Business Finances

Your money matters, and our Business Finances hub can help you more effectively manage it. From securing funding and tracking revenue and expenses to bolstering cash flow, these resources can help you build a sturdy foundation for your fiscal house.

Latest: Advice, Tips and Resources in Finance

Article

Digital Receipts: Why Retailers Are Embracing Them

By Sean Peek | January 02, 2026

The latest digital receipt technology enables retailers to include marketing messaging. Learn the benefits and get software recommendations.

Article

Budgeting Planning: A Small Business Budgeting Guide

By Sean Peek | January 02, 2026

Business owners need budgets to help them manage money and meet financial goals. Learn how and why to start budget planning for your business.

Article

Smarter Bookkeeping with AI-Powered Reconciliation

By Miranda Fraraccio | January 02, 2026

AI-powered integrations and features in modern bookkeeping software like QuickBooks can make account reconciliation easier, faster and more accurate.

Article

How to Get Paid as a Construction Contractor

By Karina Fabian | January 02, 2026

Cash flow is critical for construction contractors. Learn best practices for ensuring your clients pay you and tips for dealing with nonpaying customers.

Article

POS Systems for Small Construction Businesses

By Donna Fuscaldo | January 02, 2026

With a POS system installed on your phone or tablet, you can accept payments on the job, send digital receipts, and accurately record payment details.

Article

Why Every Company Should Have a Business Savings Account

By Jamie Johnson | December 19, 2025

Learn why it makes fiscal sense for your company to have a dedicated business savings account.

Article

Gusto vs. Paychex Comparison: Comparing Two of Our Top HR Solutions

By Skye Schooley | December 18, 2025

Gusto and Paychex are excellent HR solutions with payroll and essential human resources features. Here's how they compare in pricing, usability and more.

Article

QuickBooks Desktop vs. Online: Which Should You Use?

By Mark Fairlie | December 18, 2025

Should you use the desktop application or web browser version of QuickBooks? Here are some important updates about this software program.

Article

Revenue vs. Income: What’s the Difference?

By Dock David Treece | December 18, 2025

Learn how the relationship between revenue and income affects your business and its value.

Article

Forget the Checks: 5 Reasons Why Your Construction Company Should Accept Credit Card Payments

By Sean Peek | December 18, 2025

Accepting credit cards helps construction firms boost cash flow, reduce bounced checks and offer clients flexible, secure payment options.

Article

Should You Use a Business Credit or Debit Card?

By Donna Fuscaldo | December 18, 2025

Discover which is best for your business – a business debit card or a credit card.

Article

A Guide to Accounting Software Features and Benefits

By Donna Fuscaldo | December 18, 2025

Here's everything you need to know about accounting software and the benefits of using it.

Article

How to Keep Your Business Out of Bankruptcy

By Danielle Fallon-O’Leary | December 18, 2025

Proper budgeting and cash flow management can help protect your business from bankruptcy. Learn the steps you can take to avoid it.

Article

How to Improve Your Small Business’s Cash Flow

By Sean Peek | December 18, 2025

Cash flow is critical for businesses, so managing it is key. Here's how to improve your business's cash flow situation.

Article

How to Apply (and Get Approved) for a Business Loan

By Adam Uzialko | December 18, 2025

Applying for a business loan can seem like a daunting task, but following these steps can help you apply and get approved.

Article

20 Tips to Avoid a Tax Audit of Your Small Business Return

By Andrew Martins | December 17, 2025

IRS audits are stressful and costly. Learn best practices and tips that will reduce your chances of getting audited by the IRS and help you stay compliant.

Article

How Small Business Owners Can Use a HELOC to Fund Growth

By Adam Uzialko | December 17, 2025

A home-equity line of credit offers easy access to capital to start your business, but it puts your most important personal asset – your home – at risk.

Article

Digital Payment Guide: Best Payment Methods & Why to Accept Them

By Sammi Caramela | December 16, 2025

Learn about digital payment methods your business should consider accepting.

Article

What Is Meta Pay? A Complete Guide to Meta’s Payment Platform

By Donna Fuscaldo | December 16, 2025

Meta Pay lets businesses accept secure, fee-free payments across Meta’s platforms, making social selling easier with simple setup and purchase protection.

Article

Should Your Restaurant Accept Mobile Payments?

By Jamie Johnson | December 16, 2025

Mobile payments provide a fast and easy way for restaurants to receive payments, but there are pros and cons to this method. Here is what you need to know.

Article

Everything You Need to Know About Angel Investors

By Donna Fuscaldo | December 16, 2025

Angel investors are accredited investors who use their money to help businesses they view as worthwhile. Learn how to find and work with them.

Article

Is Your SBA Loan in Default? Forgiveness Is Possible

By Nicole Fallon | December 16, 2025

Defaulting on an SBA loan is serious; you can face bank levies, wage garnishment and foreclosure. But some cases allow forgiveness. Learn if you qualify.

Article

How to Get PPP Loan Forgiveness

By Donna Fuscaldo | November 20, 2025

The pandemic’s Paycheck Protection Program offered relief to businesses. Here is what you should know about the loan forgiveness process.

Article

POS Reports Your Retail Business Should Be Using

By Donna Fuscaldo | November 17, 2025

With this guide, learn how a point-of-sale (POS) system can transform your business by increasing sales, maximizing results and reducing waste.

Review

Rippling Payroll Review and Pricing

By Jessica Elliott | November 10, 2025

Rippling's platform has hundreds of integrations and a user-friendly workflow builder. Learn why it's the best payroll system for automating processes.

Review

Rapid Finance Review

By Mike Berner | November 08, 2025

Rapid Finance provides same-day funding for term loans, lines of credit, and merchant cash advances from $500 to $10 million with fast online applications.

Article

Gusto vs. ADP: Which Payroll Software Is Right for Your Business?

By Tom Anziano | November 07, 2025

This comparison guide breaks down the similarities and differences between ADP and Gusto payroll solutions for small businesses.

Article

Small Business Guide to Alternative Lending

By Donna Fuscaldo | November 06, 2025

Alternative lenders offer more flexible terms and faster approval and funding than traditional banks. Discover more about alternative loans.

Article

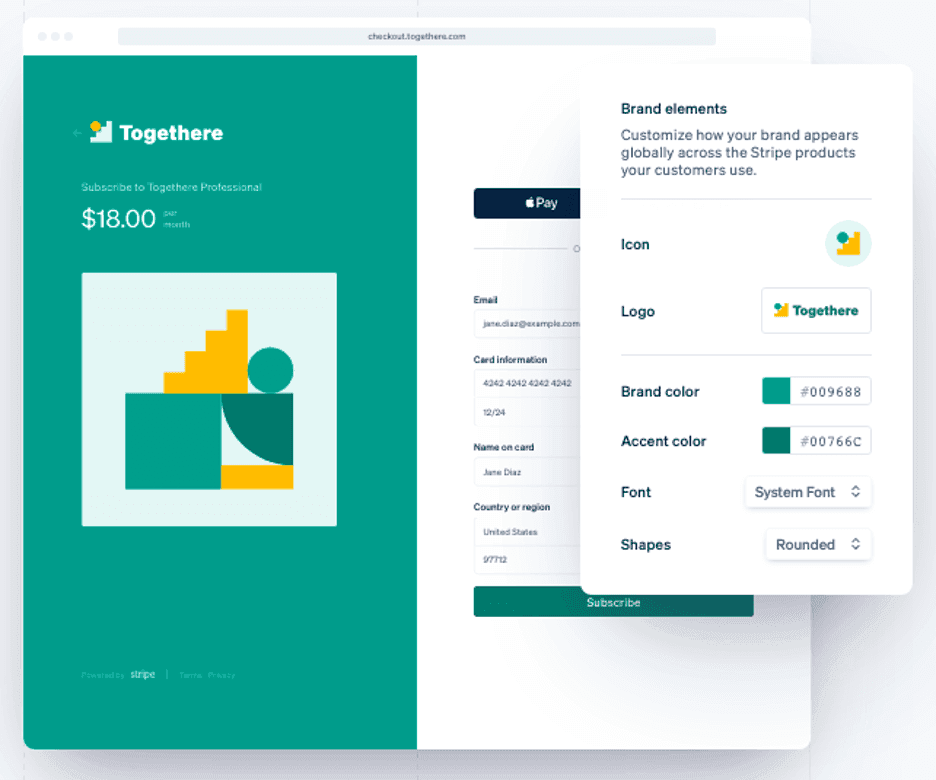

Stripe vs. PayPal

By Dock David Treece | November 04, 2025

Read our comparison of Stripe and PayPal to see which provider can best help your business accept payments.

Article

Stripe vs. Authorize.net: Credit Card Processing Comparison

By Jamie Johnson | November 04, 2025

This comparison of Stripe and Authorize.net examines the pros and cons of each, and how they stack up against one another in price and features.