Business Finances

Your money matters, and our Business Finances hub can help you more effectively manage it. From securing funding and tracking revenue and expenses to bolstering cash flow, these resources can help you build a sturdy foundation for your fiscal house.

Latest: Advice, Tips and Resources in Finance

Stax lets businesses use flexible POS systems and offers over 200 integrations, detailed reporting and subscription-based pricing without taking a revenue cut.

Small businesses need to understand how to lower credit card processing fees, secure better terms, prevent fraud and avoid hidden costs with payment processing.

Contactless, mobile wallets, peer-to-peer payments and crypto are shaping digital payments. Businesses must adapt to appeal to consumers' preferred methods.

Construction firms should choose ISO/MSP processors for large, varied payments and mobile POS systems to accept credit cards in the field and online.

Square is a better value for high-volume businesses with lower online fees and robust POS tools. PayPal suits low-volume merchants needing flexible options.

Lightspeed is a top POS system for retail businesses. Learn about its feature-rich software and advanced e-commerce, reporting, and management tools.

Investor presentations require careful planning and organization. Learn what to consider before presenting an idea to investors and signs you're not ready.

The triple bottom line measures success by profit, people and planet, encouraging companies to balance financial goals with social and environmental impact.

Learn how to run payroll for your small business's employees.

Important information is tucked away in the fine print of a loan agreement. Learn what to look for and what you're agreeing to before you sign it.

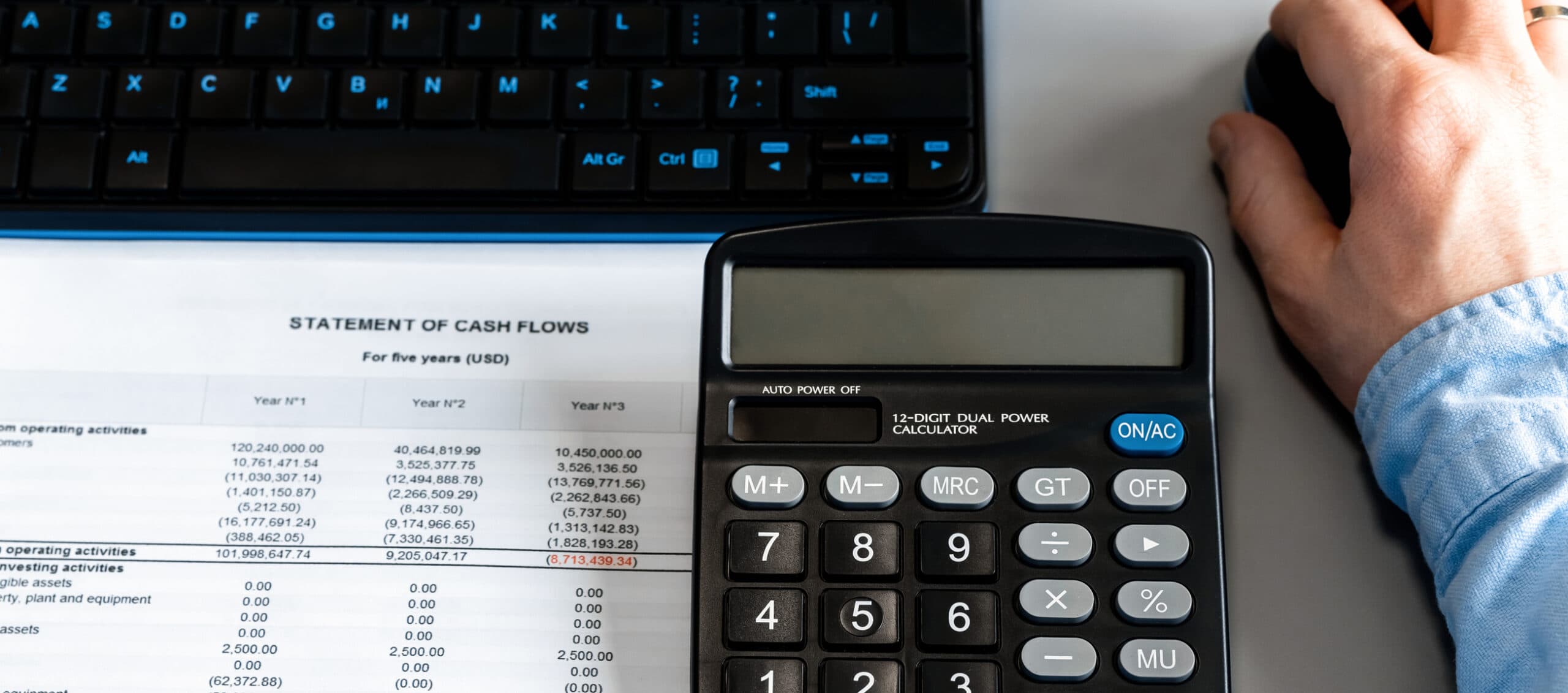

Looking to increase your small business's cash flow? Follow these tips to make sure you have enough liquid capital to keep growing.

Minor small business accounting errors can have a significant effect on your business's finances. Learn the most common accounting mistakes to avoid.

Most entrepreneurs turn to small business loans when seeking startup cash, but there are other ways to raise working capital for a store. Learn more here.

Before you sell equity, make sure the capital is well worth it. Here's how to spot a good investment deal.

When considering accepting a business loan, it's important to develop a repayment plan. Learn about the calculation formula, amortization and more.

A statement of shareholder equity can tell you if your business is doing well or if it's time to fine-tune some of your activities.

No matter what type of taxes you need help preparing, it's crucial to choose the right business tax consultant – and one whose prices fit into your budget.

Pay employees and contractors with Intuit QuickBooks Payroll. See why this is the best payroll solution for businesses seeking an accounting integration.

Night shift differential pay applies to employees who don't typically work night shifts. Learn how to calculate and apply night shift differential pay.

Learn whether a grant or loan is better for your business, the different types of each, how to choose between them and the best loan providers.

If your company is considered too risky by traditional lenders, a high-risk business loan might offer financing options.

Want to send a professional invoice via PayPal? Follow this guide to learn how.

Xero is a reasonably priced accounting software package with excellent integrations and an intuitive user interface. Learn why Xero is our top pick for growing companies.

Women-run businesses make up nearly half of all businesses, yet they're far behind in business funding. Learn about grants for women entrepreneurs to help close the gap.

GAAP refers to a set of rules and standards used for financial reporting in the U.S. Learn how GAAP principles work and what they mean for your business.

Learn how the accounts receivable process works and how accounting software can streamline your business’s ability to track and collect money owed.

Many small business loans require the business owner to sign a personal guarantee. Learn about the risks of personally guaranteeing a loan.

Merchant cash advances are risky, but they can be helpful if used correctly. Learn more about how they work and whether they’re the right option for your business.

Accounting challenges don't have to break your company. Here's how to overcome them.

The accounting cycle tracks a transaction until it's added to your company's financial statement. Follow this eight-step process to organize the data.