Business.com aims to help business owners make informed decisions to support and grow their companies. We research and recommend products and services suitable for various business types, investing thousands of hours each year in this process.

As a business, we need to generate revenue to sustain our content. We have financial relationships with some companies we cover, earning commissions when readers purchase from our partners or share information about their needs. These relationships do not dictate our advice and recommendations. Our editorial team independently evaluates and recommends products and services based on their research and expertise. Learn more about our process and partners here.

What Are Insurance Endorsements?

Effectively mitigate business risk by understanding different types of insurance endorsements and how to use them.

Table of Contents

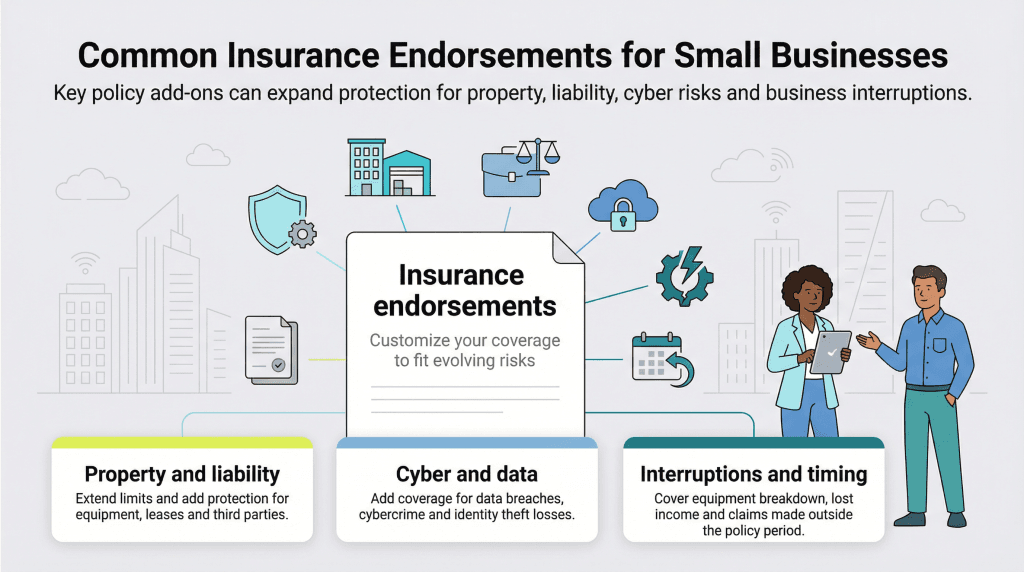

Insurance is a critical business necessity, but standard business policies may not cover every type of loss your business could face. Fortunately, adding an insurance endorsement can adjust your coverage to address specific risks. Endorsements broaden or narrow coverage on an existing policy, and most insurers offer them as add-ons so you can increase protection as needed. Some endorsements offer additional protection for insurers, while others safeguard your business. In this guide, we’ll break down how insurance endorsements work and what you need to know to help protect your operation.

What are insurance endorsements?

Insurance endorsements, also known as insurance riders, are updates to your insurance policy that add, remove or change coverage. An endorsement can also raise standard coverage limits and override the original policy terms.

How do insurance endorsements work?

Insurance endorsements work by officially updating your policy to reflect changes in coverage. With an endorsement, you can:

- Add, remove or change coverage

- Adjust limits

- Update policy terms

- Modify definitions, exclusions or conditions

- Add information to the declarations page

- Introduce new exclusions

If you have a homeowner’s policy, you may already be familiar with endorsements. For example, a standard endorsement might add coverage for mold removal or backed-up sewers and drains. These endorsements help cover specific risks tied to expensive home repairs or damage.

Endorsements in business insurance work the same way. They may protect business property, cover equipment breakdowns, or extend the reporting window for errors and omissions insurance claims. For example, a business policy might include umbrella coverage as an endorsement — a helpful way to boost your liability limits if a big claim goes beyond what your standard policies cover.

Types of insurance endorsements and examples

There are several types of insurance endorsements. Some of the most common include the following:

Standard endorsements

Standard endorsements are among the most commonly requested. Some examples include:

- Name and address changes

- Earthquake endorsements

- Endorsements to protect against zoning or tax errors

Insurance companies often use templates for these endorsements, developed by organizations like the Insurance Services Office (ISO), to ensure they meet legal and regulatory standards.

Nonstandard endorsements

Nonstandard endorsements cover unique situations not included in standard endorsements, such as:

- Protection for specific exposures

- Coverage for a valuable asset

- Insurance for high-risk activities

Insurance companies may modify standard templates or draft new documents to meet your business’s needs. If you’re considering a nonstandard endorsement, consult a legal professional to ensure it fits your situation.

Mandatory endorsements

Mandatory endorsements are required by law, regulations or industry standards to ensure your policy meets specific legal or compliance requirements. Examples include:

- Flood coverage in areas with high flood risk

- Endorsements required by ISO guidelines

- State-mandated endorsements for auto policies

Additionally, some mandatory endorsements clarify policy terms, such as how long an insurer must wait before it can cancel a policy, in compliance with state law. Consult your business insurance broker or agent to ensure you’re aware of any mandatory endorsements that apply to your location or industry.

Voluntary endorsements

Voluntary endorsements are additional coverage options that policyholders and insurers choose to add to a policy. Most policyholders opt for voluntary endorsements to:

- Modify or add coverage: An endorsement can modify or expand the scope of existing coverage. It might add industry-specific enhancements, extra parties, new business locations or loss payees. For example, many commercial property policies come with an exclusion for losses caused by communicable diseases. However, you can choose to purchase an endorsement to include that type of loss.

- Exclude or narrow coverage: You can also add endorsements that limit coverage, such as excluding a specific operation. For example, a contractor who doesn’t do roofing might get an endorsement that excludes coverage for roof work. This type of exclusion can lower the premium, since the contractor agrees not to perform roofing work in exchange for giving up coverage for related claims.

Endorsements can also involve content changes that don’t affect coverage, such as:

- Editorial changes: These updates are made by the insurer to clarify the policy without changing the coverage.

- Administrative changes: These revisions reflect the document’s validity and incorporate details like an updated mailing address.

Examples of common endorsements

Here are the most common ways to use endorsements to modify or add coverage to your current policy.

Business property endorsements

Business property adjustments are among the most common endorsements. A business property endorsement can extend coverage for your equipment, inventory or other physical business assets. You can also opt for endorsements that increase or decrease your company’s property coverage limits.

Blanket additional insured endorsements

You’ll usually find a blanket additional insured endorsement in commercial general liability insurance or a commercial property policy. This endorsement extends protection to a person — such as a contractor, client or another entity — when your business is contractually required to provide coverage. It can also offer protection if that third party is named in a business lawsuit related to your operations.

Waiver of subrogation endorsements

A waiver of subrogation is a type of commercial insurance endorsement. It prevents your insurance carrier from recovering money it paid on a claim from a third party that may have caused the loss. This type of endorsement is often required in contracts to help protect business relationships and avoid disputes.

Prior acts coverage endorsements

A prior acts coverage endorsement provides protection for claims involving incidents that occurred before you purchased your current liability policy. It’s often confused with tail coverage, which applies to claims made after a policy ends. However, prior acts coverage applies to claims from before your policy began. This endorsement is important if your policy doesn’t include a retroactive date and you still have potential claims tied to earlier events.

Extended reporting period (ERP) endorsements

This endorsement, which you can add to an errors and omissions policy, extends the time you have to report a claim after your policy expires — usually for one to five years. This can be especially valuable if a claim is made long after the work was completed.

Equipment breakdown or business interruption endorsements

Adding these endorsements to your commercial property insurance can help cover equipment damage and business interruptions caused by unexpected mechanical or system failures. The interruption might include time and labor costs resulting from a sudden electrical, mechanical, refrigeration or computer breakdown. This type of endorsement is often tied to business interruption insurance, which helps cover lost income and operating expenses when your business can’t operate due to covered damage.

Primary and noncontributory language endorsements

You would request this endorsement to ensure your insurance policy pays first in the event of a loss, without requiring contributions from other applicable policies.

Identity theft and cyber protection endorsements

You’d add these types of endorsements to an existing policy to insure against losses and expenses — such as legal fees — that result from identity theft, cyberattacks, cyber extortion and compromised data.

Small businesses should carefully consider adding these endorsements, as the stakes are high. According to the Hiscox Cyber Readiness Report, 67 percent of businesses reported an increase in cybercrime incidents over the past year, showing that this threat is growing. Additionally, 47 percent of businesses had trouble attracting new customers after a security incident, and 43 percent lost existing customers.

Commercial adjuster Sheila Flores emphasized the importance of carefully evaluating which cyber protection endorsements to get. “What would normally require an underwriter or actuary to present future risks, with cyberthreats, it will require IT and computer analytics input,” Flores explained. “The state commissioners require notification of such threats in order to identify regulation needs and act accordingly. Once a regulation is set, endorsements will be needed to cover these risks.”

Commercial lease and tenant endorsements

Adding this type of endorsement to your commercial general liability policy helps cover liabilities that arise from a tenant’s operations or negligence in a leased space.

Hired and non-hired auto endorsements

This type of endorsement is helpful for small businesses that don’t need commercial automobile insurance but have employees who rent, borrow or use their vehicles for work. When you add this endorsement to your company policy, you’ll gain coverage for damage to another person’s vehicle, medical expenses if someone else is injured in an accident, and legal fees if your business is sued.

Keep in mind that a hired and nonowned auto endorsement doesn’t cover the policyholder — including medical bills for you or your employee if you’re hurt in an accident while driving a rented or personally owned vehicle.

Endorsements for emerging risks

New risks are continually emerging, and as they do, new endorsements will follow. For example, Flores noted that as more organizations implement hybrid and remote work plans, they may need to consider endorsements that cover new exposures and evolving risks.

“With remote locations, internet safety and protection of client personal identification information will be of utmost importance,” Flores explained. “Revised endorsements should reflect coverage for such risks. With hybrid environments, the risks are unique to the locations in which the businesses work from. This could result in multiple endorsements to cover multiple locations. A business should be prepared for a premium to reflect these risks.”

How do you add or request an endorsement?

The best business insurance providers make it easy to add or remove policy endorsements and can guide you with their expertise. You can usually request changes to your coverage at any time during your current policy period or during a natural transition point, such as a renewal. However, endorsement requests must be approved by your insurer and may be subject to underwriting review.

You can also ask if the insurance company offers standard endorsement samples for your industry. These endorsements are often available at a lower cost than custom ones you request separately.

Many state statutes — including New York’s — mandate that insurance endorsements be filed with the superintendent of insurance to be considered valid. These types of riders can last for the duration of the policy or continue upon renewal.

Regulations governing endorsements

Insurance companies can add an endorsement that either excludes or includes a different type of coverage to help mitigate their risk; however, you must be informed of these exclusions or modifications.

Rest assured, most states have protections and guidelines in place, and policy changes involving endorsements typically require regulatory review and approval. According to the New York State Department of Financial Services, which governs the insurance marketplace in New York, “If a Certificate of Insurance amends, expands or otherwise alters the terms of the applicable insurance policy, it constitutes an endorsement that is a policy form, which, subject to certain exceptions, must be filed with the Superintendent of Insurance pursuant to section 2307(b).”

Another example of state-level protections comes from Texas. Under Chapter 2301 of the Texas Insurance Code, “Policy forms and endorsements may not be unjust, unfair, inequitable, misleading or deceptive.” Also, “Coverage forms are prior approval. Change endorsements may be used to change insured address, etc., but may not be used to change, alter or ‘clarify’ coverage in any way. Company must provide verification that the endorsement will not be used to change, alter or clarify coverage.”

Insurance endorsement FAQs

Nathan Weller contributed to this article.