Business.com aims to help business owners make informed decisions to support and grow their companies. We research and recommend products and services suitable for various business types, investing thousands of hours each year in this process.

As a business, we need to generate revenue to sustain our content. We have financial relationships with some companies we cover, earning commissions when readers purchase from our partners or share information about their needs. These relationships do not dictate our advice and recommendations. Our editorial team independently evaluates and recommends products and services based on their research and expertise. Learn more about our process and partners here.

Payroll and accounting go hand in hand, making integration between your financial software essential. Intuit QuickBooks Payroll is the best full-service payroll solution with an accounting integration, thanks to how it syncs seamlessly with QuickBooks Online. Whether you add a payroll module to your existing QuickBooks account or purchase a bundled plan, paying employees is a breeze. Moreover, small businesses benefit from federal and state tax filing through QuickBooks, as well as tax penalty protection.

9.4 / 10

As small businesses look to consolidate vendor contracts and streamline operations, Intuit QuickBooks offers an ideal solution for payroll and accounting needs. QuickBooks Online users can add payroll services to their existing subscriptions, while new customers can bundle payroll and bookkeeping or select a stand-alone Intuit QuickBooks Payroll plan. With a single solution like this, we love that you don’t have to integrate payroll with third-party tools or reenter payroll data into your accounting program.

Other payroll providers, like Paychex, charge fees for general ledger integrations on their base plans. Only Patriot Payroll offers similar integration with its accounting software. However, QuickBooks Online is market-leading small business software. With 6.5 million customers worldwide, QuickBooks Payroll’s ease of use for running payroll, calculating employee deductions and viewing reports also factored into our assessment. These features and others make QuickBooks Payroll the best online payroll service for businesses seeking an accounting integration.

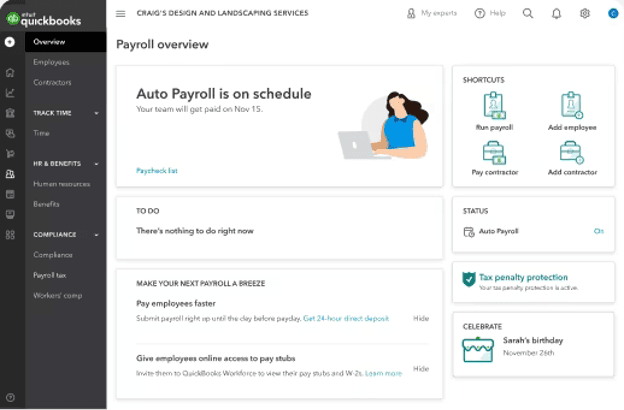

View essential payroll information from your QuickBooks Payroll dashboard. Source: QuickBooks

When evaluating QuickBooks Payroll, we explored its online interface, mobile apps and workforce portal. In each case, the software was easy for new users to navigate, and if you’re familiar with the QuickBooks Online accounting software, you’ll quickly recognize the layout.

The main screen shows your auto payroll status, upcoming birthdays and a to-do list. You can also access shortcuts to quickly run payroll, pay a contractor, and add an employee or contractor. We appreciated the timely alerts for upcoming tax payments, which allowed us to see the tax type, payment status and method.

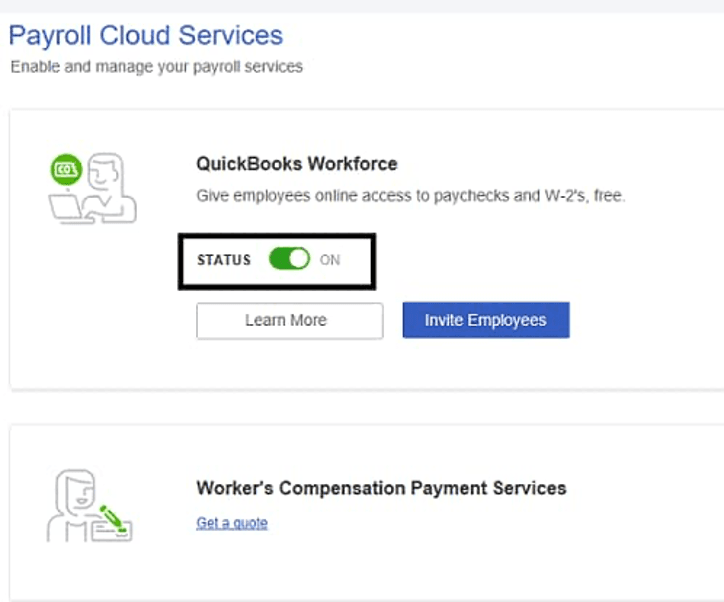

Because each QuickBooks Payroll version includes Intuit’s employee workforce portal, adding new team members or updating information is straightforward. Employees enter information about their bank accounts and complete W-4 forms online. Then, employers select hourly or salaried employees, wage rates and additional pay types, and they’re ready to go.

Salaried employees’ pay rates remain in the system, so you don’t have to enter their hours manually. However, you must input staff hours to run payroll if you don’t have integrated time-tracking tools. Depending on the number of workers, it could take five to 15 minutes. After reviewing your payroll summary, you simply click to submit it.

Alternatively, you can set up automatic payroll, which works best for companies with salaried staff on direct deposit. We also like that QuickBooks Payroll manages your state and federal taxes, so you don’t have to worry about missing a tax filing deadline.

Enable QuickBooks Workforce to allow your team to view payroll and tax information online. Source: QuickBooks

Small businesses that are seeking a streamlined solution for complex payroll tasks will appreciate QuickBooks Payroll’s capabilities. Although the features vary by plan, all tax and payroll processing services integrate seamlessly with Intuit’s accounting software.

Payroll ledgers, which involve payroll journal entries, are essential to recordkeeping, whether you run payroll manually or automatically. Several payroll systems integrate with QuickBooks Online, but those payroll providers may charge add-on fees for general ledger or integration services. With QuickBooks Payroll, there’s nothing to sync or troubleshoot when the programs suddenly stop connecting. It simply works, and that’s why QuickBooks Payroll tops our list for businesses that prioritize accounting integration.

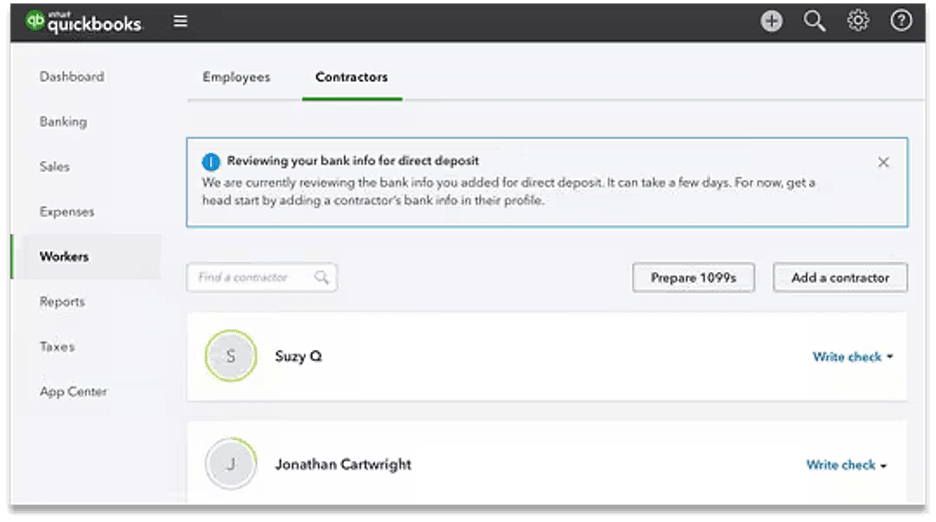

Several top-rated payroll services allow unlimited payroll runs. With an Intuit QuickBooks Payroll account, you can run payroll for employees, contractors or freelancers automatically or manually as often as you want. QuickBooks calculates wages and deductions to ensure accurate payroll withholding, and then business owners review and submit payroll for processing.

Easily toggle between W-2 and 1099 workers in your QuickBooks Payroll dashboard. Source: QuickBooks

Similar to competitors, QuickBooks Payroll allows payment via direct deposit and paper checks, but depending on your subscription tier, additional fees may apply when you pay contractors via direct deposit. Your staff can view pay stubs via the workforce portal, and employees can sign up for a Netspend Visa prepaid card as an alternative to direct deposit. Although we appreciate this option for unbanked individuals, pay card fees are higher than those of competitors. (Note: The payroll card feature isn’t available in Vermont.)

Customize paychecks and pay slips in QuickBooks Payroll, or use the system’s default options. Source: QuickBooks

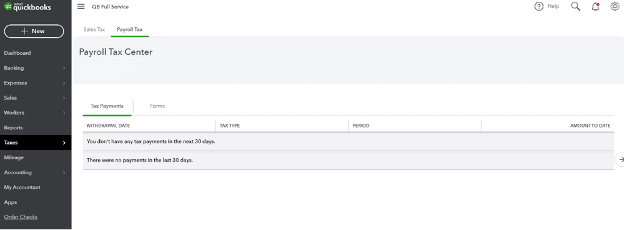

Most full-service payroll providers will automatically file taxes on your behalf. QuickBooks Payroll calculates, files and pays state and federal taxes. However, QuickBooks Payroll Core does not support automated payments or filings for local taxes, and businesses that file in more than one state will need to pay $12 per month for each additional state. Multistate tax filings cost extra only with the Core and Premium plans; Elite users don’t pay an additional fee. You can also choose to file your payroll taxes manually.

Click the Taxes tab to view upcoming payroll tax payments and recent withdrawals. Source: QuickBooks

Like many other payroll vendors we reviewed, QuickBooks Payroll manages your year-end tax form responsibilities. If you use automatic payroll processing services, QuickBooks will prepare and file your W-2 forms with the IRS. You can print them, or employees can view them in the workforce portal. You can also create and e-file unlimited 1099-MISC and 1099-NEC forms and have copies sent electronically to contractors. Additional fees may apply if you choose to have tax forms mailed.

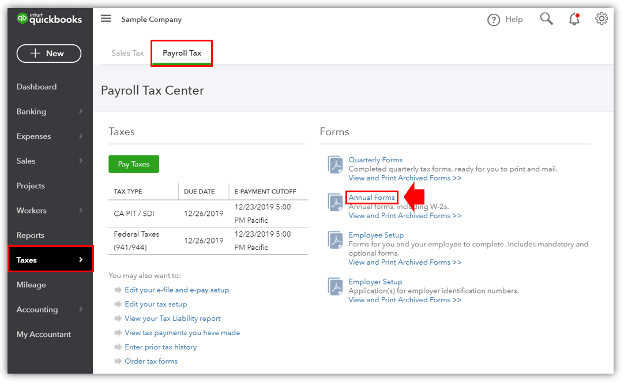

See important deadlines and download forms in the Payroll Tax Center. Source: QuickBooks

Many online payroll services administer retirement plans, offer health insurance or track paid time off (PTO). QuickBooks Payroll offers basic amenities. We liked that we could track sick and vacation pay or let the system automatically accrue hours per pay period. Employees can view available PTO through their portal.

QuickBooks Payroll partners with third parties for various benefits. Allstate provides health benefits, Guideline covers retirement plans, and Next handles workers’ compensation insurance. Availability varies by subscription and location. Payroll Core subscribers pay a nonrefundable monthly fee for workers’ compensation administration.

Typically, payroll systems let users view and download data by time frame, employee or location. QuickBooks Payroll’s downloadable reports include tax payments, PTO, payroll history, bank transactions and more. You can see information by employee or contractor. We like that you can also dive into workers’ compensation, edited time activities or employee details, and we appreciate that payroll reporting is included with all three subscription tiers.

Use QuickBooks Payroll data to improve your payroll reporting and recordkeeping. Source: QuickBooks

Each QuickBooks Payroll plan includes tiered team management tools, with more advanced features available in the Premium and Elite subscriptions. The Core plan offers basic tools, like document sharing and a company organization chart. Premium subscribers gain enhanced capabilities, including the ability to upload documents, request and share digital signatures, and use automated I-9 compliance to streamline onboarding. Elite subscribers receive all of these features, plus advanced onboarding tools and access to a personal HR advisor.

We appreciate that QuickBooks Payroll offers multiple subscription options. These tiers, detailed below, allow businesses to choose the best plan for their needs.

Plan | Price | Features |

|---|---|---|

Payroll Core | $50 monthly, plus $6 per employee per month |

|

Payroll Premium | $85 monthly, plus $9 per employee per month | Everything in Core, plus:

|

Payroll Elite | $130 monthly, plus $11 per employee per month | Everything in Premium, plus:

|

Contractor Payments | $15 monthly for up to 20 contractors; $2 for each additional contractor | Next-day direct deposit

|

If you already use QuickBooks Online, you can add payroll services to your current plan anytime. Prices for bundled accounting software and payroll are as follows:

Plan | Price |

|---|---|

Payroll Core + Simple Start | $85 monthly, plus $6 per employee per month |

Payroll Core + Essentials | $115 monthly, plus $6 per employee per month |

Payroll Premium + Plus | $184 monthly, plus $9 per employee per month |

Contractor Payments + Simple Start | $50 monthly for up to 20 contractors; $2 for each additional contractor |

QuickBooks provides a helpful outline for setting up your payroll system. It’s a self-guided process for Payroll Core users, and aside from entering data, we found it uncomplicated. You submit business and employee information, such as pay rates, bank account details and payroll history.

Existing QuickBooks users can add payroll services to their accounting platform and follow the same steps to deploy the payroll solution. If you opt for the Premium plan, an expert can review your setup. Elite users receive full support, with QuickBooks handling the entire configuration or migration process.

QuickBooks Payroll also makes it easy to onboard employees. Under the Payroll tab, click Employees. Then, select individuals to send QuickBooks Workforce invites via email. Alternatively, you can add employees and invite them to enter their information during onboarding. Each time you run payroll, employees receive an email letting them know their pay stubs are available to view, print or download.

Premium and Elite users can share important documents and request digital signatures from new hires. They can also automate I-9 compliance to simplify the onboarding process. No matter which plan you choose, employees can access their pay stubs and other important information through the workforce portal.

Our interactions with the QuickBooks team were mainly positive, with relatively quick response times and accurate answers to our questions. However, some users have reported long wait times, which is somewhat typical for payroll providers during peak hours.

QuickBooks Payroll has notable advantages, but we did identify the following limitations:

We examined dozens of payroll solutions that help small business owners realize the benefits of paperless payroll. Our research included speaking with company sales representatives and support agents, experimenting with demos, testing software, and reading user reviews. We evaluated each platform based on usability, third-party integrations, payroll and HR features, and pricing. To determine the best payroll software for business owners who prioritize accounting integration, we focused on vendors that offer all-in-one accounting and payroll products.

We recommend QuickBooks Payroll for …

We don’t recommend QuickBooks Payroll for …

Erin Donaghue contributed to this review.