Business Finances

Your money matters, and our Business Finances hub can help you more effectively manage it. From securing funding and tracking revenue and expenses to bolstering cash flow, these resources can help you build a sturdy foundation for your fiscal house.

Latest: Advice, Tips and Resources in Finance

Learn valuable tips for managing assets for your construction business.

Need a small business loan with low interest rates? Learn about the government loans available to entrepreneurs.

Learn what it means to default on a business loan and what options you have available if this happens to you.

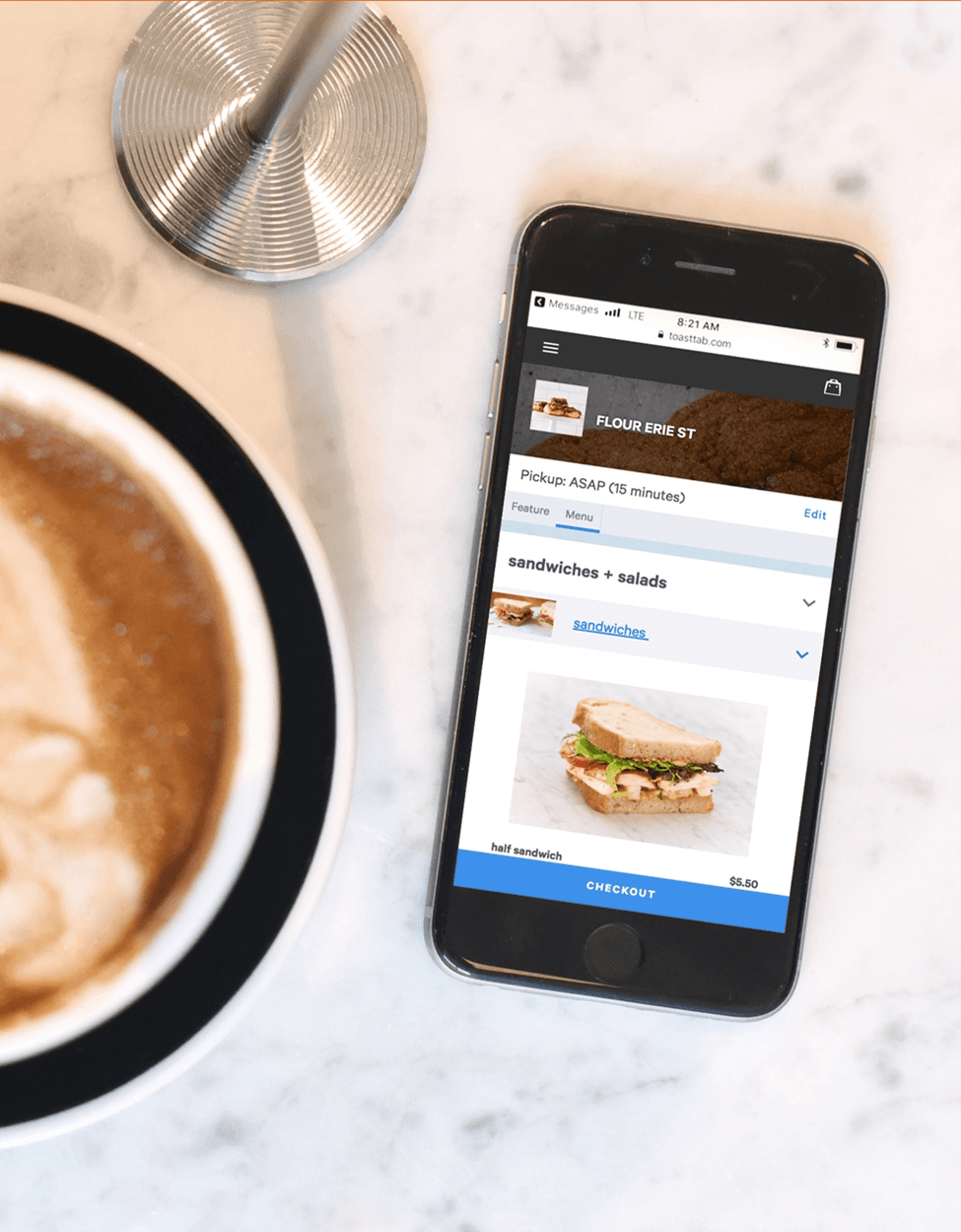

Every size business can benefit from a POS system, and there are various prices and technology suited for every need. Here's what you need to know.

Clover and Toast are payment processors that can provide POS functionality and hardware. Learn how their features, service and costs compare.

PayPal lets businesses of all sizes, including startups and microbusinesses, accept credit cards with minimal application requirements. It's affordable, has transparent pricing and terms, and is easy...

The latest digital receipt technology enables retailers to include marketing messaging. Learn the benefits and get software recommendations.

Businesses using the Shopify platform to sell products online can use Shopify Payments to accept credit and debit card payments. You can also use the service to accept payments via social media...

Shopify and Square are two popular POS systems for e-commerce. Learn how Shopify vs. Square compares and where each one stands out or falls short.

Every bar owner understands that bars have unique needs, and so does your bar POS system. Learn how to choose the best bar POS system for your business.

Epos Now is a top point-of-sale (POS) system known for excellent integrations. Learn about Epos Now's features, limitations, pricing, support and more.

Toast is a top POS system with extensive restaurant features. Learn why Toast's online ordering functionality stands out in the restaurant POS system area.

Cake by Mad Mobile is an efficient POS system ideal for restaurants. Learn about Cake's ease of use, features, pricing, inventory management and support.

Cloud-based point-of-sale (POS) software has many advantages over traditional sales technology. Consider these benefits and top systems.

The best POS system will vary based on your needs and the customer experience you want to provide. Here are 15 important features to look for.

With this guide, learn how a point-of-sale (POS) system can transform your business by increasing sales, maximizing results and reducing waste.

Proper budgeting and cash flow management can help protect your business from bankruptcy. Learn the steps you can take to avoid it.

Brilliant is a cloud-based POS system with excellent employee management features. Learn how Brilliant can track wages, hours, payroll and schedules.

Your business credit score is related to but separate from your personal credit score. Learn what a business credit score is and why it matters.

There are a lot of mobile point-of-sale apps out there. How do you choose the best mobile POS for your business?

QuickBooks, Rippling, Gusto and Zenefits are among the cheapest payroll services that also boast a range of features for small businesses.

Debt isn't the only way! Here are alternatives to getting a loan in order to start your business.

Learn how five top restaurant employee-theft scams work. We'll show you how to stop losing money to employee theft and retake control of your restaurant.

It can be difficult to keep up with the costs associated with running a farm. Low-interest agricultural loans help farmers stay afloat.

While self-funding a business is difficult, it isn’t impossible. Here are important tips for entrepreneurs considering the idea.

Accurate estimates are key to your construction business's success. Learn about the top five construction estimating software tools.

Nonprofit organizations have specific accounting regulations and requirements. Learn what nonprofits need to know about accounting.

Learn who should consider debt consolidation and what you need to know before deciding whether business debt consolidation is right for you.

Learn what every business owner needs to know about financial accounting, accounting software and financial statements.

Business grants help provide free funding to minority business owners. Check out the most updated list of minority business and how to apply.