After hiring your first employees, you’ll need to begin administering employee benefits. While some benefits are required legally, packaging additional perks and benefits can help you attract and retain top talent — a necessary element of business growth. Today’s job seekers carefully evaluate job offers based on company culture, compensation management and employee benefits, so creating a comprehensive benefits package with affordable rates is critical.

We’ll explain how to offer employee benefits and share service and software recommendations to make administering employee benefits packages easier.

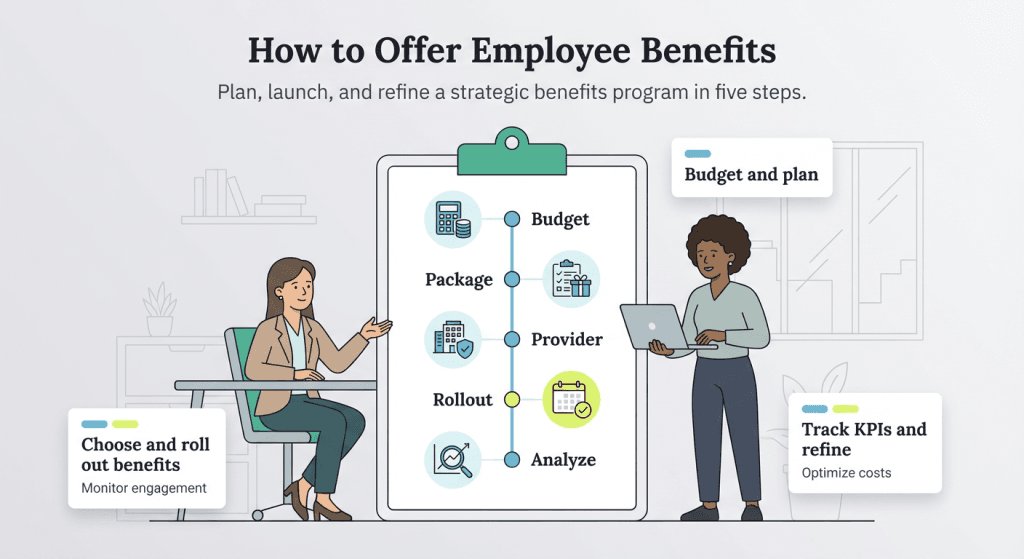

How to offer employee benefits

Strategic employee benefits management can help even the smallest companies create an attractive benefits plan. Take the following five steps to start offering employee benefits to your team.

- Determine your benefits management budget

- Choose your benefits package

- Choose a benefits provider to administer benefits

- Roll out your benefits plan

- Monitor and modify benefits as needed

Step 1: Determine your benefits management budget.

Employee benefits are expensive, typically accounting for roughly one-third of an employee’s total compensation, along with wages and salary. According to the Bureau of Labor Statistics, the average employer spends roughly $15 per hour on an employee’s benefits, with $3.68 going toward health insurance costs. (These numbers are based on a civilian employee who makes an average total compensation of $47.92 per hour.)

While costs vary by industry, employee type and the benefits you offer, here’s a good starting point:

- Identify your total employee benefits management budget.

- Divide that by the number of employees to determine how much you’ll spend per employee.

You’ll then be able to identify the benefits you can reasonably afford. Remember that the most valuable benefits — health insurance and the employee retirement plans — are often the most expensive.

Cost-saving strategies for benefits programs

Implementing strategic cost management can help reduce benefits expenses without cutting value. Consider the following options:

- Voluntary benefits programs: Allow employees to pay for additional coverage like dental, vision or life insurance at group rates, reducing employer costs while expanding options.

- Wellness program discounts: Partner with insurance carriers offering premium reductions for workplace wellness initiatives.

- Group purchasing options: Join purchasing alliances or work with brokers to leverage collective buying power for better rates on insurance and retirement plans.

- Technology integration: Use benefits administration platforms that integrate with payroll systems to reduce administrative costs and eliminate duplicate data entry.

- High-deductible health plans with HSAs: Offer lower-premium options that still provide comprehensive coverage while encouraging employee healthcare cost awareness.

In addition to benefit costs, you must consider benefits administration costs. Many businesses outsource benefits administration functions because this process can be costly and complicated. If your internal human resources (HR) department will handle benefits administration, ensure team members are current on labor and employment laws.

When

creating an employee benefits package, you don't have to absorb the entire cost. Requiring employees to make some level of contribution will lower the overall cost of your benefits administration.

Step 2: Choose your benefits package.

After determining your benefits administration budget, you can begin creating your benefits package. Aim to build a plan that includes the necessary benefits to keep your employees healthy and additional benefits that match their specific needs.

For example, if you have a primarily young, single workforce full of new grads, tuition reimbursement or student loan assistance may be a top priority. Meanwhile, a workforce composed of families with young children will likely appreciate childcare assistance.

Here’s a look at some of the most important benefits to consider:

Legally required benefits

You’ll base any benefits package on legally required benefits, including the following:

- Health insurance (for companies with 50 or more full-time employees, including full-time equivalent employees)

- Social Security, Medicare and federal insurance contributions (also known as FICA)

- Family and medical leave, as designated by the Family and Medical Leave Act

- Workers’ compensation insurance

- Unemployment insurance

Health and wellness benefits

Today’s employees and employers are prioritizing physical and mental health. Here are some popular health and wellness benefits you can offer to keep your employees healthy:

- Medical, dental and vision insurance

- Tax-advantaged health spending accounts, including health savings accounts, health reimbursement arrangements and flexible spending accounts

- Mental health resources

- Wellness programs

- Employee assistance programs

- Virtual counseling

- Child and elder care

- Family planning services

- Section 125 plans, also known as cafeteria plans

- Gym membership reimbursement

- Resource groups for employees

Financial benefits

Although you should provide a competitive salary, you can also invest in your employees’ financial well-being by offering these financial benefits:

- Retirement plans, including company contribution or matching plans, for example, 401(k) plans, 403(b) plans and 457(b) plans

- Life insurance

- Short- and long-term disability insurance (required in some states)

- Accidental death and dismemberment insurance

- Stock options

- Profit-sharing plans

- Financial planning services

- Charitable matching

Work-life balance benefits

Flexible benefits have become a top priority to improve employees’ work-life balance. Here are some popular work-life balance benefits:

- Remote and hybrid work arrangements

- Flexible work arrangements (i.e. flextime)

- Transit or commuter benefits

- Unlimited paid time off

- Paid parental leave

- Childcare assistance

When creating a

reasonable paid time off (PTO) policy, consider including incentives or benefits, such as transferring unused PTO time to other priorities and needs, including 401(k) funding.

Professional development benefits

A lack of advancement opportunities is one of the top reasons employees quit. Fortunately, offering professional development opportunities is an excellent way to retain employees and create leaders among your team. Here are some examples of professional growth benefits you can offer:

- Training and development courses (online or in person)

- Career pathing

- Educational assistance

- Tuition reimbursement or student loan contributions

- Professional development stipends

- Mentorship programs

- Career coaching

Termination benefits

When you terminate an employee, you must also terminate their employee benefits. However, depending on the reason, you may want to offer termination benefits, such as these:

- Severance packages

- Job search assistance

- Outplacement services

- Consolidated Omnibus Budget Reconciliation Act (COBRA) coverage

- Unemployment insurance

- Extended benefits coverage

Adding popular employee benefits to your package is a great way to round out your offering. Some of these benefits cost more than others, so consider which ones are most valuable to your team.

Step 3: Choose a benefits provider to administer benefits.

Choosing a benefits provider is just as important as the benefits you want to administer. You must decide whether to administer benefits on your own or partner with an organization to outsource benefits administration.

If you want to go it alone, you’ll need to contact various healthcare and retirement plan providers to find appropriate options for your team. If you prefer to outsource benefits administration, you can choose an HR outsourcing (HRO) service or a professional employer organization (PEO).

Here’s some more information about each outsourcing partner type.

HRO services

The best HRO services can help you do more than administer employee benefits. They can also handle administrative HR tasks, process payroll and manage talent. HROs are also an excellent option if you need help handling HR compliance challenges.

Here are some of our favorite HROs:

PEO services

You can also opt to partner with one of the best PEO service providers to completely outsource your benefits administration. However, with this option, you must enter a co-employment arrangement and sign on for additional bundled HR features. Some HROs also offer a PEO model, so it just depends on which type of arrangement works best for you.

These are some of our favorite PEOs:

Step 4: Roll out your benefits plan.

After finalizing your benefits plan, roll it out to your employees. Clearly explain plan options to your team and encourage employees to ask questions. Unless an employee enrolls for benefits when hired, standard open enrollment typically occurs between November and January of the following year.

Some plan options, such as 401(k)s, allow employees to make modifications throughout the year. Other types, such as health insurance, only allow enrollment outside the open enrollment period if an employee is new or experiences a qualifying life event. Qualifying life events include the following:

- Marriage or divorce

- Birth or adoption of a child

- Death of a spouse or dependent

- Loss of other health coverage

- Change in employment status

It’s essential that employees understand their options and their time frame to make benefits elections.

Include details about your benefits package in your employee handbook so everyone can reference the information at any time.

Benefits implementation timeline

Successfully launching a benefits program requires careful planning and execution. A well-structured 12-month implementation timeline can help ensure a smooth rollout and high employee satisfaction.

- Months 1-3: In the first three months, focus on planning and preparation. Start by conducting employee needs assessment surveys to understand what benefits matter most to your team. Research and evaluate potential benefits providers, determine your overall budget and decide which core benefits will be included. You can then begin the vendor selection process based on your findings.

- Months 4-6: During months four to six, shift your attention to vendor selection and contracting. Finalize your partnerships and contracts with chosen providers. Begin developing benefits administration processes and employee-facing communication materials. At the same time, set up the necessary technology platforms and ensure integrations with payroll or HR systems are in place. Don’t forget to train your HR staff on the new tools and processes so they’re equipped to manage the rollout effectively.

- Months 7-9: By months seven to nine, you’ll be in the pre-launch preparation phase. This involves testing systems and validating data to ensure accuracy. Begin crafting employee education and enrollment materials, and schedule information sessions to help employees understand their options. You’ll also need to develop compliance documentation and prepare any legal notices or required disclosures to remain in line with regulatory standards.

- Months 10-12: Finally, in months ten through twelve, launch your employee communication campaign and begin hosting benefits education sessions. Oversee the open enrollment period, making sure employees’ questions and concerns are addressed promptly. Monitor participation rates and track enrollment progress closely to identify any gaps or issues early.

While this timeline can be condensed if needed, giving each phase ample time helps reduce stress, minimize errors and improve employee engagement with your new benefits program.

Step 5: Monitor and modify benefits as needed.

Review your employee benefits package at least once yearly. Tracking participation to see which benefits are being utilized can be a great way to see your team’s most valuable benefits. You can also survey employees to see if they’d like any other benefits. As your company grows and your employees’ needs evolve, modifying your benefits plan to match such changes is crucial.

Key performance indicators (KPIs) to track benefits program success:

Enrollment and participation

- Overall enrollment rate: Target 85 to 95 percent participation in core benefits.

- Voluntary benefits uptake: Track adoption rates for supplemental coverage.

- New hire enrollment completion: Measure the percentage completing enrollment within deadlines.

- Annual enrollment changes: Monitor year-over-year participation trends.

Employee satisfaction and engagement

- Benefits satisfaction scores: Conduct annual surveys with target scores above 75 percent.

- Employee Net Promoter Score (eNPS): Track willingness to recommend company benefits.

- Exit interview feedback: Analyze departing employees’ comments about benefits.

- Benefits-related help desk tickets: Monitor volume and resolution times.

Financial performance indicators

- Cost per employee: Track total benefits cost per employee annually.

- Claims ratios: Monitor actual claims vs. projected costs for self-funded plans.

- Administrative cost efficiency: Measure administrative costs as a percentage of total benefits spend.

- Return on investment (ROI): Calculate benefits ROI through retention and productivity gains.

Health and wellness program effectiveness

- Wellness program participation: Target 60 to 70 percent employee participation in wellness initiatives.

- Health risk assessment completion: Track percentage of employees completing health screenings.

- Preventive care utilization: Monitor use of preventive services and early intervention programs.

- Absence and productivity metrics: Measure impact on sick days and workplace productivity.

Retention and recruitment impact

- Employee retention rates: Compare retention before and after benefits improvements.

- Time-to-hire: Track whether competitive benefits reduce recruitment time.

- Candidate feedback: Survey job candidates about benefits package attractiveness.

- Benefits-related turnover: Identify departures specifically related to benefits dissatisfaction.

Common implementation problems and solutions

Even well-planned benefits programs can encounter challenges. Here are the most common issues and their solutions:

Low employee participation rates

Despite offering attractive benefits, many employers find that employee enrollment and participation rates remain disappointingly low.

- Problem: Employees don’t enroll in available benefits, reducing program effectiveness and potentially increasing costs.

- Solution: Implement auto-enrollment for retirement plans, provide personalized benefits counseling, use decision support tools and conduct regular education sessions throughout the year.

Budget overruns

When benefits costs exceed projected budgets, organizations must balance maintaining coverage with controlling expenses.

- Problem: Benefits costs exceed initial budget projections due to higher-than-expected participation or claims.

- Solution: Implement tiered contribution structures, offer high-deductible health plan options, conduct mid-year budget reviews and establish contingency funds for unexpected costs.

Compliance violations

Keeping up with changing regulations and maintaining compliance across multiple benefit programs presents ongoing challenges.

- Problem: Failure to meet federal and state requirements for benefits administration, leading to penalties and legal issues.

- Solution: Partner with compliance experts, implement automated compliance tracking systems, conduct regular audits and maintain current documentation for all required notices and disclosures.

Technology integration issues

System integration issues, data accuracy problems and inadequate administrative support can undermine program effectiveness.

- Problem: Benefits systems don’t integrate properly with payroll or HR systems, causing data errors and administrative burdens.

- Solution: Conduct thorough system testing before launch, work with vendors to resolve integration issues, implement backup data verification processes and provide additional staff training.

Employee confusion about benefits

When employees don’t understand their benefits options or how to access services, even excellent programs fail to deliver value.

- Problem: Workers don’t understand their options or how to use their benefits effectively.

- Solution: Create comprehensive benefits guides, offer multiple communication channels, provide one-on-one counseling sessions and use benefits administration platforms with built-in education tools.

Proactively addressing these common pitfalls can help you maximize the value of your benefits program, improve employee engagement and ensure long-term success.