Do you need a company car, truck or van? The right vehicle can make your business run more smoothly and save money you’d otherwise spend on shipping, delivery or rental costs. However, since vehicles are expensive, it’s critical to make the right vehicle-buying decision. We’ll explore tips for buying a business vehicle, explain the benefits of company cars and flag what can go wrong if you choose poorly.

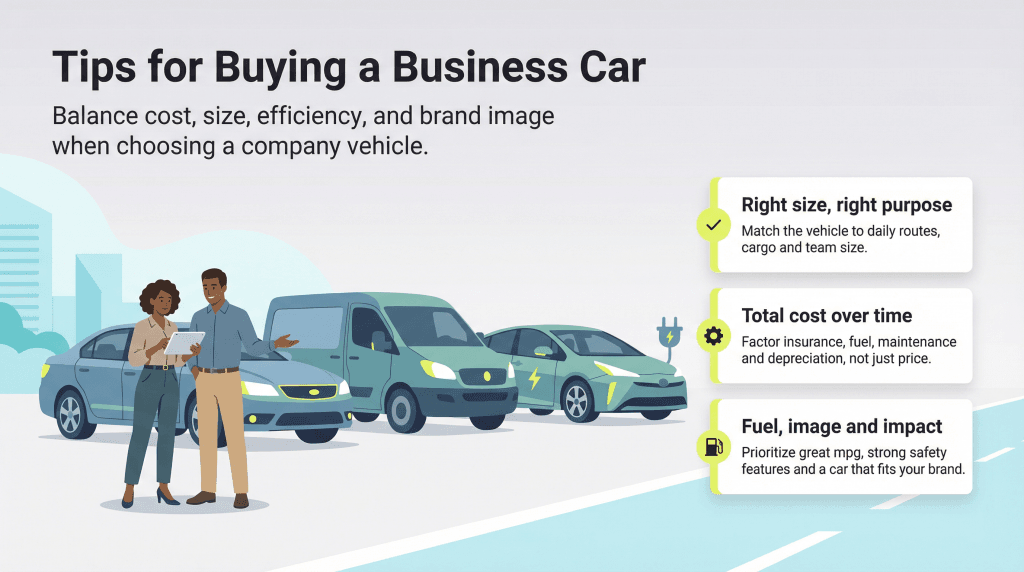

Tips for buying a business car

Keep the following tips and best practices in mind when buying a vehicle for your business.

1. Choose your business vehicle’s size carefully.

Aesthetics are fine, and choosing a sports car might be a fun statement of ambition from your business. However, will it be of much use at 2:30 p.m. on a Wednesday when it’s needed to shuttle your weary sales team with a trunk full of sample goods to a client two towns away?

Consider all the regular journeys your business’s vehicle will make and assess how much space you’ll need, now and in the near future. Perhaps a sedan is the most logical solution. Maybe you’ll need a van to complete all your tasks. Careful thought is crucial.

Skip Davenport, owner of D&D Motors in Greenville, SC, says businesses often buy for current needs instead of accounting for growth. “The biggest mistake that people make is buying a vehicle that solely meets current needs instead of looking at forecasted growth needs and trying to get a vehicle more versatile for their business,” Davenport said.

Instead, Davenport recommends assessing several aspects of your current and future requirements to determine the right vehicle size. “[They should] think about what the primary objective is and how long they plan to keep the vehicle. This helps decide the best engine choices and sizes of vehicle,” Davenport explained. “Think about who the primary driver is and how many bells and whistles are needed for the job that it is intended for.”

2. Calculate the total cost of the vehicle.

When evaluating vehicle costs, you need to look beyond the sticker price. Aside from the down payment, monthly payments and commercial auto insurance costs, consider garage, fuel, repair and maintenance expenses when calculating the total cost of the vehicle. According to AAA’s 2025 data, the average annual cost to own and operate a new vehicle is $11,577, or about $965 per month. Business vehicles can cost even more to maintain due to higher mileage, heavier use and commercial insurance requirements. And generally speaking, foreign and luxury brand vehicles tend to be more expensive to maintain and repair.

Remember, although company vehicles are business assets, they lose value over time. In most cases, it doesn’t make sense to buy a costly vehicle unless there’s a clear business reason. For example, if you’re a financial advisor working with wealthy clients, a nicer car may help reinforce a professional image. Otherwise, a more practical option will typically come with lower overall costs.

3. Consider essential business vehicle add-ons.

When buying a car for your business, think carefully about which optional add-ons are truly necessary for how you’ll use the vehicle. Below are the most common types of business vehicle add-ons and when they make sense.

- Practical add-ons: Physical upgrades such as shelving, ladder racks or service bodies can be essential for tradespeople and delivery teams. These features help organize tools and inventory, reduce wasted time and make vehicles safer to load and unload.

- Technology add-ons: If your company vehicles regularly travel long distances or serve multiple locations, GPS fleet management systems and telematics systems can be valuable. However, for businesses operating a single vehicle within a limited service area, advanced navigation systems may add cost and drain battery life without delivering much benefit.

- Safety add-ons: Vehicle safety features have advanced significantly in recent years, making them an important consideration for business vehicles. The National Highway Traffic Safety Administration (NHTSA) requires all vehicles manufactured after May 2018 to include backup cameras as standard equipment. Many newer models also have even more advanced driver assistance systems that can help reduce accidents and protect both drivers and business assets. According to research from the Insurance Institute for Highway Safety:

- Front crash prevention systems that combine forward collision warning and automatic emergency braking can cut rear-end crashes roughly in half compared with vehicles without those features.

- Forward collision warning alone reduces rear-end crashes by about 27 percent.

- Blind spot detection is associated with about 14 percent fewer lane-change crashes.

- Cosmetic add-ons: While not essential, cosmetic features such as alloy wheels or upgraded paint finishes can help slow depreciation and reinforce a polished brand image when company vehicles are on the road.

Safety isn't just a perk — it can help protect your business's future. Strong fleet safety practices safeguard employees, reduce liability exposure and help

protect your brand reputation, especially as operations grow.

4. Don’t underestimate the competition’s company cars.

It’s always good to let your work do the talking, but first impressions still matter. Keeping your business competitive sometimes means paying attention to details beyond your products or services. If competitors arrive in newer, more polished vehicles, that can shape how potential clients perceive your business before a word is spoken.

Striking the right balance is key. You don’t want to overspend and strain your cash flow by driving an extravagant, large-engine vehicle. At the same time, you don’t want your business to appear outdated or less professional than the competition.

Choose a vehicle that reflects your brand and can hold its own in a competitive market, without being drawn into unnecessary upgrades or excessive fuel costs.

5. Consider aesthetics when purchasing a business car.

A company car represents your brand and can be an unexpected source of advertising. If it’s aesthetically pleasing and compelling, you may even generate new sales leads.

If you’re partial to having your business represented by a company vehicle, you don’t want something that blends into the crowd. A more eye-catching car, whether it’s beautiful or just a little bit different, helps guarantee that your business will be noticed.

For an eye-catching vehicle, consider doing a complete branded car wrap to represent your

brand image.

6. Stay true to your purpose and review your vehicle options properly.

While shopping for a vehicle that matches your goals and ambitions, you’ll likely encounter plenty of tempting offers on models that don’t quite fit what you set out to buy. It’s important to evaluate whether any vehicle you’re considering can realistically handle the demands it will face day to day.

Choose a vehicle that can do the job, whether that means a reliable 9-to-5 shuttle between offices, frequent client visits or serving as a mobile marketing tool.

7. Prioritize fuel economy when buying a business car.

After adding a vehicle to your workforce, the last thing you want is to overpay for fuel year after year. While a high-performance or luxury vehicle might make sense for limited personal use, it’s much harder to justify an oversized engine when the vehicle’s primary role is transporting staff, equipment or supplies.

Fuel efficiency continues to improve. According to the EPA’s 2024 Automotive Trends Report, model year 2023 vehicles achieved a record-high real-world average fuel economy of 27.1 miles per gallon, with all signs pointing toward continued improvement.

This matters because, for businesses, fuel costs can add up quickly. If your business vehicle logs around 15,000 miles a year, fuel costs don’t stay abstract for long. At roughly $3.50 per gallon, choosing a vehicle that averages 35 mpg instead of 25 mpg can mean saving around $600 a year — and that gap widens quickly when gas prices spike.

Keep in mind that business vehicles often experience heavier use than personal cars, including frequent stops, fleet idle time and added cargo weight, which can increase fuel consumption and maintenance costs. For many businesses, opting for a fuel-efficient, hybrid or electric vehicle can significantly reduce long-term operating expenses.

8. Get your business car insurance right.

Purchasing the right commercial auto insurance is crucial. Standard personal insurance policies don’t typically carry the level of protection you may require if you’re using your car for work purposes and need business insurance coverage.

When you consider the disparity between commercial auto liability insurance and standard car insurance rates, you may be tempted to skimp on your coverage. However, the risk of invalidating your policy is too significant to sidestep adequate coverage.

There are typically three business car insurance categories with various commercial car insurance costs:

- Business use by you

- Business use for all drivers

- Commercial traveling policies

It’s best to explore these coverage levels and choose the most appropriate for you and your company.

Business vehicle accidents can lead to costly

insurance claims for companies. An accident involving an uninsured or underinsured company car, truck or van can financially devastate your business.

9. Maximize tax deductions by paying for the vehicle through your company.

Purchasing a vehicle through your business can offer tax advantages, but the rules vary based on the type of vehicle you buy, how it’s used and when it’s placed in service. Here’s what you need to know:

- Section 179 deductions for heavier vehicles. For vehicles with a gross vehicle weight rating (GVWR) over 6,000 pounds, Section 179 may allow businesses to expense a portion of the purchase price in the year the vehicle is placed in service. However, certain sport utility vehicles (SUVs) are subject to a special cap. For taxable years beginning in 2026, the IRS limits the Section 179 deduction for qualifying SUVs to $32,000.

- Higher deductions may apply to certain non-SUV vehicles. Other heavy vehicles, such as cargo vans and pickup trucks that meet specific IRS requirements, may be eligible for higher deductions, depending on business use and taxable income.

- Bonus depreciation rules depend on timing and IRS guidance. Bonus depreciation may also apply to qualifying vehicles, but the rules depend on when the vehicle is acquired and placed in service. Congress amended federal tax provisions, including depreciation rules, under the One Big Beautiful Bill Act, enacted in 2025. However, detailed IRS implementation guidance for 2026, including updated IRS publications and revenue procedures, was still forthcoming as of early January 2026, according to tax experts. Because bonus depreciation rules have changed multiple times in recent years and depend on IRS interpretation, businesses should confirm current eligibility and deduction percentages before claiming this benefit.

- Passenger vehicles are subject to annual depreciation caps. Passenger automobiles — including most cars, trucks and vans under 6,000 pounds GVWR — are subject to annual depreciation limits, often referred to as the “luxury auto” caps. These limits are updated by the IRS each year and can restrict how much depreciation businesses can claim in the first year, even when bonus depreciation applies.

Because vehicle depreciation rules change regularly and depend on factors like business use and profitability, it’s smart to review current IRS guidance or talk to a tax consultant before claiming vehicle-related deductions.

Armine Alajian, CPA and founder of The Alajian Group, stresses the importance of doing your due diligence. “Don’t assume all vehicles qualify for full deductions; not every vehicle qualifies for full tax benefits,” Alajian warned. “Some have limits on depreciation deductions, particularly luxury vehicles.”

10. Weigh the pros and cons of used vehicles.

Buying a used vehicle for your business can still make sense, but it helps to go in with realistic expectations. While there are more pre-owned options available than there were during the supply crunch of the past few years, prices haven’t dropped back to bargain levels. By late 2025, dealerships were carrying a larger selection of used vehicles, yet average listing prices were still hovering around the mid-$25,000 range, according to Cox Automotive data.

That said, used vehicles have a built-in advantage: depreciation. Much of the initial value loss has already happened, which can make a pre-owned car a smarter upfront purchase than buying new. If you decide to buy a used car, choose one with a reputation for reliability and try to get the newest model possible within your budget.

Additionally, be sure to ask the seller for maintenance records, as regular servicing is one of the biggest predictors of long-term reliability. If you’re buying from a dealership, inquire about pre-owned warranties and whether you can have a third-party mechanic inspect the vehicle before purchase. A professional inspection can catch hidden issues that aren’t obvious at first sight.

11. Ensure you’re getting the best possible price.

At most dealerships, you can negotiate the price of a new or used car. Negotiation is also common when buying a used car from an individual or business. You will have more leeway to lower the price on a pre-owned vehicle because you can use its condition to justify the cost decrease.

Effective negotiating tactics include not appearing rushed, mentioning that you’re considering other vehicles or sellers, and offering to pay cash in exchange for a discount. Stay alert for special deals in your area. “Look for fleet discounts if you need multiple vehicles, as some manufacturers offer fleet discounts to businesses,” Alajian advised.

12. Consider leasing a car for your business.

Leasing a company car may be a cost-effective option for your business. It typically requires a lower down payment, and repair and maintenance costs are often included or lower. You can also drive a higher-end vehicle for a lower monthly payment than you would if you purchased it, and lease payments are generally tax-deductible for businesses.

However, be aware of mileage restrictions. Most commercial leases allow 10,000 to 15,000 miles annually, with excess mileage charges ranging from 15 to 30 cents per mile. Additionally, at the end of the lease, you won’t own the car as an asset to sell. Weigh the benefits of leasing against these potential downsides before deciding.

13. Take your company’s mission and values into account.

If appropriate, look to your business’s mission statement and values to help guide your vehicle choice. Here are a couple of examples:

- Sustainability: If a sustainable business model is important to you, consider an electric vehicle. EV adoption is accelerating rapidly. Cox Automotive reports that electric vehicles accounted for nearly 10 percent of new vehicle sales by mid-2025, reaching an all-time high as both new and used EV demand surged. At the same time, the nationwide charging network continues to expand, with more than 160,000 public charging ports now available across the U.S. By showcasing your commitment, you show customers and other stakeholders that you follow through on your values with action.

- Domestic support: If your values include supporting domestic employment and labor unions, consider buying vehicles made in the United States. This includes American manufacturers like Ford, General Motors and Chrysler (some of which are made in other countries) and foreign-owned manufacturers with U.S. manufacturing plants.

Of course, you must balance values-based purchasing with your company’s needs. For example, if you support sustainability but your vehicle must take time-sensitive cross-country trips, an electric vehicle may not be the best option. In this case, consider a hybrid or an all-gas vehicle with excellent fuel efficiency.

Benefits of buying a company car

Buying a company car can bring significant benefits to your business, including the following:

1. Buying a company car brings tax advantages.

One of the biggest benefits of purchasing a company car is the potential tax savings. Many business owners know that some insurance costs are deductible, but fewer realize that car insurance premiums and many vehicle-related expenses may also be deductible when the vehicle is used for business purposes, subject to IRS rules.

Business owners generally have two options for deducting vehicle expenses:

- The standard mileage rate

- The actual expense method, which includes costs such as fuel, maintenance, repairs, insurance, registration fees and depreciation

For 2026, the IRS set the standard mileage rate for business use at 72.5 cents per mile, an increase of 2.5 cents from the prior year.

To maximize your deduction, track business mileage carefully throughout the year and keep detailed records of vehicle expenses if you plan to use the actual expense method. Because the better option depends on how much you drive and your operating costs, it’s smart to calculate both methods and review them with your business accountant before filing.

2. Buying a company car can protect your personal insurance rate.

An additional benefit of a company car is that it does not impact your personal auto insurance plans. If the vehicle is involved in an accident, your personal auto rates are not negatively affected.

Understanding your

state's commercial car insurance laws is crucial. While your state mandates minimum coverage levels, consult your insurance agent to ensure you're getting adequate coverage for your business's needs.

3. Buying a company car can help you control your corporate image.

If a salesperson arrives at a prospect’s location and takes them to lunch in a clunker, your company image could suffer. When you own the vehicles your employees drive while they’re working, you can strike the right balance between successful and conservative.

Unless your company sells luxury or premium products to very wealthy people, an overly expensive company car can make customers think your prices are too high. Conversely, a vehicle deemed too cheap might convey that your company is struggling and, therefore, risky to do business with.

4. A company car lets you spread brand awareness.

Your business car, van or truck can include information like your brand name, logo, domain name, tagline, contact information and graphics. Everywhere your vehicle goes, it’ll spread the word about your company, what you do and how to contact you. In most cases, employees wouldn’t typically be OK with this kind of branding on their personal vehicles.

5. A company car can help you attract talent.

A company car can be an attractive employee perk to mention during the hiring process, especially when new employees will drive as part of their position. According to a Robert Half survey, commuter-related benefits were cited by 48 percent of respondents as a top workplace incentive. New recruits will likely prefer to sign with your company if they can use a company car rather than go with a competing job offer that requires them to use a personal vehicle.

6. Buying a company car lets you customize vehicle features.

A company car can include features you or employees might not have on private vehicles. For example, if you have a roofing company, you would need a truck with storage for ladders and a towing hitch for a trailer with tar and other supplies. If your company makes deliveries, a van with ample space for boxes would come in handy.

When you have a fleet of vehicles, you can use one of the best GPS fleet management services to ensure your drivers and their cargo are safe and where they need to be at all times.

GPS fleet management can save your business money by reducing fuel and maintenance costs, preventing employee overtime and

increasing productivity.