Business Payments

Whether you’re paying suppliers or processing customer transactions, payments are a necessary part of keeping your business running. Business payments require the right technology and agreements to keep your business profitable, while the best tools generate vital payments data that impacts your bottom line. Manage accounts payable and receivable with these resources.

Article

How Much Do Payroll Services Cost?

By Sean Peek | January 20, 2026

If you plan to outsource payroll, CPAs and payroll services are good options. Here's a look at what CPAs and payroll services offer and how much they cost.

Article

Credit Card Receivables Financing Guide

By Jennifer Dublino | January 20, 2026

Credit card receivables financing advances funding based on future sales with high approval rates. Factor rates tend to be 1.1-1.5 with 10-20% holdback rates.

Article

How to Accept Apple Pay

By Jennifer Dublino | January 13, 2026

To accept Apple Pay, ensure your credit card processor supports it, use an NFC-enabled card reader, enable Apple Pay on your account and train your staff.

Article

Credit Card Processing in High-Risk Industries

By Dachondra Cason | January 12, 2026

High-risk merchant accounts face higher fees, rolling reserves, and stricter terms but can access international markets and find processors like PayKings.

Article

How to Do Payroll for a Small Business

By Matt D’Angelo | January 12, 2026

Payroll processing requires an EIN, pay schedule, gross pay calculation, deduction management, and tax withholding. Follow these steps to run payroll.

Article

Everything You Need to Know About NFC Mobile Payments

By Jennifer Dublino | January 09, 2026

NFC mobile payments use Apple Pay and Google Pay through contactless card readers. By 2026, 60% of people globally will use digital wallets for purchases.

Article

Why Small Businesses Need Online Payment Apps

By Donna Fuscaldo | January 09, 2026

Accepting online payment apps like Apple Pay and Google Pay can boost sales and offer convenience, though they have higher fees and security risks.

Article

How to Accept Mobile Payments via SMS

By Jennifer Dublino | January 09, 2026

Text-to-Pay lets customers pay bills via SMS by clicking secure payment links. Requires PCI-compliant processing, TCPA compliance, and customer opt-in consent.

Article

What Are the Benefits of Using Direct Deposit? A Complete Guide

By Simone Johnson | January 07, 2026

Direct deposit can benefit small businesses when set up correctly. Learn all about direct deposit, including the pros, cons, tax laws and implementation.

Article

How to Charge Late Fees and Interest on Unpaid Invoices

By Jennifer Dublino | January 06, 2026

Learn about late payment charges, late charge fee policies and maximum allowable invoice late fees by state, including legal limits and best practices.

Article

How to Get Paid as a Construction Contractor

By Karina Fabian | January 02, 2026

Cash flow is critical for construction contractors. Learn best practices for ensuring your clients pay you and tips for dealing with nonpaying customers.

Article

POS Systems for Small Construction Businesses

By Donna Fuscaldo | January 02, 2026

With a POS system installed on your phone or tablet, you can accept payments on the job, send digital receipts, and accurately record payment details.

Article

Forget the Checks: 5 Reasons Why Your Construction Company Should Accept Credit Card Payments

By Sean Peek | December 18, 2025

Accepting credit cards helps construction firms boost cash flow, reduce bounced checks and offer clients flexible, secure payment options.

Article

Digital Payment Guide: Best Payment Methods & Why to Accept Them

By Sammi Caramela | December 16, 2025

Learn about digital payment methods your business should consider accepting.

Article

What Is Meta Pay? A Complete Guide to Meta’s Payment Platform

By Donna Fuscaldo | December 16, 2025

Meta Pay lets businesses accept secure, fee-free payments across Meta’s platforms, making social selling easier with simple setup and purchase protection.

Article

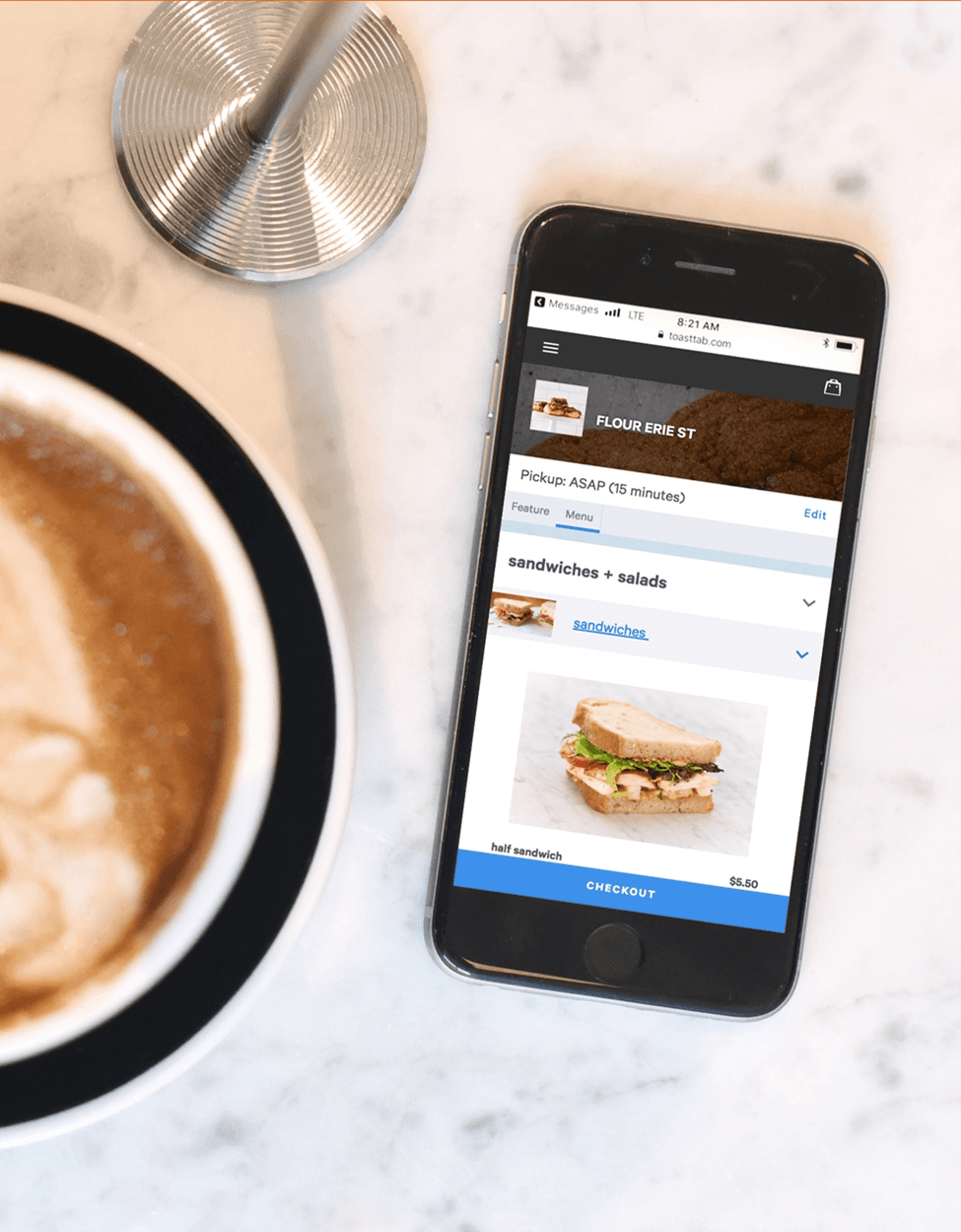

Should Your Restaurant Accept Mobile Payments?

By Jamie Johnson | December 16, 2025

Mobile payments provide a fast and easy way for restaurants to receive payments, but there are pros and cons to this method. Here is what you need to know.

Article

POS Reports Your Retail Business Should Be Using

By Donna Fuscaldo | November 17, 2025

With this guide, learn how a point-of-sale (POS) system can transform your business by increasing sales, maximizing results and reducing waste.

Best Pick

The Best Point-of-Sale (POS) Systems for Retail Businesses

By Nicole Fallon | October 30, 2025

Lightspeed, Helcim and Clover offer retail POS systems with inventory management, sales analytics and customer engagement features.

Article

Credit Card Payment Processing Rules and Laws You Need to Know About

By Jennifer Dublino | September 02, 2025

Credit card processing laws ensure secure payments by requiring PCI compliance, fraud prevention, and adherence to federal and state regulations.

Best Pick

The Best POS Systems for Coffee Shops

By Jamie Johnson | August 04, 2025

Square, Clover and Toast offer coffee shop POS systems with order customization, inventory management and loyalty program features.

Article

Stax vs. Square: Credit Card Processor Comparison

By Jennifer Dublino | June 10, 2025

Stax and Square give merchants an easy and convenient way to accept credit cards. Learn how their features, plans, pricing and integrations compare.

Article

Stripe vs. Square Credit Card Processing Comparison

By Jennifer Dublino | June 10, 2025

Stripe is ideal for online businesses needing customization, while Square suits in-person sellers with free POS tools, transparent pricing and fast setup.

Article

Square vs. PayPal

By Jennifer Dublino | June 09, 2025

Square suits high-volume businesses with lower online fees and robust POS tools at 2.6% + $0.10. PayPal works for low-volume merchants needing flexibility.

Article

Stripe vs Stax Comparison

By Mike Berner | June 09, 2025

Stax charges flat subscriptions ($99-$199 monthly plus 8-15¢ per transaction) for high-volume businesses. Stripe charges 2.9% + 30¢, better for e-commerce.

Article

Merchant One vs. Square Comparison

By Jennifer Dublino | June 09, 2025

Merchant One charges interchange-plus pricing with $13.95 monthly fees and 24/7 support. Square offers flat 2.6% + 10¢ rates with no monthly fee on basic plans.

Article

11 Ways to Help Protect Your Company (and Customers) When You Take Payments Online

By Jennifer Dublino | June 09, 2025

Secure online payments with 2FA, SSL certificates, PCI DSS compliance, cyber insurance, and secure platforms like BigCommerce, Shopify, and WooCommerce.

Article

7 Medical Billing Tips for Small Practices

By Danielle Fallon-O’Leary | December 06, 2024

Streamline your medical billing process – and receive payment for your services faster – with these suggestions.

Article

Clover vs. Toast POS & Payment Processing Comparison

By Jennifer Dublino | September 30, 2024

Clover and Toast are payment processors that can provide POS functionality and hardware. Learn how their features, service and costs compare.

Article

Shopify vs. Square: Which POS Is Best for Your Business?

By Jamie Johnson | September 30, 2024

Shopify and Square are two popular POS systems for e-commerce. Learn how Shopify vs. Square compares and where each one stands out or falls short.

Review

Shopify POS Review and Pricing

By Lori Fairbanks | September 30, 2024

Shopify Payments charges 2.25% to 2.9% plus 30 cents per transaction. The platform integrates directly with Shopify stores and includes fraud analysis.