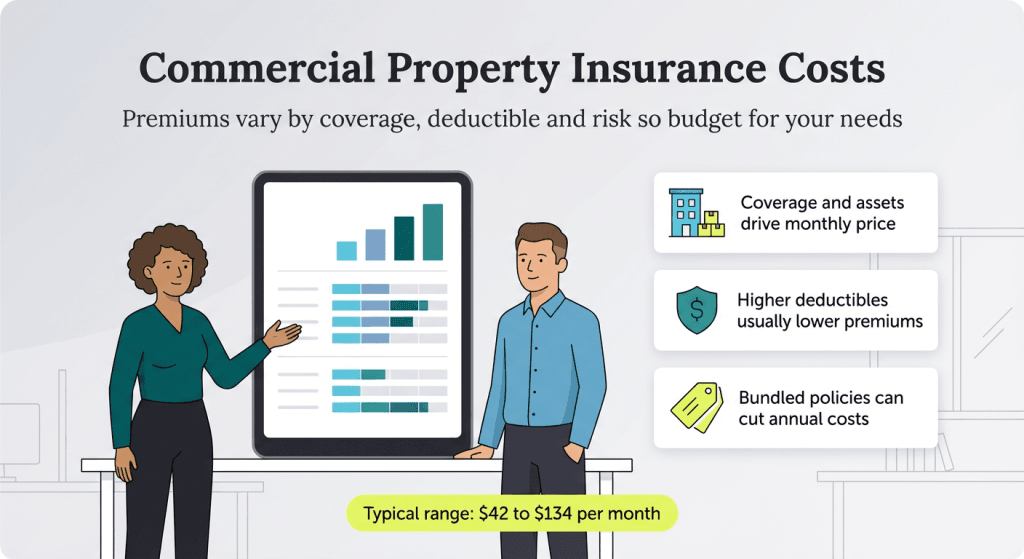

How much does commercial property insurance cost?

The cost of a commercial property insurance policy depends on many factors. Your premium will increase as you insure more real estate or business assets. If you choose a higher deductible, you can reduce the annual premium, but you should choose a deductible that you are comfortable paying. The location of your business property will also affect the price, since some neighborhoods are considered riskier than others.

The cost of commercial property insurance varies based on the amount of coverage required, the deductible you choose and the provider. A business owner can expect to pay between $42 a month to as much as $134 a month for a commercial property insurance policy.

How do you get insurance for commercial buildings?

You can buy a commercial property insurance policy as a stand-alone policy or as a part of a business owner’s policy. Contact a commercial insurance carrier or a broker for a quote. To get an accurate price, you’ll need to have an idea of the value of the business property and other details, such as your location and the industry you serve. Once you have a quote that you are happy with, the next step is to bind the policy. Binding means that you pay the required premium and the policy becomes effective. As soon as you bind a policy, it will cover you against losses.

There are so many provider options available that it can feel overwhelming when shopping for insurance. Business.com has streamlined the process for you by researching the best providers for small business insurance.

Commercial property insurance FAQs

- Floods

- Tsunamis

- Earthquakes

- Sewer backups

- Damage from insects and rodents

- Rust, rot and mold

Nathan Weller and Kimberlee Leonard contributed to the reporting and writing in this article.