Business.com aims to help business owners make informed decisions to support and grow their companies. We research and recommend products and services suitable for various business types, investing thousands of hours each year in this process.

As a business, we need to generate revenue to sustain our content. We have financial relationships with some companies we cover, earning commissions when readers purchase from our partners or share information about their needs. These relationships do not dictate our advice and recommendations. Our editorial team independently evaluates and recommends products and services based on their research and expertise. Learn more about our process and partners here.

ZarMoney Accounting Software Review: Pricing and Features

Table of Contents

- ZarMoney's report-generation capabilities exceed those of many competitors, including QuickBooks.

- The flat-rate pricing structure makes it easy to understand what you owe each month.

- ZarMoney integrates with over 9,600 U.S. banks.

- ZarMoney doesn't offer a free plan.

- ZarMoney supports accrual-based reporting but lacks dedicated cash-based reporting capabilities.

- The platform doesn't support more advanced features like project tracking.

Looking for more options?

Check out The Best Accounting Software Choices for E-commerce Businesses: Our Top Picks for 2026 business.com recommends.

ZarMoney helps organizations turn small business accounting data into actionable insights, making it our pick for the best accounting software for report generation. Its software includes over 40 built-in reports and numerous customizable options to help business owners use powerful data analytics to inform decisions. Additionally, ZarMoney integrates with thousands of banks in the United States, supports credit card payments and offers a straightforward, flat-rate pricing structure.

ZarMoneyEditor's Rating:

8.1 / 10

- Payments

- 9/10

- Automatic invoicing

- 9/10

- Third-party integrations

- 7/10

- Mobile app

- 7/10

- 24/7 customer support

- 8.5/10

Why We Chose ZarMoney as the Best for Report Generation

We were impressed by the breadth of ZarMoney’s reporting capabilities, which matched or exceeded even big names like QuickBooks. ZarMoney includes 40 built-in reports, and you can also tailor parameters to your own specifications with over 1,000 customizable options. In addition to numerous financial tracking reports, ZarMoney provides accounts receivable (A/R) reports and 1099 reports to help your business comply with regulations. For these reasons and more, we chose ZarMoney as the best accounting software for report generation.

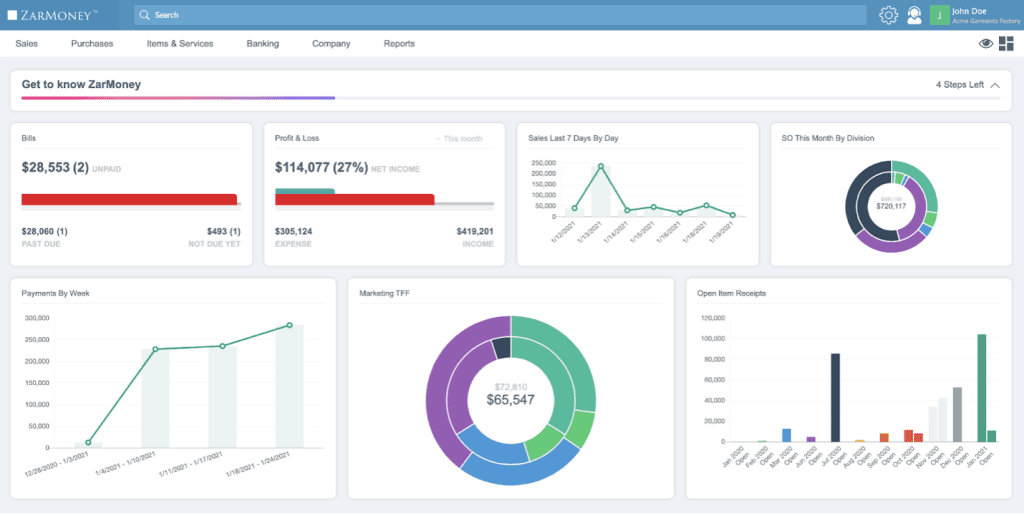

Ease of Use

During testing, we found ZarMoney uncomplicated and straightforward to work with. The user interface is organized neatly, with tabs for sales, purchases, items and services, banking, company and reports. The main dashboard displays key statistics, including unpaid bills and invoices, profit and loss (P&L) figures and sales totals. Another sidebar displays messages and reminders. We like that ZarMoney’s dashboard is completely customizable and that you can add or remove widgets as needed.

Some familiarity with basic accounting skills and terminology will help new users get the most out of the platform. Still, business owners and their teams likely won’t face a steep learning curve when implementing ZarMoney’s accounting software because its simplicity makes it easy to get started right away.

ZarMoney Features

ZarMoney offers a wide range of accounting software features that small businesses will find valuable, including report generation, bank integration, inventory management, bill payment and more.

Reports

Big data in accounting is a rising trend that ZarMoney showcases. We were impressed by the platform’s report-generation capabilities, which help business owners analyze their organization’s data.

The number of insights ZarMoney’s software provides exceeds those of popular big-name competitors like QuickBooks Online. With 40 prebuilt reports and 1,000 customizable reporting options, your data analysis options are virtually unlimited. Standard reports include:

- Profit and loss statements

- Balance sheets

- General ledger reports

- A/R analysis

ZarMoney can also help you meet 1099 tax form reporting obligations, ensuring you comply with employment regulations.

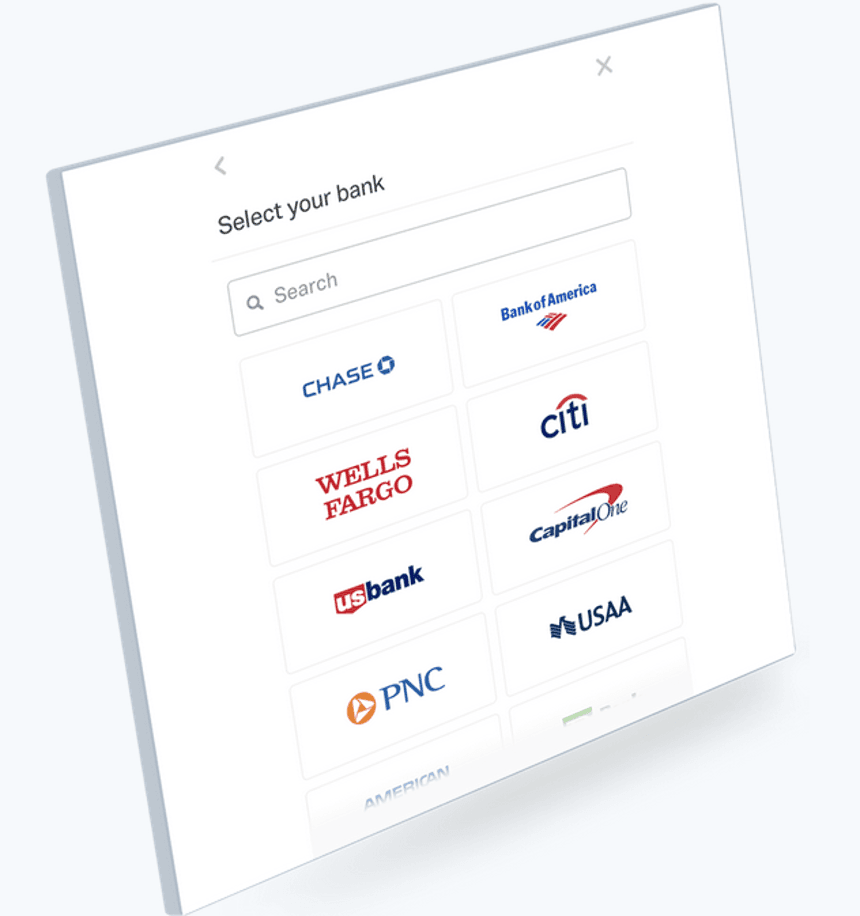

Bank Integration

We were impressed that ZarMoney’s software connects with over 9,600 financial institutions in the U.S. and Canada. ZarMoney imports bank transactions automatically, and the accounting software also supports batch deposits of checks, cash and credit card sales. We also like that it calculates sales tax according to regional laws and allows you to transfer funds between linked bank accounts.

We were pleased that ZarMoney includes a built-in bank reconciliation tool that matches your bank transactions automatically to those you’ve created in the software. Reconciling a business bank account without accounting software is a tedious task, making this feature extremely valuable for small business owners.

Another feature that differentiates ZarMoney is that it allows unlimited transactions. Some competitors we reviewed have monthly transaction caps, so we appreciated this flexibility.

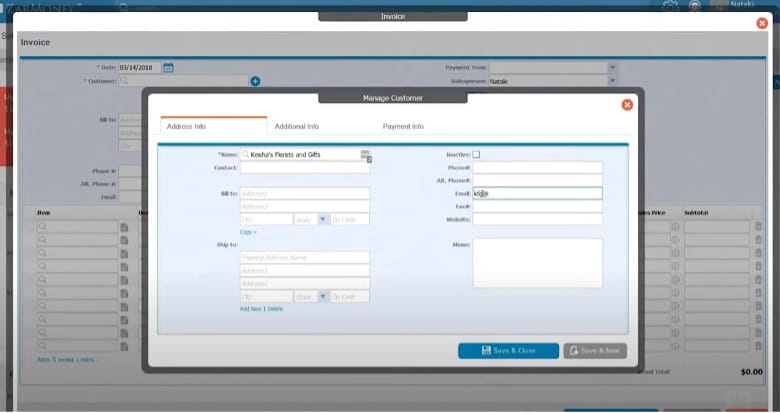

Invoicing

Creating professional invoices for your small business helps ensure timely payments. We like that ZarMoney allows you to create customized invoices with your logo and branding, which you can print, email or fax to customers. The software also supports recurring invoicing, so you can bill customers on a regular schedule. We also appreciate that ZarMoney lets you accept credit cards and ACH payments online to help you get paid quickly and efficiently.

Accounts Receivable (AR)

We were impressed that ZarMoney empowers businesses with a comprehensive set of tools to streamline operations and manage the accounts receivable process. You can manage estimates and sales orders efficiently, offer your customers flexible payment terms and provide early payment discounts. With the ability to send order alerts via text or email, you can keep your customers informed and engaged throughout the order process.

We also like that ZarMoney’s A/R tool automates credit limit enforcement at the order entry and invoicing stages, ensuring that your business maintains control over credit risk. This is a unique feature we didn’t see with many competitors.

Inventory Management

We like ZarMoney’s real-time inventory tracking features. The software tracks inventory counts in multiple locations separately, which is great for a small business operating several physical locations. ZarMoney lets you attach prices to your inventory items, allowing you to follow the first-in, first-out method (FIFO) outlined in Generally Accepted Accounting Principles (GAAP).

Bill Payment

Although ZarMoney doesn’t have the tools to pay vendors directly like some competitors do, we appreciate that it offers a few useful features to help track payments. For example, its payables calendar tool lets you record your scheduled payments, helping you better manage your business’s cash flow.

Productivity Tools

We like that ZarMoney offers several cool and unique tools to increase productivity for your business. For example, its scheduler allows you to schedule deliveries, customer calls and other tasks and sync them with Google Calendar or your iPhone calendar. You can also send notifications to customers alerting them to order status changes. Additionally, ZarMoney features a messaging system for your team with internal notes.

Mobile App

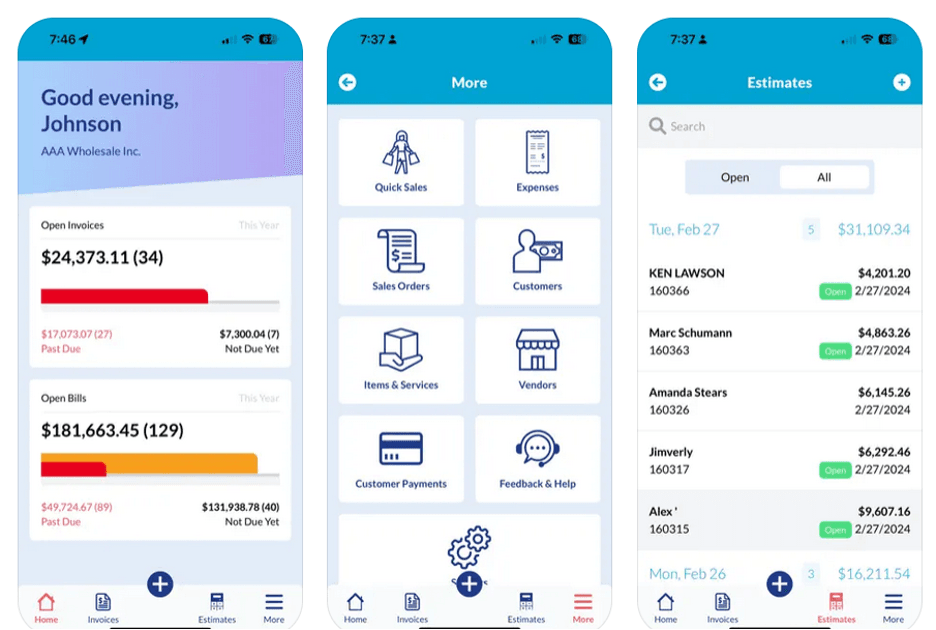

ZarMoney offers users a mobile app on both Android and iOS, allowing business owners to perform accounting tasks on the go. With the app, users can access financial data, banking systems and business books anytime, anywhere.

ZarMoney Pricing

We like that ZarMoney keeps its pricing simple, with two paid plans that both include core accounting tools (invoicing, reports, bill payment, etc.). However, unlike some rivals, it doesn’t sell extra add-ons to expand the software’s capabilities.

Here’s how it breaks down:

Plan | Pricing | Features |

|---|---|---|

Small Business | $20 per month for two users; $10 for each additional user |

|

Enterprise | $350 per month for 30 or more users | Everything in Small Business, plus:

|

Implementation/Onboarding

We appreciate that ZarMoney offers a 15-day free trial of its software. We especially like that you don’t need to input any credit card information for the free trial. Sign-up takes just a few minutes on the company’s website, and you can begin using the software immediately. All your trial data is stored for 60 days in case you need extra time to make a decision.

Another standout aspect of ZarMoney’s onboarding process is the ability to migrate customer and vendor data from another accounting software program directly into your ZarMoney account. The software is entirely cloud-based, so you don’t need to download anything onto your computer, and plans can be upgraded at any time.

Customer Support

In an era when many companies have cut back on customer service, we were impressed to learn that ZarMoney offers U.S.-based phone support. Customer service representatives are available Monday to Friday, 9 a.m. to 5 p.m. Pacific time. Support is also available via 24/7 live chat and email. For users on the Enterprise plan, ZarMoney assigns a dedicated account representative and provides priority service.

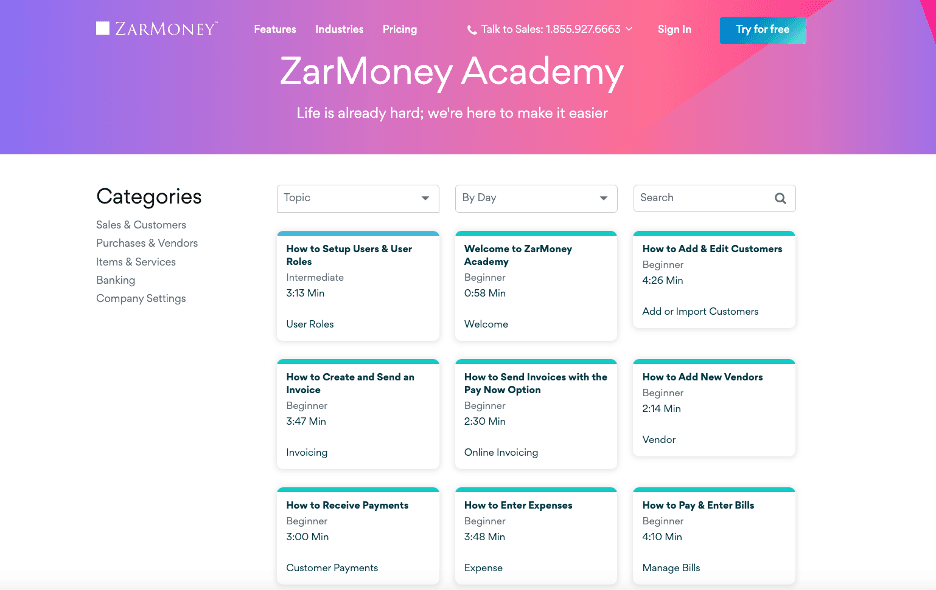

ZarMoney’s ample online resources include ZarMoney Academy, which features video training, tutorials and a knowledge base; there’s also a traditional, searchable online help center with articles on everything from getting started to detailed customer and sales topics.

Limitations

ZarMoney has some impressive features. However, we discovered some limitations:

- No free version: Although ZarMoney offers a 15-day free trial, it doesn’t provide a free version of its software. Other competitors we reviewed, including Zoho Books, have free tiers in addition to paid plans. (Read our review of Zoho Books to learn more about this solution.)

- No cash-basis reports: Another downside is the lack of cash-basis reports. When it comes to cash-based vs. accrual-based accounting, most businesses use the latter. However, many small businesses still use cash-based accounting due to its simplicity and the easier learning curve.

- Limited advanced features: We also noted that ZarMoney lacks some of the advanced features of competing accounting software, such as project tracking. If you need an accounting solution with project management features, check out our review of Sage 50.

Methodology

We researched and analyzed dozens of the best accounting and invoicing software solutions to help small businesses choose the right accounting software for their needs. We reviewed key features such as payment and invoicing capabilities, integrations, mobile apps, report generation, supported user count and customer service options to generate our quantitative scores and use cases. We also assessed pricing and the availability of free trials.

We examined each company’s website and participated in software demos. Additionally, we studied user reviews for independent opinions on each software’s pros and cons. When looking for the best accounting software for report generation specifically, we focused on the total number of preset reports and customization options.

ZarMoney FAQs

Bottom Line

We recommend ZarMoney for …

- Business owners who appreciate big data and actionable insights from reports.

- Businesses with a large number of transactions.

- Businesses seeking seamless bank connections.

We don’t recommend ZarMoney for …

- Freelancers looking for a no-cost solution.

- Businesses that practice cash-basis accounting.

- Businesses that need extensive integrations with other third-party platforms.

Amanda Hoffman contributed to this article.

Looking for more options?

Check out The Best Accounting Software Choices for E-commerce Businesses: Our Top Picks for 2026 business.com recommends.