Cash flow is essential to running a successful business. Understanding your company’s liquidity is nonnegotiable, and a cash flow statement gives you clear visibility into how money moves through your business. These reports show how much cash is coming in, how much is going out and where it’s coming from. Below, we explain how to prepare a cash flow statement and what the numbers actually mean for your business.

What is a cash flow statement?

A cash flow statement is a report that summarizes how much cash and cash equivalents flow into and out of your business over a specific period. It also shows how much cash you have on hand, including bank deposits, short-term investments and other business assets that can quickly be converted into cash. It does not include credit items, such as invoices you’ve sent but haven’t received payment for or bills you’ve received but haven’t paid yet.

“A cash flow statement is a great tool to give business owners insight into where their actual cash is spent, since most businesses are run on an accrual basis,” said Katie Thomas, a certified public accountant and corporate controller at Trust & Will.

What is the purpose of a cash flow statement?

A cash flow statement helps you understand whether your business has enough cash to cover expenses and stay financially healthy. It shows how money moves through your business so you can spot potential issues before they become serious problems.

For example, if your cash flow statement shows a deficit, you may need to adjust your pricing, shorten payment terms or cut expenses to improve cash flow. If you have a cash surplus, it may be a good time to invest in new equipment, hire staff or set aside savings.

Cash flow statements, along with your balance sheet and income statement, are also commonly required by banks and investors when you apply for financing. Lenders use these reports to evaluate whether your business is financially stable and able to repay a loan or investment.

What does a cash flow statement include?

A cash flow statement has three main sections: operating activities, investing activities and financing activities. Each section shows a different way money moves through your business.

- Operating activities: The operating activities section shows how much cash comes in and goes out from your day-to-day business operations. This includes routine transactions such as customer payments, payments to suppliers, employee wages and tax payments.

- Investing activities: The investing activities section shows cash you’ve earned or spent on long-term investments. Common examples include purchasing vehicles or machinery, or buying and selling investments like stocks or bonds.

- Financing activities: The financing activities section shows how your business raises capital and repays debt. This includes receiving loans, repaying principal on debt, issuing equity to investors and paying dividends.

The

best business loans can help you cover temporary cash flow difficulties, such as delayed customer payments or seasonal dips in revenue.

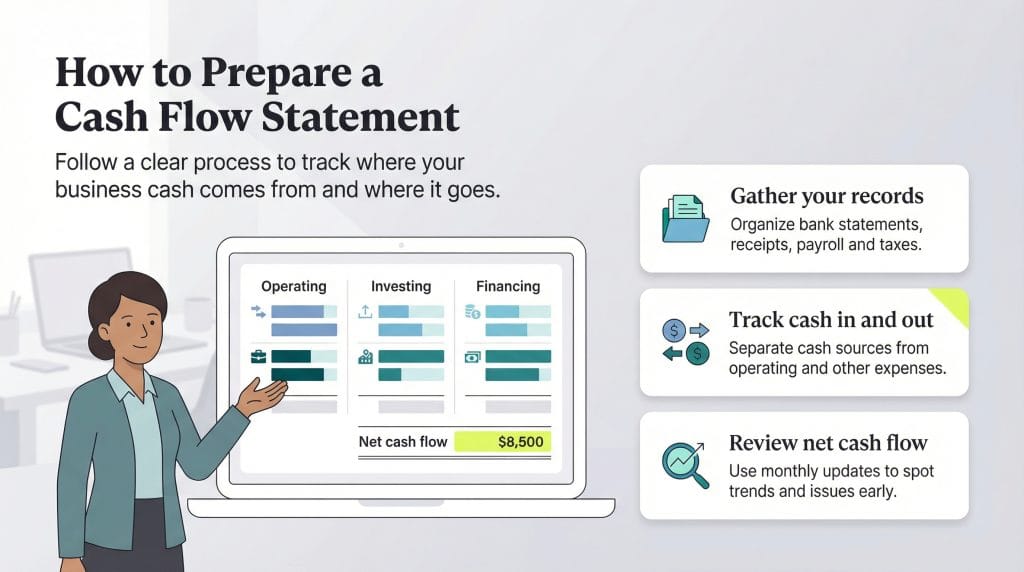

How to prepare a cash flow statement, step by step

To build a cash flow statement that accurately reflects your business’s financial situation, follow these steps. Note that using one of the best accounting software platforms can also make the process faster and more accurate.

1. Gather your financial records.

Accurate financial reporting starts with organized data. Gather all relevant documents, including bank statements, credit card receipts, payroll journals and tax records. The more organized your records are, the easier it will be to create an accurate cash flow statement.

2. Identify your cash sources.

Cash sources include all the ways money enters your business. For most small businesses, inflows include customer payments, sales revenue, tax refunds, small business grants, capital from business investors and business loans.

Go through your records and categorize each source of cash. Be sure to distinguish between cash you’ve actually received and invoices that haven’t been paid yet. This step matters because a cash flow statement tracks real money movement, not accounts receivable.

3. Track your cash expenses.

Next, map out where your money is going. Categorize expenses into groups like operating costs (such as rent, utilities, overhead costs and salaries), inventory purchases, equipment investments, loan repayments and taxes. Account for both fixed and variable expenses as well as one-time purchases, since they can significantly impact your cash flow.

The goal is to understand how much cash is leaving your business and where you’re spending the most.

4. Choose your accounting method.

Small businesses typically use one of two accounting methods: cash basis or accrual basis. The cash basis method records transactions when money actually changes hands, while the accrual method records revenue when it’s earned and expenses when they’re incurred, even if no cash has been paid or received yet.

For many small businesses, the cash basis is simpler and provides a clearer view of actual cash movement. However, some businesses are required to use accrual accounting, including those with inventory, certain corporations and companies that must follow Generally Accepted Accounting Principles (GAAP). Decide which method makes the most sense for your business and use it consistently.

Some businesses, including those with inventory or required to follow GAAP, must use accrual accounting. If you're unsure which method applies, a

tax consultant or accountant can help you choose the right approach.

5. Calculate net cash flow.

To calculate net cash flow, subtract your total cash expenses from your total cash income for the period you’re reviewing (such as a month, quarter or year). If the number is positive, you have extra cash to save or reinvest. If it’s negative, you’re spending more cash than you’re bringing in. This gives you a quick snapshot of how healthy your cash flow is.

6. Create your cash flow statement.

Now, organize your findings into a structured statement with three main sections:

- Operating activities (day-to-day business)

- Investing activities (long-term asset purchases)

- Financing activities (loans and investments)

List cash inflows and outflows in each category and detail the sources and uses of cash. Most accounting software can automate this process, but you can also build a simple spreadsheet manually.

7. Analyze and interpret your results.

Don’t just create the statement — study it. Look for trends, such as seasonal dips in revenue or rising operating costs. Are there months with cash shortages? Are expenses consistent or unpredictable? Use these insights to identify opportunities to cut business costs and plan for future growth.

8. Regular maintenance and review.

A cash flow statement isn’t a one-time document. To stay useful, update and review it regularly, ideally monthly or quarterly. Routine monitoring helps you address liquidity issues before they become serious problems. Consider setting aside time each month to update your statement and reflect on your financial performance.

Reviewing your cash flow statement regularly can help you spot problems early and take action before

cash flow problems affect payroll, vendor payments or growth plans.

Methods to prepare a cash flow statement

Most small businesses use accounting software to generate a cash flow statement automatically, but you can also build one manually using a template or spreadsheet. Regardless of how you create it, you’ll need to choose between the direct method and the indirect method.

- Direct method: The direct method uses gross cash receipts and gross cash payments to calculate cash flow. This includes money paid to suppliers, receipts from customers, interest and dividends received, interest paid and income taxes paid. This method can be time-consuming because it requires you to track cash receipts and payments for every transaction. You’ll also need to reconcile your cash flow statement with your income statement.

- Indirect method: Many businesses prefer the indirect method because it’s simpler and relies on data you already have. This approach starts with net income from your profit and loss statement and adjusts for noncash transactions. Next, it adjusts for changes in working capital using your balance sheet. Income statements use accrual accounting, so they show revenue when it’s earned, not when the money actually comes in. The indirect method also adjusts for noncash items like depreciation, which affects profit on paper but doesn’t change your cash balance.

Most small businesses use the indirect method because it’s easier to generate from accounting software, but the direct method can provide a clearer view of day-to-day cash movement.

What are the limitations of a cash flow statement?

A cash flow statement is a useful tool for reviewing past financial activity, but it has limits. For example, it focuses on historical data and doesn’t predict future cash flow.

“A cash flow statement is historically based,” explained Katie Swanson, a certified public accountant, certified valuation analyst and corporate controller at Inter-State Studio & Publishing Co. “It does not help a business look forward to manage cash today, next week or a month from now. Business owners are concerned with the ongoing operations of their business, not what happened last year.”

Swanson also noted that cash flow statements can be difficult to interpret without accounting skills. “The information is not presented in a way that makes sense to nonaccountants,” Swanson noted. “Therefore, the information is difficult for small business owners to use when making decisions.”

If you're unsure how to interpret your cash flow statement,

hiring an accountant can help you spot issues, improve forecasting and avoid costly cash flow problems. An accountant can also explain what the numbers mean for taxes, budgeting and growth decisions.

How is cash flow calculated?

Most modern accounting software calculates cash flow automatically, which can reduce errors. If you prefer to calculate it manually, you’ll need data from your balance sheet and income statement.

>>FREE TOOL: Cash Flow Calculator<<

A cash flow statement includes three main categories: operating, investing and financing activities. Together, these sections show whether your business gained or lost cash during the period. Here’s what each one means.

Operating cash flow

Operating cash flow reflects cash generated by your core business activities, such as selling products or services. It starts with net income and adjusts for noncash expenses and changes in working capital.

Operating cash flow = net income + depreciation and other noncash charges ± changes in working capital

Investing cash flow

Investing cash flow tracks cash spent on or generated from long-term assets and investments. Examples include purchasing equipment or selling property, as well as buying or selling investments.

Financing cash flow

Financing cash flow shows how your business raises capital and repays debt. This includes issuing equity or debt, repaying loans, paying dividends or buying back shares.

A simplified formula is:

Financing cash flow = cash from equity or debt issuance − dividends and debt or equity repayments

Net cash flow

Net cash flow combines all three categories:

Net cash flow = operating cash flow + investing cash flow + financing cash flow

Operating, investing and financing cash flows can fluctuate, but over the long term, businesses need positive cash flow to stay sustainable and

achieve profitable growth.

How do accounts payable and accounts receivable relate to cash flow?

It’s important to understand the difference between accounts receivable and accounts payable, because both affect your cash flow. Accounts payable is the money your business owes suppliers, while accounts receivable is the money customers owe you. Changes in accounts payable and accounts receivable can increase or decrease your cash flow, depending on whether those balances rise or fall.

- Accounts payable and cash flow: To see how accounts payable affects cash flow, compare the current period’s accounts payable balance to the previous period. If accounts payable increases, it typically improves cash flow in the short term because you’re delaying payments. If accounts payable decreases, it usually reduces cash flow because you’ve paid suppliers and cash has left your business.

- Accounts receivable and cash flow: For accounts receivable, look at how the balance changes over time. If it goes up, it usually means less cash in your bank account because customers haven’t paid yet. If it goes down, it generally means more cash on hand because those invoices have been paid.