All Content

Latest: Advice, Tips and Resources

Article

How to Negotiate When Hiring Freelancers

By Bennett Conlin | January 30, 2026

If you need additional help but can’t afford to hire a full-time employee, working with a freelancer is a good option. Here’s how to negotiate fairly.

Article

How Virtual Reality Is Impacting the Ad Industry

By Sean Peek | January 30, 2026

Virtual and augmented reality are two forms of media that can impact how advertisers build relationships with customers. Here is what you need to know.

Article

Why You Should Advertise on Podcasts

By Jennifer Dublino | January 30, 2026

Podcast advertising can be a cost-effective marketing solution that earns listener trust. Learn why advertising on podcasts works and how to get started.

Article

Why You Need a Mix of Push and Pull Marketing

By Sammi Caramela | January 30, 2026

Push marketing sends your message to consumers, while pull marketing is when customers come to you. Learn how and when to use push and pull marketing.

Article

How Women-Owned Businesses Can Use Social Media Marketing

By Ryan Ayers | January 30, 2026

How women-owned companies can highlight their business's unique features using social media marketing.

Article

11 Essential Components of Excellent Customer Service

By Megan Totka | January 30, 2026

Looking to improve your company's customer service? Make sure everyone on your team follows these best practices.

Article

Is a College Degree Necessary for Success?

By Miranda Fraraccio | January 30, 2026

Not all education is completed in a school; on-the-job training can also lead to a successful career.

Article

International Calling Costs: Everything You Need to Know

By Marc Prosser | January 30, 2026

Any business that deals with international clients or partners will need to make calls overseas. This guide will help you save on such expenses.

Article

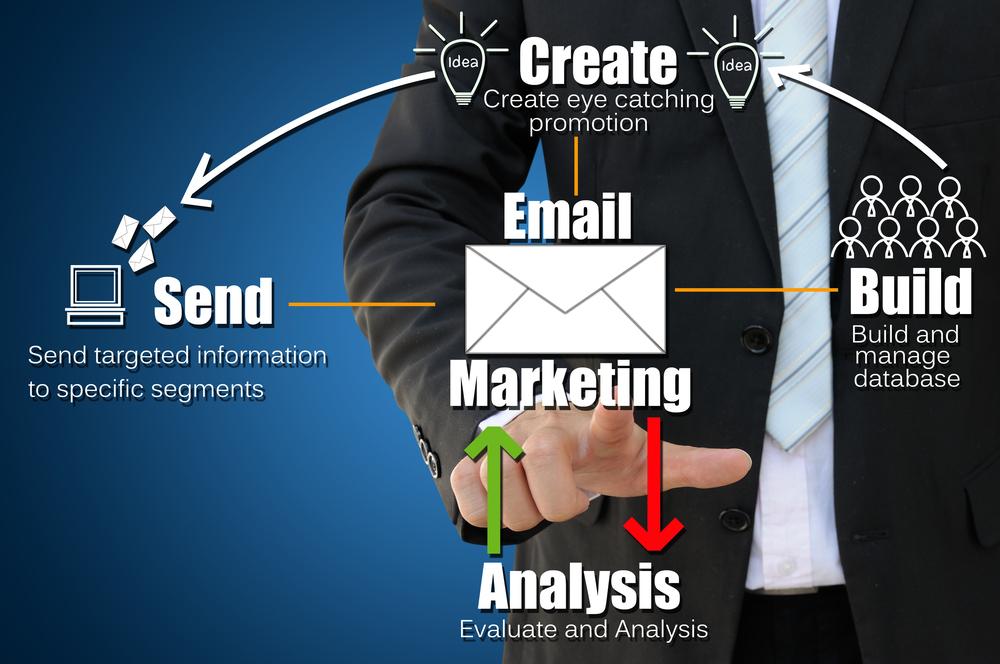

5 Ways to Influence Your Email Subscribers With Relevant Content

By Jennifer Dublino | January 30, 2026

Customer and prospect engagement is crucial in email marketing campaigns. Learn how to influence and impact subscribers with timely, relevant content.

Article

How to Create and Write Your Business’s First E-Book

By Chris Christoff | January 30, 2026

Here are the benefits of creating an e-book for your business, and how you can create one, step by step.

Article

The 5:3:2 Rule for Social Media Explained

By Jennifer Dublino | January 30, 2026

Social followers don't always want a hard sell, but you must accomplish business goals. Learn what to post and how much of each content type is optimal.

Article

Starting an Advertising Agency

By Sean Peek | January 30, 2026

If you have a background in marketing and communications, an advertising agency could be a smart startup option. Here's what you need to know.

Article

How to Apply for a Business Credit Card as a Sole Proprietor

By Andrew Martins | January 30, 2026

Sole proprietors can use a business credit card to build credit, earn rewards and even out cash flow. Learn how to improve your chances of qualifying.

Article

5 Ideas to Boost Your Loyalty Program’s Success

By Mark Fairlie | January 30, 2026

Want to boost customer loyalty and retention for your business? Learn rewards program tactics to help you build a loyal customer base and drive more sales.

Article

6 Signs It’s Time Your Business Should Partner With a Digital Marketing Agency

By Julie Thompson | January 30, 2026

Outsourcing your marketing may improve results. Learn when a business should partner with a digital marketing agency and how it can grow your company.

Article

How to Send an Email Blast (With Examples)

By Rachelle Gordon | January 30, 2026

Email blasts are a small but impactful way to reach a wide audience. Find out how to craft a successful e-blast in this guide.

Article

How to Calculate Gross and Net Pay

By Julie Ritzer Ross | January 30, 2026

In order to pay your employees correctly each pay period, you need to know how to calculate gross and net pay. Learn how to ensure your payroll is precise.

Article

Business Decision-Making: Gut Instinct or Hard Data?

By Sean Peek | January 30, 2026

When it comes to business, your decisions matter. But it's important to recognize whether your choices are based on intuition or emotions.

Article

Business Debt: How Much Is Too Much to Carry?

By Jamie Johnson | January 30, 2026

To start your business, you’ll need money and sometimes borrowing funds is fine. Without proper management and care, though, debt can become problematic.

Article

How to Create Community Around Your Brand

By Jennifer Dublino | January 30, 2026

Cultivating a fan community around your brand and products can create marketing and retention opportunities. Learn how to build a robust brand community.

Article

How to Apply for a Business Credit Card if You Have Bad Credit

By Donna Fuscaldo | January 30, 2026

Qualifying for a business credit card with bad credit is hard but not impossible. Learn about card options if you have bad credit, such as secured cards.

Article

8 Tips for Building a Successful Remote Company

By Jennifer Dublino | January 30, 2026

Remote companies provide significant benefits to employers and employees. Learn tips for building a successful remote company that runs like clockwork.

Article

How to Use YouTube to Build Community

By Sean Peek | January 30, 2026

YouTube can be a powerful way for your business to build a digital community. Here are tips on how to build your audience.

Article

11 Ways to Drastically Cut Business Costs

By Katharine Paljug | January 30, 2026

Small businesses often have slim profit margins. Learn how to cut expenses to boost cash flow, invest in growth and lower prices without impacting revenue.

Article

The Best Places for Purchasing Office Supplies

By Mark Fairlie | January 30, 2026

Many office supply places offer savings programs for corporate accounts, volume sales and other benefits. Learn how small businesses can save.

Article

How Email Personalization and Follow-Ups Can Boost Your Bottom Line

By Julie Thompson | January 30, 2026

Consumers want personalized shopping experiences. Here is how you can use email to increase customer loyalty and revenue.

Article

Buying a Car for Your Business? How to Avoid Mistakes

By Jennifer Dublino | January 30, 2026

Buying a company car can help your business run more smoothly and save money. Ensure you invest in the right business vehicle and avoid common mistakes.

Article

The Best Business Uses of Microsoft Word

By Jennifer Post | January 30, 2026

Microsoft Word lets you share documents, create templates and collaborate with your team. Learn about the other business uses for Microsoft Word.

Article

5 Best Digital Marketing Certifications

By Mark Fairlie | January 30, 2026

Digital marketing specialists are in demand and getting average salaries of over $75,000. Find out the qualifications you need to get ahead in this job market.

Article

Asset Management for Your Construction Firm: 8 Tips for Success

By Mark Fairlie | January 30, 2026

Learn valuable tips for managing assets for your construction business.