As a business professional, you’re responsible for the knowledge, expertise and services you provide to clients. As a result, clients can take legal action against you and your company when they believe mistakes that harmed them financially were made when you provided your services. Under these circumstances, professional liability insurance can help cover your legal costs. This comprehensive guide will walk you through everything you need to know about professional liability insurance, including its definition, coverage details, who needs this protection and current cost considerations.

>> Read next: What Is a Business Owner’s Policy?

What is professional liability insurance?

Professional liability insurance, also known as professional indemnity insurance, provides businesses with coverage against clients’ legal claims of negligence, malpractice and misrepresentation. This insurance can help cover the monetary costs associated with legal fees, judgments against you, settlements, compensatory damages, punitive damages, and economic or business damages that result from a lawsuit.

The professional liability insurance market is experiencing significant growth, with the global market size valued at USD 42.8 billion in 2024 and projected to expand at a compound annual growth rate (CAGR) of 3.9 percent through 2031. This growth reflects the increasing awareness among businesses of the need to protect themselves from professional liability risks.

General liability insurance vs. professional liability insurance

It’s important to understand how general liability insurance differs from professional liability insurance. General liability insurance provides coverage against claims that arise when a third party is injured — for example, if a customer trips on the stoop in your store’s doorway and twists their ankle — or property is accidentally damaged on your premises. It also covers damages an employee causes on a third party’s premises.

However, general liability insurance does not protect against claims that relate to professional or business practices, which would be covered by professional liability insurance. [Discover which types of insurance are best for your business.]

Errors and omissions insurance

Some professionals require errors and omissions insurance, which is another type of professional liability insurance. This insurance provides coverage for claims that a professional made a mistake in providing services or advice that caused financial or business difficulties for the client. States and licensing boards may require certain types of businesses to have errors and omissions insurance coverage. Some professionals, such as real estate agents and business accountants, also benefit from having this type of insurance coverage.

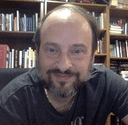

Who needs professional liability insurance?

Business owners and professionals who have expertise in a certain area — such as lawyers, accountants, consultants and graphic designers — need professional liability insurance to protect their business against clients’ claims of negligence. Professional liability insurance is required particularly if the business owner or professional meets any of these criteria:

- The professional provides advice or consulting services to businesses or individuals.

- The professional conducts business in an industry where mistakes could result in significant financial losses for clients.

- The professional needs professional liability insurance to obtain a professional license or to work with certain clients.

- The professional works as an independent contractor.

Many modern businesses also face new challenges that require updated professional liability protection. For example, as artificial intelligence (AI) becomes integrated into business operations, professionals must consider coverage for AI-generated responses that could lead to legal challenges. Recent developments in AI liability cases, such as A.F. v. Character Technologies, highlight how AI systems can create new forms of professional liability exposure.

The shift to remote work has also introduced additional coverage considerations, as professionals working from home face increased cybersecurity risks and non-traditional workplace exposures. Studies show that injury claim rates for remote workers have increased by 24 to 54 percent on average, making comprehensive professional liability coverage more critical than ever.

Business owners and professionals who have expertise in a certain area need professional liability insurance to protect their business against clients' claims of negligence. Check out our list of the

top business insurance providers to find the right coverage for you.

Industry-specific professional liability coverage

Professional liability insurance needs vary significantly across industries, with different sectors facing unique risks, regulatory requirements and claim trends.

Healthcare professionals

Healthcare professionals (namely, physicians) require medical malpractice insurance, a specific type of professional liability insurance. This insurance protects against claims from patients who believe they were harmed by the medical professional’s negligence or intentionally harmful treatment decisions. It also provides coverage against claims that arise from a patient’s death.

The healthcare sector faces particularly prevalent malpractice claims, with medical liability representing one of the largest segments of the professional liability market. Healthcare professionals must navigate complex regulatory requirements while adapting to new technologies like AI-assisted diagnostics that create novel liability exposures.

Legal professionals

Legal sector professionals need robust professional liability coverage due to increased scrutiny and the potential for high-value malpractice claims. Law firms face unique challenges as client expectations rise and the complexity of legal practice increases. While only a few states require lawyers to carry malpractice insurance – often with minimum limits like $100,000 per claim and $300,000 aggregate – many others require attorneys to disclose to clients or the state bar if they are not insured.

Technology and consulting services

Technology professionals and consultants face evolving risks from data breaches, system failures and algorithmic bias claims. As businesses increasingly rely on AI and automated systems, technology errors and omissions insurance has become essential for covering claims related to software failures, data security breaches and AI-related liability.

Architecture and engineering

Architects, engineers, and other design professionals face unique liability exposures due to the complex, high-value nature of construction projects. Building design professionals typically pay less than $145 per month for professional liability insurance, though costs can range from $300 to $4,000 annually depending on firm size and project complexity.

The architecture and engineering professional liability market has experienced significant challenges, with claim severity trends continuing in 2024 due to social inflation and third-party bodily injury claims. Design professionals face particular risks from structural design failures, project delays and construction defects that can result in substantial financial damages for clients. Many design professionals are also required to carry professional liability coverage as a condition of licensure or project contracts, especially for public infrastructure projects.

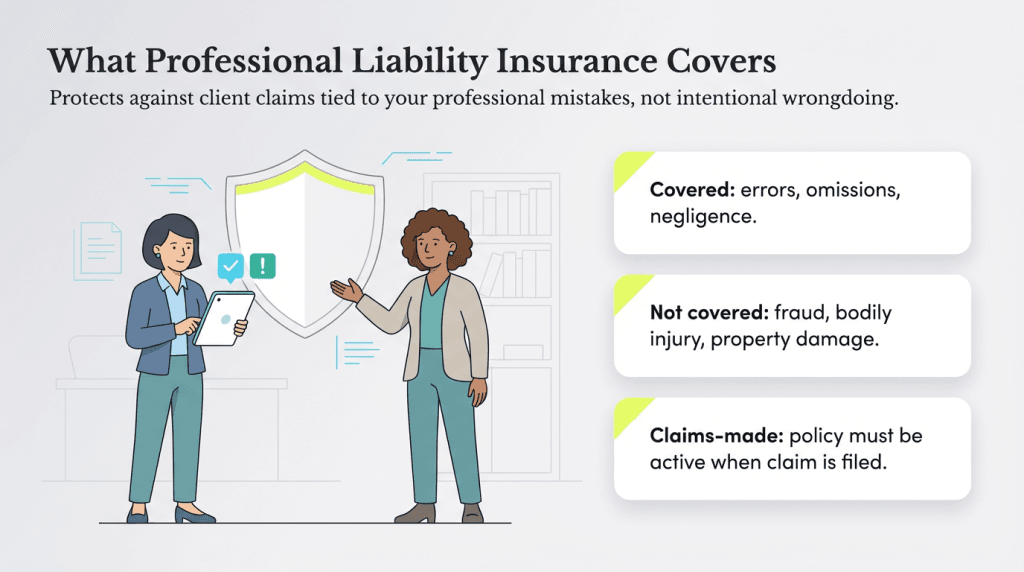

What does professional liability insurance cover?

Professional liability insurance covers clients’ claims of wrongdoing made during the policy period. Policies are usually arranged on a claims-made basis, meaning insurance coverage applies only to claims that are made during the policy period. A typical professional liability policy protects the insured party against financial loss that arises from a claim made during the policy period for a covered error, omission or negligent act that takes place in the conduct of the insured party’s professional business.

Professional liability insurance provides coverage for the following types of claims:

- Negligence claims: Failing to meet professional standards when providing services to clients

- Misrepresentation claims: Making false or misleading statements about products, services or professional qualifications

- Breach of duty claims: Failing to perform the duties you’re professionally bound to perform

- Malpractice claims: Providing inadequate professional services that result in client harm

- Errors and omissions claims: Making mistakes or failing to perform certain services

- Employment-related claims: Wrongful termination, discrimination and harassment (if employment practices liability coverage is included)

Modern policies increasingly need to address digital-age risks, including liability from AI decision-making errors, data security failures in remote work environments and cyber-related professional mistakes. As technology becomes more integrated into professional services, coverage must evolve to protect against algorithmic bias, automated system failures and cyber liability exposures.

Ordinary negligence

A client can accuse any business or individual of ordinary negligence — for example, if the person slips and falls on the sidewalk in front of the business, resulting in an injury. This type of liability applies to claims that assert a business hasn’t abided by its duty and care and that a client suffered from physical or financial harm due to that carelessness. Businesses or individuals can be sued for ordinary negligence if they do not take the same amount of care as any reasonable person would to avoid harming others.

Professional negligence

Professional negligence is when a client hires a professional for their specialized skills or experience but that professional fails to meet a higher duty or standard of care than a person without this specialized knowledge would and, consequently, causes the client physical or financial harm. Examples include an accountant failing to file a client’s tax return on time and a real estate agent failing to notify a buyer of a defect in the home.

There are two methods for measuring a professional’s duty of care:

- Foreseeability tests determine if you could have reasonably predicted your actions would hurt the client. (For example, you should have known that missing the tax deadline would lead to your client being fined.)

- Multifactor tests evaluate several factors, including the extent of the damages, the possibility of taking another action, the cost of taking that other action and the safety of the alternative options.

Misrepresentation

Misrepresentation is when professionals make false statements of material facts that affect a client’s decision when they’re agreeing to a contract. If the misrepresentation is discovered, the contract can be declared void and the client can seek damages. For example, a business consultant could be charged with misrepresenting themselves to a client by falsely stating they have expertise in a specific area.

There are three types of misrepresentation:

- Innocent misrepresentation: The person making the statement honestly believes it’s true.

- Negligent misrepresentation: The person making the statement has no reasonable basis for believing it’s true but is not intentionally lying.

- Fraudulent misrepresentation: The person making the statement either knows the statement is false or doesn’t care if it’s true or false.

Organizations should regularly review their coverage to ensure it adequately protects against evolving threats in their industry.

Exclusions

Professional liability insurance does not cover the following:

- Intentional wrongdoing: Deliberate illegal acts, fraud or criminal behavior

- Bodily injury and property damage: Physical injuries to people or damage to physical property (covered by general liability insurance)

- Employment practices claims: Wrongful termination, discrimination and harassment claims from employees (requires employment practices liability insurance)

- Cyber liability: Data breaches, network security failures and cyber attacks (requires separate cyber liability coverage)

- Work-related injuries or illnesses: Health issues sustained by employees while working (covered by workers’ compensation insurance)

- Personal activities: Claims unrelated to your professional work

Claims period

Many insurance companies provide professional liability insurance on a claims-made basis. That means the policy covers claims made within a specific period and may include the following:

- A retroactive date, which covers you for incidents that happen on or after the specified date in your policy

- An extended reporting period, which covers claims that occur within a certain time after your policy expires (e.g., 30 to 60 days)

Specific wording

Some professional liability insurance policies have specific wording governing what’s covered. For instance, the policy might include a “breach of duty” clause related to whether the policyholder reported the incident to the insurer during the policy period.

Here’s another example: Coverage for a “negligent act, error or omission” protects you against loss or circumstances that occurred only as a result of a professional error, omission or negligent act. In other words, “negligent” does not apply to all three categories. A “negligent act, negligent error or negligent omission” clause is more restrictive and doesn’t cover a lawsuit in which a client claims a nonnegligent error or omission.

How much does professional liability insurance cost?

The cost of professional liability insurance varies significantly based on industry, business size and risk factors. Small businesses typically pay an average of $61 per month, or about $735 annually, for errors and omissions insurance. For some professionals, a professional liability insurance policy can cost as little as $22.50 per month, but several factors can affect the price. For example, The Hartford reported that architects and engineers errors and omissions insurance has an average minimum monthly premium of $239.

Factors that affect professional liability insurance costs include:

- Industry and risk level: High-risk professions like healthcare and legal services typically pay more.

- Business size and revenue: Larger businesses with more employees and higher revenue face higher premiums.

- Coverage limits: Higher coverage limits result in higher premiums.

- Claims history: Previous claims can increase premium costs.

- Geographic location: Some states have higher claim frequencies and costs.

- Risk management practices: Strong risk management can help reduce premiums.

When you get quotes for professional liability insurance, show the insurer what you’ve done to maintain your professionalism and how you regularly meet your obligation to provide a higher standard of duty or care. You’ll want to provide the insurance company with the following business documentation:

- Copies of contracts with current clients

- Information on documentation procedures

- Information on previous professional liability insurance coverage

- Information on processes that demonstrate quality control (where applicable)

- Information on employee training initiatives

How do you show proof of a professional liability insurance policy?

You might be required to show proof of professional liability insurance when signing a contract with a new client or to verify that you have specific coverage. To show proof of professional liability insurance, you typically need a certificate of insurance (COI). A COI is a document that contains important information about your insurance policy and acts as verification of insurance and proof of specific insurance coverage.

A COI should include the following information:

- The name of the policyholder

- The effective date of the policy

- The type of coverage involved

- The policy’s limits

Requesting a certificate of insurance

To request a COI, contact your insurance company and provide the following information:

- Contact information

- Policy number

- Certificate holder’s name

- Certificate holder’s contact information

- Information of other individuals or companies to be listed on the certificate

- Copy of the insurance requirements or contract

Kimberlee Leonard contributed to this article.