Business.com aims to help business owners make informed decisions to support and grow their companies. We research and recommend products and services suitable for various business types, investing thousands of hours each year in this process.

As a business, we need to generate revenue to sustain our content. We have financial relationships with some companies we cover, earning commissions when readers purchase from our partners or share information about their needs. These relationships do not dictate our advice and recommendations. Our editorial team independently evaluates and recommends products and services based on their research and expertise. Learn more about our process and partners here.

Merchant One provides an intuitive platform, various payment acceptance options and an easy application and approval process. The platform integrates with hundreds of third-party apps and has high customer satisfaction ratings. Plus, it offers text marketing, loyalty programs and gift cards to help you boost sales. We were most impressed by Merchant One’s flexible custom pricing model.

8.9 / 10

Merchant One tailors pricing to each client business’s unique needs. The company works with merchants to create custom pricing and packages, allowing nearly any small business to start accepting credit card payments and digital payment methods with ease. Other credit card processors we evaluated didn’t offer this level of pricing customization. Merchant One also provides a well-rounded and robust feature set.

Merchant One facilitates credit card payments via terminal swiping, smartphones and tablets. Source: Merchant One

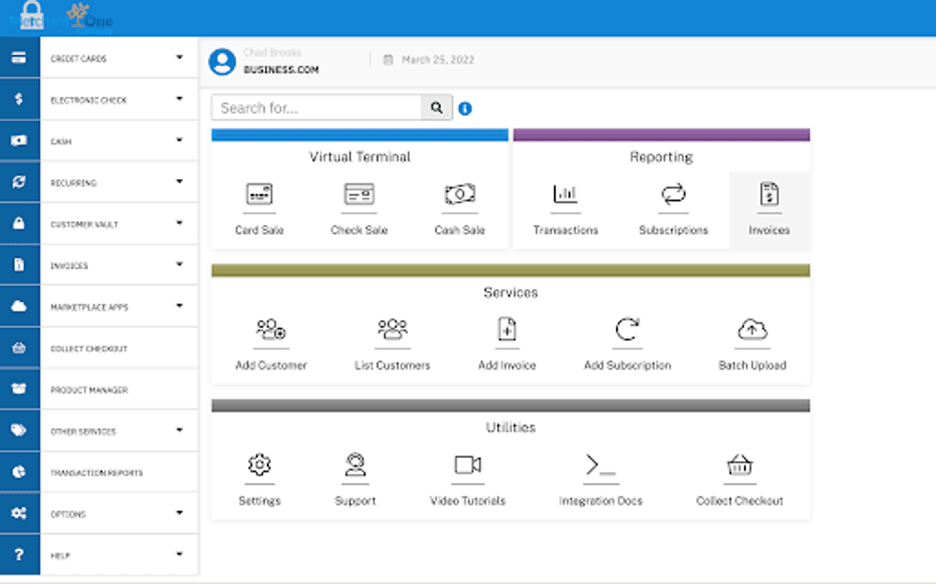

Merchant One’s credit card processing functionality is intuitive and easy to use. The platform’s modern user interface (UI) features a logical layout with tabs for credit card payments, checks, invoices, reports and more.

Merchant One’s central dashboard displays key tools like the virtual terminal, reporting functions and customer lists prominently. Its virtual terminal makes entering customer information and accepting credit card payments seamless and straightforward. Merchant One’s system is easy for business owners and teams to learn quickly.

Merchant One’s sleek and friendly UI makes it easy for merchants to start using the platform effectively. Source: Merchant One

During our review of Merchant One, we especially liked the following features.

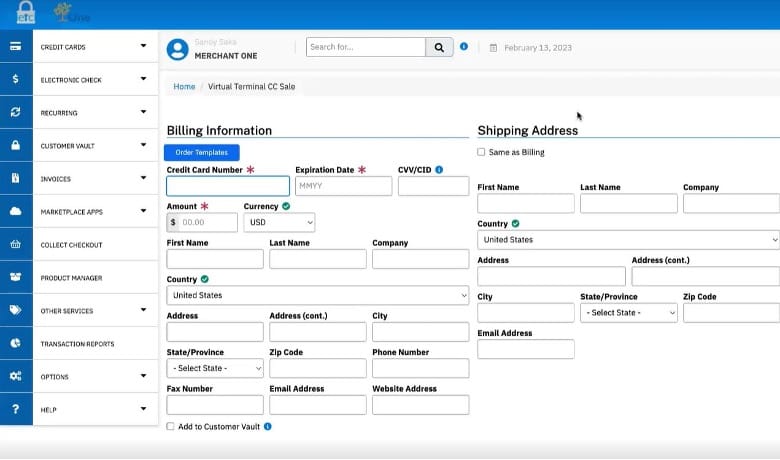

We found Merchant One’s virtual terminal intuitive to learn and use. Businesses that accept credit card payments over the phone can easily enter customer transaction data in a web browser. You can also use it to accept automated clearing house payments.

Merchant One’s form can feel a little busy compared to virtual terminals from other processors, such as Clover. However, Merchant One securely stores customer information in the “customer vault” for easy access and recurring payments.

Merchant One’s virtual terminal makes it easy to enter customer information manually. Source: Merchant One

Merchant One’s reporting and data analytics features help merchants better understand sales trends, including:

One downside is that Merchant One doesn’t produce certain data visualizations such as graphs.

We were impressed by Merchant One’s tools for setting up an online store.

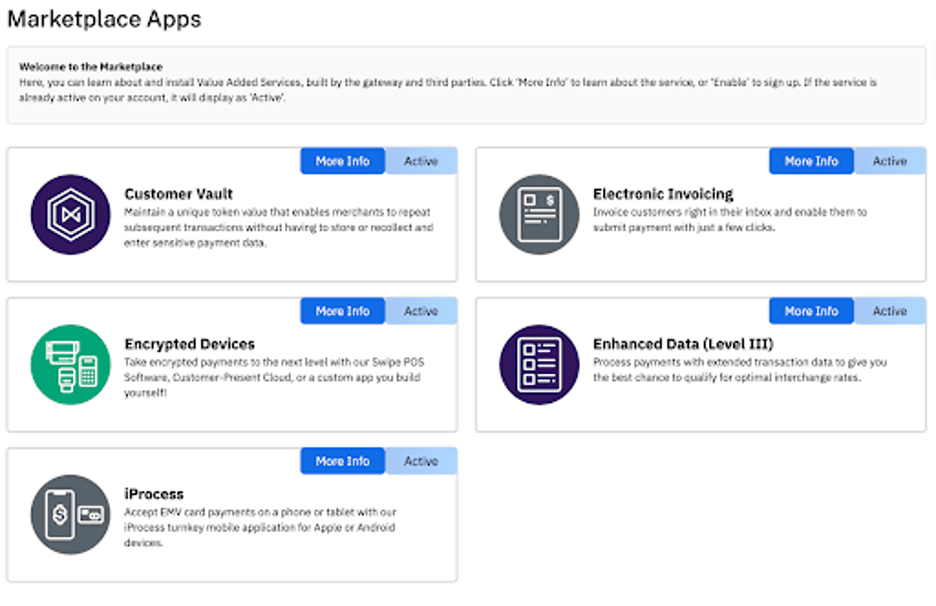

We were impressed by the breadth of Merchant One’s compatibility with third-party apps.

Merchant One offers a wide selection of integrations. Source: Merchant One

Merchant One doesn’t manufacture its own hardware, unlike some competitors, such as Clover and Square.

Merchant One is an authorized reseller of Clover POS terminals, including the Clover Station. Source: Merchant One

Merchant One’s payout time is similar to that of competing credit card processors. That means you won’t need to worry about cash flow problems from slow processing times.

If you prefer same-day funding, check out our review of Chase Payment Solutions. Chase is the only competitor we reviewed that offers same-day deposits.

Merchant One charges a flat monthly fee of $13.95 for its payment processing services. However, your actual price will depend on your specific hardware preferences and other factors. This flexibility allows merchants to create a custom solution that best fits their needs. Some factors to consider include the following:

Merchant One uses an interchange-plus pricing model, in which you pay interchange fees set by the credit card networks, plus a fixed markup. Your transaction rates will vary based on how payments are processed. Your business type, volume and the type of card your customers use will also affect your rates, which combine the interchange fee and Merchant One’s markup:

Merchant One has a high approval rating and serves many businesses, including those with low credit card scores and organizations in high-risk industries. According to the company, any legitimate business can be approved, and Merchant One states on its website that it has a 98 percent approval rate.

The application and approval process is quick and easy. You complete the initial application online and then speak on the phone with a representative to discuss your business and specific credit card processing needs. Merchants can start taking payments on the same day in most cases.

If you buy a Clover POS system from Merchant One, the company will help you set it up, offer training and provide in-house support.

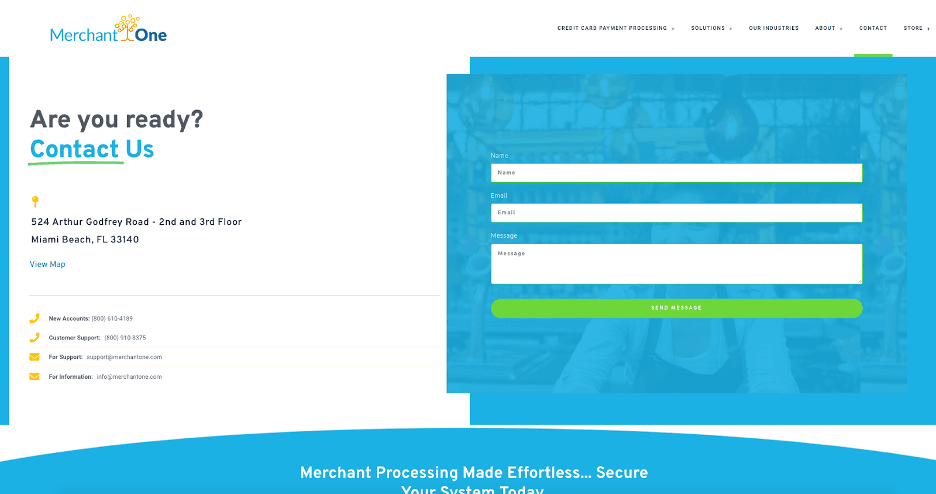

We found Merchant One’s customer support options to be quite robust compared to other competitors:

Merchant One earns high customer satisfaction scores on independent review sites. The company scores a 4.8 out of 5 on Trustpilot. Many customers praise Merchant One’s customer support, while many competitors we reviewed fared poorly on third-party review sites.

Merchant One offers 24/7 phone support. Source: Merchant One

Merchant One is an excellent option for many merchants, but we did identify the following limitations:

We researched and analyzed the best credit card processors to find the right services for small businesses. Our investigation process included viewing demos, testing free trials, examining user reviews carefully and interacting with each vendor’s customer service team. We looked at the usability of each company’s hardware and software offerings and evaluated how fair the contract terms are to merchants.

Furthermore, we scrutinized the rates and fees charged by each processor. When considering flexible pricing specifically, we paid particular attention to how willing the providers were to customize their pricing options.

We recommend Merchant One for …

We don’t recommend Merchant One for …