Financial accounting is the process of recording and reporting your business’s income, expenses, assets and liabilities, often with the help of software. This information gives managers, owners and shareholders the insights they need to make informed decisions.

Some aspects of financial accounting can sound technical, but in practice, it’s much easier thanks to modern accounting software. The best solutions can help you track transactions, generate statements and build custom reports. Below, we’ll break down how financial accounting works and explain why it matters for your business.

Editor’s note: Looking for the right accounting software for your business? Fill out the below questionnaire to have our vendor partners contact you about your needs.

What is financial accounting?

Financial accounting is a branch of accounting that focuses on recording and reporting a business’s financial activity. It operates under established frameworks such as Generally Accepted Accounting Principles (GAAP), set by the Financial Accounting Standards Board (FASB) for U.S. companies, or International Financial Reporting Standards (IFRS) for companies that operate globally.

Financial accounting is often required when companies prepare financial statements for annual reports or shareholder disclosures. These statements are also valuable for management decisions and tax planning. (Keep in mind that while financial statements support tax preparation, actual tax filings require separate reports.)

“Financial accounting provides you with the tools to truly understand your business,” explained Teresa Thomas, founder of Ridge CFO. “By applying solid accounting principles, you can track performance, identify trends and make confident decisions based on facts rather than guesses.”

Many companies conduct annual

financial statement audits to ensure their financial health and demonstrate credibility with shareholders and lenders.

Financial accounting legal and compliance requirements

Financial accounting isn’t just about good business practices. In many cases, it’s a legal requirement. The exact rules you need to follow depend on your business structure and industry. Consider the following guidelines:

- Regulatory framework: Publicly traded companies must follow Securities and Exchange Commission (SEC) regulations and use GAAP standards set by federal law. Private companies aren’t under SEC oversight, but many still adopt GAAP to build credibility with lenders, investors and business partners.

- Industry-specific rules: Some industries go beyond basic GAAP. Banks and other financial institutions follow extra regulations from banking authorities. Healthcare organizations must meet Medicare and Medicaid reporting requirements. Construction firms often use percentage-of-completion accounting for long-term projects.

- Deadlines and penalties: Reporting deadlines also vary. Public companies file quarterly (10-Q) and annual (10-K) reports with the SEC, while private companies may only need to provide annual reports to investors or lenders. Still, all businesses must keep accurate records for taxes and potential audits. Missed deadlines or inaccurate reporting can lead to penalties, legal action and, in the case of public companies, even a loss of trading privileges.

What’s the difference between accounting and financial accounting?

Business accounting is the process of creating financial systems and procedures and tracking your company’s revenue, expenses, assets and liabilities. Financial accounting goes a step further by compiling individual transaction records into comprehensive reports that management, shareholders and others can review.

In other words, financial accounting takes the raw data from everyday accounting and turns it into concise statements that reflect your company’s financial health.

Small business accounting

Small business accounting typically involves:

- Setting up books and records, including accounts payable and accounts receivable.

- Recording every company transaction — cash and noncash.

- Establishing policies for how you’ll categorize revenue, expenses, assets and liabilities.

- Managing all of your company’s financial data.

At some point, these accounting activities need to translate into reports that reflect your company’s financial situation. That’s where financial accounting comes in.

Financial accounting

Financial accounting consolidates all those day-to-day transactions into standardized reports. Modern accounting software features make this much easier, helping you generate statements that comply with standards set by authoritative bodies such as the FASB and the American Institute of CPAs (AICPA).

The key financial statements include:

- Income statement: Shows all revenue, expenses, gains and losses for a set period.

- Balance sheet: Provides a snapshot of your company’s financial condition — including assets, debts and net value — as of a particular date.

- Cash flow statement: Summarizes how money moves in and out of your business over a specific period, including collected revenue and paid expenses.

- Statement of retained earnings: Reports shareholders’ equity based on initial contributions and net earnings that haven’t been distributed as dividends.

- Statement of shareholder equity: A statement of shareholder equity is a section of the balance sheet that shows the difference between total assets and total liabilities.

While

accounting challenges certainly exist, especially for specific industries, business and financial accounting aren't difficult; both just require dedication and persistence.

Financial accounting principles and methods

Understanding how your business records revenue and expenses is key to producing reliable financial statements. Financial accounting operates under established principles set by the FASB and generally follows GAAP rules.

Cash vs. accrual accounting

The two primary methods of financial accounting are cash and accrual, and the one you use determines when your business books revenue and expenses.

“Cash accounting is straightforward,” Thomas explained. “You record income when you receive payment and expenses when you pay them, making it great for freelancers and very small businesses. Accrual accounting provides a clearer picture of your profitability because it aligns income and expenses with when they’re actually earned or incurred. This is important if you invoice clients, manage inventory or want to understand how your business truly performs over time.”

Here’s a quick primer:

- Cash accounting: Records transactions only when money changes hands. Revenue is recognized when payment is received, and expenses are recorded when bills are paid. It’s simple but can make it harder to see the bigger picture of performance.

- Accrual accounting: Records transactions when they occur, not when money changes hands. This method follows two GAAP principles:

- Revenue recognition: Revenue is booked when it’s earned, not when cash arrives.

- Matching principle: Expenses are recorded in the same period as the revenues they helped generate.

Accrual accounting gives a more accurate view of profitability, which is why most businesses use it and why GAAP requires it for financial statements.

IRS restrictions

While many small businesses are allowed to use cash accounting, certain companies must use accrual accounting. The IRS prohibits cash accounting for:

- C corporations with average annual gross receipts over $31 million for the past three years.

- Partnerships with a C corporation partner and average receipts over $31 million.

- Tax shelters under Section 448(d)(3).

- Businesses where inventory is a key part of income, though those with average receipts of $31 million or less may treat inventory as supplies to continue using cash accounting.

How does financial accounting work?

At its core, financial accounting means recording every transaction your business makes and organizing it into a clear picture of your finances. Today, most businesses use accounting software to handle this process. The software — or your business accountant — sorts transactions into the right accounts and then generates reports that show where your business stands financially.

“When your books are clean and accurate, you can see where your business stands financially, identify problems early, and take advantage of tax deductions and credits you might otherwise miss,” Thomas noted. “It also helps you stay compliant and avoid surprises, whether it’s an IRS notice or a cash flow crisis. I always tell my clients that solid accounting isn’t a luxury. It’s a foundation.”

The good news is that creating these reports is often just a few clicks away with accounting software. The bigger challenge is knowing how to interpret the information and use it to make smart business decisions.

Common accounting mistakes and how to prevent them

Even seasoned business owners slip up sometimes. Here are some of the most common accounting mistakes we see — and how to avoid them.

Frequent accounting errors include:

- Transposition errors: Mixing up numbers (like typing $496 instead of $946). These small slips can throw off reports and even affect your tax filings.

- Duplication errors: Entering the same transaction twice, which often happens if more than one person has access to the books without clear coordination.

- Principle errors: Recording something in the wrong way, such as misclassifying transactions or not following GAAP rules.

- Omission errors: Forgetting to record a transaction altogether, which can snowball if reconciliations aren’t done regularly.

Follow these best practices to help prevent errors:

- Set review procedures: Make it standard practice to double-check entries before they’re finalized.

- Use software tools: The best accounting software platforms have built-in error detection and safeguards.

- Assign clear roles: Avoid confusion by making sure each team member has specific accounting responsibilities.

- Reconcile regularly: Monthly bank reconciliations and account reviews help catch mistakes early.

- Maintain audit trails: Keep thorough records of every transaction so errors can be traced and corrected quickly.

Financial accounting examples

You don’t need to be an accountant or bookkeeper to follow the basics of financial accounting. Even if you don’t plan on preparing reports yourself, knowing how to read the key statements is an important skill as your business grows. Here are some examples:

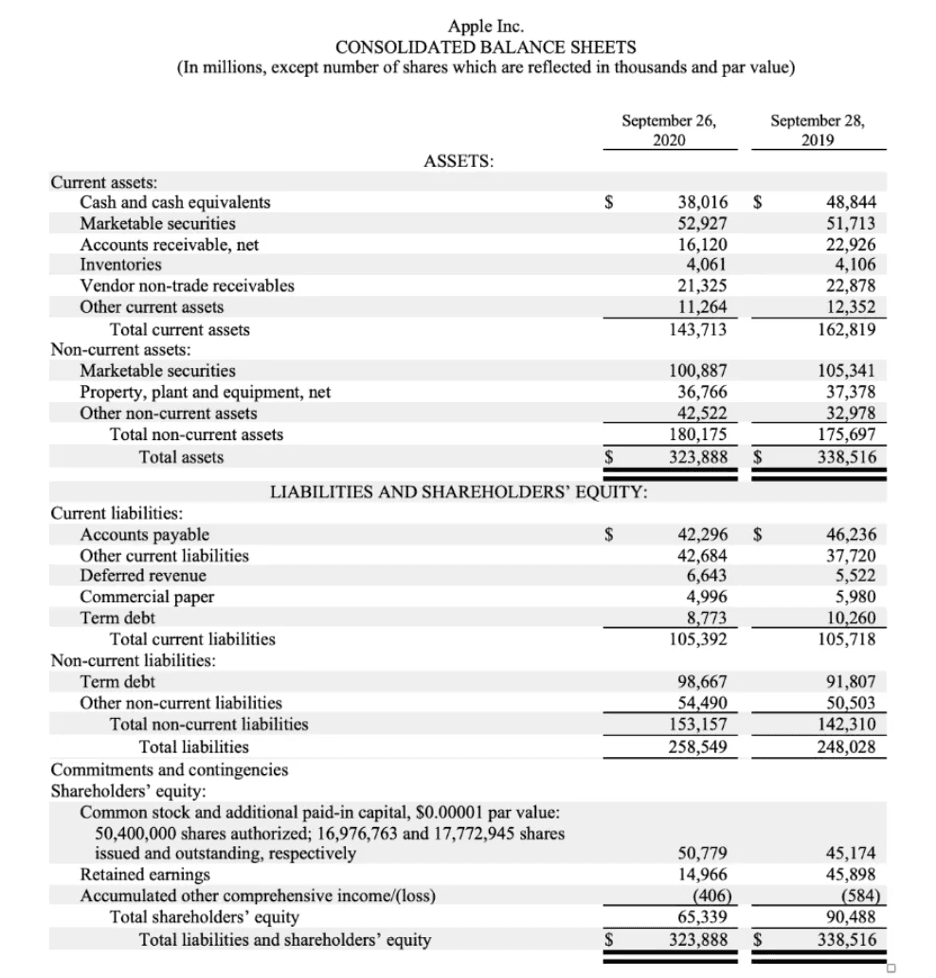

Balance sheet

A balance sheet is like a financial snapshot. It shows what your company owns (assets), what it owes (liabilities) and what’s left over for shareholders (equity) at a specific point in time. The golden rule: assets should always equal liabilities plus equity.

In the example here, Apple’s balance sheet from September 2020 is compared to September 2019. You can see the breakdown of Apple’s assets, liabilities and equity, right down to shares outstanding. Notice how the totals at the bottom of both sections balance out. That double underline shows everything is in sync, just as it should be.

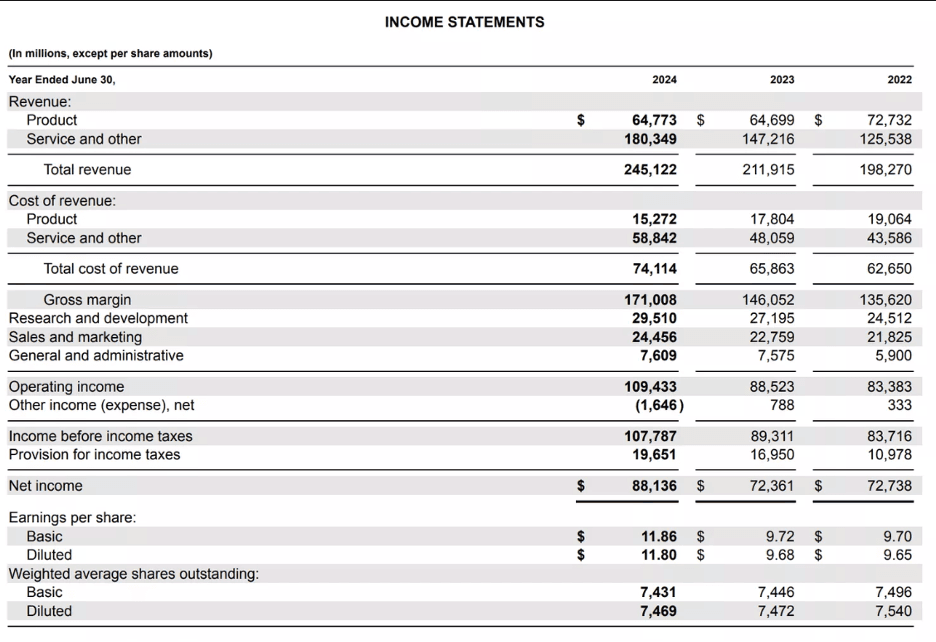

Income statement

An income statement shows how much money your business is bringing in and where it’s going out. It starts with revenue, subtracts the costs of generating that revenue, and then accounts for other expenses like operations and taxes. The result is your net income — what’s left over after all costs are paid.

In Microsoft’s income statement shown above, you’ll see revenue broken out by products and services, followed by the costs of producing that revenue. Additional expenses and tax provisions are listed further down. At the bottom is the net income — the company’s true earnings for that period.

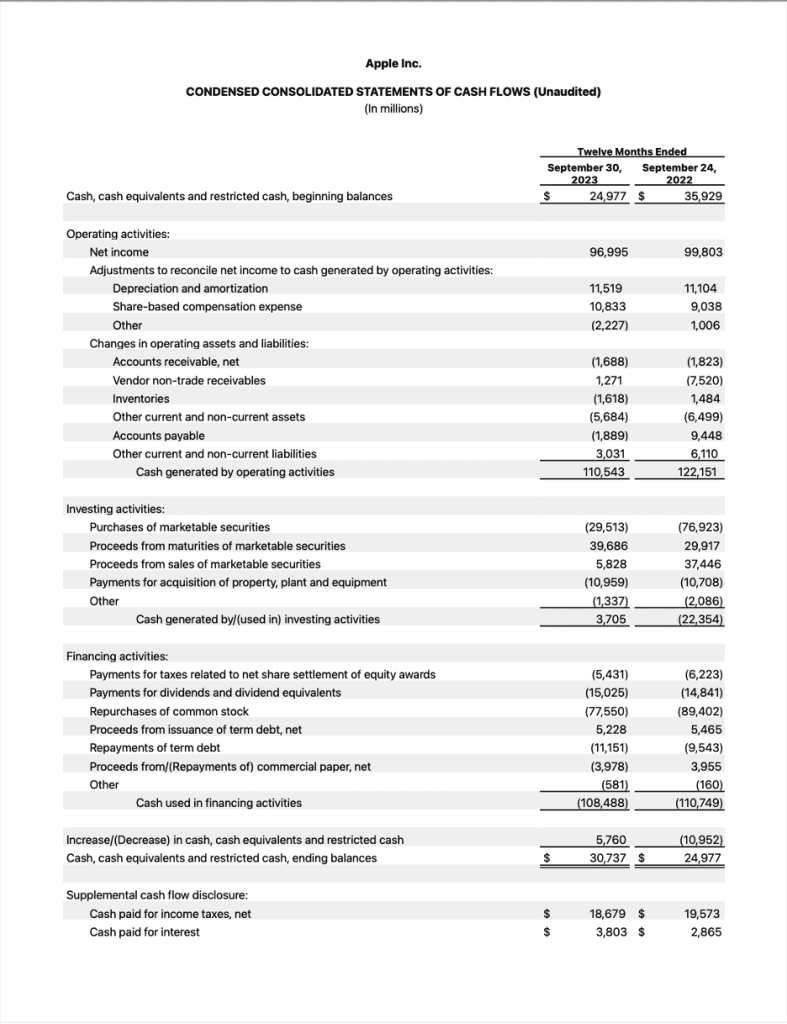

Cash flow statement

A cash flow statement shows how money moves in and out of a business over a set period. It breaks down cash from operating activities (day-to-day business), investing activities (like equipment purchases or asset sales), and financing activities (such as issuing stock or paying dividends). Together, these categories give you a clear picture of how sustainable a company’s operations are.

In Apple’s cash flow statement shown above, you can see how changes in assets and liabilities, along with investing and financing activities, affected the company’s overall cash position. The ending balance at the bottom shows that Apple had more cash on hand at the end of September 2023 than it did at the same time in 2022.