Business insurance is more than just a line item in your budget; it’s a safety net you rely on when something goes wrong. If a client sues you, an employee gets hurt or a fire forces you to shut down operations, the right coverage can mean the difference between a manageable setback and a serious financial hit.

Choosing that coverage, however, isn’t always straightforward. Policies vary widely, costs can be confusing, and it’s not always obvious what protection your business actually needs. Below, we walk through the key factors to consider when choosing business insurance so your coverage fits your company, not just your budget.

Editor’s note: Looking for the right insurance for your business? Fill out the below questionnaire to have our vendor partners contact you about your needs.

What to keep in mind when choosing business insurance

Choosing business insurance can feel intimidating, especially if you’re buying coverage for the first time. The process gets easier, though, when you focus on a few core factors that actually affect how a policy works in real life.

Coverage terms and conditions

Just as you would closely review a vendor contract or lease agreement, it’s important to scrutinize the details of an insurance policy before signing. Coverage can vary significantly from one provider to the next, even when policies appear similar on the surface.

“Not all commercial policies are created equal,” cautioned Jeff Kroeger, executive vice president and division revenue leader for the insurance broker World Insurance Associates. “Many contain problematic exclusions, restrictions, terms and conditions that may result in an uncovered claim.”

Ciara Gravier, founder and CEO of The Bunker Insurance & Risk Management, echoed Kroeger’s concerns. “Business owners should carefully review what’s included in each quote and check for any limitations,” she said. “It’s wise to ask, ‘What am I not covered for?’ to understand the policy’s limits and whether additional coverage is necessary.”

Scalability

All insurance policies are designed to cover unexpected events, but some are easier to adjust than others. As your business grows (or contracts), your coverage should be able to change with it.

For example, you may need to update a policy if you add employees, scale back your team or experience seasonal swings in revenue. Before committing to a plan, confirm whether coverage limits, payroll assumptions and premiums can be adjusted over time without penalties or unnecessary friction.

Cost per employee

Insurance costs don’t exist in a vacuum, especially when coverage is tied to your headcount. As you evaluate options, look closely at how much you’re paying per employee and how that expense fits into your broader payroll and revenue picture.

In simple terms, the cost of business insurance (including health insurance costs) should be proportionate to what each role contributes to the business. If coverage costs per employee significantly outpace the revenue those employees help generate, the numbers can start working against you very quickly.

Legal requirements

Some types of business insurance aren’t optional. For example, in most states, employers are required to carry workers’ compensation coverage. Landlords may also require tenants to hold a general liability policy to protect against bodily injury or property damage claims.

Beyond legal and lease requirements, insurance can be a prerequisite for doing business. Clients may ask you to carry specific coverage before signing a contract or allowing you on-site. State regulations, industry standards and contract terms vary, so working with an insurance broker or agent — and doing a bit of homework on your own — can help you confirm what’s required for your business.

Industry risks

Insurance needs vary widely by industry because the risks businesses face aren’t the same. Coverage that makes sense for a professional services firm may do little for a company that sells physical products.

For example, professional liability insurance is often essential for businesses that provide expertise or advice, such as accounting or consulting firms. It can help cover claims tied to errors, omissions or professional mistakes. Product liability coverage, on the other hand, is more relevant for businesses that sell goods, including restaurants and retail stores, where issues like defective products or food-related illness are a concern.

As you compare policies, focus on the risks that are most common in your industry and how well a policy addresses them, rather than assuming one-size-fits-all coverage will be enough.

Deductibles

Like most health insurance plans, business insurance policies typically include a deductible, the amount you pay out of pocket before coverage begins. In general, higher deductibles come with lower premiums, while lower deductibles usually mean higher ongoing costs.

The important thing is how that trade-off fits your cash flow. A lower premium can look appealing on paper, but a deductible that’s too high can put pressure on your finances if you ever need to file an insurance claim. When comparing policies, it helps to look at both the monthly cost and what you’d realistically be able to pay upfront in a worst-case scenario.

Insurers classify businesses by risk level when pricing policies.

Construction businesses have more risks than marketing companies, for example, since there are so many opportunities for mistakes and accidents while building. Faulty construction could also lead to lawsuits that insurance companies become responsible for.

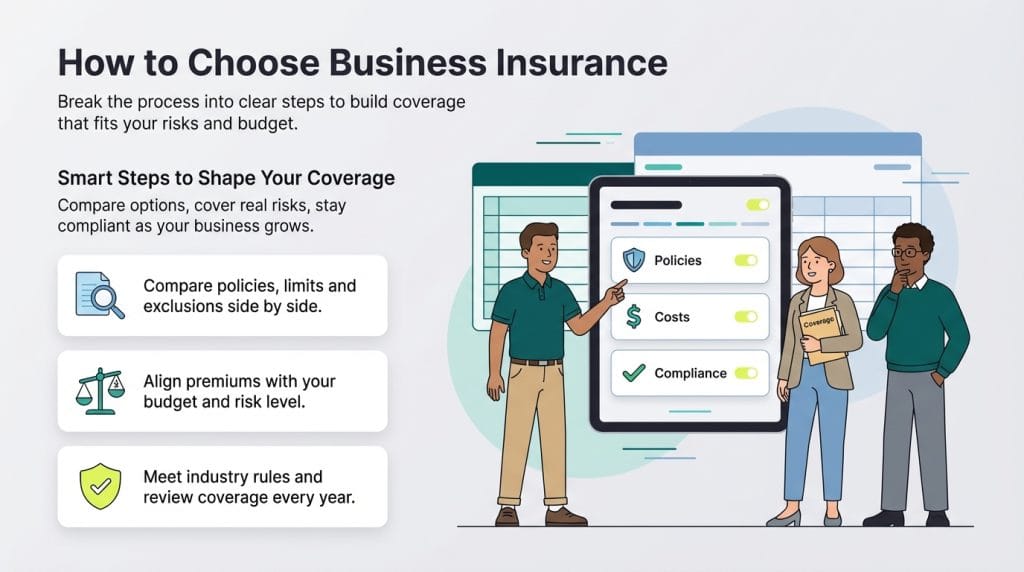

How to choose business insurance

Choosing business insurance is easier when you approach it in steps and focus on how different policies work together to protect your business.

1. Research the market.

Most businesses need a combination of policies rather than a single, all-purpose plan. Depending on your operations, that mix may include some or all of the following:

Gravier emphasized that as you compare providers, it’s important to look beyond pricing. An insurer’s financial stability and claims-paying track record matter, especially if you expect a long-term relationship. “Rating agencies like AM Best, Moody’s or Standard & Poor’s offer ratings that reflect an insurer’s financial strength and reliability,” Gravier said. “This is especially important for businesses looking for long-term relationships with their insurer.”

It can also help to map out your options side by side. Comparing coverage limits, deductibles and exclusions even in a simple spreadsheet makes differences easier to spot. That upfront effort often pays off later, when you’re clearer on what you’re covered for and what you’re not.

2. Get quotes from multiple insurance providers.

Shopping for insurance works best when you treat it like any other major business purchase. Collect quotes from several providers before making a decision, and be sure you’re sharing the same information with each one. Details such as your company’s size, location and the business assets you want to insure all affect pricing, so consistency matters.

Once you have multiple quotes in hand, look for patterns. Extremely low or unusually high estimates can be misleading, while a cluster of similar prices usually gives you a more realistic sense of what coverage should cost.

Comparing quotes also helps you align insurance costs with your budget. In some cases, you may need to adjust expectations or make operational changes to accommodate the coverage you need. If rates come back higher than expected, steps like installing fire-suppression systems or improving workplace safety can reduce risk and, in turn, help lower premiums over time.

3. Look beyond general liability insurance to cover all your risks.

A basic general liability policy may be the least expensive option, but it rarely provides full protection on its own. In many cases, businesses can add coverage that better reflects their actual risks without a dramatic increase in cost. Here are some tips for assessing your needs to ensure the best protection:

- Turn to peers and industry contacts: Talking with people who’ve been through the process can surface risks you haven’t dealt with yet. Mentors, peers or industry contacts often spot issues based on what they’ve already run into. “Having conversations with peers and business groups you are a part of will help point you in the right direction,” said Nicole Farley, vice president of carrier operations at the insurance agency software provider Bold Penguin.

- Err on the side of overestimating: When assessing coverage, it’s often safer to slightly overestimate your needs than to come up short. From there, you can match your list of risks against available policy options and narrow down what makes sense. If the right combination isn’t obvious, a conversation with an experienced insurance agent can help bridge the gap.

- Get expert input from an agent: Farley emphasized the importance of being prepared for those conversations. “Have contracts available for review, be able to explain your business in detail, and know what your long-term goals are,” Farley advised. “An experienced agent will be able to take these details and put together a customized insurance plan for your business now and in the future.”

4. Know your specific industry’s business insurance obligations.

Some insurance requirements apply broadly, while others depend on where and how your business operates. In most states, businesses with employees are required to carry workers’ compensation insurance and may also need unemployment and disability coverage. The U.S. Small Business Administration offers a helpful starting point for understanding how federal and state insurance requirements intersect.

Beyond baseline requirements, insurance obligations can vary by industry and location. State websites, often through a division of insurance or similar agency, spell out what coverage is required. Checking those resources early helps clarify what’s mandatory before you look at optional policies.

If you work with an insurance agent, local expertise matters. Agents who understand your state’s regulations — and, ideally, your industry — are better positioned to flag requirements and gaps you might otherwise miss. Once required coverage is in place, it becomes much easier to see where additional policies may be needed to round out your protection.

5. Reassess every year.

As your business evolves, your insurance needs rarely stay the same. A yearly review gives you a chance to ensure your coverage still reflects how your business operates today and where it’s headed next. If you open a new business location, hire more employees or invest in new equipment, it’s worth checking in with your provider to confirm your policies still fit.

An annual review is also a good time to think through less predictable scenarios. Planning for emergencies or a situation where you’re temporarily unable to run the business can highlight gaps that aren’t obvious day to day. At the same time, you may find coverage you no longer need, freeing up funds that can be redirected toward more relevant protection.

Operating without required insurance does more than leave you paying out of pocket after an incident. Businesses that fall out of compliance can also face fines, penalties or even forced shutdowns, depending on state regulations.

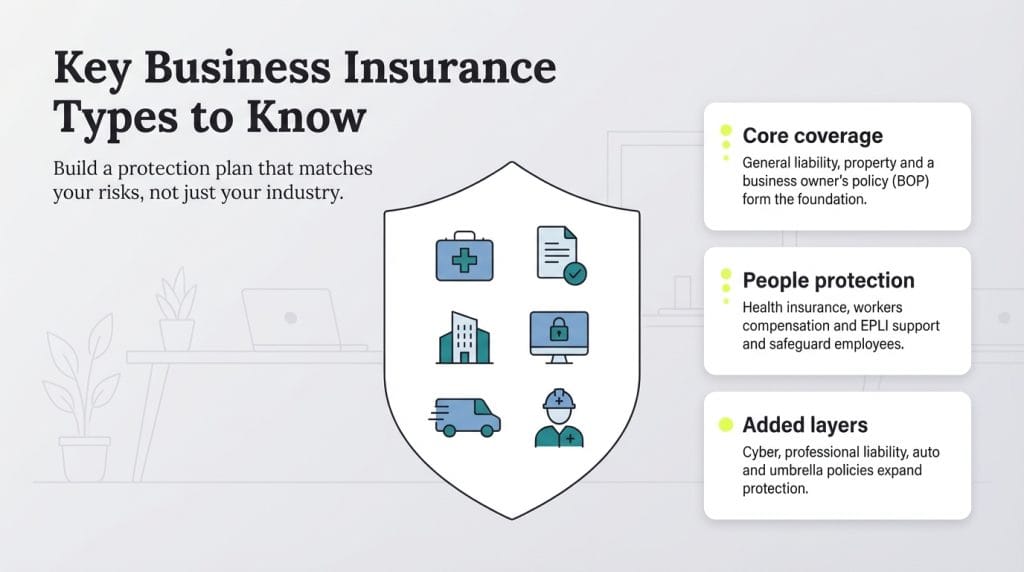

Types of business insurance to consider

One of the most important steps in choosing business insurance is understanding which types of coverage your company actually needs (and which it doesn’t). Below are some of the most common policies businesses consider.

Health insurance

Health insurance doesn’t directly protect your business assets, but it plays a critical role in supporting your workforce. Coverage helps employees access medical care, stay healthier and miss less work over time. It also factors into employee retention, since most full-time workers expect health insurance as part of a competitive benefits package.

Professional liability insurance

Professional liability insurance protects against lawsuits that your clients or customers file to allege that your company has not adequately carried out its promised duties. This type of insurance is especially common for attorneys and accountants to obtain, but any business that provides services may benefit from it. Consultants, information technology specialists, and medical practitioners all minimize risk with professional liability insurance.

Commercial property insurance

Commercial property insurance helps cover damage to physical business assets caused by events like fires, explosions, vandalism or natural disasters. Coverage details vary by policy. Some plans narrowly define what’s protected, while others offer broader coverage, making it important to understand exactly what’s included before you commit.

General liability insurance

General liability insurance helps cover costs tied to third-party claims, including personal injuries, advertising injuries and damage your business or employees cause to someone else’s property. It’s often the foundation of a business insurance portfolio because it addresses risks most companies face at some point.

Gravier emphasized that general liability insurance is the single most critical policy for any business to have.

“For instance, if a customer slips and falls in a store, the business could be liable for their medical bills and even a lawsuit,” Gravier explained. “Without general liability coverage, these expenses come out of the business owner’s pocket and can be financially devastating — especially for a new or small business.”

Business owner’s insurance

A business owner’s policy (BOP) typically bundles general liability and commercial property insurance into a single policy. Because the coverage is packaged together, premiums are often lower than purchasing separate general liability and property policies, making BOPs a cost-effective option for many small businesses.

Cyber insurance

Cyber risks are getting more expensive to ignore. According to the 2025 Cost of a Data Breach Report from IBM, the global average cost of a data breach is $4.4 million.

While strong cybersecurity practices can reduce risk, they don’t eliminate it. Ransomware attacks, phishing and other threats continue to evolve, and even well-protected businesses can be affected. Cyber insurance, sometimes called data breach insurance, adds a layer of financial protection if your business experiences a cyber incident. It can also help offset recovery costs and limit financial damage when preventative measures fall short.

Commercial auto insurance

If your business uses company-owned vehicles, commercial auto insurance is essential. Personal auto policies typically don’t cover business-related driving, which means accidents involving company vehicles require separate coverage.

“Commercial auto insurance protects against property, liability and medical costs if you are involved in an automobile accident [at work],” Kroeger explained. “It pays for your legal responsibility to others for bodily injury or property damage. It pays for damage or theft of your vehicle.”

Commercial umbrella insurance

Even well-structured insurance portfolios have limits. A commercial umbrella policy provides additional coverage when a major claim exceeds the limits of your primary liability policies. This type of coverage is especially valuable for higher-risk businesses or those with greater exposure to lawsuits.

“Commercial umbrella insurance provides protection for losses that exceed the policy limits found within an organization’s standard liability insurance portfolio,” Kroeger said.

Employment practices liability

Employment practices liability insurance (EPLI) helps protect your business from claims related to how employees are treated. Even when policies and expectations are clear, businesses can still face lawsuits tied to employee behavior or management decisions.

“Employment practices liability insurance protects against risks due to employment-related lawsuits such as wrongful termination, discrimination and sexual harassment,” Kroeger said.

Because employers can be held responsible for the actions of their staff, EPLI coverage can help reduce financial and legal exposure if a claim arises.

Workers’ compensation insurance

As noted previously, unlike many other types of business insurance, workers’ compensation coverage is usually required. Workers’ compensation laws are administered at the state level, so requirements vary depending on where your business operates, according to the U.S. Department of Labor.

This coverage provides employees with a formal way to recover lost wages and medical costs related to work-related injuries or illnesses. For employers, it also reduces the risk of paying those expenses out of pocket or facing lawsuits tied to workplace injuries.

Make sure you, your HR team and your employees understand the

workers' compensation claims process before an incident occurs. Clear expectations can help prevent delays and confusion when coverage is actually needed.

Insurance can be costly, but lawsuits are costlier

Business insurance can feel expensive, especially when nothing has gone wrong. But the real cost often shows up after a business lawsuit, accident or unexpected disruption. Taking the time to work with a qualified insurance agent and moving thoughtfully through the coverage process can help protect your finances when legal or operational issues arise.

You may never need to file a major claim, but insurance isn’t about predicting what will happen. It’s about being prepared if it does. By building your insurance portfolio carefully now, you give your business the protection it needs to weather the unexpected without putting everything you’ve built at risk.

Max Freedman and Scott Gerber contributed to this article. Source interviews were conducted for a previous version of this article.