Business.com aims to help business owners make informed decisions to support and grow their companies. We research and recommend products and services suitable for various business types, investing thousands of hours each year in this process.

As a business, we need to generate revenue to sustain our content. We have financial relationships with some companies we cover, earning commissions when readers purchase from our partners or share information about their needs. These relationships do not dictate our advice and recommendations. Our editorial team independently evaluates and recommends products and services based on their research and expertise. Learn more about our process and partners here.

Access to HR services and payroll management tools allows expanding businesses to better support their employees and manage complex everyday human resources (HR) workflows. As a payroll service provider, ADP works equally well for startups and established companies. On top of automating payroll processing and tax filings, ADP enhances hiring, the onboarding process and attendance tracking. Its customizable, multijurisdictional payroll plans scale with your organization, making ADP our pick for the best full-service payroll software for growing businesses. We also appreciate the platform’s intuitive mobile app, which makes self-service a breeze for workers and employers alike.

9.2 / 10

ADP brings more than 75 years of experience to the table. Its cloud-based human capital management (HCM) solutions unify payroll software, attendance tracking, employee benefits, and HR tools like learning management and administration. This makes it a top choice for businesses in highly regulated industries and those operating in multiple states.

ADP works for companies of all sizes, from payroll for one employee to enterprise services for 1,000-plus. It offers seven service plans: four through Run Powered by ADP (for one to 49 employees) and three through ADP Workforce Now (for 50 or more). If you start with a small business tier and your company grows, you can easily upgrade to Workforce Now, which is why ADP is our pick for the best online payroll service for growing businesses.

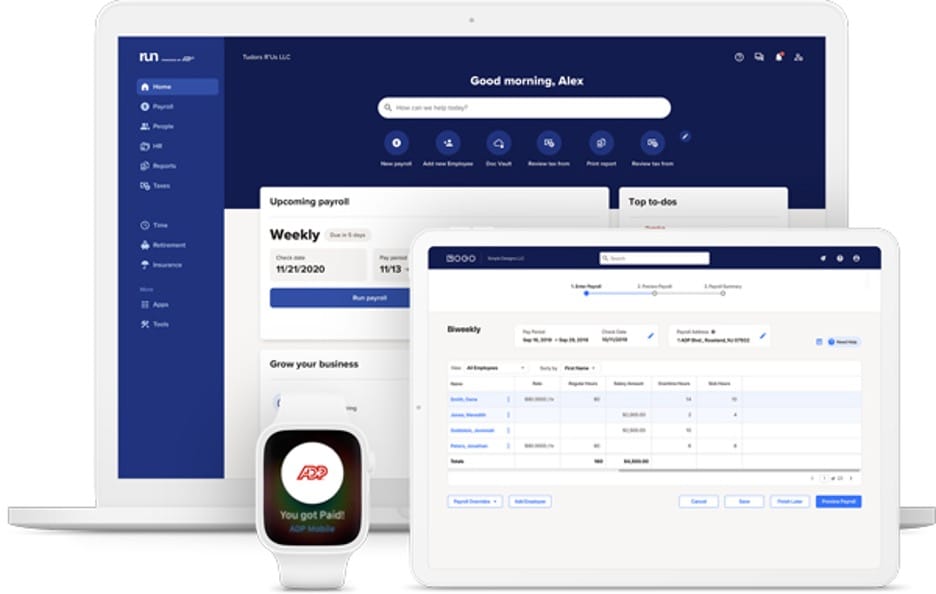

ADP’s flexibility extends to payroll processing, which you can run from a mobile device or desktop. As your needs expand, you can add features like an applicant tracking system and an employee handbook wizard. We also like that ADP incorporates digital recordkeeping and workforce management tools to help scale your company while controlling costs.

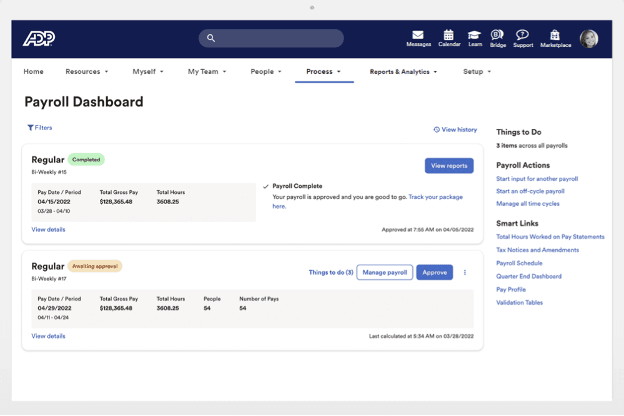

When we tested the system, we were pleased with ADP’s intuitive dashboard that put payroll data at our fingertips. The Run Powered by ADP platform is easy to navigate, with shortcuts at the top and a left sidebar for payroll, taxes and HR. For small businesses, the main screen displays a to-do list, calendar and recent and upcoming payrolls.

Similar to competitors, the system lets you preview account debits before running payroll. We liked how the dashboard flags employee records that require attention. Unlike most providers, ADP’s payroll software lets you add contractor pay alongside salaried or hourly employees — a real time-saver.

Larger organizations using ADP Workforce Now can customize their homepage. We found it slightly more complex to navigate due to its additional features, such as expense reimbursements, third-party sick pay and benefits administration. Notably, businesses can also connect the platform to one of the best accounting software solutions and set up automated payroll cycles with both ADP systems.

ADP is a complete payroll solution with basic and advanced services. With seven service plans and the capacity to handle one to 1,000-plus employees, most businesses can take advantage of the vendor’s paperless payroll capabilities, which streamline payment processing and reduce administrative tasks. Below are the features that stood out to us during our in-depth examination of ADP’s payroll services.

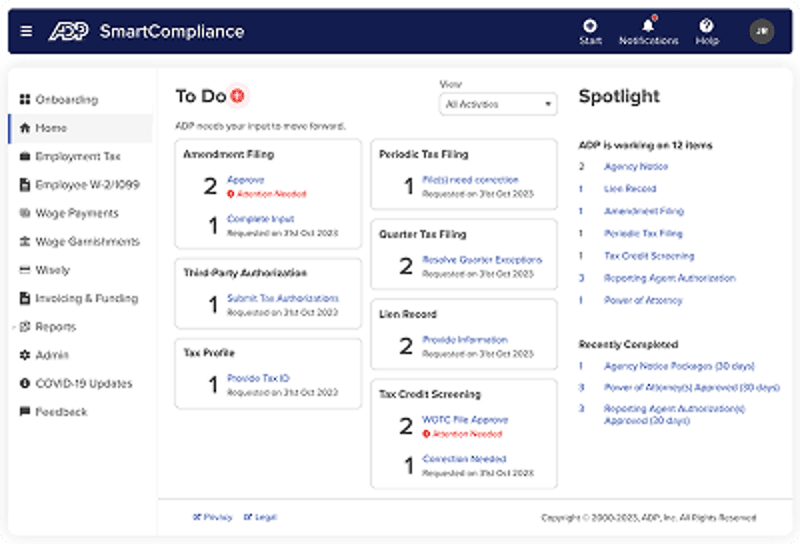

Like most competitors, ADP calculates payroll taxes and remits payments to federal, state and local agencies. We appreciate that ADP guarantees it will pay any fines or penalties if it makes a tax filing error. The company’s SmartCompliance tools can help streamline tax filing and manage HR compliance requirements, making it easier to stay on top of regulations as your business grows.

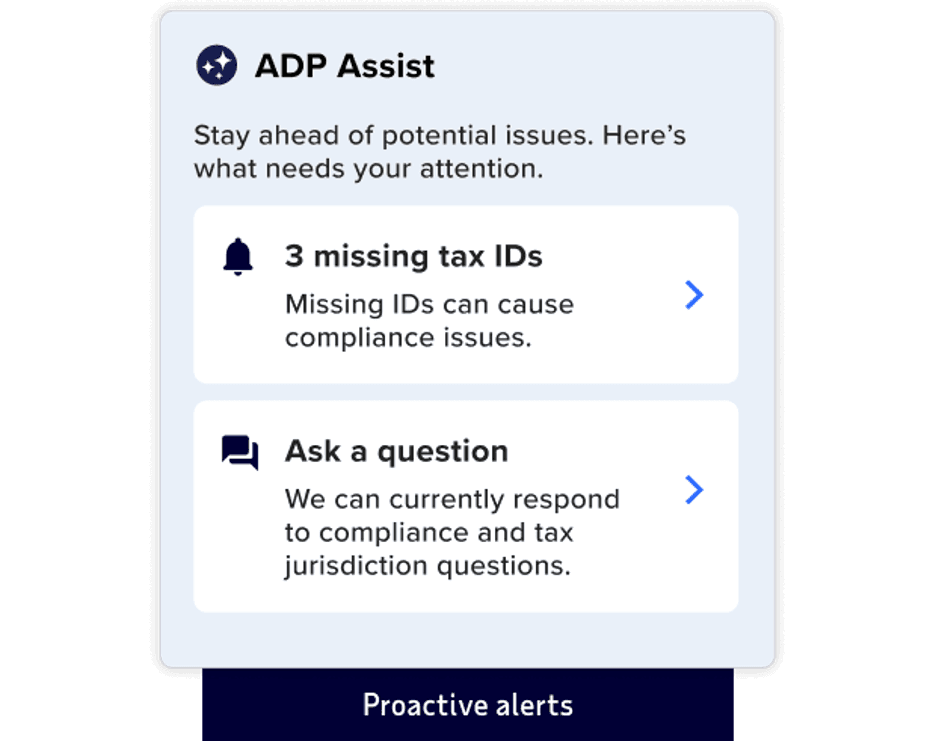

In addition, ADP can communicate with government agencies on your behalf and offers expert regulatory and compliance support. As your business expands, you can use built-in, AI-powered error detection and alerts to ensure your payroll and HR practices meet current standards.

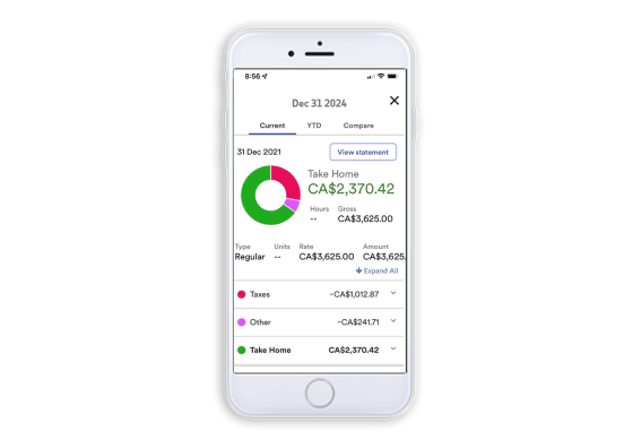

Most payroll providers allow manual or automated payroll runs through a web application. We like that ADP also supports payroll processing over the phone or through its iOS and Android mobile apps. While Run Powered by ADP computes deductions and payroll taxes, ADP Workforce Now adds capabilities like assigning compensation to specific funding sources and reconciling multiple pay rates.

Businesses can pay employees via direct deposit or by printing paper checks using most payroll software. With ADP, companies must use pre-printed check stock, or the vendor can deliver checks directly to your office, saving you the hassle of printing them yourself. As a direct deposit alternative, ADP offers payroll cards to employees through Wisely. The platform also integrates with enterprise resource planning (ERP) systems, providing a flexible, streamlined payment solution for growing organizations.

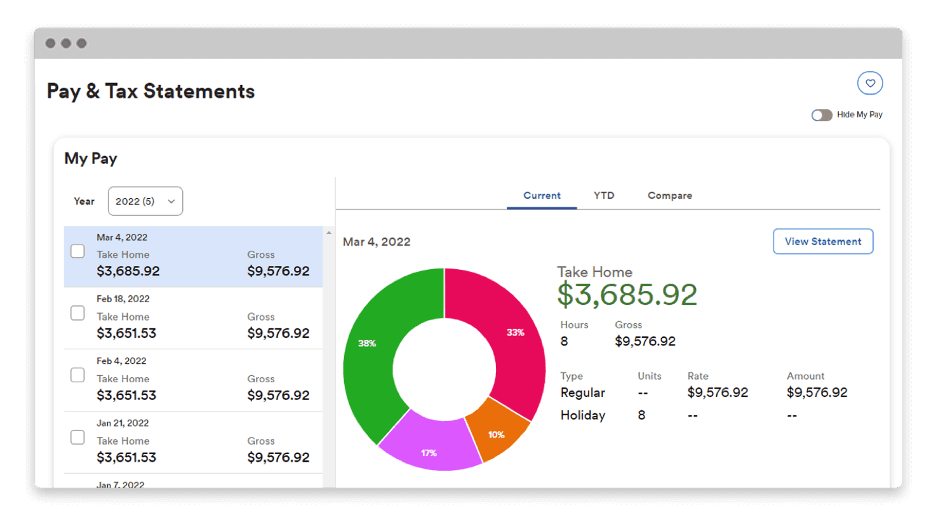

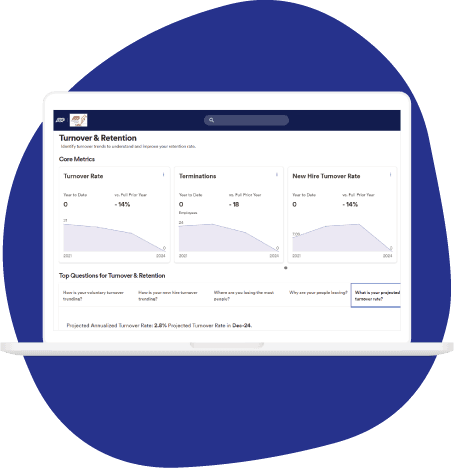

Not all payroll providers offer insights to support a growing business, but we were impressed with ADP’s basic and advanced data analytics tools. Smaller companies can view and customize compensation and tax information. As your business expands, you can leverage several unique payroll reporting features, including the Turnover Probability Explorer, compensation and workforce benchmarks, and the Pay Equity Explorer.

ADP offers more than 200 standard payroll reports and the ability to easily customize your own. With rapid report creation, we love that you can create and run a report in three steps. We also appreciated the ability to share and view payroll reports via the mobile app and download them into your accounting system.

ADP goes beyond the basic payroll-accounting integrations that many rivals offer. In addition to working with small business staples like QuickBooks Online and Wave, it connects with enterprise-level systems such as Sage 50 and NetSuite, plus hundreds of third-party apps for POS, time and attendance, benefits, productivity, collaboration, recruiting and onboarding through the ADP Marketplace. (Learn more about these top accounting programs ADP works with in our detailed review of Sage 50, our NetSuite review and our review of QuickBooks Online.)

Surprisingly, several payroll services lack mobile apps. However, we were pleased to see that ADP’s Mobile Solutions app — used by more than 20 million people, according to ADP — offers excellent functions for both employees and employers.

ADP’s mobile apps receive higher ratings among Android and iOS users than similar payroll tools offered by ADP’s competitors. However, Android users should note that features such as making pay rate changes and updating employee information are available only on Apple devices.

We were impressed by the breadth and depth of ADP’s optional HR and payroll services, which can help businesses manage people, processes and compliance as they grow. These include HR management, benefits administration and retirement and business insurance services.

Notably, background checks are available with every plan — a perk many competitors reserve for higher tiers. All plans also include new hire onboarding, employee discounts and ADP Employee Access, a self-service portal for workers.

Higher-tier plans include even more helpful services and functions, including:

These resources allow businesses to streamline hiring, personalize onboarding experiences, store records digitally and track employee development within ADP’s platform.

We also found ADP’s partnerships and unique offerings noteworthy. It’s the only payroll service we reviewed that provides Upnetic legal services, a valuable resource during rapid expansion. ADP Workforce Now subscribers gain even more capabilities, including HR compliance reporting, employee survey tools and ADP Assist, an AI-powered virtual assistant that uses real-time insights to help quickly resolve HR, payroll and benefits issues.

ADP Workforce Now integrates with more than 900 insurance carriers and offers extra benefits connections for larger businesses. We like that it includes advanced perks such as benefits analytics, a plan creation wizard, an AI-powered decision support tool, automated compliance tracking and mobile open enrollment for employees. You’ll also have access to dedicated support staff to guide your open enrollment and benefits strategy.

However, it’s worth noting that built-in benefits administration and time and attendance tools are included only with Workforce Now’s higher tiers. Small business users on ADP Run will need to purchase time and attendance functionality, as well as administration for health insurance, retirement and workers’ compensation plans, as add-ons.

ADP’s pricing depends on several factors, including payroll frequency, number of employees, and selected features. Because of this, businesses must contact ADP for a custom quote. While that’s not unusual in the payroll industry, the lack of upfront pricing can make it harder to compare ADP’s costs with competitors.

Below is an overview of the available plans for Run Powered by ADP and ADP Workforce Now, along with key features in each tier.

Run Powered by ADP is primarily designed for organizations with one to 49 employees. All plans include automated payroll processing, multiple ways to run payroll (online, by phone or mobile app) and employee self-service tools. Higher tiers add more HR and compliance support.

Plan | Features |

|---|---|

Essential Payroll |

|

Enhanced Payroll | Everything in Essential Payroll, plus:

|

Complete Payroll & HR Plus | Everything in Enhanced Payroll, plus:

|

HR Pro Payroll | Everything in Complete, plus:

|

Paid add-ons include time-tracking, retirement plans, workers’ compensation management and health insurance. Certain services, like W-2 filing on your behalf, may incur extra fees.

ADP Workforce Now is well-suited to midsize companies, though it can handle organizations with 1,000-plus workers. All tiers come with payroll integrations, background checks, new hire reporting, automated payroll and full federal, state and local tax filing.

Plan | Features |

|---|---|

Select |

|

Plus | Everything in Select, plus:

|

Premium | Everything in Plus, plus:

|

Paid add-on options include performance management, HR assistance, talent acquisition tools, advanced data analytics and compensation management.

In general, we found that ADP offers a more hands-on onboarding experience than other online payroll service providers. For starters, the ADP implementation team and service representatives consider your unique needs and goals to ensure the system is installed properly. They assist with payroll setup and transitioning from another payroll provider.

Depending on your company’s size, ADP can deliver both in-person and online training. We especially liked the interactive simulations, which made it easier to learn key payroll processes before going live. While entering payroll data is inherently time-consuming, the added guidance and 24/7 customer support made the process more manageable.

The platform’s employee self-service tools also simplify onboarding for new hires. You can invite employees to enter their own direct deposit and benefits information, reducing data entry on your end. Combined with ADP’s clean, intuitive interface, this helps minimize confusion and speeds up company-wide adoption.

Unlike many payroll providers that limit assistance to business hours, ADP offers customer support 24 hours a day, seven days a week. Whether you’re on the entry-tier plan or the most advanced package, you can reach a representative by phone or through your client administrator portal.

Higher-tier packages come with even more support perks. In addition to round-the-clock assistance, you can connect with HR professionals, business advisors, marketing experts and even legal specialists — resources that can be especially valuable as your business grows.

ADP’s website also has several valuable resources, including a knowledge base where both administrators and employees can get answers to a wide range of questions. These self-service resources make it easy to find quick answers without picking up the phone.

Here are some potential concerns if you’re considering ADP as your payroll provider:

When determining the best options for businesses choosing a payroll provider, we considered several factors, including payroll and HR features, integrations and overall usability. Our process involved comparing dozens of platforms, speaking directly with vendor representatives and customer service agents, and reviewing user feedback. We also tested payroll software ourselves to see how each system performed in real-world scenarios. To assess scalability for growing businesses, we evaluated the number of plans each provider offered and how their features evolved to meet the needs of companies adding employees and managing increasingly complex HR workflows.

We recommend ADP for …

We don’t recommend ADP for …

Erin Donaghue contributed to this article.